How Will Boomers Fare at Retirement? by Barbara Butrica

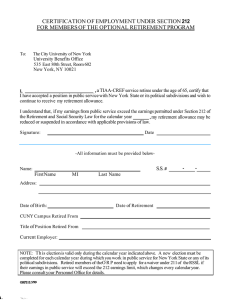

advertisement