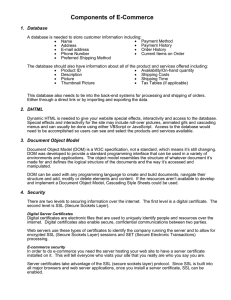

Building an E-Commerce Trust Infrastructure SSL Server Certificates and

advertisement