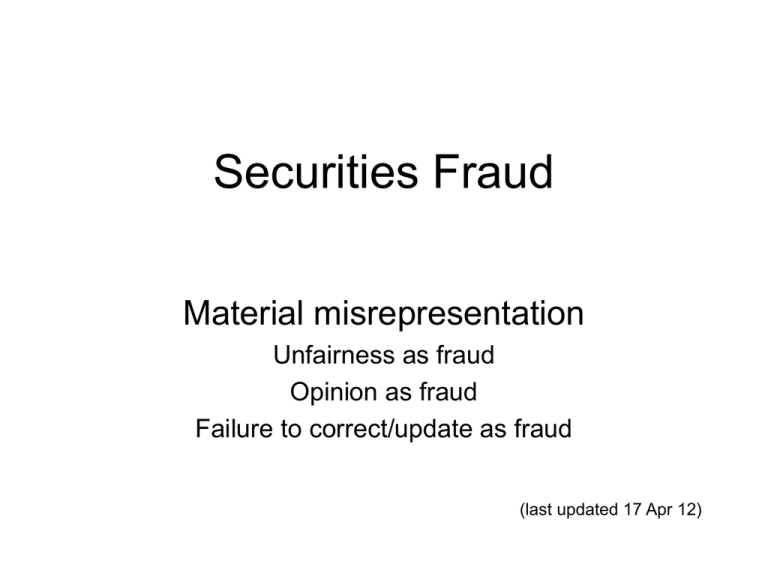

Securities Fraud Material misrepresentation Unfairness as fraud Opinion as fraud

advertisement

Securities Fraud Material misrepresentation Unfairness as fraud Opinion as fraud Failure to correct/update as fraud (last updated 17 Apr 12) Securities Fraud Action Rule 10b-5 • Transaction (“in connection with • • purchase or sale of securities”) Plaintiff (“purchasers or sellers” / except SEC) Defendant (“primary violator” / including company) • Elements – Material misrepresentation or omission – Scienter – Reliance – Causation – Damages Rule 10b-5: • Procedure – Jurisdictional nexus (federal court) – Statute of limitations / repose – Special rules for class actions It shall be unlawful …To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, … Can unfair transaction be securities fraud? Unfairness as fraud? Santa Fe 95% Minority (Green) 5% Kirby Lumber Short-form merger • 95% shareholder • Post-merger notice Morgan-Stanley • Assets = $640/sh • FMV = $125/sh • Price = $150/sh Minority – appraisal for “fair value” Why not seek appraisal? Santa Fe Industries v. Green (US 1977) Rule 10b-5 It shall be unlawful for any person, directly or indirectly, (1) To employ any device, scheme, or artifice to defraud, (2) To make any untrue statement of a material fact … or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or (3) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person, in connection with the purchase or sale of any security. Justice Byron White Santa Fe Industries v. Green (US 1977) Section 10 -- Manipulative and Deceptive Devices It shall be unlawful for any person, …(b) To use or employ, in connection with the purchase or sale of any security … any manipulative or deceptive device or contrivance in contravention of [SEC] rules … Justice Byron White Are opinions misleading? Va Bankshares v. Sandberg (US 1991) “ in the opinion of the Board of Directors, the merger price is high value for the shares … fair price.” Supreme Court (actionability of opinions) … Shareholders know that directors usually have knowledge and expertness far exceeding the normal investor’s resources … [and] will think it important … … statements of belief are factual in two senses: [1] directors … hold the belief stated … and [2] statements about the subject matter of belief expressed. … disbelief, standing alone, is insufficient to satisfy element of fact. … Whether price “fair” depended on provable facts about actual/potential operations … in accordance with recognized methods of valuation. Justice David Souter Is there a duty to update? to correct? Duty to correct / update Company disclosed in Annual Report: • 3/9/99: “[company] subject to comprehensive government regulation” Company should have disclosed: • 3/17/99: FDA sends letter demanding compliance [Bloomberg reveals in June] • 9/99: FDA insists on substantial penalties [not reported] When Company did disclose: • 9/29/99: Abbott press release that in settlement negotiations with FDA [stock drops 6%] • 11/2/99: FDA and Abbott settle [court enters consent decree = $100 million fine + $18 million accounting charge / stock drops 8%] Duty – • to correct? • to update? Seventh Circuit: “We do not have a system of continuous disclosure” “A statement need be corrected only if it was incorrect when made …” “Updating documents has its place … but only when selling stock.” Second Circuit: duty to update when “information alive in market” Judge Frank Easterbrook Congress: SOX 409 – new Form 8-K When is a “guess” false? Forward-looking information Regulation S-K MD&A (Item 303) Annual 10-K must reveal Any known trends or uncertainties that have had or that the registrant reasonably expects will have a material favorable or unfavorable impact on net sales or revenues or income from continuing operations … Material (bespeaks caution) “Commitments” (repeated) • Growth in “low teens” and EPS in “mid-teens” and CF of $500 MM In fact • • • Renal division not meeting budget Immunoglobin products below predictions Manufacture failure of drug – w/o changing forecasts PSLRA (Exchange Act 21E) (c) Safe harbor (1) In general in any private action arising under this title that is based on an untrue statement of a material fact or omission of a material fact necessary to make the statement not misleading, a person referred to in subsection (a) of this section shall not be liable with respect to any forward-looking statement, whether written or oral, if and to the extent that— (A) the forward-looking statement is-(i) identified as a forward-looking statement, and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the forward looking statement; .. Baxter Annual Report: Statements throughout this report that are not historical facts are forwardlooking statements. These statements are based on the company's current expectations and involve numerous risks and uncertainties. Some of these risks and uncertainties are factors that affect all international businesses, while some are specific to the company and the health care arenas in which it operates. Many factors could affect the company's actual results, causing results to differ materially, from those expressed in any such forward-looking statements. These factors include, but are not limited to, interest rates; technological advances in the medical field; economic conditions; demand and market acceptance; risks for new and existing products, technologies and health care services; the impact of competitive products and pricing; manufacturing capacity; new plant start-ups; global regulatory, trade and tax policies; regulatory, legal or other developments relating to the company's Series A, AF, and AX dialyzers; continued price competition; product development risks, including technological diffiulties; ability to enforce patents; actions of regulatory bodies and other government authorities; reimbursement policies of government agencies; commercialization factors; results of product testing; and other factors described elsewhere in this report or in the company's other filings with the Securities and Exchange Commission. Material (bespeaks caution) Seventh Circuit: “… when markets are informationally efficient, it is impossible to segment information as plaintiffs propose…” “Yet Baxter’s language may fall short. [Baxter may have known more than identified as potential risks.] Baxter [argues full truth had reached the market] – hard to understand the sharp drop in the price of its stock. …” Judge Frank Easterbrook Plaintiffs get discovery – but of what? The end