MEETING PROFESSIONALS INTERNATIONAL AND AMERICAN EXPRESS ®

PRESENT

Planning a meeting is no small task.

But now, managing the payment is.

The American Express Card can help you simplify

the process of planning and paying for your next event.

®

■

Eliminate time-consuming credit applications

■

Reduce the time you spend and phone calls you make arranging payment

■

Cut the need for purchase orders and company checks

■

Help manage when your vendors process event charges

■

Combine all your event-related expenses onto a single statement

For more information or to apply for the Card, visit www.americanexpress.com/meetingsolutions

© 2003 American Express Company.

WELCOME

TO FUTUREWATCH

2005

T

here is, perhaps, no more fertile ground for insights and

indicators for the future of the meetings industry than the global

membership of Meeting Professionals International (MPI).

With a nearly 50-50 ratio of more than 19,000 planner and

supplier members in 60 countries, MPI is in a unique position

to leverage data points and holistically report on internal and external

factors impacting the industry’s current state and future direction.

Capitalizing on this leadership position, MPI and American Express began an annual landmark

research study in 2003 on the business of meetings. Now in its third year, FutureWatch 2005

builds on side-by-side planner and supplier comparisons from North America and Europe,

reporting year-over-year trending on key economic indicators such as spending, international

travel, and employment. It also maintains a watchful eye on the pace of meetings management

and other signs of commoditization and consolidation and continues a call to action for stronger

buyer/seller relationships to ensure long-term success in an evolving industry.

In addition, FutureWatch 2005 looks closely at attrition due to the level of concern planners and

suppliers have expressed about this issue in previous years. The need to more quantitatively prove

the value of meetings in today’s cost-conscious environment has led to a new section on how

planners and suppliers are involved in the ROI (return on investment) measurement process.

Beyond guidance for the industry as a whole, the contributions of 1,851 respondents

(960 planners and 891 suppliers) to FutureWatch 2005 also serve as a reference to MPI as the

organization executes Pathways to Excellence. This strategic plan will propel members and the

meetings they implement to a more strategic level, ensuring the US$102.3 billion business of

meetings and events remains a dominant force in the global economy.

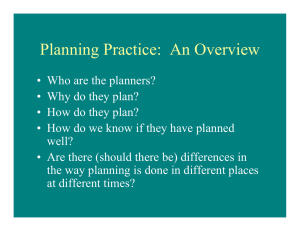

General Economic and Industry Outlook

Summary of

SIGNIFICANT FINDINGS

Multiple indicators point to sustained and expanding economic

growth for the meetings industry worldwide in 2005.

The meetings industry is expected to grow again in 2005, with increases in key areas, including

budgets, employment, employee training, proposal activity, number of attendees per meeting or

event and expenditures per meeting or event. Additionally, international travel continues to

rebound, as meeting planners on all geographic fronts forecast more meetings beyond their

domestic borders with the largest increase coming from Canadian and European planners.

FUTUREWATCH 2005

1

Summary of

SIGNIFICANT FINDINGS

While all parties forecast growth, the

gap has widened between projected

supplier revenue targets and meeting

planner expenditures in 2005.

Hoping to capitalize on positive

economic trends, suppliers continued

a track record of eagerness, projecting

higher revenue gains than the positive,

yet more restrained, spending projections

of meeting planners. The resulting 8

percent disparity vs. a 7 percent disparity

in 2003 and 2004, respectively signals a

continued buyer’s market as suppliers

battle to steal market share and make

their revenue goals.

For the second consecutive year,

recovering corporate budgets reflect

improved overall corporate health;

yet, budgets for consultants and

independent planners still dominate

the marketplace.

Corporate meeting-related expenditures

continued to recover from budget cuts

and downsizing in 2002, growing at

a steady pace. While a sign of enterprise

improvement across the board,

companies are not walking away from

external meeting planning resources.

In fact, 2005 budget forecasts for independent and consultant planners

outpace corporate budgets by almost

double, indicating a continued move to

outsourcing as an ongoing strategy.

Another sign of positive economic

recovery comes with a healthy threefold increase in associations/society

planner budgets in 2005.

Major external forces such as the

economy and world security continue

to weigh heavily on the business of

meetings and the people that plan and

support them, presenting significant

professional challenges for planners

and suppliers alike.

External factors, largely out of the

control of the meetings industry, are

impacting the way planners and

suppliers do business. Leading the way,

the global economy and security are

affecting meeting planners in the forms

of budget constraints, rising travel costs,

consolidation and threats of commoditization. The “do more with less”

mantra adopted by businesses during

the economic crisis of 2002 and 2003—

and shortened lead time for planning

and booking meetings—has, in large

part, become standard operating

procedure, despite economic recovery.

As a result, planners feel significant

pressure to justify the value of their

jobs, as suppliers must justify the value

of their products and services amidst an

increasingly competitive business

environment and escalating expenses.

Planner/Supplier

Dynamics

Despite last year’s predictions of a

potential swing to a market favoring

suppliers, 2005 will remain a buyer’s

market.

While most planners and suppliers

don’t expect an increase over last year’s

heightened attention to price concessions and flexibility surrounding

attrition and cancellation clauses, about

a quarter of suppliers expect to increase

concessions. This price elasticity combined with disparities between expected

supplier revenues and planner expenditures will increase pressure on

suppliers to gain greater market share

through favorable business negotiations

that will benefit planners in 2005.

The year-over-year pace of meetings

management is steadily moving

ahead, with more planners reporting

full implementation of standardized

policies and procedures than reported

in FutureWatch 2004.

Standardized meetings management

policies and procedures are in place or

will be within the next two years at

many organizations. About one-half of

planner respondents have adopted or

are implementing organization-wide

meetings management processes,

programs, tools and technology,

standardizing items such as purchasing

policies, contract language, meeting

request forms and reporting platforms.

Web site enhancements continue as

the focus of technology investment

among suppliers in 2005, followed by

wireless technologies; all other new

technology investment categories will

decline.

Nearly all suppliers expect to invest in

Web site enhancements in 2005,

addressing planner expectations to

increase reliance on the Internet for

research and booking meeting venues.

Suppliers also indicate a slight technology investment increase in wireless.

The increased use of technology will

allow suppliers to work more efficiently

and accommodate increasingly

compressed lead times, however, this

puts additional pressure on face-to-face

business communications already

strained during staffing downturns.

Unexpected is the marked departure

from FutureWatch 2004 in which new

investments rose in all technology

categories except one … in 2005, only

Web enhancements and wireless

technology will see investment gains.

Commoditization ranks second only to

budget concerns as the operational

trend expected to have the greatest

impact on planners and suppliers in

2005; attrition drops substantially.

An increasing number of planners and

suppliers agree that commoditization

concerns within the meetings industry

will be on the rise again in 2005. As

technology offers more opportunities for

automation and the industry employs

more standardized meetings management, the risk that the function becomes

reduced to a purchasing decision based

on cost grows. Meanwhile, in a significant turn, attrition concerns among

suppliers and planners plummeted,

signaling positive outcomes from

corrective action on both sides of the

business.

FUTUREWATCH 2005

Despite increased pressure to prove

the value of meetings, suppliers are

not being involved in ROI or other

critical measurement processes.

both aspire to establish a partner

relationship, the limited communications

on meeting success measures underscores

a breakdown in this process.

Most planners say they measure the

return of meeting investments frequently,

but the majority of suppliers are seldom

or never asked to help build systems or

processes for measuring meeting return.

Suppliers are not receiving feedback on

meeting ROI, with less than one-third

mentioning that planners consistently

share meeting success measures. While

In addition to desiring greater sharing of

ROI measures, most suppliers want

planners to offer more honest disclosure

of budgets, more comprehensive communications and more detailed RFPs.

They also want to improve their relationships with planners by understanding

more about their business and responding

to inquiries faster, which hinge on an open

flow of communication. The vast majority

of planners would like to work with

suppliers as partners rather than as vendors.

In addition, planners want increased

flexibility in attrition/cancellation clauses

and quicker turnarounds on requests.

Suppliers and planners, well intentioned

and committed to working together to

make the industry thrive, will continue to

face challenges to their business relationship without greater communication.

Facts and

FIGURES

A Sustained Market Recovery

Expecting more growth in 2005, meeting planner and supplier average spending

and revenue projections increased by 2 and 3 percent respectively from 2004.

Meeting planners forecasted a 5 percent budget increase vs. 3 percent in 2004.

Meanwhile, suppliers project revenues to increase by 13 percent compared to

10 percent last year, creating an 8 percent differential for 2005. Interestingly,

however, when looking at the three-year trend, planners’ budgets increased a

total of 6 percent and suppliers tracked at a 7 percent increase overall.

Suppliers and Planners:

Projected employment and training

budget increases 2004 vs. 2005

Suppliers:

Employment

Training

4%

4%

2005

2004

9%

9%

2005

2004

13%

10%

6%

2005

Suppliers

Suppliers and Planners:

Estimated budget/revenue

change 2003 - 2005

2004

2003

Employment

2004

2003

4%

3%

2005

2004

5%

3%

-1%

2005

Planners

Planners:

Training

7%

5%

2005

2004

10

0

10

0

In addition to measuring projected percentage change in year-over-year budgets,

FutureWatch 2005 also sought to quantify spending among planners by asking

them to provide actual budget figures for 2005. European planners are the most

aggressive in their projections, expecting budget increases of 6.5 percent from 2004,

while U.S. planners come in on the lower end at 4.7 percent. Canadian planners

rest squarely in the middle, projecting budget growth of 5 percent. Suppliers in the

United States, Canada and Europe project strong positive revenue growth rates as

well from meetings/events in 2005 at 14, 13 and 11 percent, respectively … all

higher than the 10 percent growth rate projected last year.

Suppliers and Planners:

Average percentage changes per

meeting or event 2004 vs. 2005

Suppliers:

Number of attendees

4%

1%

2005

2004

Length

-3%

-4%

2005

2004

Expenditure

per attendee

3%

-2%

2005

2004

Planners:

Number of attendees

6%

5%

2005

2004

Length

-1%

-2%

2005

2004

Expenditure

per attendee

2%

1%

2005

2004

Slight gains expected in other

notable meetings industry indicators.

10

0

Beyond forecasted increases for meetings industry revenue and spending,

additional signs of further recovery come in the form of increases in employment

and training budgets for the second year in a row. Employment is expected to

increase in planner and supplier organizations by an average of 4 percent, and

training budgets are expected to increase by an average of 7 percent for planners

and 9 percent for suppliers.

FUTUREWATCH 2005

3

Facts and

FIGURES

U.S. Planners:

Projected Venue Usage

European meeting planners are projecting the biggest jump in international bookings,

with an increase from 17 percent in 2004 to 28 percent in 2005. While the United

States remains the top destination at 8 percent, Asia made an impressive comeback at

7 percent, up from 4 percent in 2004. Canadian planners also forecast an increase in

the likelihood to meet outside of the country from 23 percent in 2004

to 29 percent in 2005. The United States is the lead locale, expected to get 13 percent

of all Canadian meetings, 2 percent more than was projected in 2004. Venue choices

of U.S., Canada and Europe planners are projected to remain relatively constant.

2005

FutureWatch 2005 points to a second year in a sustained growth of international

meetings and business travel. U.S. planners project 23 percent of all 2005 meetings—

up 1 percent from 2004—will be held outside domestic borders, with Europe and

Canada cited as the top destinations at 6 and 5 percent, respectively.

2004

2003

International Travel Sustains Growth

Convention centers

7% 11% 9%

Restaurants, country clubs

and unique venues

9% 11% 11%

Conference centers

and universities

9% 11% 10%

Airport and suburban hotels

13% 13% 15%

Resort hotels

27% 24% 25%

City hotels

35% 30% 32%

Canadian Planners:

U.S. Planners:

Projected Venue Usage

2004

2003

77%

78%

89%

5%

5%

3%

6%

7%

4%

3%

2%

1%

2%

1%

1%

Asia

3%

3%

1%

Other

4%

5%

1%

Canadian Planners:

2005

2005

Central South

Canada Europe America America

2004

U.S.

2003

Projected Meetings in Various Geographical Locations

Convention centers

12% 11% 12%

Restaurants, country clubs

and unique venues

9% 12% 9%

Conference centers

and universities

8% 9% 9%

Airport and suburban hotels

9% 16% 11%

Resort hotels

12% 14% 15%

City hotels

50% 39% 45%

Projected Meetings in Various Geographical Locations

U.S.

Central South

Canada Europe America America

Asia

Other

European Planners:

Projected Venue Usage

71%

77%

89%

4%

3%

2%

3%

4%

1%

3%

0%

0%

2%

0%

0%

4%

6%

0%

European Planners:

Projected Meetings in Various Geographical Locations

U.S.

2005

2004

2003

8%

9%

6%

Central South

Canada Europe America America

3%

1%

1%

72%

83%

82%

3%

1%

0%

3%

2%

1%

Asia

7%

4%

6%

2005

2003

13%

11%

8%

2004

2004

2003

2005

Convention centers

19% 15% 17%

Restaurants, country clubs

and unique venues

10% 14% 14%

Conference centers

and universities

16% 18% 19%

Airport and suburban hotels

4% 8% 8%

Resorts hotels

16% 13% 12%

City hotels

35% 32% 30%

Other

4%

0%

4%

ers:

ill be

5 as

2004

FUTUREWATCH 2005

Operational Trends

Impacting Meetings

Outsourcing Here to Stay?

Corporate planner respondents paint a positive picture of rebounding budgets

topping an estimated $7.1 million average in 2005 vs. a 2004 average of

$5.3 million. Independent, multimanagement and planner consultants expect

even higher budgets foretelling a stronger hold on the industry with average

budgets expected to reach $11.8 million in 2005 from $6.1 million last year.

Apparently, the growth in corporate planner budgets is having little, if any,

impact on the money being spent with independent planners, indicating that

the outsourcing model will potentially remain viable and active even upon full

market recovery. And association, society and non-profit planners come out the

big budget winners, with average estimated budgets growing to $4.8 million

after holding steady at $1.4 million in 2003 and 2004 … indicating a return to

membership in professional society and non-profit organizations as professional

development purse strings loosen.

Planners and suppliers agree about expected

changes in price concessions and degrees of

flexibility in attrition and cancellation clauses

by suppliers. Twenty-five percent of suppliers

and 24 percent of planners expect these to

increase while 18 percent of suppliers and

25 percent of planners expect a decrease.

Slightly over half of suppliers and planners

expect them to remain as flexible as last year

… again suggesting that a new business

environment might well be here to stay.

While budgets continue to be the leading

operational trend expected to impact the

meetings business in 2005, there continues

to be increasing concern about commoditization, a trend first observed in

FutureWatch 2003. Eighteen percent of

planners and suppliers project that

commoditization will have the greatest

impact on meetings in 2005, increasing by

13 percent for planners and 5 percent for

suppliers.

Planners:

Estimated Budgets By Category 2003-2005

Corporate/company

$4,059,235

$5,296,329

$7,143,191

Consultant/independent

planner/multimanagement

$4,379,485

$6,128,952

$11,782,429

Association/society/non-profit

$1,336,366

$1,328,770

$4,843.088

$637,098

$1,264,922

$1,875,942

University/government/medical/other

2003

2004

2005

Other factors that suggest further

commoditization potential include the

expanded use of Internet technology by

planners, investment in Internet technology

by suppliers and the implementation of

standardized meeting practices.

Attrition Resolution

As one of the hottest meetings industry issues in past years, the topic

of attrition was more deeply analyzed in FutureWatch 2005.

A surprising decrease in attrition concerns by suppliers and planners

indicates how powerful their partnerships can be when they attack an

issue together to find resolutions favorable to both. Approximately

41 percent of planner respondents think attrition will be only a

minor problem in 2005, and 17 percent predicted it will not be a

problem at all. Only 10 percent identified attrition as a significant

Significant

problem in the coming year.

Planners and Suppliers:

2005 Operational Trends

With The Greatest Impact On Meetings

Planners:

Not a problem

In a related question, the proportion of respondents indicating

10%

17%greatest impact on

attrition clauses as the operational trend with the

meetings declined from 31 to 17

Planners:

percent among planners and from

Extent attrition will be

21 to 13 percent among 32%

an issue in 2005 as

suppliers. Top strategies

opposed to 2004

Minor identified

41%by planners for

Significant

Not a problem

reducing attrition are

combining conference event

10%

17%

registration with housing

reservations, creating

attendee incentives

Moderate

32%

and ensuring

published Internet

Minor

41%

rates are greater than room

block rates.

Organizational

budget changes

2005

Cancellation and

attrition clauses

2005

Commoditization

of planning

Moderate

Airline ticketing/scheduling

policy changes

53%

51%

2004

17%

31%

2004

18%

5%

2005

2004

5%

11%

2005

2004

Suppliers:

Organizational

budget changes

2005

Cancellation and

attrition clauses

2005

Commoditization

of planning

2005

Airline ticketing/scheduling

policy changes

2005

58%

60%

2004

13%

21%

2004

18%

13%

2004

5%

4%

2004

60

40

20

FUTUREWATCH 2005

5

Facts and

FIGURES

Web and Wireless Take the Lead

Suppliers:

New Technology Investments

The Internet continues to be a primary technology focus for planners and suppliers.

In 2005, meeting planners expect to use the Internet 21 percent more to research and

4 percent more to book meeting venues. These numbers reflect a slight increase in

the use of the Web for research and a slight decline in booking over 2004.

Web site enhancement

Wireless technologies

Guest room technologies

New A/V equipment

On the supplier front, 85 percent of respondents plan to invest in

Online booking/planning systems for meeting planners

Web site enhancements and 67 percent in wireless technologies.

Customer relationship management technologies

Surprisingly, these are the only two categories of technology expected

Registration technologies

to grow in 2005 as opposed to 2004, when investments were expected to

Online travel and housing systems for bookings

grow or stay the same in every category except teleconferencing. Despite

Teleconferencing

the retrenchment in technology investments, more than half of the

Audience/attendee response tools

suppliers responding expect to make some investment in new audio/video

Virtual meetings/shows

81% 83% 85%

48% 66% 67%

55% 65% 56%

55% 62% 58%

54% 59% 52%

50% 59% 51%

40% 47% 45%

48% 47% 42%

35% 29% 28%

25% 28% 26%

24% 24% 20%

equipment, guest room technologies, online booking/planning systems

and customer relationship management technologies this year.

2003 2004 2005

Meetings Management Under Way

FutureWatch 2004 undertook an industryfirst measurement of the pace of

standardized meetings management,

asking planners to indicate the degree to

which their organizations are implementing standards and practices in areas

such as contract language, registration

tools, meeting request forms, reporting

and reconciliation platforms. This year’s

study provides a year-over-year analysis.

purchasing channels, 50 percent have

preferred supplier programs, and 48

percent have or will have a technology

base established. The percentage of

orgnizations that have completed full

implementation has grown in three of

the four meetings management categories since 2004 while the percentage of

those not considering areas of standardization has decreased.

According to findings, implementation

and consideration of organization-wide

meetings management practices will

steadily climb in 2005. Fifty-seven

percent of planner respondents have fully

implemented or plan to implement

organization-wide purchasing policies;

54 percent have or will standardize

Meanwhile, suppliers indicate they are

not conforming to standardized

purchasing policies at the levels they did

in 2004. Only 37 percent of suppliers are

conforming to planners’ standardized

purchasing policies a majority of the

time, down from 44 percent last year.

And just 13 percent of supplier

respondents say they are required to be a

preferred vendor more than 50 percent of

the time, down 1 percent from 2004.

Seventy percent say the requirement

occurs less than 25 percent of the time.

The seeming disparity between planners

and suppliers on the pace of meetings

management indicates that planners are

implementing internal policies and

procedures that are not being clearly

communicated or reflected in their direct

relationships with suppliers.

Planners:

Meetings Management Policies And Procedures

Degree Of Implementation

Areas Of

Standardization

2004

2005

23%

20%

2%

3%

21%

20%

9%

13%

2%

3%

1%

1%

42%

40%

21%

18%

4%

3%

25%

25%

11%

13%

1%

2%

1%

1%

37%

39%

30%

25%

4%

4%

24%

23%

5%

8%

3%

3%

0%

1%

34%

38%

28%

22%

2%

2%

24%

28%

12%

11%

4%

3%

1%

1%

29%

33%

FUTUREWATCH 2005

Planners:

Measuring Meeting ROI

Use of Measurement

of ROI Tools

Sixty-seven percent of planner respondents always or frequently measure the returns on their

meeting investments. To get a better understanding of how they measure those returns, they

were asked about tools used to determine success. Eighty-one percent of respondents

indicated that post-event attendee surveys are the most frequent ways planners measure ROI.

Meeting budget and revenue reports and client feedback followed at 73 percent and

68 percent, respectively. This indicates that planners still predominantly rely on tactical event

measures rather than those that underscore the broader strategic impact of meetings on their

organizations’ business goals and objectives.

Suppliers are not highly involved in helping develop return on investment measurement

tools or models for the industry. In fact, 68 percent of supplier respondents indicated

planners seldom or never ask for help in building or enhancing systems or processes for

measuring meeting ROI.

Forty-four percent of planners say they always or frequently share meeting performance

measures with suppliers, and 29 percent of suppliers always or frequently receive meeting

performance measures from planners. This disparity indicates planners and suppliers are

typically not communicating with each other about ROI performance measurement results.

In fact, suppliers do not appear to know when planners are measuring results and vice versa.

The research indicates that 38 percent of suppliers think their planner partners measure ROI,

compared to the 67 percent of planners who claim they do, in fact, measure ROI.

Post-event

attendee surveys

81%

Meeting budget

and revenue reports

73%

Client feedback

68%

Onsite audience

response systems

23%

Organization’s

sales reports

20%

Other

7%

Communication Challenges

Commitment to Partnering

37%

of suppliers are comforming to

planners’ standardized purchasing

policies a majority of the time.

13%

of suppliers say they are required

to be a preferred vendor more

than 50 percent of the time.

70%

of suppliers say the requirement

occurs less than 25 percent of

the time.

Last year, FutureWatch 2004 provided a firstever forum for planners and suppliers to

describe business interaction and highlight

areas to optimize their working interactions

and business success. Suppliers said that

planners could help by focusing on better

and more complete communication, more

lead time and flexibility, honesty regarding

budgets and expectations, detailed

information regarding needs, teamwork and

more allowance for creativity. Planners

similarly indicated they needed more

efficient communications from suppliers,

quicker response to requests, better

understanding of lead time and flexibility

restraints, more team work, continuation of

competitive pricing and taking time to learn

about planners’ needs and work flows.

Building on this, FutureWatch 2005

measured these common themes to

establish year-over-year trending. The results

indicate that most planners and suppliers

still have room for improvement when it

comes to improving relationships and

meeting each others’ expectations during the

business cycle.

FUTUREWATCH 2005

7

Facts and

FIGURES

Communication Challenges

Commitment to Partnering (cont.)

When asked in a write-in question, what, if anything, they did to aid the other in the

business process, just 18 percent of planners and 11 percent of suppliers indicated they

communicated more over the past year, and 12 percent of planners and 4 percent of

suppliers responded that they tried to work as partners. There was little or no significant

increase in improving business relationships in any other area.

Planners:

Planned Approaches to Improve

Relationships With

Suppliers in 2005

Submit more thorough

Suppliers:

Desired Business Practices from Planners in 2005

Work together as a partner 71%

More honest disclosure of budgets 67%

More lead time/flexibility 56%

More comprehensive communication 49%

More detailed requests for proposals 45%

More allowance for creativity 29%

Other

8%

Planners:

Desired Business Practices from Suppliers in 2005

In 2005, however, suppliers and partners

Planners:and detailed RFPs

express an equal and overwhelming

desirePractices

to

from Suppliers in 2005

Desired Business

Allow suppliers more creativity

work as partners. Seventy-one percent of

Flexibility 85%

suppliers and planners identified this as a

Honest, full disclosure

Work together as a partner 71%

working objective for 2005. When suppliers

of budgets

were asked how planners couldFaster

workresponses

better to requests/inquiries 58%

More detailed, transparent quotes 42%

with them, they asked for more honest

Increase RFP/execution

lead time and flexibility

disclosure of budgets, more leadLearn/better understand my business 35%

time/flexibility, more comprehensive

Use e-mail more 33%

Learn

communication and more detailed RFPs.

Better

Webmore

site about

30% suppliers’ business

When planners were asked how Softer

suppliers

sales and marketing approach 26%

Automate RFP and/or

could work better with them, more flexibility,

Other 6%

contract process

faster response to requests and inquiries and

more detailed, transparent quotes led the list.

Thirty percent also cited better Web sites as

tools they would like suppliers to deliver.

50%

42%

41%

36%

34%

18%

Flexibility 85%

One-half of planners intend to improve their

relationships with suppliers by submitting

Faster responses to requests/inquiries 58%

more thorough and detailed RFPs. In

More detailed, transparent quotes 42%

addition, a segment of planners will allow

Learn/better understand my business 35%

suppliers more creativity, give honest, full

Use e-mail more 33%

disclosure of budgets, increase RFP lead

Better Web site 30%

time/flexibility and learn more about their

Softer sales and marketing approach 26%

business. Most suppliers intend to improve

Other 6%

their relationships with planners by

understanding/learning more about their

businesses and responding to requests/

inquires faster. In addition, a large segment of suppliers will use e-mail more and provide

more detailed proposals.

Work together as a partner 71%

With both sides of the business

committed to bettering the

relationship, the time to act on that

commitment is now.

All of these improvements are based upon free exchange of information. Without strong

communications, planners and suppliers cannot establish the value necessary to stem

further commoditization and may, in fact, sabotage efforts to strengthen the relationships

needed to ensure the long-term viability of the meetings industry.

Suppliers:

Planned Approaches to Improve

Relationships With

Planners in 2005

Understand/learn more

about planners’ businesses

71%

More rapid response to

requests and inquiries

61%

Increase use of

e-mail vs. phone/fax

45%

More transparent

and detailed proposals

36%

Softer sales and

marketing approaches

14%

FUTUREWATCH 2005

KEY TAKEAWAYS

The health of the meetings industry mirrors

that of business and the economy in general.

Increased meetings, particularly those requiring

international travel, are fuel for a worldwide

economic engine and are signs of continued

steady growth in the meetings industry in 2005

and its supporting effect on a stabilizing, recovering

world economy.

At the same time, with external factors

weighing heavily on the industry,

planners and suppliers must prove more

flexible and adaptable than ever by

continuing to improve working

relationships. The meetings industry has

experienced a shake out, and while the

business is picking up and budgets are

expanding, the industry is not returning

to doing business in the same way. The

efficiencies companies were forced to

create in a tight economic market are

likely to remain in place, positioning

companies for greater growth as the

marketplace rebounds.

Predictions that 2004 would evolve into

more of a seller’s market have not

transpired. Despite growing planner

budgets, sellers remain challenged to

grow market share, continuing to make

price concessions in order to win

business. 2005 will continue to be a

buyer’s market, with sellers needing to

provide added value through speed and

flexibility.

Technology and standardized meetings

management practices have become

standard operating procedure for many

organizations, making consolidation and

commoditization concerns long-term

realities for meeting professionals.

Meeting professionals must understand

and embrace how procurement officers

are impacting meetings management,

become fluent in the language of

business, articulate the strategic value of

meetings and adopt more sophisticated

skills, tools and metrics to ensure

relevancy and positive impact to their

organizations.

While planners recognize the importance

of measuring meetings, they are not yet

effectively measuring them against

The effort put forth on both sides to identify

and implement solutions for attrition is a

model for moving forward on critical issues

such as proving the ROI of meetings through

creating and implementing ROI

measurement tools and committing to

better, more frequent communication. As

planners work to get seats at the executive

table, they should not hesitate to call on

their suppliers to help make their case. By

fully understanding meeting details and the

corporate objectives planners are working

What has happened with the issue of attrition

is a testament to the power that planners and

suppliers have when they engage in a focused

effort to address an industry challenge.

strategic corporate business objectives.

There exists significant opportunity for

planners and suppliers to pursue a more

concerted, proactive partnership. What

has happened with the issue of attrition is

a testament to the power that planners

and suppliers have when they engage in a

focused effort to address an industry

challenge. Cited as a major concern in the

past two FutureWatch studies, attrition has

been largely mitigated, according to this

year’s study.

toward, suppliers can offer more effective

and efficient solutions.

For additional tools and information

regarding strategic meetings management

practices and return on investment, visit the

MPI Global Corporate Circle of Excellence

Web site at www.gccoe.mpiweb.org.

FUTUREWATCH 2005

9

BACKGROUND

FutureWatch is an annual research study, now in its third year, commissioned by Dallas-based

Meeting Professionals International (MPI) in partnership with American Express. Conducted in late

October 2004, FutureWatch 2005 surveyed MPI members, the world’s best collective of professional

meeting planners and suppliers, to identify and comment on global meetings industry trends and

indicators for 2005 and beyond. MPI commissioned an independent firm, Syndics Research, to conduct

an online survey and perform statistical and qualitative analysis of the findings.

Suppliers:

Planners:

Organizational Responsibility

Organizational Responsibility

Sales or marketing director,

supervisor or manager

55%

Internal planning staff

37%

Member of a sales

and/or marketing team

20%

Internal planning executive

26%

Owner/CEO/President

15%

Independent planners

20%

Operations or financial director,

supervisor or manager

3%

Professional planner staff

or executive

9%

Other

5%

Owner/CEO/President

3%

Operations or

financial executive

2%

Other

5%

Suppliers:

Planners:

Response Rate

Response Rate

10%

8%

Canada

10%

11%

U.S.

Participation: The survey garnered 1,851 responses

(11 percent total response rate of those invited to

participate), of which 52 percent (960) were from

MPI planners and 48 percent (891) were from MPI

suppliers. Overall, participation represented 11

percent of MPI planner members and 9 percent of

MPI supplier members, which was slightly more than

19,000 at the time the survey was executed.

Europe

Europe

Canada

Methodology: MPI sent a series of three e-mail

invitations to 16,503 members worldwide

announcing the study and requesting participation.

All responses were received anonymously. Member

respondents were asked to provide a range of

information regarding their organizational roles,

projected business, organizational and operational

challenges, use of technology, implementation of

standardized purchasing policies and procedures, ROI

measurement, attrition issues and more for 2005.

79%

U.S.

82%

Publisher

Colin Rorrie Jr., Ph.D., CAE

Editorial and Design Support

Allison Ellis, Vice President of Marketing and Communications

Joe Welch, Syndics Research Corporation

Kelly Schulz, Director of Communications

Shannon Couzens, Couzens Communications

Stacy Clark, Marketing Manager

Jeff Daigle, Assistant Art Director

Gary Rockwood, Graphic Designer

Publications Staff

John Delavan, Director of Publications/Editor in Chief

Blair Potter, Managing Editor

Jason Hensel, Associate Editor

Angela Chiarello, Associate Editor

Michael Pinchera, Assistant Editor

Kirsten Rockwood, Publications Coordinator

Printed by RR Donnelley & Sons Company

Senatobia, Mississippi, USA

Meeting Professionals International

Global Headquarters

3030 LBJ Freeway, Suite 1700

Dallas, TX 75244-5903 USA

tel 972.702.3000

fax 972.702.3089

www.mpiweb.org

In Europe

15, route de Grundhof

L-6315 Beaufort

Grand-Duchy of Luxembourg

tel +352-2687.6141

fax +352-2687.6343

In Canada

6519-B Mississauga Road

Mississauga, Ontario L5N 1A6

Canada

tel 905.286.4807

fax 905.567.7191

FutureWatch 2005 is an official supplement to the January 2005

issue of The Meeting Professional, the official publication of

Meeting Professionals International, a professional association of

meeting planners and suppliers. Members receive The Meeting

Professional as a membership benefit paid for by membership

dues; $50 of membership is allotted to The Meeting Professional

and is nondeductible there from. Nonmembers may subscribe to

the publication for $99 annually ($129 international). For

subscription information, deletions and address updates, call

(972) 702-3035 or e-mail publications@mpiweb.org. File address

changes with the U.S. Postal Service online at

www.moversguide.com.

Copyright 2005, Meeting Professionals International,

All Rights Reserved.