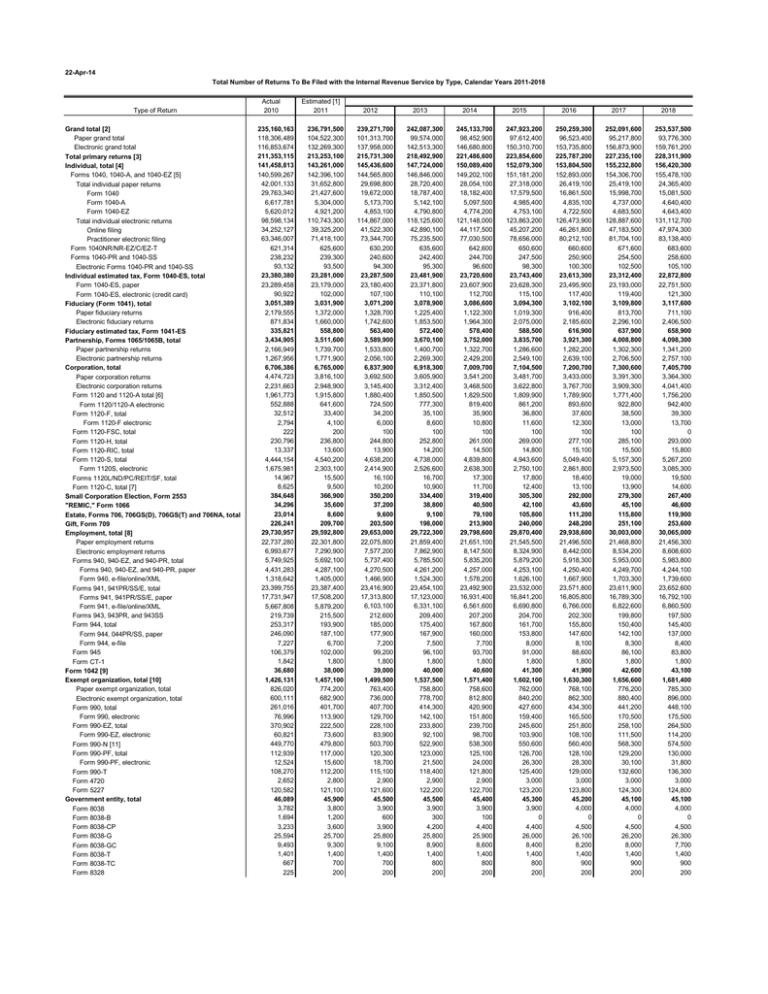

22-Apr-14 Total Number of Returns To Be Filed with the Internal...

advertisement

22-Apr-14 Total Number of Returns To Be Filed with the Internal Revenue Service by Type, Calendar Years 2011-2018 Type of Return Grand total [2] Paper grand total Electronic grand total Total primary returns [3] Individual, total [4] Forms 1040, 1040-A, and 1040-EZ [5] Total individual paper returns Form 1040 Form 1040-A Form 1040-EZ Total individual electronic returns Online filing Practitioner electronic filing Form 1040NR/NR-EZ/C/EZ-T Forms 1040-PR and 1040-SS Electronic Forms 1040-PR and 1040-SS Individual estimated tax, Form 1040-ES, total Form 1040-ES, paper Form 1040-ES, electronic (credit card) Fiduciary (Form 1041), total Paper fiduciary returns Electronic fiduciary returns Fiduciary estimated tax, Form 1041-ES Partnership, Forms 1065/1065B, total Paper partnership returns Electronic partnership returns Corporation, total Paper corporation returns Electronic corporation returns Form 1120 and 1120-A total [6] Form 1120/1120-A electronic Form 1120-F, total Form 1120-F electronic Form 1120-FSC, total Form 1120-H, total Form 1120-RIC, total Form 1120-S, total Form 1120S, electronic Forms 1120L/ND/PC/REIT/SF, total Form 1120-C, total [7] Small Corporation Election, Form 2553 "REMIC," Form 1066 Estate, Forms 706, 706GS(D), 706GS(T) and 706NA, total Gift, Form 709 Employment, total [8] Paper employment returns Electronic employment returns Forms 940, 940-EZ, and 940-PR, total Forms 940, 940-EZ, and 940-PR, paper Form 940, e-file/online/XML Forms 941, 941PR/SS/E, total Forms 941, 941PR/SS/E, paper Form 941, e-file/online/XML Forms 943, 943PR, and 943SS Form 944, total Form 944, 044PR/SS, paper Form 944, e-file Form 945 Form CT-1 Form 1042 [9] Exempt organization, total [10] Paper exempt organization, total Electronic exempt organization, total Form 990, total Form 990, electronic Form 990-EZ, total Form 990-EZ, electronic Form 990-N [11] Form 990-PF, total Form 990-PF, electronic Form 990-T Form 4720 Form 5227 Government entity, total Form 8038 Form 8038-B Form 8038-CP Form 8038-G Form 8038-GC Form 8038-T Form 8038-TC Form 8328 Actual 2010 235,160,163 118,306,489 116,853,674 211,353,115 141,458,813 140,599,267 42,001,133 29,763,340 6,617,781 5,620,012 98,598,134 34,252,127 63,346,007 621,314 238,232 93,132 23,380,380 23,289,458 90,922 3,051,389 2,179,555 871,834 335,821 3,434,905 2,166,949 1,267,956 6,706,386 4,474,723 2,231,663 1,961,773 552,888 32,512 2,794 222 230,796 13,337 4,444,154 1,675,981 14,967 8,625 384,648 34,296 23,014 226,241 29,730,957 22,737,280 6,993,677 5,749,925 4,431,283 1,318,642 23,399,755 17,731,947 5,667,808 219,739 253,317 246,090 7,227 106,379 1,842 36,680 1,426,131 826,020 600,111 261,016 76,996 370,902 60,821 449,770 112,939 12,524 108,270 2,652 120,582 46,089 3,782 1,694 3,233 25,594 9,493 1,401 667 225 Estimated [1] 2011 236,791,500 104,522,300 132,269,300 213,253,100 143,261,000 142,396,100 31,652,800 21,427,600 5,304,000 4,921,200 110,743,300 39,325,200 71,418,100 625,600 239,300 93,500 23,281,000 23,179,000 102,000 3,031,900 1,372,000 1,660,000 558,800 3,511,600 1,739,700 1,771,900 6,765,000 3,816,100 2,948,900 1,915,800 641,600 33,400 4,100 200 236,800 13,600 4,540,200 2,303,100 15,500 9,500 366,900 35,600 8,600 209,700 29,592,800 22,301,800 7,290,900 5,692,100 4,287,100 1,405,000 23,387,400 17,508,200 5,879,200 215,500 193,900 187,100 6,700 102,000 1,800 38,000 1,457,100 774,200 682,900 401,700 113,900 222,500 73,600 479,800 117,000 15,600 112,200 2,800 121,100 45,900 3,800 1,200 3,600 25,700 9,300 1,400 700 200 2012 239,271,700 101,313,700 137,958,000 215,731,300 145,436,600 144,565,800 29,698,800 19,672,000 5,173,700 4,853,100 114,867,000 41,522,300 73,344,700 630,200 240,600 94,300 23,287,500 23,180,400 107,100 3,071,200 1,328,700 1,742,600 563,400 3,589,900 1,533,800 2,056,100 6,837,900 3,692,500 3,145,400 1,880,400 724,500 34,200 6,000 100 244,800 13,900 4,638,200 2,414,900 16,100 10,200 350,200 37,200 9,600 203,500 29,653,000 22,075,800 7,577,200 5,737,400 4,270,500 1,466,900 23,416,900 17,313,800 6,103,100 212,600 185,000 177,900 7,200 99,200 1,800 39,000 1,499,500 763,400 736,000 407,700 129,700 228,100 83,900 503,700 120,300 18,700 115,100 2,900 121,600 45,500 3,900 600 3,900 25,800 9,100 1,400 700 200 2013 242,087,300 99,574,000 142,513,300 218,492,900 147,724,000 146,846,000 28,720,400 18,787,400 5,142,100 4,790,800 118,125,600 42,890,100 75,235,500 635,600 242,400 95,300 23,481,900 23,371,800 110,100 3,078,900 1,225,400 1,853,500 572,400 3,670,100 1,400,700 2,269,300 6,918,300 3,605,900 3,312,400 1,850,500 777,300 35,100 8,600 100 252,800 14,200 4,738,000 2,526,600 16,700 10,900 334,400 38,800 9,100 198,000 29,722,300 21,859,400 7,862,900 5,785,500 4,261,200 1,524,300 23,454,100 17,123,000 6,331,100 209,400 175,400 167,900 7,500 96,100 1,800 40,000 1,537,500 758,800 778,700 414,300 142,100 233,800 92,100 522,900 123,000 21,500 118,400 2,900 122,200 45,500 3,900 300 4,200 25,800 8,900 1,400 800 200 2014 245,133,700 98,452,900 146,680,800 221,486,600 150,089,400 149,202,100 28,054,100 18,182,400 5,097,500 4,774,200 121,148,000 44,117,500 77,030,500 642,600 244,700 96,600 23,720,600 23,607,900 112,700 3,086,600 1,122,300 1,964,300 578,400 3,752,000 1,322,700 2,429,200 7,009,700 3,541,200 3,468,500 1,829,500 819,400 35,900 10,800 100 261,000 14,500 4,839,800 2,638,300 17,300 11,700 319,400 40,500 79,100 213,900 29,798,600 21,651,100 8,147,500 5,835,200 4,257,000 1,578,200 23,492,900 16,931,400 6,561,600 207,200 167,800 160,000 7,700 93,700 1,800 40,600 1,571,400 758,600 812,800 420,900 151,800 239,700 98,700 538,300 125,100 24,000 121,800 2,900 122,700 45,400 3,900 100 4,400 25,900 8,600 1,400 800 200 2015 247,923,200 97,612,400 150,310,700 223,854,600 152,079,300 151,181,200 27,318,000 17,579,500 4,985,400 4,753,100 123,863,200 45,207,200 78,656,000 650,600 247,500 98,300 23,743,400 23,628,300 115,100 3,094,300 1,019,300 2,075,000 588,500 3,835,700 1,286,600 2,549,100 7,104,500 3,481,700 3,622,800 1,809,900 861,200 36,800 11,600 100 269,000 14,800 4,943,600 2,750,100 17,800 12,400 305,300 42,100 105,800 240,000 29,870,400 21,545,500 8,324,900 5,879,200 4,253,100 1,626,100 23,532,000 16,841,200 6,690,800 204,700 161,700 153,800 8,000 91,000 1,800 41,300 1,602,100 762,000 840,200 427,600 159,400 245,600 103,900 550,600 126,700 26,300 125,400 3,000 123,200 45,300 3,900 0 4,400 26,000 8,400 1,400 800 200 2016 250,259,300 96,523,400 153,735,800 225,787,200 153,804,500 152,893,000 26,419,100 16,861,500 4,835,100 4,722,500 126,473,900 46,261,800 80,212,100 660,600 250,900 100,300 23,613,300 23,495,900 117,400 3,102,100 916,400 2,185,600 616,900 3,921,300 1,282,200 2,639,100 7,200,700 3,433,000 3,767,700 1,789,900 893,600 37,600 12,300 100 277,100 15,100 5,049,400 2,861,800 18,400 13,100 292,000 43,600 111,200 248,200 29,938,600 21,496,500 8,442,000 5,918,300 4,250,400 1,667,900 23,571,800 16,805,800 6,766,000 202,300 155,800 147,600 8,100 88,600 1,800 41,900 1,630,300 768,100 862,300 434,300 165,500 251,800 108,100 560,400 128,100 28,300 129,000 3,000 123,800 45,200 4,000 0 4,500 26,100 8,200 1,400 900 200 2017 252,091,600 95,217,800 156,873,900 227,235,100 155,232,800 154,306,700 25,419,100 15,998,700 4,737,000 4,683,500 128,887,600 47,183,500 81,704,100 671,600 254,500 102,500 23,312,400 23,193,000 119,400 3,109,800 813,700 2,296,100 637,900 4,008,800 1,302,300 2,706,500 7,300,600 3,391,300 3,909,300 1,771,400 922,800 38,500 13,000 100 285,100 15,500 5,157,300 2,973,500 19,000 13,900 279,300 45,100 115,800 251,100 30,003,000 21,468,800 8,534,200 5,953,000 4,249,700 1,703,300 23,611,900 16,789,300 6,822,600 199,800 150,400 142,100 8,300 86,100 1,800 42,600 1,656,600 776,200 880,400 441,200 170,500 258,100 111,500 568,300 129,200 30,100 132,600 3,000 124,300 45,100 4,000 0 4,500 26,200 8,000 1,400 900 200 2018 253,537,500 93,776,300 159,761,200 228,311,900 156,420,300 155,478,100 24,365,400 15,081,500 4,640,400 4,643,400 131,112,700 47,974,300 83,138,400 683,600 258,600 105,100 22,872,800 22,751,500 121,300 3,117,600 711,100 2,406,500 658,900 4,098,300 1,341,200 2,757,100 7,405,700 3,364,300 4,041,400 1,756,200 942,400 39,300 13,700 0 293,000 15,800 5,267,200 3,085,300 19,500 14,600 267,400 46,600 119,900 253,600 30,065,000 21,456,300 8,608,600 5,983,800 4,244,100 1,739,600 23,652,600 16,792,100 6,860,500 197,500 145,400 137,000 8,400 83,800 1,800 43,100 1,681,400 785,300 896,000 448,100 175,500 264,500 114,200 574,500 130,000 31,800 136,300 3,000 124,800 45,100 4,000 0 4,500 26,300 7,700 1,400 900 200 22-Apr-14 Total Number of Returns To Be Filed with the Internal Revenue Service by Type, Calendar Years 2011-2018 Type of Return Political organization, total Form 1120POL, total Form 1120POL, electronic Form 8871 [12] Form 8872 Form 8872, electronic Excise, total Form 11-C Form 720 Form 720, electronic Form 730 Form 2290 Form 2290, electronic Form 8849 Form 8849, electronic Form 5330 [13] Form 5330-EZ [14] Form 8752 [15] Supplemental documents, total [16] Form 1040-X, total Form 4868, total Form 4868, paper Form 4868, electronic Credit card E-file Form 1120-X Form 5558 Form 7004, total Form 7004, electronic Form 8868, total Form 8868, electronic Actual 2010 12,635 6,142 19 2,533 3,960 3,095 817,021 6,264 96,220 69 35,601 667,668 48,660 11,268 640 20,269 191,263 36,177 23,807,048 6,624,153 10,407,611 6,454,301 3,953,310 51,301 3,902,009 3,797 581,850 5,619,579 1,985,255 570,058 112,664 Estimated [1] 2011 10,800 6,300 0 2,500 2,000 1,500 833,100 6,200 94,300 100 35,200 686,000 59,700 11,300 600 20,300 191,300 33,800 23,538,400 6,072,700 10,504,800 6,436,200 4,068,600 50,600 4,018,100 3,900 605,000 5,772,900 2,715,800 579,100 127,000 2012 13,200 6,400 0 2,700 4,000 3,200 849,800 6,200 92,500 100 34,900 704,900 73,200 11,300 600 20,300 191,300 32,800 23,540,400 5,773,800 10,685,000 6,473,600 4,211,400 52,300 4,159,000 4,000 628,100 5,861,300 3,197,000 588,300 144,100 2013 11,500 6,600 0 3,000 2,000 1,500 867,000 6,100 90,700 200 34,500 724,300 89,800 11,300 600 20,300 191,300 31,800 23,594,400 5,527,400 10,868,000 6,516,400 4,351,500 54,100 4,297,400 4,100 651,200 5,946,100 3,497,700 597,600 161,200 2014 14,000 6,700 0 3,200 4,100 3,200 884,700 6,100 88,900 400 34,200 744,300 110,100 11,300 600 20,300 191,300 30,800 23,647,100 5,281,000 11,052,200 6,563,500 4,488,800 55,800 4,433,000 4,200 674,300 6,028,300 3,715,400 607,100 179,500 2015 12,200 6,800 0 3,400 2,000 1,500 903,100 6,000 87,200 700 33,900 764,800 135,000 11,300 600 20,300 191,300 29,900 24,068,600 5,428,100 11,213,300 6,600,000 4,613,400 57,300 4,556,000 4,400 697,400 6,108,600 3,876,000 616,700 191,400 2016 14,800 7,000 0 3,600 4,200 3,300 922,100 6,000 85,400 1,100 33,500 785,800 165,600 11,300 600 20,300 191,300 29,000 24,472,100 5,575,300 11,357,500 6,581,000 4,776,500 59,400 4,717,100 4,500 720,600 6,187,800 3,997,500 626,500 199,300 [1] Estimated based on information available as of August 2011. [2] Grand total is the sum of total primary returns and supplemental documents. [3] Total primary returns is the sum of all returns, excluding supplemental documents. [4] "Individual, total" is the sum of paper and electronic Forms 1040, 1040A, 1040C, 1040EZ, 1040EZ-T, 1040NR, 1040NR-EZ, 1040PR, and 1040SS. [5] Forms 1040/A/EZ is the sum of the paper and electronic Forms 1040, 1040A, and 1040EZ. [6] Form 1120-A cannot be filed for tax years beginning after Dec. 31, 2006. [7] Form 1120-C includes Form 990-C. [8] "Employment, total" includes paper, magnetic tape and electronic Forms 940, 940EZ, 940PR, 941, 941E, 941PR, 941SS, 943, 943PR, 943SS, 944, 944PR, 944SS, 945, and CT-1. [9] Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. [10] "Exempt organization, total" includes Forms 990, 990EZ, 990N, 990PF, 990T, 4720, and 5227. See footnote 7. [11] Form 990-N is all electronic. [12] Form 8871 is all electronic. [13] Form 5330 is the Return of Excise Taxes Related to Employee Benefit Plans [14] IRS regained responsibility for processing Form 5500EZ from the Department of Labor beginning in 2010. [15] Form 8752 is Required Payment or Refund Under Section 7519, a computation of payment or refund by a partnership or S corporation. [16] Supplemental documents consist mainly of applications for extensions of time to file and amended tax returns. NOTE: Details may not add to totals because of rounding. Table excludes Non-Master File counts. SOURCE: IRS, Statistics of Income, Winter 2012 Bulletin. "Projections of Federal Tax Return Filings: Calendar Years 2011–2018," Table 1. 2017 12,900 7,100 0 3,800 2,000 1,600 941,600 5,900 83,800 1,700 33,200 807,500 203,100 11,300 600 20,300 191,300 28,100 24,856,600 5,722,500 11,483,300 6,533,400 4,929,800 61,300 4,868,600 4,600 743,700 6,266,200 4,092,300 636,400 205,000 2018 15,600 7,300 0 4,000 4,300 3,400 961,900 5,900 82,100 2,400 32,900 829,700 249,100 11,300 600 20,300 191,300 27,200 25,225,600 5,869,700 11,593,800 6,519,200 5,074,600 63,100 5,011,500 4,700 766,800 6,344,100 4,168,800 646,500 209,500 13-May-11 Total Number of Returns To Be Filed with the Internal Revenue Service by Type, Calendar Years 2009-2016 Type of Return Grand total [2] Paper grand total Electronic grand total Total primary returns [3] Individual, total [4] Forms 1040, 1040A, and 1040EZ [5] Total individual paper returns Form 1040 Form 1040A Form 1040EZ Total individual electronic returns Online filing Practitioner electronic filing Form 1040NR/NR-EZ/C/EZ-T Forms 1040PR and 1040SS Individual estimated tax, Form 1040-ES, total Form 1040-ES, paper Form 1040-ES, electronic (credit card) Fiduciary (Form 1041), total Paper fiduciary returns Electronic fiduciary returns Fiduciary estimated tax, Form 1041-ES Partnership, Forms 1065/1065B, total Paper partnership returns Electronic partnership returns Corporation, total Paper corporation returns Electronic corporation returns Form 1120 and 1120-A total [6] Form 1120/1120-A electronic Form 1120F, total Form 1120F electronic Form 1120FSC, total Form 1120H, total Form 1120RIC, total Form 1120S, total Form 1120S, electronic Forms 1120L/ND/PC/REIT/SF, total Form 1120C, total [7] Small Corporation Election, Form 2553 "REMIC," Form 1066 Estate, Forms 706 and 706NA, total Gift, Form 709 Employment, total [8] Paper employment returns Electronic employment returns Forms 940, 940EZ, and 940PR, total Forms 940, 940EZ, and 940PR, paper Form 940, e-file/online/XML Forms 941, 941PR/SS/E, total Forms 941, 941PR/SS/E, paper Form 941, e-file/online/XML Forms 943, 943PR, and 943SS Form 944, total Form 944, paper Form 944, e-file Form 945 Form CT-1 Form 1042 [9] Exempt organization, total [10] Paper exempt organization, total Electronic exempt organization, total Form 990, total Form 990, electronic Form 990EZ, total Form 990EZ, electronic Form 990-N [11] Form 990PF, total Form 990PF, electronic Form 990T Form 4720 Form 5227 Government entity, total Form 8038 Form 8038G Form 8038GC Form 8038T Form 8328 Actual 2008 252,537,925 150,306,315 102,231,610 231,728,688 154,709,342 153,832,040 64,059,483 39,093,746 15,939,026 9,026,711 89,772,557 26,894,530 62,878,027 642,569 234,733 29,218,011 29,121,190 96,821 3,110,569 2,354,985 755,584 928,532 3,348,845 2,653,445 695,400 6,865,246 5,595,892 1,269,354 2,185,188 336,779 33,222 313 479 223,841 12,404 4,390,857 932,262 13,875 5,380 475,602 33,771 48,274 257,010 30,502,853 24,146,682 6,356,171 6,172,266 4,990,901 1,181,365 23,508,192 18,345,350 5,162,842 249,067 440,588 428,624 11,964 130,790 1,950 33,647 1,135,314 848,082 287,232 423,358 53,093 171,342 11,037 216,872 97,766 6,230 98,071 2,438 125,467 47,368 4,414 29,159 11,644 1,929 222 Estimated [1] 2009 240,415,900 131,558,000 108,857,900 218,966,200 141,841,400 140,881,400 46,642,300 31,447,800 8,052,300 7,142,200 94,239,100 31,900,300 62,338,800 700,500 259,500 29,136,500 29,039,000 97,500 3,124,200 2,353,700 770,500 712,200 3,433,800 2,481,700 952,100 6,990,700 5,281,100 1,709,600 2,172,900 447,300 32,600 900 400 231,400 12,800 4,517,500 1,261,500 14,500 8,700 444,600 29,200 43,700 255,000 30,622,100 23,637,400 6,984,800 6,073,600 4,800,200 1,273,400 23,813,700 18,117,800 5,695,900 231,500 388,800 373,400 15,500 112,600 1,900 35,100 1,210,600 842,300 368,300 389,400 59,700 217,600 24,800 274,500 98,300 9,300 96,200 2,600 132,000 47,400 4,100 28,900 12,100 2,000 300 2010 238,017,200 124,657,000 113,360,200 216,644,000 139,485,000 138,492,900 41,042,700 27,010,400 7,787,400 6,244,900 97,450,200 33,285,500 64,164,700 726,600 265,500 28,603,200 28,504,900 98,300 3,134,300 2,351,000 783,300 712,200 3,776,900 2,636,000 1,140,900 7,004,800 4,927,700 2,077,100 2,145,700 561,500 32,300 2,300 300 226,700 12,700 4,561,100 1,513,300 14,400 11,600 424,300 30,700 23,400 265,600 30,797,600 23,689,600 7,108,000 6,101,900 4,776,800 1,325,100 23,873,200 18,110,100 5,763,100 228,600 486,700 466,800 19,800 105,500 1,800 36,500 1,254,200 833,500 420,700 398,800 85,900 234,600 34,100 285,500 101,300 15,200 99,200 2,700 132,100 48,600 4,100 28,900 13,200 2,100 300 2011 239,234,600 121,057,000 118,177,600 217,363,400 140,149,200 139,125,100 38,059,500 25,393,100 7,137,800 5,528,600 101,065,600 34,724,200 66,341,300 752,600 271,500 28,193,300 28,091,100 102,300 3,144,300 2,348,300 796,000 712,200 3,977,600 2,685,900 1,291,700 7,145,200 4,734,900 2,410,300 2,137,400 659,000 32,500 3,500 300 228,300 12,700 4,705,200 1,747,700 14,500 14,300 406,300 33,200 10,000 267,800 30,976,800 23,744,500 7,232,200 6,180,700 4,795,700 1,385,000 23,947,500 18,121,900 5,825,600 225,800 519,300 497,700 21,600 101,600 1,900 36,500 1,212,500 751,100 461,400 408,200 118,500 169,900 29,800 293,200 104,200 19,900 102,200 2,700 132,100 48,300 4,100 28,900 12,800 2,200 300 2012 242,274,200 118,851,400 123,422,800 219,705,700 141,960,600 140,904,400 35,683,600 23,786,100 6,856,500 5,040,900 105,220,800 35,824,000 69,396,800 778,600 277,600 28,126,800 28,017,200 109,600 3,154,400 2,345,700 808,700 712,200 4,138,400 2,740,400 1,398,000 7,333,200 4,653,700 2,679,600 2,129,700 726,700 33,000 4,900 200 232,500 12,900 4,893,400 1,948,000 14,700 16,800 390,500 36,000 86,900 270,100 31,136,200 23,791,800 7,344,400 6,238,900 4,800,700 1,438,200 24,027,300 18,144,900 5,882,500 223,100 545,900 522,200 23,700 99,000 1,900 37,200 1,218,000 736,300 481,700 417,600 130,500 154,600 29,600 298,500 107,200 23,100 105,100 2,800 132,200 48,100 4,100 28,900 12,400 2,400 300 2013 245,703,900 117,533,500 128,170,400 222,475,500 144,256,500 143,168,200 34,187,500 22,756,900 6,691,700 4,739,000 108,980,700 36,788,400 72,192,300 804,700 283,600 28,047,000 27,930,100 116,900 3,164,400 2,343,000 821,400 712,200 4,299,100 2,816,100 1,483,000 7,532,500 4,649,900 2,882,600 2,122,300 767,500 33,700 6,600 200 238,000 13,100 5,091,200 2,108,600 15,000 19,100 376,600 38,800 107,100 272,500 31,279,300 23,834,400 7,444,800 6,289,400 4,802,300 1,487,100 24,103,500 18,170,900 5,932,600 220,700 567,000 541,900 25,100 96,700 1,900 37,800 1,242,100 742,100 500,000 427,000 141,300 159,600 31,500 302,200 110,200 25,000 108,100 2,800 132,200 48,200 4,100 28,900 12,400 2,500 300 2014 248,792,000 116,517,300 132,274,800 225,018,700 146,380,400 145,260,100 33,081,200 22,028,500 6,550,200 4,502,600 112,178,900 37,493,500 74,685,400 830,700 289,600 27,941,200 27,817,100 124,000 3,174,500 2,340,300 834,200 712,200 4,459,600 2,904,400 1,555,200 7,718,100 4,688,500 3,029,600 2,115,100 789,400 34,300 8,100 200 244,200 13,300 5,274,500 2,232,000 15,300 21,200 364,600 41,400 113,700 274,900 31,418,000 23,880,800 7,537,200 6,332,300 4,800,600 1,531,700 24,187,600 18,208,100 5,979,500 218,400 583,600 557,600 26,000 94,100 1,900 38,600 1,264,200 746,900 517,300 436,400 151,800 163,600 33,700 304,700 113,200 27,100 111,100 2,900 132,300 48,300 4,100 28,900 12,400 2,600 300 2015 251,378,000 115,484,800 135,893,200 227,113,000 148,086,900 146,934,600 31,985,500 21,235,200 6,383,000 4,367,300 114,949,100 37,931,800 77,017,300 856,700 295,600 27,819,100 27,688,100 131,000 3,184,500 2,337,600 846,900 712,200 4,620,000 3,000,000 1,620,000 7,889,900 4,750,600 3,139,300 2,108,000 800,100 34,900 9,400 200 251,100 13,400 5,443,500 2,329,800 15,600 23,200 354,300 43,800 119,400 277,300 31,559,400 23,935,500 7,623,900 6,376,400 4,802,600 1,573,800 24,276,900 18,253,500 6,023,400 216,300 596,300 569,700 26,700 91,500 1,900 39,400 1,284,300 750,800 533,500 445,800 162,400 166,800 35,700 306,300 116,200 29,100 114,000 2,900 132,300 48,500 4,100 28,900 12,400 2,800 300 2016 253,644,400 114,725,400 138,919,000 228,905,500 149,562,200 148,377,700 30,899,500 20,303,600 6,304,400 4,291,400 117,478,200 38,314,500 79,163,700 882,800 301,700 27,676,400 27,538,600 137,800 3,194,500 2,334,900 859,600 712,200 4,740,200 3,073,400 1,666,800 8,050,900 4,819,000 3,231,900 2,100,800 810,100 35,500 10,400 100 258,700 13,600 5,601,100 2,411,400 15,900 25,100 345,800 46,200 125,000 279,800 31,697,500 23,993,600 7,703,900 6,421,100 4,807,600 1,613,500 24,365,100 18,301,800 6,063,300 214,400 606,100 579,000 27,100 88,800 1,900 40,200 1,303,600 754,200 549,400 455,200 173,200 169,400 37,600 307,500 119,100 31,100 117,000 3,000 132,400 48,600 4,100 28,900 12,400 2,900 300 13-May-11 Total Number of Returns To Be Filed with the Internal Revenue Service by Type, Calendar Years 2009-2016 Type of Return Political organization, total Form 1120POL, total Form 1120POL, electronic Form 8871 [12] Form 8872 Form 8872, electronic Excise, total Form 11-C Form 720 Form 720, electronic Form 730 Form 2290 Form 2290, electronic Form 8849 Form 8849, electronic Form 5330 Form 8752 [13] Supplemental documents, total [14] Form 1040X, total Form 4868, total Form 4868, paper Form 4868, electronic Credit card E-file Form 1120X Form 5558 Form 7004, total Form 7004, electronic Form 8868, total Form 8868, electronic Actual 2008 11,592 6,168 11 1,905 3,519 2,758 935,498 8,143 100,165 24 40,842 718,066 16,133 68,282 40 24,137 43,077 20,809,237 4,803,051 9,661,156 7,877,250 1,783,906 66,838 1,717,068 3,447 436,965 5,370,245 1,139,906 534,373 53,808 Estimated [1] 2009 10,200 6,300 0 1,300 2,600 1,800 964,500 8,400 97,700 200 41,200 753,900 31,900 63,300 200 24,500 40,500 21,449,700 5,082,900 9,671,600 7,614,700 2,056,900 69,600 1,987,300 3,700 455,900 5,665,900 1,567,800 569,700 75,900 2010 11,700 6,300 0 1,900 3,500 2,800 969,600 8,200 96,500 400 40,600 765,300 40,000 58,900 600 25,000 40,400 21,373,100 4,957,100 9,677,100 7,347,800 2,329,300 73,900 2,255,400 4,100 461,100 5,677,500 1,807,800 596,200 98,900 2011 10,200 6,300 100 1,300 2,600 1,700 974,200 7,900 94,500 700 40,100 776,800 55,100 54,900 1,100 25,400 40,300 21,871,300 5,070,800 10,014,000 7,322,900 2,691,000 78,200 2,612,800 4,500 466,100 5,728,600 1,950,600 587,400 116,500 2012 11,800 6,300 100 1,900 3,500 2,800 979,300 7,700 92,500 1,200 39,500 788,200 80,900 51,300 1,900 25,800 40,200 22,568,400 5,229,700 10,465,500 7,359,800 3,105,700 82,500 3,023,200 4,900 471,100 5,803,500 2,048,500 593,700 137,100 2013 10,300 6,400 100 1,300 2,600 1,700 984,800 7,600 90,500 1,700 39,000 799,700 112,100 48,000 3,200 26,200 40,100 23,228,300 5,375,400 10,881,200 7,347,200 3,534,000 86,900 3,447,100 5,200 476,000 5,893,000 2,129,300 597,500 157,500 2014 11,800 6,400 100 1,900 3,500 2,800 990,700 7,500 88,600 2,500 38,400 811,100 157,600 45,100 4,500 26,600 39,900 23,773,400 5,512,100 11,179,600 7,235,300 3,944,200 91,300 3,852,900 5,600 480,900 5,991,300 2,205,900 604,000 178,800 2015 10,300 6,400 100 1,300 2,600 1,800 996,800 7,400 86,600 3,200 37,900 822,600 207,200 42,500 6,300 27,000 39,800 24,265,000 5,657,600 11,410,600 7,065,000 4,345,500 95,800 4,249,700 5,800 485,700 6,094,800 2,283,400 610,500 200,700 [1] Estimated based on information available as of August 2009. [2] Grand total is the sum of total primary returns and supplemental documents. [3] Total primary returns is the sum of all returns, excluding supplemental documents. includes the marginal effects of the 2008 Economic Stimulus Package. [4] "Individual, total" is the sum of paper and electronic Forms 1040, 1040A, 1040C, 1040EZ, 1040EZ-T, 1040NR, 1040NR-EZ, 1040PR, and 1040SS. The Forms 1040, 1040A and 1040EZ Totals [5] Forms 1040/A/EZ is the sum of the paper and electronic Forms 1040, 1040A, and 1040EZ. [6] Form 1120-A cannot be filed for tax years beginning after Dec. 31, 2006. [7] Form 1120-C includes Form 990-C. [8] "Employment, total" includes paper, magnetic tape and electronic Forms 940, 940EZ, 940PR, 941, 941E, 941PR, 941SS, 943, 943PR, 943SS, 944, 944PR, 944SS, 945, and CT-1. [9] Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. [10] "Exempt organization, total" includes Forms 990, 990EZ, 990N, 990PF, 990T, 4720, and 5227. See footnote 7. [11] Form 990-N is all electronic. [12] Form 8871 is all electronic. [13] Form 8752 is Required Payment or Refund Under Section 7519, a computation of payment or refund by a partnership or S corporation. [14] Supplemental documents consist mainly of applications for extensions of time to file and amended tax returns. NOTE: Details may not add to totals because of rounding. Table excludes Non-Master File counts. SOURCE: IRS, Statistics of Income, Winter 2010 Bulletin. "Projections of Federal Tax Return Filings: Calendar Years 2009–2016," Table 1. 2016 11,900 6,400 100 1,900 3,500 2,800 1,003,300 7,300 84,600 4,400 37,300 834,000 258,100 40,100 8,100 27,400 39,700 24,739,000 5,788,800 11,635,000 7,204,000 4,431,000 100,300 4,330,700 6,100 490,400 6,201,600 2,362,200 617,100 222,900