13-Mar-09 PRELIMINARY RESULTS

advertisement

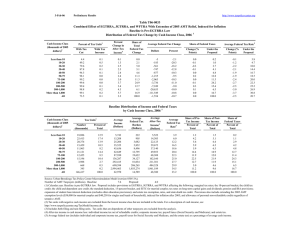

13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 68.3 69.0 67.8 76.4 84.4 86.4 78.5 66.8 14.3 6.1 3.2 70.2 With Tax Increase 0.0 0.3 0.2 0.2 0.2 0.1 0.2 0.8 50.1 88.1 92.9 3.7 Percent Change in After-Tax Income 4 6.1 3.5 2.1 1.6 1.4 1.1 0.8 0.5 -0.9 -3.4 -5.9 -0.3 Share of Total Federal Tax Change -12.3 -31.1 -29.5 -23.9 -18.6 -36.3 -22.6 -37.1 43.6 60.4 208.0 100.0 Average Federal Tax Change ($) -348 -587 -555 -579 -628 -675 -617 -609 2,294 20,294 143,066 257 Average Federal Tax Rate5 Change (% Points) -5.7 -3.3 -1.9 -1.4 -1.2 -0.9 -0.6 -0.4 0.7 2.6 4.3 0.3 Under the Proposal 0.4 1.6 6.1 10.6 14.1 16.9 18.6 21.0 24.7 27.9 32.2 21.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 6.7 Proposal: 4.0 (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 68.3 69.0 67.8 76.4 84.4 86.4 78.5 66.8 14.3 6.1 3.2 70.2 0.0 0.3 0.2 0.2 0.2 0.1 0.2 0.8 50.1 88.1 92.9 3.7 Percent Change in After-Tax Income 4 6.1 3.5 2.1 1.6 1.4 1.1 0.8 0.5 -0.9 -3.4 -5.9 -0.3 Share of Total Federal Tax Change -12.3 -31.1 -29.5 -23.9 -18.6 -36.3 -22.6 -37.1 43.6 60.4 208.0 100.0 Average Federal Tax Change Dollars -348 -587 -555 -579 -628 -675 -617 -609 2,294 20,294 143,066 257 Percent -92.8 -67.8 -23.8 -11.8 -7.8 -5.2 -3.2 -1.8 2.9 10.1 15.3 1.3 Share of Federal Taxes Change (% Points) -0.2 -0.4 -0.4 -0.3 -0.3 -0.6 -0.4 -0.8 0.3 0.7 2.5 0.0 Under the Proposal 0.0 0.2 1.2 2.3 2.9 8.5 9.0 26.6 20.3 8.5 20.3 100.0 Average Federal Tax Rate5 Change (% Points) -5.7 -3.3 -1.9 -1.4 -1.2 -0.9 -0.6 -0.4 0.7 2.6 4.3 0.3 Under the Proposal 0.4 1.6 6.1 10.6 14.1 16.9 18.6 21.0 24.7 27.9 32.2 21.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 15,235 22,814 22,859 17,762 12,750 23,157 15,801 26,251 8,189 1,281 626 167,465 Percent of Total 9.1 13.6 13.7 10.6 7.6 13.8 9.4 15.7 4.9 0.8 0.4 100.0 Average Income (Dollars) 6,128 17,765 29,352 40,959 52,812 72,610 102,167 160,325 332,733 795,956 3,342,190 94,762 Average Federal Tax Burden (Dollars) 376 866 2,331 4,926 8,096 12,907 19,591 34,336 80,011 201,370 934,004 19,596 Average AfterTax Income 4 (Dollars) 5,752 16,899 27,020 36,032 44,715 59,703 82,576 125,989 252,721 594,586 2,408,185 75,167 Average Federal Tax Rate 5 6.1 4.9 7.9 12.0 15.3 17.8 19.2 21.4 24.1 25.3 28.0 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 2.6 4.2 4.6 4.2 10.6 10.2 26.5 17.2 6.4 13.2 100.0 0.7 3.1 4.9 5.1 4.5 11.0 10.4 26.3 16.4 6.1 12.0 100.0 0.2 0.6 1.6 2.7 3.2 9.1 9.4 27.5 20.0 7.9 17.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 6.7 Proposal: 4.0 (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 68.5 61.4 57.7 71.0 83.7 84.8 61.7 11.4 5.7 4.5 0.7 63.5 0.0 0.5 0.1 0.0 0.0 0.0 0.0 1.9 70.1 83.2 90.3 1.6 Percent Change in After-Tax 4 Income 5.4 2.3 1.3 1.2 1.1 0.8 0.3 0.1 -1.5 -3.4 -5.9 0.2 Share of Total Federal Tax Change 50.9 80.2 70.0 56.3 42.5 72.2 19.9 5.8 -64.9 -54.2 -179.5 100.0 Average Federal Tax Change Dollars -299 -363 -340 -401 -453 -466 -258 -78 3,809 19,912 133,855 -86 Percent -53.1 -23.4 -10.8 -6.6 -4.7 -3.0 -1.1 -0.2 4.6 9.8 13.3 -0.8 1 Share of Federal Taxes Change (% Points) -0.4 -0.6 -0.5 -0.4 -0.3 -0.4 -0.1 0.1 0.6 0.5 1.5 0.0 Under the Proposal 0.4 2.0 4.5 6.1 6.6 17.8 13.5 21.3 11.5 4.7 11.7 100.0 Average Federal Tax Rate5 Change (% Points) -4.9 -2.1 -1.2 -1.0 -0.9 -0.7 -0.3 -0.1 1.1 2.5 4.1 -0.2 Under the Proposal 4.3 6.7 9.6 13.8 17.5 20.8 22.7 24.0 26.1 28.6 34.8 20.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 10,917 14,145 13,202 9,000 6,002 9,922 4,940 4,748 1,093 174 86 74,602 14.6 19.0 17.7 12.1 8.0 13.3 6.6 6.4 1.5 0.2 0.1 100.0 Average Income (Dollars) 6,111 17,666 29,277 40,778 52,703 71,984 100,800 155,733 335,909 782,418 3,269,296 55,098 Average Federal Tax Burden (Dollars) 563 1,551 3,162 6,045 9,696 15,426 23,150 37,510 83,782 203,564 1,005,140 11,291 Average AfterTax Income 4 (Dollars) 5,547 16,115 26,115 34,734 43,008 56,558 77,650 118,223 252,128 578,855 2,264,156 43,807 Average Federal Tax Rate 5 9.2 8.8 10.8 14.8 18.4 21.4 23.0 24.1 24.9 26.0 30.7 20.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 6.1 9.4 8.9 7.7 17.4 12.1 18.0 8.9 3.3 6.8 100.0 1.9 7.0 10.6 9.6 7.9 17.2 11.7 17.2 8.4 3.1 6.0 100.0 0.7 2.6 5.0 6.5 6.9 18.2 13.6 21.1 10.9 4.2 10.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 49.6 71.1 71.5 69.1 75.2 83.2 88.9 83.8 15.8 6.3 3.8 71.0 0.0 0.0 0.1 0.9 0.3 0.1 0.3 0.2 46.5 88.9 93.1 7.5 Percent Change in After-Tax 4 Income 6.2 4.9 3.3 2.4 2.1 1.5 1.0 0.6 -0.8 -3.4 -5.9 -0.8 Share of Total Federal Tax Change -1.0 -4.3 -6.5 -5.9 -5.6 -12.6 -11.9 -24.7 21.9 34.4 116.4 100.0 Average Federal Tax Change Dollars -303 -861 -916 -894 -986 -938 -862 -778 2,015 20,342 141,932 997 Percent -99.6 -144.2 -60.3 -27.2 -17.6 -9.3 -5.0 -2.3 2.5 10.1 15.7 2.9 1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.2 -0.2 -0.5 -0.5 -1.6 -0.1 0.7 2.7 0.0 Under the Proposal 0.0 0.0 0.1 0.5 0.7 3.5 6.4 29.2 24.9 10.5 24.2 100.0 Average Federal Tax Rate5 Change (% Points) -5.9 -4.7 -3.1 -2.2 -1.9 -1.3 -0.8 -0.5 0.6 2.6 4.3 0.6 Under the Proposal 0.0 -1.5 2.0 5.8 8.7 12.5 15.9 20.2 24.5 27.8 31.8 22.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 1,991 3,134 4,456 4,170 3,564 8,441 8,693 19,961 6,842 1,063 516 63,115 3.2 5.0 7.1 6.6 5.7 13.4 13.8 31.6 10.8 1.7 0.8 100.0 Average Income (Dollars) 5,173 18,155 29,515 41,272 53,048 73,582 103,145 162,169 332,093 798,676 3,301,793 160,242 Average Federal Tax Burden (Dollars) 304 597 1,518 3,285 5,608 10,112 17,213 33,556 79,329 201,401 906,572 34,470 Average AfterTax Income 4 (Dollars) 4,869 17,558 27,997 37,987 47,441 63,470 85,931 128,613 252,764 597,275 2,395,221 125,773 Average Federal Tax Rate 5 5.9 3.3 5.1 8.0 10.6 13.7 16.7 20.7 23.9 25.2 27.5 21.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.6 1.3 1.7 1.9 6.1 8.9 32.0 22.5 8.4 16.9 100.0 0.1 0.7 1.6 2.0 2.1 6.8 9.4 32.3 21.8 8.0 15.6 100.0 0.0 0.1 0.3 0.6 0.9 3.9 6.9 30.8 25.0 9.8 21.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 83.2 87.2 89.7 93.7 96.4 95.9 77.3 16.7 9.7 7.8 0.4 85.8 0.0 0.0 0.6 0.1 0.2 0.0 0.0 0.4 54.8 87.9 98.1 0.7 Percent Change in After-Tax 4 Income 8.4 5.5 2.8 1.8 1.3 1.1 0.6 0.1 -1.0 -3.2 -6.2 1.4 Share of Total Federal Tax Change 8.6 33.3 24.4 17.2 10.0 17.5 5.7 1.3 -3.0 -3.7 -11.4 100.0 Average Federal Tax Change Dollars -640 -1,031 -812 -657 -575 -675 -499 -163 2,561 19,220 142,939 -600 Percent 124.7 116.8 -121.7 -16.5 -7.6 -5.5 -2.4 -0.5 3.2 10.4 15.4 -8.0 1 Share of Federal Taxes Change (% Points) -0.8 -3.1 -2.0 -0.8 0.0 0.7 1.1 1.8 0.9 0.6 1.5 0.0 Under the Proposal -1.4 -5.4 -0.4 7.6 10.5 26.0 19.9 23.7 8.5 3.4 7.4 100.0 Average Federal Tax Rate5 Change (% Points) -9.0 -5.8 -2.8 -1.6 -1.1 -0.9 -0.5 -0.1 0.8 2.5 4.4 -1.2 Under the Proposal -16.3 -10.7 -0.5 8.1 13.2 16.1 19.8 22.6 25.0 26.1 33.0 13.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,203 5,282 4,916 4,293 2,839 4,236 1,871 1,315 192 32 13 27,245 8.1 19.4 18.0 15.8 10.4 15.6 6.9 4.8 0.7 0.1 0.1 100.0 Average Income (Dollars) 7,096 17,817 29,377 40,991 52,683 72,016 101,150 150,485 334,180 784,301 3,240,237 51,423 Average Federal Tax Burden (Dollars) -513 -882 667 3,987 7,531 12,248 20,550 34,190 81,009 185,593 925,597 7,521 Average AfterTax Income 4 (Dollars) 7,610 18,699 28,710 37,003 45,152 59,767 80,601 116,295 253,171 598,708 2,314,640 43,902 Average Federal Tax Rate 5 -7.2 -5.0 2.3 9.7 14.3 17.0 20.3 22.7 24.2 23.7 28.6 14.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.1 6.7 10.3 12.6 10.7 21.8 13.5 14.1 4.6 1.8 3.0 100.0 1.4 8.3 11.8 13.3 10.7 21.2 12.6 12.8 4.1 1.6 2.5 100.0 -0.6 -2.3 1.6 8.4 10.4 25.3 18.8 21.9 7.6 2.9 5.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 82.1 96.2 97.2 98.4 99.1 98.7 93.0 85.2 16.8 3.5 1.0 86.6 0.0 0.0 0.1 0.1 0.1 0.0 0.4 0.4 46.5 94.8 97.8 4.9 Percent Change in After-Tax Income 4 8.9 6.7 3.9 2.7 2.1 1.6 1.1 0.7 -0.8 -3.9 -6.6 -0.2 Share of Total Federal Tax Change -16.8 -67.8 -61.9 -48.7 -37.1 -70.9 -49.8 -92.4 67.0 119.7 359.7 100.0 Average Federal Tax Change Dollars -672 -1,292 -1,136 -1,000 -984 -983 -910 -901 1,925 22,812 154,877 204 Percent 89.0 79.7 11,189.9 -29.4 -14.1 -8.5 -4.9 -2.6 2.4 10.8 16.3 0.8 Share of Federal Taxes Change (% Points) -0.1 -0.6 -0.5 -0.4 -0.3 -0.7 -0.5 -1.0 0.4 0.9 2.8 0.0 Under the Proposal -0.3 -1.3 -0.5 1.0 1.9 6.4 8.1 28.8 24.3 10.3 21.4 100.0 Average Federal Tax Rate5 Change (% Points) -9.9 -7.3 -3.9 -2.4 -1.9 -1.4 -0.9 -0.6 0.6 2.9 4.7 0.2 Under the Proposal -21.1 -16.4 -3.9 5.9 11.4 14.5 17.3 20.9 25.3 29.5 33.7 21.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,595 5,461 5,669 5,070 3,920 7,506 5,690 10,667 3,622 546 242 51,137 5.1 10.7 11.1 9.9 7.7 14.7 11.1 20.9 7.1 1.1 0.5 100.0 Average Income (Dollars) 6,785 17,790 29,309 41,044 52,884 73,020 102,722 161,284 331,083 795,506 3,286,010 116,581 Average Federal Tax Burden (Dollars) -756 -1,622 -10 3,404 7,003 11,587 18,685 34,615 81,974 211,926 951,222 24,258 Average AfterTax Income 4 (Dollars) 7,540 19,412 29,320 37,640 45,882 61,433 84,037 126,669 249,108 583,581 2,334,788 92,323 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.1 -9.1 0.0 8.3 13.2 15.9 18.2 21.5 24.8 26.6 29.0 20.8 0.3 1.6 2.8 3.5 3.5 9.2 9.8 28.9 20.1 7.3 13.3 100.0 0.4 2.3 3.5 4.0 3.8 9.8 10.1 28.6 19.1 6.8 12.0 100.0 -0.2 -0.7 0.0 1.4 2.2 7.0 8.6 29.8 23.9 9.3 18.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0155 Administration's Fiscal Year 2010 Budget Proposals Major Individual Income Tax Provisions Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 19.1 16.2 15.9 21.8 24.7 31.2 42.6 38.9 8.9 7.1 3.5 24.8 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.8 53.8 80.6 91.9 4.1 Percent Change in After-Tax Income 4 1.1 0.5 0.3 0.3 0.3 0.3 0.3 0.2 -1.1 -2.7 -5.3 -0.9 Share of Total Federal Tax Change -0.5 -1.8 -2.2 -1.8 -1.0 -2.6 -3.7 -5.4 20.9 18.5 79.5 100.0 Average Federal Tax Change Dollars -65 -86 -86 -116 -132 -180 -282 -246 2,944 16,245 131,784 744 Percent -27.0 -17.0 -9.6 -6.4 -5.3 -2.8 -2.1 -0.9 4.1 8.6 13.8 4.4 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.3 -0.5 -1.4 -0.1 0.4 2.3 0.0 Under the Proposal 0.1 0.4 0.9 1.1 0.8 3.9 7.3 25.3 22.5 9.9 27.9 100.0 Average Federal Tax Rate5 Change (% Points) -1.1 -0.5 -0.3 -0.3 -0.3 -0.3 -0.3 -0.2 0.9 2.0 3.8 0.7 Under the Proposal 2.9 2.3 2.8 4.2 4.5 8.7 12.9 16.8 22.1 25.7 31.7 17.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 1,852 5,347 6,566 4,059 2,012 3,712 3,389 5,760 1,853 296 157 35,022 5.3 15.3 18.8 11.6 5.8 10.6 9.7 16.5 5.3 0.9 0.5 100.0 Average Income (Dollars) 6,147 18,393 29,413 40,752 52,579 73,495 102,388 160,774 336,349 797,727 3,436,875 100,433 Average Federal Tax Burden (Dollars) 240 506 901 1,808 2,506 6,544 13,502 27,187 71,447 188,646 958,312 16,772 Average AfterTax Income 4 (Dollars) 5,907 17,887 28,513 38,943 50,073 66,951 88,886 133,587 264,902 609,082 2,478,563 83,660 Average Federal Tax Rate 5 3.9 2.8 3.1 4.4 4.8 8.9 13.2 16.9 21.2 23.7 27.9 16.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.3 2.8 5.5 4.7 3.0 7.8 9.9 26.3 17.7 6.7 15.4 100.0 0.4 3.3 6.4 5.4 3.4 8.5 10.3 26.3 16.8 6.2 13.3 100.0 0.1 0.5 1.0 1.3 0.9 4.1 7.8 26.7 22.5 9.5 25.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is Administration baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.