ASSIGNMENT INFORMATION Library Short Loan File DEPARTMENT OF BUSINESS MANAGEMENT

advertisement

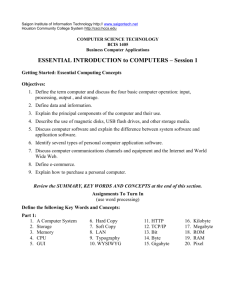

DEPARTMENT OF BUSINESS MANAGEMENT NMMU ASSIGNMENT INFORMATION 2006 Library Short Loan File Documents 1 Assignment lecture (separate power point presentation) 2 Report writing information 3 Examples of previous assignments Gray, B.A. Louw, M.J. Rootman, C. Van Eeden, S.M. 200134598 200345879 202086751 200206979 Note: Title page Group names in alphabetical order Name of lecturer/lecturers AIDS AND THE SMALL BUSINESS THE PERSPECTIVE OF PRO-DIVE DATE: 9 April 2004 LECTURER: Ms J Krüger TABLE OF CONTENTS Page 1 INTRODUCTION 1 2 2.1 2.2 2.3 LITERATURE OVERVIEW Aids in South Africa Impact of Aids on business Steps and measures being undertaken by business to combat Aids 2 3 3.1 3.2 EMPIRICAL RESEARCH Background of small business interviewed Report on findings 4 4 CONCLUSIONS AND RECOMMENDATIONS 6 3 5 LIST OF SOURCES ANNEXURE A: COMPLETED QUESTIONNAIRE Note: Contents page (centred heading) Treat headings in contents page the same as in text e.g. bold / not bold No full stops after numbering No heading numbers for List of sources / Annexures (No page number) 1 INTRODUCTION Problem statement “It is estimated that one in eight persons in South Africa has Aids… Reason for the research….. It is unknown what the perception of the small business is towards Aids and what is currently being done to manage and combat this disease. The Objective is to investigate the following among small businesses, namely their attitude towards Aids, the impact of Aids on their business and the what steps (if any) are being undertaken to manage and combat Aids Method of research A theoretical investigation into Aids was undertaken and existing secondary sources (journals, internet and books) were consulted. An empirical research was conducted by means of an interview and a structured questionnaire. Difficulties encountered – Working in the group, lack of sources, existing sources were old etc Contents to follow – What follows is firstly an overview of Aids in South Africa, its impact on business and an overview of steps and measures being undertaken by business to combat Aids. This is followed by the results of the interview conducted. Note: No page number shown on the first page of report No full stops after numbering of headings Headings are not shown in introduction – merely a guide ASSIGNMENT Note: Important information to note No headings shown in introduction Title page According to instructions (NO FRILLS) Names: Surnames first in alphabetical order Double title page: for receipt purposes Table of contents Numbering No full stop after the numbers List of sources (at the end) – no number Page numbers must be indicated, Page heading Layout of table of contents must be the same as in the body of the report i.e. if a heading is in capitals and underlined in the body it should appear the same in the table of contents Body/text of the assignment Never not refer to “I” or “we” Headings must be numbered Page numbers are shown (except first page) When taking information from a book, no matter how short the extract, reference or source MUST be acknowledged and indicated (otherwise plagiarism) If use of reference in the body it must appear in the list of sources Referencing The first time a source is used (three or more authors) it must be in full, thereafter make use of et al. List of sources In alphabetical order and listed According to “How to complete a scientific assignment” No numbers / bullets NB NB NB…. Consult: “How to complete a scientific assignment” Note: Documents may not resemble and copy exactly from the original work Biggs, M.A. 204024412 Meiring, A.H. 204001706 Roux, G.J. 204006090 Sparius, O. 204003202 THE USE OF “E-COMMERCE”: A SMALL BUSINESS PERSPECTIVE Module: EB101 Lecturer: Ms B Gray Date: 2 April 2004 TABLE OF CONTENTS Page 1 INTRODUCTION 2 LITERATURE OVERVIEW 1 2.1 THE NATURE AND IMPORTANCE OF E -COMMERCE 1 2.2 THE USES OF E-COMMERCE BY A SMALL BUSINESS 2 2.3 THE FACTORS INFLUENCING THE USE OF E-COMMERCE 3 2.4 THE CURRENT AND FUTURE TRENDS IN E-COMMERCE 3 3 EMPIRICAL RESEARCH 3.1 GENERAL INFORMATION 4 3.2 THE USE OF E-COMMERCE 5 3.3 FACTORS INFLUENCING THE USE OF E-COMMERCE 5 4 CONCLUSION AND RECOMMENDATIONS 7 LIST OF SOURCES 8 ANNEXURE A: COMPLETED QUESTIONNAIRE No sub-headings! 1 INTRODUCTION Problem statement “E-commerce is changing the way we communicate shop, invest, learn and stay informed about the world around us.” Reason for research In today’s information driven society the use of e-commerce is becoming increasingly more important. This report is focused on determining the role ecommerce plays in the small business enterprise. Objective The aim of this report is to investigate and focus on the nature and importance of e-commerce, its uses in the small business environment and the factors influencing this usage. Method of research A theoretical research on e-commerce was undertaken and existing secondary sources were consulted. An empirical research was conducted by means of an interview with a small business owner and structured questionnaire. Difficulties with research A vast amount of information is available, causing difficulties to find only that relevant to the report. Some information was outdated and could not be used. Contents to follow Firstly a literature overview is given about what e-commerce is, its uses in small businesses and future trends in e-commerce. To follow is the report back on the findings of the questionnaire used to interview a small business owner to determine the role of e-commerce in the particular small business. 2 LITERATURE OVERVIEW 2.1 THE NATURE AND IMPORTANCE OF E-COMMERCE According to www.gcal.ac.uk e-commerce is a business approach in which some or all of the sales and customer support processes are managed electronically, usually via the Internet. According to the website www.intechnology.co.uk an e-business combines the resources of traditional information systems with the vast reach of an electronic medium such as the Internet (including the World Wide Web, intranets, and extranets). Ecommerce plays an important part in today’s information driven society. It enables enterprises simplifies many day-to-day tasks. An example is that business transactions can be done from anywhere around the world independent of office hours. The most important part e-commerce plays in the small business environment is that it creates the opportunity for small enterprises to compete with larger ones for customers. (www.iib.qld.gov.au) According to Davis & Benamati (2003:7) “the real potential of ecommerce is improved efficiency, not revenue generation.” 2.2 THE USES OF E-COMMERCE BY A SMALL BUSINESS According to the web site www.sccd.sk.ca a business can utilize e-commerce in many ways to work faster, more efficiently, or to facilitate relationships with customers, suppliers or partners. On the Internet a business can create a website that provides information for existing and potential stakeholders (such as customers, investors, shareholders, etc.) about products, services or developments. A business can be accessible through their website. In this way a business improves its customer service by having a faster response time for ordering and after –purchase service. (www.sccd.sk.ca) Newsgroups, chat rooms, web-based newsletters and banner ads can all be used to promote a business beyond its current client base. A business can also use its web site to solicit market research from clients or guests to their sites about what products or services they want and need, and what they think of current products or services offered. The electronic sharing of information also reduces the need for meetings which are time consuming and involve large amounts of paper. (www.sccd.sk.ca) Customers can shop or do other transactions 24 hours a day, all year round. This facilitates international trade, especially from countries in different time zones. (Tassabehji 2003:12-13) 2.3 THE FACTORS INFLUENCING THE USE OF E-COMMERCE According to Williams (1999) in a study done by Goeler (1998) the factors identified to implementing e-commerce includes the following: The costs involved. The main concerns are the lack of funds for implementation costs, the lack of monthly cash to maintain sites and the probability that their will be no real return on their investment. The security concerns are customer fraud and the potential for hackers to gain access to vulnerable information. The businesses in the study by Goeler (1998) had the necessary technical skills, but they were impeded by the difficulties of implementing and integrating commerce sites. The majority of the Businesses in the study by Goeler (1998) were worried “that the loss of customer contact would decrease the quality of service.” Visa (1998) is of the meaning that gender and age have an influence on how small businesses utilise technology. 2.4 THE CURRENT AND FUTURE TRENDS IN E-COMMERCE E–commerce has grown in the United States from zero in 1995 to a $95 billion retail business and reached a $1.2 trillion turn over rate in 2003. In the next five years electronic business is expected to grow at double digit rates, making it the fastest growing commerce in the world. (Davis et al. 2003:i-iv) According to Tassabehji (2003:299-301) e–commerce trends can be divided into 5 phases: Phase 1 (1995+) The very earliest stages of internet advertising, businesses and organisations were using the internet to establish a presence in the cyber world Phase 2 (1998+) Faculties for basic electronic transactions developed. Very few user interaction and transactions were done mainly off line. Companies use internet as an alternative channel to increase revenue and sales. At this time a lack of internet users and sufficient skill and technology resulted in a slow moving process. Phase 3 (2000+) This stage has already begun or is at the begin stages for many companies and for those at the peak of e –commerce technology it is still developing. Companies are now concentrating on achieving system compatibility to support business changes and they are moving closer and closer to customers, suppliers and manufacturers. Information, products and services are becoming more personalised and customised to individual consumers. The goal now is profit – commercial benefits and survival. Phase 4 (2003+) Involves re-engineering of sites to promote e-commerce. Organisation and transactions time delay decrease to reach an aim claimed by Bill Gates (business at the speed of thought). Goal – Continued growth and development. Phase 5 (2006) Here the business model would have developed to a whole new dynamic and increasingly comfortable system and no longer be seen as new. E-commerce becomes an everyday activity, where after we can expect a new wave of business activities. 3 EMPIRICAL RESEARCH 3.1 GENERAL INFORMATION A small business enterprise in Uitenhage, called Do IT Computers was interviewed. The form of the enterprise is a partnership and the owners are Mr. G.J. Roux and Mr. J. van Niekerk. The owners do not have management qualifications, because they are both still in school. Do IT Computers has been in existence for 2 years and has employed only the two owners for the entire period. Taking into consideration that the business is run parttime the annual turnover of R500 000 or less is quite impressive. The business has experienced strong growth over the past two years and with the addition of Mr. Roux a few months after the start of the business, their business has also experienced growth in employees. Both of the owners regard the business profitable and agree that the business is very successful. 3.2 THE USE OF E-COMMERCE E-commerce tools get used quite extensively in Do IT Computers. The internet is the main form of communication for Do IT. They use it to communicate with their customers and with all of their suppliers. Financial and management accounting and the set-up and upkeep of a database are solely done on computer and are the responsibility of Mr. Roux. Mr. Van Niekerk is responsible for managing the payroll and benefits as well as the efilling and the banking. All of the banking activities get done via the internet. The internet and e-mail correspondence are used regularly to search for, locate and correspond with new suppliers. Orders from the suppliers and payment of these orders are done via the internet, but unfortunately no order can be made electronically. The business relies heavy on the electronic payment of accounts by customers, as the only other way to pay is with physical cash. Customers can enquire about their order via e-mail, but tracking facilities are not available. Products get promoted the old fashion way, but the business also makes use of more modern means of advertising, like sms and e-mail. This is largely restricted by the financial implications. The internet is used to gather information regarding the product that the business is selling as well as any thing else that is of interest to the business. 3.3 FACTORS INFLUENCING THE USE OF E-COMMERCE Infrastructure The business has a modern and extensive infrastructure. Computer technologies are at the fore front of technology and access to the internet provides no problem. The business also has access to a reliable, uninterruptible ISDN internet connection which provides sound internet security, and computer software like Microsoft Windows XP and Office System 2003 gets used for all the management activities. The only thing that the business lacks is its own web-site, but this is largely because of the financial pressure it will put on the enterprise. Skills/Training Both of the owners of the enterprise are extremely competent when it comes to computers. They both know how to use the internet, all of the software that they use and, although they don’t have a web-site, they know how to create and maintain a web-site. Most of the knowledge is self taught and when uncertainty arises they consult books and the internet. Both of the owners have attended workshops, but not on a regular basis. Knowledge of benefits The owners strongly agree that an enterprise cannot operate efficiently if it doesn’t make use of E-commerce tools and that these tools will reduce the overall cost to the business. They agreed further more that sales volume would increase with the use of these tools and that new costumers can be reached more easily when using E-commerce tools. Mr. Van Niekerk added that E-commerce tools improve customer satisfaction and that it also helps businesses to deliver better customer services. Cost of E-commerce Although Do IT Computers is a registered business and has access to the internet and modern technologies; it still finds the cost of E-commerce very expensive. The business is managed from home, which means that the enterprise uses the private recourses of the owners. If the enterprise had its own premises it would not have access to the large amount of E-commerce tool it has access to at this moment, largely due to the costs. E-commerce support As stated previously, the owners are competent when it comes to computers and seeing as most of the business gets done on the computer they are able to solve most of the problems them self. When a problem requires specialized attention they don’t find it difficult to find this specialized help, although it rarely comes from family or friends. The HELP function on the computer and the internet are not used extensively when assistance is required. Benefits of E-commerce The owners agree that their enterprise is much more efficient because of the use of E-commerce. They testify that it has increased sales volume, customer numbers and, most importantly, customer satisfaction. Because they have always used e-commerce they are neutral about the fact the e-commerce reduces cost. 4 CONCLUSION AND RECOMMENDATIONS We have come to the conclusion that E-commerce tremendously benefits all enterprises of all sizes. It not only provides an improvement in the efficiency of the business, but also improves the relationship the enterprise has with it clients. The relatively high cost of ecommerce for a small enterprise is the only factor keeping it from becoming one of the most important tools in the business industry today. If an enterprise is in the financial position to make use of e-commerce we would full heartedly recommend it because of all the benefits it holds for the enterprise. LIST OF SOURCES Davis & Benamati. 2003. E-commerce basics. Boston: Addison Wesley. Tassabehji, R. 2003. Applying e-commerce in business. London: SAGE. Van Niekerk, J. 2004. Interview: Do IT Computers. 26 March Visa. 1998, in Williams V. 1999. E-commerce: small businesses venture online. http://www.sbaonline.sba.gov/advo/stats/e_comm.pdf (29 Mar. 2004). Von Goeler, K. 1998, in Williams V. 1999. E-commerce: small businesses venture online. http://www.sbaonline.sba.gov/advo/stats/e_comm.pdf (29 Mar. 2004). www.gcal.ac.uk/cit/helpdesk/useful_definitions.htm (27 Mar. 2004). www.iib.qld.gov.au/itcareers/talk.asp(27 Mar. 2004). www.intechnology.co.uk/html/reseller/techserv_R/res_glossary.asp (28 Mar. 2004). www.sccd.sk.ca/aims/html/Programs/ecom/source/Module1/uses.html (28 Mar. 2004). Kemp, S. 203007166 Mentz, M. 203008960 Rossouw, J.H. 203010817 Snyders, A.J.M. 201305135 MEASURING SERVICE QUALITY OF BANKING INSTITUTIONS A SMALL BUSINESS PERSPECTIVE DATE: 23 SEPTEMBER 2004 LECTURER: Ms B. Gray TABLE OF CONTENTS Page 1. INTRODUCTION 1 2. LITERATURE OVERVIEW 2 2.1 THE NATURE OF SERVICES 2 2.2 THE CHARACTERISTICS OF SERVICES 2 2.2.1 Intangibility 2 2.2.2 Inseparability 2 2.2.3 Heterogeneity 3 2.2.4 Perishability 3 2.3 THE NATURE OF SERVICE QUALITY 3 2.4 THE IMPORTANCE OF SERVICE QUALITY 4 2.5 THE TEN DIMENSIONS OF SERVICE QUALITY 5 3. EMPIRICAL RESEARCH 7 3.1 BACKGROUNDS OF THE SMALL BUSINESSES INTERVIEWED 7 3.2 REPORT ON FINDINGS 8 3.2.1 General findings 8 3.2.2 Findings with respect to the ten dimensions of service quality 9 4. CONCLUSIONS AND RECOMMMENDATIONS 11 LIST OF SOURCES 13 ANNEXURES A-C: COMPLETED QUESTIONNAIRES 14 ANNEXURE D: LETTERHEADS 26 ANNEXURES E & F: COPIES OF REPORTS 27 1. INTRODUCTION When considering service quality, the tendency is to look at chain stores and major national service providers. It is often over-looked that inherent in every encounter with a banking institution, whether in person or indirectly, is the provision of a service, the quality of which can be measured according to the same criteria applicable to other service providers. Since banks are such an indispensable part of everyday life, unacceptable levels of service quality are often ignored. From a different perspective though, another aspect that is often neglected is the major contribution of small businesses as clients of the banking sector. Therefore it is important to establish exactly what the needs of a small business owner are with respect to banking and to establish whether banks successfully satisfy these needs. The objective of the research was to gain an insight into the perception and overall satisfaction of small businesses with respect to the level of service quality provided by the banking sector, as well as to conduct a study of the assessment criteria applied by small businesses in this regard. A two-fold research method was implemented to reach the objective. A study of available literature sources pertaining to services and service quality, both in general and specifically related to banking institutions, was undertaken. The second part was an empirical study conducted by means of interviews and topic-related questionnaires, in which three small businesses, each banking at a different institution, were approached to provide information. This research project presented no difficulties whatsoever. Sufficient secondary literature sources were available, and the owners interviewed gave wonderful co-operation. Following this will be a theoretical overview of the nature and importance of services and service quality, as well as a summary of the ten dimensions of service quality. The subsequent section deals with the background of the businesses interviewed and provides a report on the findings. This is followed by a summary and recommendations. 2. LITERATURE OVERVIEW A study of available literature sources was undertaken to determine the nature and characteristics of services, as well as the nature and importance of service quality and the ten dimensions applicable to service quality, with specific reference being made to banking institutions. This section provides a report of these findings. 2.1 THE NATURE OF SERVICES Many different definitions and perceptions may be associated to services. Pollard and Liebeck (1994:732) define a service as a helpful or beneficial act. This is however a very general definition revealing little about the nature of services. In order to more accurately describe the nature of services, it is necessary to take note of the fact that services usually consist of tangible and intangible components (Baron & Harris 1995:159), that it cannot be physically possessed and that it results from human and/or mechanical effort focused on people or objects (Lamb, Hair, McDaniel, Boshoff & Terblanche 2004:438). 2.2 THE CHARACTERISTICS OF SERVICES Services are uniquely identified by four main characteristics. They are: 2.2.1 Intangibility This characteristic relates to the impossibility of observing a service by means of the five human senses. The service cannot be inspected before purchase and it is inevitable that the selling activity will precede production. (Lambin 2000:300.) In order to counter this lack of physical evidence of the service offered, banking institutions resort to cards, cheques and other instruments. 2.2.2 Inseparability Various interpretations of this characteristic are available. It is impossible to produce and consume a service in separate locations, since they are sold, produced and consumed at the same time (Lamb et al. 2004:440). It also relates to the impossibility of separating the service from its provider (Lamb et al. 2004:206). This has two implications: the client participates in production and the service provider has direct contact with the client (Lambin 2000:301). With respect to banking institutions, this characteristic is evident from the consideration of the necessity of visiting the bank in order to utilise certain services. 2.2.3 Heterogeneity Heterogeneity is especially applicable to services with a high labour content (Zeithaml, Parasuraman & Berry 1990:15) and it means that services tend to be less standardized and uniform than physical goods (Lamb et al. 2004:440). This pertains to banking institutions when related to the different standards of services delivered by different employees, for example the varying quality of interactions with different cashiers. 2.2.4 Perishability Unlike physical products, a service is incapable of being stored or inventoried, and as a result of this it is impossible to regain service production capacity that has been lost (Lambin 2000:301). 2.3 THE NATURE OF SERVICE QUALITY In the service industry, service quality is a very important aspect since it measures how well the service level delivered matches customer expectations (Baron & Harris 1995:160). According to this the customer will determine his/her satisfaction with the service delivered. The client will be satisfied if expectations are met, will deem the service quality as being exceptional if expectations are exceeded, but will regard it as unacceptable if expectations are not met (Fitzsimmons & Fitzsimmons 1994:189). Customers assess service quality according to the service delivery process, peripherals associated to the service as well as the service outcome (Parasuraman & Zeithaml 2002:340). To illustrate this, consider a client who approaches his/her banker. The client will not only measure service quality according to the outcome, but will also consider the responsiveness and friendliness of the banker, and even the level of technology used by the bank. 2.4 THE IMPORTANCE OF SERVICE QUALITY Every service provider will agree to the statement that service quality is fundamental to the success and survival of a service institution. There are two main reasons for this. ● The South African economy has evolved into a service economy in which institutions compete on the basis of services delivered (Zeithaml et al. 1990:1). This also holds true for banking institutions. This evolution of the economy is illustrated by means of a table indicating the increase in services as a percentage of Gross Domestic Product (GDP) in South Africa. Figure 1: Services as percentage of the South African GDP Year 1981 1991 2000 2001 % 47.9 57.1 65.2 65.3 Source: World Bank (2003) ● Superior quality serves as an excellent competitive strategy (Zeithaml et al. 1990:2) giving institutions the competitive advantage needed to survive in a highly competitive market. Due to the number of banking institutions available, clients are able to simply change to another institution should they experience unacceptable problems at their current banking institution. This will result in the institution losing a portion of its market share, therefore banking institutions simply cannot afford to provide average services. 2.5 THE TEN DIMENSIONS OF SERVICE QUALITY Service quality is evaluated according to criteria established by customers (Zeithaml et al. 1990:16), thus it is important to identify the criteria in order to facilitate improvement. There are ten dimensions generally recognized as evaluative criteria used by customers to assess service quality, irrespective of the type of service concerned (Parasuraman & Zeithaml 2002:340). Zeithaml et al. (1990:20) stress the importance of realizing that these ten dimensions are not necessarily independent of one another, while Lambin (2000:505) suggests that in some instances they are somewhat redundant. Below follows a summary of these ten dimensions. A short explanation of each dimension, followed by an example relating to banking institutions, will be provided. ● Tangibles This refers to various aspects, such as the appearance of the premises, equipment, communication materials (see Annexure D – Letterheads) and personnel (Zeithaml et al. 1990:21), as well as the physical evidence relating to the service provided (Lambin 2000:505), for example the various types of bank cards. ● Reliability Reliability indicates the ability of a business to perform a promised service dependably and accurately (Zeithaml et al. 1990:21), and it relates to the consistency of performance (Lambin 2000:504). An example is the degree to which bank statements are free of errors. ● Security The main components of security are physical, financial and moral safety (Lambin 2000:505), in other words a risk- and danger-free environment (Parasuraman & Zeithaml 2002:340). The main concerns of banking institutions in this respect are the safety of using ATMs (First National Bank 2004 - see Annexure E) and the risks involved in Internet banking, as shown in a fairly recent media report by Altenroxel and Thiel (2003) (see Annexure F – copy of report). ● Courtesy Clients always observe the politeness, respect, consideration and friendliness of contact personnel (Zeithaml et al. 1990:21), for example the bank’s switchboard operator or the employee responsible at the information desk. ● Responsiveness Zeithaml et al. (1990:21) define responsiveness as the willingness of a service provider to provide assistance and punctual service. For a small business, the timely arrival of a new cheque book will be very important, since many businesses use cheques to pay expenses. ● Competence A service provider will be regarded as competent if the necessary skills and knowledge are displayed. The ease of processing a transaction serves as an example in this regard. (Zeithaml et al. 1990:21.) ● Credibility Credibility involves the trustworthiness, believability and honesty of the service provider (Parasuraman & Zeithaml 2002:340). An employee of a banking institution who discloses the financial information of a client to others will seriously jeopardise the reputation and credibility of the bank. ● Communication According to Parasuraman and Zeithaml (2002:340) clients must be kept informed, while the service provider must be capable of listening to the client and communicating in a language he/she understands. Interest rates fluctuate, which necessitates regular updates to clients, especially mortagees and investors. ● Access Parasuraman and Zeithaml (2002:340) submit that a client will consider the approachability of a service provider and ease of contact as evaluative criteria. The availability of branches is relevant in this respect, such as the fact that prior to the incorporation of BOE into Nedbank, the latter did not have a branch in Jeffreys Bay, which is one of the most popular holiday destinations in South Africa during summer. ● Understanding the customer As far as any service provider is concerned, the effort made to know clients and their needs is invaluable (Parasuraman & Zeithaml 2002:341). Knowledge of a client’s personal situation and financial capabilities will be an important factor in assessing credit-worthiness when considering mortgage applications. 3. EMPIRICAL RESEARCH An empirical study was undertaken in order to obtain an insight into a small business’ perception of the service quality of the banking institution of which it is a client. Included in the study was a comparison of the level of service quality at three of South Africa’s largest banking institutions, as perceived by clients of the respective institutions. Below follows the background of each business interviewed as well as a report on the findings. 3.1 BACKGROUNDS OF THE SMALL BUSINESSES INTERVIEWED Three small businesses, including a hairdresser, a laundry and a mini market, were interviewed to facilitate this study. A brief background of each business is provided in this section. Cape View Mini Market, a retailer in Kabega Park, Port Elizabeth, has been owned and managed by an Asian male for the past fifteen years. The owner has no formal management qualification, yet this close corporation had a turnover between R500 000 and R999 999 in the last financial year. As far as the growth and success of the business is concerned, the owner reports no significant changes during the last two years. The Newton Park branch (Branch code: 5103) of First National Bank provides this retailer with banking services. Mrs. E. Haasbroek, a hairdresser from Uitenhage, has twenty years experience as owner and manager of Salon Erika, a sole proprietorship with a reported turnover of less than R500 000 for the last financial year. She has a qualification in Beautyculture and Hairdressing. During the last two years the owner has experienced growth in terms of turnover, and this contributes to her view of her business as being successful and profitable. Mrs. Haasbroek does her banking at Nedbank, Uitenhage (Branch code: 126-317). Wash `n Spin Laundry, situated in Cape Road, Port Elizabeth, has been active in the service industry for the past eight years. This close corporation is owned and managed by a white male, Mr. Harris, who employs two full-time workers. Although his annual turnover last year was less than R500 000, he feels that he is experiencing sufficient growth, considering the type of business concerned. Mr. Harris does his banking at the North End branch (Branch code: 632005) of ABSA Bank. 3.2 REPORT ON FINDINGS 3.2.1 General findings On a general basis, consideration of the information provided led to the following conclusions: ● Despite dissatisfaction in a few areas, small businesses tend not to change to other banks. ● Small businesses consider themselves to be loyal clients of their banks. This reinforces the importance of the contribution of small businesses when viewed from the banking sector. ● It was also derived that the satisfaction of the business as a client seemed to increase with an increase in the number of years the business banked at a specific institution. ● Only one business experiences dissatisfaction to some extent. The other two businesses are generally satisfied with the level of service quality provided by their respective banks. ● The only business indicating reluctance to recommend its bank to others was the business that experienced some dissatisfaction relating to the quality of services provided. Figure 2 provides a graphical presentation of the three small businesses’ general perception of the level of service quality provided by their respective banking institutions. Figure 2: General Perceptions Vertical Axis: (1) - Disagree strongly (2) - Disagree (3) - Neutral (4) - Agree (5) - Strongly agree 5 4 3 2 1 0 ABSA FNB Nedbank A B C D E F Categories as listed below Categories: A) - I have no plans to switch to another bank in the future B) - I regard myself as a "loyal" client of this bank C) - I would recommend my bank to others D) - I prefer this bank to any of the other banking institutions E) - I am satisfied with the service rendered to me by my bank F) - My bank treats me as a valued client 3.2.2 Findings with respect to the ten dimensions of service quality This section will provide feedback on the ten dimensions of service quality as perceived by the three small businesses interviewed. ● Tangibles All three businesses agreed that their bank has attractive premises and that staff is neatly dressed. As for communication material, only one owner indicated a minor degree of dissatisfaction with respect to bank statements. It is evident that all three relevant banks optimally utilise the latest technology available. ● Reliability Two owners agreed that they can depend on their bank and that the accuracy of services provided by their bank is of a high standard. The third owner disagreed with statements relating to accuracy and showed great dissatisfaction as far as the dependability of his bank is concerned. ● Security The overall security perceived by two owners was of a high standard. The third owner agreed that there is sufficient security available for clients at the premises, though he has some reservations regarding the safety of Internet banking and his financial transactions. ● Courtesy Courtesy at all three branches is deemed to be excellent. One owner was undecided with respect to the level of courtesy provided in situations of impersonal contact, such as the banking institution’s website. ● Responsiveness All three businesses generally agreed that the bank is willing to provide assistance timeously. The availability of senior managers caused some dissatisfaction in one owner’s banking experiences. ● Competence Of the three small businesses interviewed, one strongly agreed and one merely agreed that their bank displays sufficient levels of competence, while the third business remained undecided in this regard. This owner did however agree that staff displayed sound knowledge of bank related matters. ● Credibility The credibility of the respective banks varied from a completely neutral perception in one case to a situation of absolute satisfaction in another. ● Communication Communication at all three relevant banks is regarded as adequate, except for one owner who feels that information and options are not always explained properly. ● Access It was found that the owners’ overall experiences with respect to access to the bank, whether in person, by telephone or Internet, have been positive. Two small businesses did however show some indecision as to whether they always agree or disagree with the necessity of placing a client on hold. ● Understanding This section of the interview revealed divergent experiences. Even though two owners agreed that their bank delivers services specific to their individual needs, one owner feels that his bank does not recognize him as a regular client and staff does not understand his specific needs. This owner showed no positive responses to any questions pertaining to the relevant bank’s understanding of his business as a client of the institution. This report supports the inference that two businesses are in general satisfied with the services provided by their bank, whereas the remaining business experiences varying degrees of satisfaction, with undecided perceptions in respect of many fields. 4. CONCLUSIONS AND RECOMMENDATIONS The literature study emphasized the distinction between physical products and services, and provided a well-structured foundation for extended research in the field of service quality. This foundation was provided by means of overviews pertaining to the importance of and the ten dimensions of service quality, with specific reference to banking institutions. The empirical study confirmed the importance of service quality as perceived by clients and showed the accuracy of the ten dimensions of service quality as evaluative criteria used by clients to assess service quality. Two aspects observed during research serve as central focus points in the study of service quality provided by banking institutions. Firstly, the level of service quality provided by a bank has the potential of having an indirect influence on the success of the bank. Satisfied clients displayed willingness to recommend their bank to others while dissatisfied clients did not. Secondly, the level of satisfaction enjoyed by clients reflected a tendency to increase as the client’s relationship with the bank matured over a period of years. It is also submitted that there exists a link between these two aspects that, if utilised, has the potential to increase the bank’s market share and efficiency. The bank should aim at providing satisfactory levels of service quality to small businesses during the early years of their association with the particular bank, and at maintaining this level throughout the association. Not only will this ensure the retention of clients, but it will also lead to an expansion of the bank’s client base over the years. This will serve as a major contribution to the success and survival of a banking institution. LIST OF SOURCES Altenroxel, L. and Thiel, G. 21 July 2003. Hacker steals R530 000 from Absa Clients, The Herald [Online]. Available: http://www.theherald.co.za/herald/3003/07/21/ ews/n04_21072003.htm [Accessed 24 Aug. 2004]. Baron, S. & Harris, K. 1995. Services marketing – Text and cases. Houndmills: MacMillan. First National Bank. 2004. FNB ATM security week. Available: ttp://www.fnb.co.za/FNB/popups/ news/articles/20040816ATMsecurity.scml [Accessed 24 Aug. 2004]. Fitzsimmons, J.A. & Fitzsimmons, M.J. 1994. Service management for competitive advantage. New York: McGraw-Hill. Lamb, C.W., Hair, J.F., McDaniel, C., Boshoff, C. & Terblanche, N.S. 2004. Marketing. 2nd South African edition. Cape Town: Oxford. Lambin, J.J. 2000. Market-driven management – Strategic & operational marketing. Houndmills: MacMillan. Parasuraman, A. & Zeithaml, V.A. 2002. Understanding and improving service quality: A literature review and research, in Handbook of marketing. Ed. by B. Weitz and R. Wensley. London: SAGE, pp. 339 – 354. Pollard, E. & Liebeck, H. Ed. 1994. The Oxford Paperback Dictionary. 4th edition. New York: Oxford. World Bank. 2003. South Africa at a glance. Available: http://www.worldbank.org, in Lamb, C.W., Hair, J.F., McDaniel, C., Boshoff, C. & Terblanche, N.S. 2004. Marketing. 2nd South African edition. Cape Town: Oxford. Zeithaml, V.A., Parasuraman, A. & Berry, L.L. 1990. Delivering quality service – Balancing customer perceptions and expectations. New York: The Free Press.