1-Jul-15 1955 2,460 0.00

advertisement

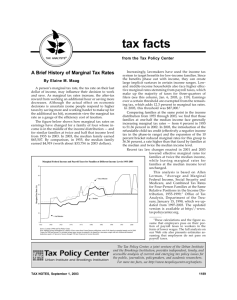

1-Jul-15 Average and Marginal Federal Income Tax Rates for Four-Person Families at the Same Relative Position in the Income Distribution, 1955-2014 One-Half Median Income Income Average Income Tax Rate 1955 1956 1957 1958 1959 2,460 2,660 2,744 2,843 3,035 0.00 0.00 0.00 0.00 0.00 1960 1961 1962 1963 1964 3,148 3,219 3,378 3,569 3,744 1965 1966 1967 1968 1969 Median Income Income Average Income Tax Rate 0.00 0.00 0.00 0.00 0.00 4,919 5,319 5,488 5,685 6,070 5.64 6.38 6.65 6.96 7.49 0.15 0.49 1.19 1.95 2.06 20.00 20.00 20.00 20.00 16.00 6,295 6,437 6,756 7,138 7,488 3,900 4,171 4,497 4,917 5,312 2.16 2.72 3.32 4.03 4.58 14.00 14.00 15.00 15.00 15.00 1970 1971 1972 1973 1974 5,583 6,088 6,404 6,855 7,485 4.65 4.73 4.37 4.88 4.17 1/ 15.00 15.00 15.00 16.00 16.00 1975 1976 1977 1978 1979 7,924 8,658 9,362 10,214 11,256 4.12 4.68 3.61 4.73 5.11 2/ 2/ 2/ 2/ 2/ 27.00 17.00 17.00 19.00 16.00 2/ 2/ 2/ 2/ 2/ 15,848 17,315 18,723 20,428 22,512 9.62 9.89 10.42 11.07 10.84 2/ 2/ 2/ 2/ 2/ 22.00 22.00 22.00 25.00 24.00 1980 1981 1982 1983 1984 12,166 13,137 13,810 14,591 15,549 6.02 6.82 6.51 6.53 6.50 2/ 2/ 2/ 2/ 2/ 18.00 17.78 16.00 15.00 14.00 2/ 2/ 2/ 2/ 2/ 24,332 26,274 27,619 29,181 31,097 11.42 11.79 11.06 10.38 10.25 2/ 2/ 2/ 2/ 2/ 1985 1986 1987 1988 1989 16,389 17,358 18,543 19,526 20,382 6.56 6.64 5.16 5.17 5.29 2/ 2/ 2/ 2/ 2/ 14.00 14.00 15.00 15.00 15.00 2/ 2/ 2/ 2/ 2/ 32,777 34,716 37,086 39,051 40,763 10.34 10.48 8.90 9.30 9.36 1990 1991 1992 1993 1994 20,726 21,526 22,126 22,581 23,506 5.12 5.04 4.55 4.35 3.35 2/ 2/ 2/ 2/ 2/ 15.00 15.00 28.14 28.93 32.68 2/ 2/ 2/ 2/ 2/ 41,451 43,052 44,251 45,161 47,012 1995 1996 1997 1998 1999 24,844 25,759 26,675 28,031 29,991 3.52 2.92 3.09 1.02 2.15 2/ 2/ 2/ 2/ 3/ 2/ 3/ 35.22 36.06 36.06 36.06 36.06 2/ 2/ 2/ 2/ 3/ 2/ 3/ 2000 2001 2002 2003 2004 31,335 4/ 31,639 31,366 32,547 33,012 2.93 -0.11 -2.04 -4.20 -4.31 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 15 36.06 31.06 31.06 31.06 2005 2006 2007 2008 2009 35,156 36,708 6/ 37,838 38,235 37,203 -3.44 -2.79 -2.79 -8.33 -9.10 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 2010 2011 2012 2013 2014 37,375 37,785 39,849 40,178 37,923 -8.95 -6.88 -5.68 -6.20 -8.52 2/ 6/ 8/ 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 9/ Year Twice Median Income Income Average Income Tax Rate 20.00 20.00 20.00 20.00 20.00 9,838 10,638 10,976 11,370 12,140 10.76 11.22 11.40 11.59 11.93 22.00 22.00 22.00 22.00 22.00 7.77 7.94 8.30 8.68 7.56 20.00 20.00 20.00 20.00 18.00 12,590 12,874 13,512 14,276 14,976 12.11 12.22 12.44 12.85 11.66 22.00 22.00 26.00 26.00 23.50 7,800 8,341 8,994 9,834 10,623 7.09 7.48 8.00 9.21 9.92 17.00 19.00 19.00 20.42 20.90 15,600 16,682 17,988 19,668 21,246 11.12 11.50 11.89 13.37 14.24 22.00 22.00 22.00 26.88 27.50 11,165 12,176 12,808 13,710 14,969 9.35 9.27 9.09 9.45 8.99 1/ 19.48 19.00 19.00 19.00 22.00 22,330 24,352 25,616 27,420 29,938 13.47 13.45 13.52 14.05 14.35 1/ 25.62 28.00 28.00 28.00 33.00 1/ 2/ 2/ 2/ 2/ 2/ 31,696 34,630 37,446 40,856 45,024 14.86 15.51 16.40 17.38 17.20 2/ 2/ 2/ 2/ 2/ 32.00 32.00 36.00 39.00 37.00 2/ 2/ 2/ 2/ 2/ 24.00 23.70 25.00 23.00 22.00 2/ 2/ 2/ 2/ 2/ 48,664 52,548 55,238 58,362 62,194 18.25 19.11 18.01 16.83 16.62 2/ 2/ 2/ 2/ 2/ 43.00 42.46 39.00 35.00 38.00 2/ 2/ 2/ 2/ 2/ 2/ 2/ 2/ 2/ 2/ 22.00 22.00 15.00 15.00 15.00 2/ 2/ 2/ 2/ 2/ 65,554 69,432 74,172 78,102 81,526 16.78 17.04 15.80 15.21 15.28 2/ 2/ 2/ 2/ 2/ 38.00 38.00 35.00 28.00 28.00 2/ 2/ 2/ 2/ 2/ 9.33 9.30 9.18 9.18 9.17 2/ 2/ 2/ 2/ 2/ 15.00 15.00 15.00 15.00 15.00 2/ 2/ 2/ 2/ 2/ 82,902 86,104 88,502 90,322 94,024 15.10 15.03 14.79 14.73 14.79 2/ 2/ 2/ 2/ 2/ 28.00 28.00 28.00 28.00 28.00 2/ 2/ 2/ 2/ 2/ 49,687 51,518 53,350 56,061 59,755 9.28 9.33 9.32 7.98 7.88 2/ 2/ 2/ 2/ 3/ 2/ 3/ 15.00 15.00 15.00 15.00 15.00 2/ 2/ 2/ 2/ 3/ 2/ 3/ 99,374 103,036 106,700 112,222 119,510 15.04 15.13 15.16 14.70 15.27 2/ 2/ 2/ 2/ 3/ 2/ 3/ 28.00 28.00 28.00 33.00 33.00 2/ 2/ 2/ 2/ 3/ 2/ 3/ 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 62,670 4/ 63,278 62,732 65,093 66,023 8.02 6.71 6.56 5.34 5.37 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 15.00 15.00 15.00 15.00 15.00 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 125,340 126,556 125,464 130,186 132,046 15.68 14.94 14.23 12.46 12.49 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 33.00 33.00 32.00 30.00 30.00 2/ 3/ 2/ 3/ 5/ 2/ 6/ 2/ 6/ 2/ 6/ 31.06 31.06 31.06 31.06 31.06 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 70,312 73,415 75,675 76,470 74,406 5.69 5.85 5.93 3.54 4.47 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 15.00 15.00 15.00 15.00 15.00 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 140,624 146,830 151,350 152,940 148,812 13.11 13.42 13.53 12.35 12.31 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 30.00 30.00 25.00 30.00 30.00 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 7/ 2/ 6/ 8/ 31.06 31.06 31.06 31.06 31.06 2/ 6/ 8/ 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 9/ 74,750 75,570 79,698 80,356 75,845 4.50 5.59 5.84 5.79 5.34 2/ 6/ 8/ 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 9/ 15.00 15.00 15.00 15.00 15.00 2/ 6/ 8/ 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 9/ 149,500 151,140 159,396 160,712 151,690 12.36 12.92 13.13 13.01 12.43 2/ 6/ 8/ 2/ 6/ 2/ 6/ 2/ 6/ 2/ 6/ 9/ 30.00 2/ 6/ 8/ 25.00 2/ 6/ 25.00 25.00 25.00 Marginal Income Tax Rate Marginal Income Tax Rate Marginal Income Tax Rate 1/ 2/ 3/ 4/ 5/ 6/ 7/ 8/ 9/ Reflects one-year rebate under P.L. 94-12, including income related phaseout for the twice-median income family. Includes effects of the Earned Income Tax Credit (EITC), assuming two eligible dependents. Includes effects of Child Tax Credit enacted in the Taxpayer Relief Act of 1997. Sample expanded by 28,000 households. If calculated by old method, would've been $62,228. Includes effects of $600 rebate given as part of EGTRRA. Includes effects of Child Tax Credit expansion as part of EGTRRA. Includes effects of the Recovery Rebate Credit enacted in the Economic Stimulus Act of 2008. Includes effects of the Making Work Pay Credit enacted in the American Recovery and Reinvestment Act of 2009. Preliminary estimates for 2014 based on medican income for a four-person family in 2014 estimated for LiHEAP assistance. http://www.acf.hhs.gov/programs/ocs/resource/estimated-state-median-income-by-household-size-and-by-state-federal-fiscal Notes: Median income is for a four-person family. All calculations are for a married couple and income is assumed to be earned by one spouse. Itemized deductions are assumed to equal 23 percent of income through 1986 and 18 percent of income thereafter Median incomes from U.S. Census Bureau, Historical Income Tables, Table F-8. Available for download at http://www.census.gov/hhes/www/income/data/historical/families/ Average and marginal tax rates from Treasurey Department calculations through 1995; 1996 - 2014 Tax Policy Center calculations. Source: