U H S

advertisement

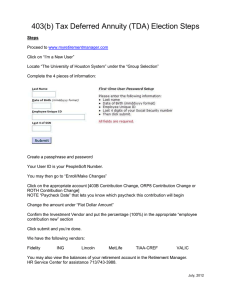

UNIVERSITY OF HOUSTON SYSTEM ADMINISTRATIVE MEMORANDUM SECTION: Human Resources AREA: Fringe Benefits NUMBER: SUBJECT: Supplemental Retirement ProgramsRefunds of Contributions to 403(b) Tax Sheltered Plans (ORP and TDA Plans) 1. Excess 02.C.02 Employee PURPOSE The purpose of this administrative memorandum is to document the University of 1.1. Houston System’s policies and procedures for complying with the Internal Revenue Code requirements for contributions to Supplemental Retirement Programs. Internal Revenue Code requirements for excess employee contributions to a tax sheltered annuity. The Texas statute is not specific with regard to the administration of these plans. Therefore, these policies and procedures have been adopted to address the administration of the plan and should be considered part of the working plan document. The University of Houston System sponsors two different 403(b) tax sheltered plans, Tax Deferred Annuities (TDAs) and the Optional Retirement Plan (ORP). The Teachers Retirement System plan is not a 403(b) plan and is not subject to these restrictions. 1.2. The System sponsors three different voluntary Supplemental Retirement Programs: Tax Deferred Annuities (TDA) 403 (b), Deferred Compensation 457 (b) and Roth IRA 403 (b). 1.3. All employees of the System are eligible to participate in these voluntary Supplemental Retirement Programs by setting aside part of their current salary within defined limits. 1.4. Each employee should recognize that: (a) participation in the Supplemental Retirement Programs represents a firm, long-term commitment; (b) withdrawal of benefits is contingent upon retirement, unemployment, serious financial hardship, or death; and (c) comparison of cost and benefits between plans offered by two or more companies or associations is the responsibility of the employee. 1.5. The System assumes no liability or responsibility for income tax issues related to the Supplemental Retirement Programs or the terms and provisions of any contract issued there-under. Employees of the System are specifically prohibited from counseling employees in the various aspects of financial and/or retirement planning. April 15, 1996; Draft June 1, 2008 Page 1 of 9 AM No. 02.C.02 2. 1.6. A new participant may enroll in a Supplemental Retirement Program by executing an agreement with the third party administrator prior to the first day of the month in which enrollment is to be effective. Such execution must be done online, by telephone, or through the completion of an enrollment form. Participants may increase or decrease the amount of their contribution by executing an agreement prior to the first day of the month in which the change is to be effective with the third party administrator. 1.7. The minimum monthly contribution to Supplemental Retirement Program is $25.00. 1.8. The maximum amount of salary which will qualify each tax year for tax deferment must be determined annually by the employee and the third party administrator in accordance with current IRS regulations regarding maximum amount contributable. The third party administrator will notify the System when the maximum amount contributable has changed. An additional amount may be allowed under an approved catch-up provision. The employee should discuss the catch-up options with the third party administrator. 1.9. A participant may receive a distribution from his/her account as early as 51 days after retirement/separation or as late as April 1 after the year in which the participant reaches the age of 70 ½. Once the participant has retired/terminated and reached age 70 ½, he/she must begin distribution. 1.10. Participants should contact their third party administrator prior to separating employment with the System to explore the distribution options available. 1.11. The component university human resources department is responsible for administering the policies and guidelines of the Supplemental Retirement Programs at the System, and serving as liaison with the third party administrator. Questions regarding Supplemental Retirement Programs should be directed to the component university human resources department. TAX DEFERRED ANNUITY 2.1. A tax deferred annuity (TDA) or tax sheltered annuity (TSA) under Internal Revenue Code Section 403(b) is a deferred compensation retirement arrangement for employees of certain tax exempt organizations, including public educational systems, such as including institutions of higher education. 2.2. TDAs are funded primarily through salary reduction agreements whereby employees reduce their annual gross salary by contributing a fixed amount monthly to his/her individual TDATSA and/or ORP account. The employee’s annual contribution to their individual annuity account is subtracted from his/her annual gross salary, and the employee’s income taxes are calculated based upon this reduced annual gross income figure. April 15, 1996; Draft June 1, 2008 Page 2 of 9 AM No. 02.C.02 2.3. 2.4. Questions regarding 3. 3.1. 3. Contributions to TDAs and interest earned become taxable income to the employee at the time he/she receives a distribution from the annuity account. DEFINITIONS Tax Deferred Annuity, including obtaining information on the approved TDA Vendors, should be directed to the component university human resources department. DEFERRED COMPENSATION PROGRAM 3.1. The Deferred Compensation Program is a voluntary supplemental - A retirement program administered by the Employees Retirement System (ERS) under Internal Revenue Code Section 457. While therefore, not subject to this administrative memorandum, contributions to all plan that receives tax -deferred programs must be considered in exclusion calculations. Employees should consult with their component university benefits department to ensure compliance with the combined limitations. 3.2. Under the Deferred Compensation Program,treatment, benefiting an employee may enter into an agreement with the state to reduce current by delaying payment of taxes on employer contributions and earnings up to specified limits and to apply the proceeds of such reduction to the purchase of a tax deferred retirement savings account through an approved carrierby excluding them from income. 3.2. Elective Deferral - Amounts contributed under the salary reduction agreement and invested in the employee’s TDA/ORP by the employer on behalf of the employee. 3.3. Exclusion Allowance - The amount of ORP (both employee and employer contributions) and TDA employee deferral contributions that can be excluded from income. 3.4. Excess Contributions - The amount of employee deferral or employer contribution that is more than the limit allowed for the year. 3.5. MEA Worksheet - The form that is used to Deferred Compensation Programs and interest earned become taxable incomecalculate all three of the annual contribution limits. 3.6. Special Catch-up Provision - The provision for employees with at least 15 years service with the same employer to the employee at the time he/she receives increase the elective deferral limit from $9,500 to a distribution from maximum of $12,500. Limitations apply. April 15, 1996; Draft June 1, 2008 Page 3 of 9 AM No. 02.C.02 4. 3.7. ORP - Optional Retirement Program, a defined contribution retirement plan offered by the State of Texas and limited to only certain employees of higher education agencies. 3.8. TRS - Teachers’ Retirement System, a defined benefit retirement plan offered by the State of Texas to employees of public and higher education agencies. 3.9. Carrier - The insurance company or custodian of money contributed to a TSA. That entity which holds and invests funds in separate tax deferred accounts for employees. ANNUAL LIMITATIONS ON EMPLOYEE CONTRIBUTIONS TO 403(b) PLANS 4.1. There are three separate, yet interrelated, limitations on the tax deferred amount employees may contribute to their 403(B) plan. Each contribution limit is tested separately, and corrections made differently for each limit excess. 4.2. The three tax deferred employee contribution limits are determined as follows: 4.2.1. Elective deferrals limit, or 402(g) limit, is an arrangement under which eligible employees elect to contribute a portion of their gross annual salary, before taxes, to his/her TDA. The amount of annual salary contributed to their TDA is not taxed until the annuity account.is distributed, at which time the employees anticipate that their income tax rate will be lower than at the time the contribution was made. This arrangement is considered an elective deferral for purposes of the Internal Revenue Code 403(b)(1), 401(a)(30) and 402(g). (This paragraph is applicable to TDAs only since the ORP contribution is an irrevocable election and, therefore, is not subject to elective deferral limits.) 3.4. 4. Questions regarding Deferred Compensation Programs should be directed to the component university human resources department. ROTH IRA 4.1a. The Roth 403(b) allows faculty and staffmaximum amount an employee may contribute to his/her TDA annually is $9,500. Contributions to defer somea 457 plan reduces the $9,500 limit. b. However, Code Sec. 402(g)(8) provides a special “catch-up election” which is intended to allow long term employees to catchup on funding of their retirement benefits if they were unable to contribute the maximum allowable amount to their TDA in prior years. This election allows eligible employees to increase the dollar amount of their elective deferrals over the $9,500 limit. April 15, 1996; Draft June 1, 2008 Page 4 of 9 AM No. 02.C.02 c. Employees eligible for this election must have 15 years of service with the same qualified employer. The 15 years of service must be University of Houston System service; other state employment years of service are not used in calculating the 15 years. An employee with 15 years of service with the University of Houston System may elect to contribute additional annual tax deferred contributions in the following amounts, whichever is least: 1. Additional annual tax deferred contributions in an amount not to exceed $3,000, increasing the $9,500 limit to $12,500; or, 2. A total of $15,000 reduced by elective deferrals excluded from gross income on an after-tax basis with earnings growing tax free. in prior years under the catch-up rule (total aggregate life-time limit of catch-up contributions is $15,000). For example, if you are contributing the maximum $3,000 per year to your TDA, then you could only use this provision for 5 years; or 4.2. The System allows faculty and staff the option to participate in both a traditional 403 b (pre-tax) and Roth 403 b (post-tax). However, if members want to participate in both voluntary saving plans the aggregate contribution may not exceed the maximum annual deferral limit. 4.3. Questions about the Roth 403(b) should be directed to the component university human resources department. 3. $5,000 multiplied by the employee’s number of years of service with the qualified employer, less all elective deferrals in prior years. 4.2.2. Exclusion allowance limit, or Code Section 403(b)(2) limit, is a limitation on the amount an employee may contribute to his/her ORP/TDA, based on the individual employee’s maximum exclusion allowance (MEA). An employee’s annual MEA is calculated by his/her ORP/TDA representative, using a form similar to the one shown in Attachment A. The MEA for amounts contributed by an employee to his/her ORP/TDA is equal to 20 percent of the employee’s includable compensation multiplied by the number of the employee’s years of service with the University of Houston System, and reduced by amounts contributed by the employee or employer to his/her ORP/TDA annuities in prior years. In addition, the limit is also offset by the value of the contributions made to the TRS plan. 4.2.3. Annual additions limit, or Code Section 415 limit, is a limitation on the amount of tax deferred contributions that an employee can make to his/her April 15, 1996; Draft June 1, 2008 Page 5 of 9 AM No. 02.C.02 TDA/ORP when combined with the University of Houston System’s contributions to the employee’s ORP. Under the general rule for 403(b) plans, the limitation on the amount of contribution (employee’s contribution combined with UH System’s contribution) to an employee’s account is the lessor of: 5. a. $30,000, or b. 25% of the employee’s annual gross salary. CORRECTION OF EXCESS CONTRIBUTIONS 5.1. If Excess elective deferrals (402(g)). 5.1.1. An employee who has contributed an amount which exceeds the annual contribution limit set by the IRSof $9,500, and if that employee has not elected (or is not eligible) to participate in the “catch-up” option, the employee will be refunded the excess amount contributed to his/her TDA and applicable earnings on the excess amount contributed. Unless an exception is available, The refund must be issued by the employee’s TDA carrier by April 15th of the following year. The employee’s TDA carrier is responsible for calculating the applicable earnings and for issuing a 1099R to the employee. 5.1.2. If the carrier does not calculate the earnings on the excess contribution, the Benefits Office may use a safe harbor calculation. The safe harbor calculations are A&B as follows: A. Safe Harbor Method of Allocating Income. Income for the taxable year allocable to elective contributions Employee’s excess deferrals for the taxable year over X The total account balance of the employee attributable to elective contributions at the beginning of the year + the employee’s elective contributions for the taxable year. April 15, 1996; Draft June 1, 2008 Page 6 of 9 AM No. 02.C.02 B. Safe Harbor Method for Allocating Gap Period Income. Income on excess deferrals determined under the preceding formula (A) multiplied by the number of months that have elapsed since the close of the taxable year. A distribution made on or before the fifteen day of the month is treated as made on the last day of the preceding month. 5.1.3. In accordance with the Internal Revenue Code, the excess contribution amount refunded to the employee is includable as income in the “year of contribution.””. The earnings on this excess are taxable in the “year of distribution”. Two separate Internal Revenue Code forms 1099R will be issued to the employee by his/her TDA carrier. The “year of contribution” (prior year) tax liability will be reported on 1099R code P. The “year of distribution” (current year) tax liability will be reported on 1099R code 8. If 5.36. 5.2. Exclusion allowance (403(b)(2)). The employee reduces his/her current annual TDA contribution by the amount determined to be an excess contribution in the prior year. In this case, it is not necessary for Internal Revenue Code forms (such as 1099R’s) to be sent to the employee. 5.3. Annual additions (Code Sec. 415). The employee will be refunded the excess contribution and applicable earnings are not distributed by April 15thif the excess contribution was a reasonable error in either the employee’s annual compensation or elective deferrals before the end of the following “year of contribution,” the excessyear (December 31). The employee will receive an Internal Revenue Code form 1099R for the year the refund will again be taxed as income in the “year of distribution.”is received (i.e., the year after the contributions were made) from his/her TDA carrier. PROCEDURES FOR REFUNDING EMPLOYEE EXCESS CONTRIBUTIONS 6.1. It is the employee’s responsibility to not to exceed the annual various tax deferred contribution limitations. 5.46.2. If an employee is contributing the maximum contribution as calculated by his/her MEA, and if the employee receives a promotion with a higher annual compensation rate or receives a merit pay raise, the employee should contact his/her TDA/ORP carrier representative and prepare a new MEA calculation so that the employee will not contribute an amount in excess of the contribution limits. 6.3. A new MEA calculation should be prepared by the employee and his/her TDA/ORP carrier representative annually to ensure compliance with Internal Revenue Code. A copy of the most current MEA should be forwarded by the April 15, 1996; Draft June 1, 2008 Page 7 of 9 AM No. 02.C.02 employee to his/her respective campus Benefits Office of the Human Resources Department to be placed in his/her personnel file. 6.4. 6.5. 6.7. To assist the employee in monitoring his/her annual contributions to their TDA/ORP, the University of Houston System provides the following services: a. The Payroll Department will develop reports to be distributed to the Human Resource Directors which will detail University of Houston System employees who have exceeded, or are close to exceeding, Internal Revenue Code limitations for employee contributions to his/her TDA/ORP. b. The Human Resource Directors at each component will mail a letter (to the most current employee home address listed in his/her personnel file) to each employee on the list, stating that the employee has exceeded, or is expected to exceed, the Internal Revenue Code contribution limits to his/her TDA/ORP. An employee who has contributed an amount in excess of the Internal Revenue Code limitations guidelines to his/her TDA is responsible for the following: a. Notifying his/her TDA/ORP carrier representative that a new MEA calculation needs to be prepared. b. Requesting a refund of the excess contribution and applicable earnings from his/her TDA carrier representative. c. Ensuring that all required Internal Revenue ServiceCode forms are obtainedfurnished to the employing department by his/her TDA carrier. REVIEW AND RESPONSIBILITIES Responsible Partiesy: Associate Vice Chancellor for Administration and Finance Human Resource Directors Review: 87. AnnuallyEvery five years, on or before DecemberMarch 1 APPROVAL Approved: Executive Vice Chancellor for Administration and Finance April 15, 1996; Draft June 1, 2008 Page 8 of 9 AM No. 02.C.02 William P. Hobby Chancellor Date: 9. April 15, 1996 INDEXING TERMS Tax sheltered annuity (TSA) Elective deferral Exclusion allowance Excess contributions Maximum exclusion allowance (MEA) Catch-up provision Teachers’ Retirement System (TRS) Optional Retirement Program (ORP) Carrier Safe harbor 403(b) plan April 15, 1996; Draft June 1, 2008 Page 9 of 9