9-Mar-10 PRELIMINARY RESULTS

advertisement

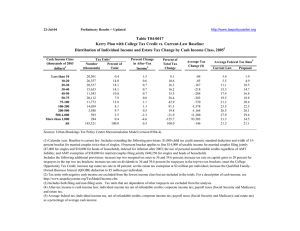

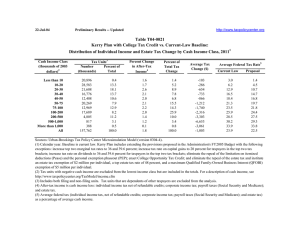

9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 29.9 31.1 30.9 28.8 25.0 30.6 27.4 27.9 39.4 61.7 80.3 30.2 With Tax Increase 65.7 65.4 68.2 71.0 74.9 69.3 72.6 72.1 60.6 38.3 19.7 68.6 Percent Change in After-Tax Income 4 5.5 0.5 -1.0 -1.5 -2.0 -1.7 -2.2 -1.9 2.4 9.4 22.2 2.8 Share of Total Federal Tax Change 1.7 0.7 -1.8 -2.8 -3.6 -7.1 -8.3 -16.6 12.8 20.3 104.0 100.0 Average Federal Tax Change ($) -298 -81 245 494 788 899 1,611 2,123 -5,514 -50,859 -501,861 -1,786 Average Federal Tax Rate Change (% Points) -5.2 -0.5 0.9 1.3 1.7 1.4 1.7 1.5 -1.8 -7.0 -15.8 -2.2 5 Under the Proposal 0.6 3.9 9.6 13.9 17.2 19.1 21.1 23.4 22.6 18.3 12.8 18.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 23.2 Proposal: 0.0 (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the system that miniizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 29.9 31.1 30.9 28.8 25.0 30.6 27.4 27.9 39.4 61.7 80.3 30.2 65.7 65.4 68.2 71.0 74.9 69.3 72.6 72.1 60.6 38.3 19.7 68.6 Percent Change in After-Tax Income 4 5.5 0.5 -1.0 -1.5 -2.0 -1.7 -2.2 -1.9 2.4 9.4 22.2 2.8 Share of Total Federal Tax Change 1.7 0.7 -1.8 -2.8 -3.6 -7.1 -8.3 -16.6 12.8 20.3 104.0 100.0 Average Federal Tax Change Dollars -298 -81 245 494 788 899 1,611 2,123 -5,514 -50,859 -501,861 -1,786 Percent -89.7 -11.5 10.7 10.6 10.6 7.7 9.0 6.7 -7.5 -27.7 -55.2 -10.5 Share of Federal Taxes Change (% Points) Average Federal Tax Rate 5 Under the Proposal Change (% Points) 0.0 0.6 2.2 3.5 4.4 11.6 11.8 31.1 18.6 6.2 9.9 100.0 -5.2 -0.5 0.9 1.3 1.7 1.4 1.7 1.5 -1.8 -7.0 -15.8 -2.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.7 3.0 4.3 4.7 4.8 11.4 10.4 24.9 15.3 6.3 14.4 100.0 0.9 3.7 5.0 5.2 5.1 11.8 10.6 24.6 14.6 6.0 13.0 100.0 0.2 0.6 1.8 2.8 3.5 9.7 9.6 26.1 18.0 7.7 19.8 100.0 -0.2 0.0 0.4 0.7 0.8 2.0 2.1 5.0 0.6 -1.5 -9.9 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,395 24,950 21,464 16,563 13,107 22,796 14,829 22,547 6,681 1,152 598 161,771 Percent of Total 10.1 15.4 13.3 10.2 8.1 14.1 9.2 13.9 4.1 0.7 0.4 100.0 Average Income (Dollars) 5,731 15,992 26,534 37,088 47,849 65,785 92,580 145,308 302,126 725,130 3,175,497 81,418 Average Federal Tax Burden (Dollars) 332 703 2,292 4,651 7,428 11,665 17,875 31,842 73,926 183,574 909,696 16,992 Average AfterTax Income 4 (Dollars) 5,400 15,289 24,241 32,437 40,420 54,120 74,704 113,466 228,199 541,556 2,265,801 64,425 Average Federal Tax Rate 5 5.8 4.4 8.6 12.5 15.5 17.7 19.3 21.9 24.5 25.3 28.7 20.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 23.2 Proposal: 0.0 (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 0.6 3.9 9.6 13.9 17.2 19.1 21.1 23.4 22.6 18.3 12.8 18.7 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 29.1 31.1 32.8 29.4 24.2 35.9 31.9 37.4 59.1 77.0 87.0 31.9 65.5 63.9 65.7 70.2 75.6 64.0 68.0 62.6 40.9 23.0 13.0 65.8 Percent Change in After-Tax Income 4 3.5 0.5 0.0 -0.4 -1.2 -0.2 -0.4 2.0 10.7 18.9 31.5 3.7 Share of Total Federal Tax Change 2.2 1.2 0.1 -1.1 -2.8 -0.7 -1.2 8.4 21.5 15.4 56.5 100.0 Average Federal Tax Change Dollars -185 -78 -5 134 461 75 305 -2,124 -24,346 -98,217 -654,513 -1,376 Percent -37.0 -6.2 -0.1 2.2 5.0 0.5 1.4 -6.2 -31.6 -51.7 -69.5 -14.2 Share of Federal Taxes Change (% Points) Average Federal Tax Rate5 Under the Proposal Change (% Points) 0.6 3.1 6.5 8.3 9.9 21.8 14.5 21.0 7.7 2.4 4.1 100.0 -3.2 -0.5 0.0 0.4 1.0 0.1 0.3 -1.5 -8.0 -13.8 -21.7 -3.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.0 7.4 9.3 8.8 8.7 17.9 10.8 16.5 8.0 3.3 7.7 100.0 2.3 8.6 10.3 9.3 8.9 17.7 10.4 15.8 7.5 3.1 6.7 100.0 0.9 2.8 5.6 7.0 8.1 18.6 12.3 19.2 9.7 4.2 11.5 100.0 -0.2 0.3 0.9 1.3 1.8 3.2 2.2 1.8 -2.0 -1.9 -7.4 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,785 15,609 11,803 7,961 6,076 9,192 3,953 3,918 873 155 85 71,749 16.4 21.8 16.5 11.1 8.5 12.8 5.5 5.5 1.2 0.2 0.1 100.0 Average Income (Dollars) 5,738 15,863 26,403 37,030 47,870 65,017 91,214 140,835 305,307 710,840 3,020,093 46,638 Average Federal Tax Burden (Dollars) 500 1,261 3,314 6,123 9,253 14,078 21,563 34,143 76,959 190,125 941,898 9,696 Average AfterTax Income 4 (Dollars) 5,238 14,602 23,089 30,908 38,617 50,939 69,651 106,692 228,348 520,715 2,078,195 36,942 Average Federal Tax Rate 5 8.7 8.0 12.6 16.5 19.3 21.7 23.6 24.2 25.2 26.8 31.2 20.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 5.5 7.5 12.5 16.9 20.3 21.8 24.0 22.7 17.2 12.9 9.5 17.8 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 37.7 33.8 37.2 39.9 33.1 32.1 28.1 26.7 35.9 59.1 79.0 32.5 60.7 65.5 62.7 59.9 66.8 67.8 71.9 73.3 64.1 41.0 21.0 67.3 Percent Change in After-Tax Income 4 17.2 1.5 0.0 -0.2 -1.4 -1.9 -2.4 -2.6 1.0 7.9 20.4 3.1 Share of Total Federal Tax Change 0.8 0.5 0.0 -0.1 -1.2 -5.1 -8.1 -25.5 6.2 20.4 111.4 100.0 Average Federal Tax Change Dollars -789 -245 8 61 581 1,114 1,835 2,960 -2,247 -43,090 -459,411 -3,262 Share of Federal Taxes Average Federal Tax Rate5 Percent Change (% Points) Under the Proposal Change (% Points) Under the Proposal -296.7 -53.9 0.6 2.2 11.7 11.9 11.5 9.5 -3.1 -23.6 -51.9 -11.0 -0.1 -0.1 0.0 0.1 0.3 1.2 2.0 6.8 2.0 -1.4 -10.9 0.0 -0.1 0.1 0.4 0.8 1.4 5.9 9.7 36.5 24.3 8.2 12.8 100.0 -16.3 -1.5 0.0 0.2 1.2 1.7 2.0 2.0 -0.7 -5.9 -14.6 -2.4 -10.8 1.3 4.8 7.6 11.5 15.6 19.1 23.3 23.6 19.2 13.6 19.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.7 1.5 1.9 2.3 7.3 9.9 30.2 19.9 8.2 18.2 100.0 0.2 0.9 1.8 2.3 2.6 8.0 10.4 30.4 19.2 7.9 16.7 100.0 0.0 0.1 0.3 0.7 1.1 4.7 7.8 29.7 22.3 9.5 23.6 100.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,149 3,779 4,683 4,384 4,031 9,255 8,936 17,410 5,581 957 490 61,925 3.5 6.1 7.6 7.1 6.5 15.0 14.4 28.1 9.0 1.6 0.8 100.0 Average Income (Dollars) 4,856 16,580 26,660 37,167 47,976 66,869 93,299 146,871 301,626 728,191 3,139,514 136,599 Average Federal Tax Burden (Dollars) 266 456 1,281 2,770 4,951 9,335 15,963 31,311 73,429 182,882 884,941 29,636 Average AfterTax Income 4 (Dollars) 4,590 16,125 25,379 34,396 43,025 57,533 77,336 115,560 228,198 545,309 2,254,574 106,964 Average Federal Tax Rate 5 5.5 2.8 4.8 7.5 10.3 14.0 17.1 21.3 24.3 25.1 28.2 21.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 25.9 28.1 19.2 15.3 14.6 14.8 12.9 13.0 41.9 59.5 79.5 19.6 72.4 70.5 80.4 84.7 85.2 85.2 87.1 87.0 58.1 40.5 20.5 79.9 Percent Change in After-Tax Income 4 5.5 -0.3 -4.3 -5.1 -4.4 -4.3 -4.9 -4.3 4.0 8.1 22.8 -2.7 Share of Total Federal Tax Change -3.4 1.1 19.9 24.9 18.1 33.8 21.8 17.9 -5.9 -4.6 -23.0 100.0 Average Federal Tax Change Dollars -386 53 1,128 1,698 1,809 2,333 3,587 4,489 -9,045 -43,270 -481,899 1,036 Percent 80.5 -6.3 194.3 47.9 26.9 20.8 19.2 14.3 -12.5 -26.0 -55.6 16.2 Share of Federal Taxes Average Federal Tax Rate5 Under the Proposal Change (% Points) Under the Proposal -1.1 -2.2 4.2 10.7 11.9 27.4 18.9 19.9 5.8 1.8 2.6 100.0 -5.9 0.3 4.2 4.6 3.8 3.6 3.9 3.3 -3.0 -6.2 -16.2 2.3 -13.3 -5.0 6.4 14.2 18.0 20.9 24.3 26.3 21.1 17.6 12.9 16.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.3 7.4 10.9 12.6 11.0 21.8 13.0 12.6 4.6 1.7 3.3 100.0 1.7 9.1 12.5 13.3 11.0 21.1 12.1 11.3 4.0 1.6 2.7 100.0 -0.7 -2.7 1.7 8.4 10.9 26.4 18.5 20.3 7.7 2.9 6.7 100.0 Change (% Points) -0.4 0.5 2.5 2.3 1.0 1.0 0.5 -0.3 -1.9 -1.1 -4.2 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,328 5,290 4,676 3,883 2,649 3,843 1,615 1,055 174 28 13 25,605 9.1 20.7 18.3 15.2 10.4 15.0 6.3 4.1 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,522 15,961 26,716 37,061 47,582 64,966 91,867 136,677 299,733 701,148 2,976,702 44,717 Average Federal Tax Burden (Dollars) -479 -847 581 3,546 6,732 11,221 18,691 31,481 72,406 166,615 866,581 6,393 Average AfterTax Income 4 (Dollars) 7,001 16,808 26,135 33,515 40,851 53,745 73,176 105,196 227,327 534,533 2,110,121 38,325 Average Federal Tax Rate 5 -7.4 -5.3 2.2 9.6 14.2 17.3 20.4 23.0 24.2 23.8 29.1 14.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 26.0 28.9 17.9 12.9 12.1 11.5 8.3 10.4 23.3 50.3 73.5 16.1 68.5 70.6 81.9 87.0 87.9 88.5 91.7 89.6 76.8 49.7 26.6 83.5 Percent Change in After-Tax Income 4 7.6 -0.6 -4.7 -5.8 -5.3 -5.6 -6.0 -5.8 -1.8 5.4 19.1 -1.0 Share of Total Federal Tax Change -3.7 1.6 17.8 24.6 22.2 57.9 66.1 166.6 31.3 -35.6 -246.6 100.0 Average Federal Tax Change Dollars -525 111 1,264 1,992 2,228 3,088 4,583 6,589 3,961 -28,666 -421,646 793 Percent 76.0 -7.4 -1,273.4 68.5 36.4 29.2 26.7 20.8 5.2 -14.8 -45.5 3.7 Share of Federal Taxes Change (% Points) -0.1 0.1 0.6 0.8 0.7 1.8 2.0 4.9 0.3 -1.6 -9.5 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) Under the Proposal -0.3 -0.7 0.6 2.2 3.0 9.2 11.2 34.6 22.4 7.3 10.6 100.0 -8.4 0.7 4.8 5.4 4.7 4.7 4.9 4.5 1.3 -4.0 -13.4 0.8 -19.4 -8.6 4.4 13.2 17.4 20.7 23.3 26.2 26.5 22.9 16.1 21.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,749 5,590 5,566 4,882 3,929 7,405 5,694 9,988 3,118 490 231 49,780 5.5 11.2 11.2 9.8 7.9 14.9 11.4 20.1 6.3 1.0 0.5 100.0 Average Income (Dollars) 6,253 16,191 26,627 37,104 47,874 66,154 93,283 146,051 300,423 724,847 3,138,297 102,631 Average Federal Tax Burden (Dollars) -690 -1,500 -99 2,906 6,116 10,579 17,188 31,715 75,605 194,362 926,669 21,429 Average AfterTax Income 4 (Dollars) 6,943 17,691 26,726 34,198 41,758 55,574 76,095 114,336 224,818 530,485 2,211,628 81,202 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.0 -9.3 -0.4 7.8 12.8 16.0 18.4 21.7 25.2 26.8 29.5 20.9 0.3 1.8 2.9 3.6 3.7 9.6 10.4 28.6 18.3 7.0 14.2 100.0 0.5 2.5 3.7 4.1 4.1 10.2 10.7 28.3 17.3 6.4 12.6 100.0 -0.2 -0.8 -0.1 1.3 2.3 7.3 9.2 29.7 22.1 8.9 20.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 9-Mar-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0092 Major Tax Provisions of the Roadmap for America's Future Act of 2010 Baseline: Current Policy; Taxpayers choose their preferred tax system Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 34.1 30.8 52.7 66.0 68.8 75.9 79.9 85.2 86.7 87.7 93.9 59.9 57.8 62.6 45.0 33.4 30.8 24.2 20.0 14.9 13.3 12.3 6.1 37.7 Percent Change in After-Tax Income 4 7.6 1.9 3.0 4.7 4.6 5.6 6.4 10.0 14.4 20.1 29.8 12.1 Share of Total Federal Tax Change 0.4 0.8 1.7 2.2 1.8 5.5 5.6 15.7 16.0 10.9 39.5 100.0 Average Federal Tax Change Dollars -452 -306 -768 -1,626 -2,050 -3,369 -5,134 -12,059 -34,644 -111,076 -685,872 -8,008 Share of Federal Taxes Average Federal Tax Rate 5 Percent Change (% Points) Under the Proposal Change (% Points) -218.0 -83.4 -70.9 -80.4 -65.5 -53.3 -44.2 -48.4 -52.4 -63.3 -73.2 -60.2 -0.4 -0.3 -0.4 -0.8 -0.2 1.1 3.1 5.8 3.6 -0.8 -10.6 0.0 -0.3 0.2 1.0 0.8 1.5 7.3 10.6 25.3 22.0 9.6 21.9 100.0 -7.3 -1.9 -2.9 -4.4 -4.3 -5.1 -5.6 -8.3 -11.3 -15.3 -21.2 -10.1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.5 4.3 5.7 5.0 4.3 10.9 10.0 19.0 14.3 7.2 18.8 100.0 0.6 5.1 6.6 5.7 4.8 11.9 10.5 19.0 13.5 6.6 16.1 100.0 0.1 0.6 1.4 1.6 1.7 6.2 7.6 19.5 18.4 10.4 32.5 100.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,141 6,773 5,562 3,452 2,280 4,211 2,785 3,346 1,188 253 148 32,167 6.7 21.1 17.3 10.7 7.1 13.1 8.7 10.4 3.7 0.8 0.5 100.0 Average Income (Dollars) 6,199 16,256 26,342 36,971 47,737 66,263 91,958 145,447 307,476 728,374 3,239,966 79,440 Average Federal Tax Burden (Dollars) 208 366 1,084 2,022 3,128 6,317 11,614 24,932 66,155 175,553 936,840 13,295 Average AfterTax Income 4 (Dollars) 5,992 15,890 25,258 34,949 44,609 59,945 80,343 120,515 241,321 552,821 2,303,126 66,146 Average Federal Tax Rate 5 3.4 2.3 4.1 5.5 6.6 9.5 12.6 17.1 21.5 24.1 28.9 16.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current policy and makes the 2001 and 2003 individual income tax cuts permanent, indexes the parameters of the AMT for inflation after 2009, and makes 2009 estate tax law permanent. Proposal is effective Jan. 1, 2011 and would (a) eliminate the AMT;(b) repeal the income and payroll tax exclusion for employer-sponsored health insurance; (c) provide a refundable tax credit equal to $2,300 ($5,700 for families) for the purchase of health insurance; (d) repeal the corporate income tax; (e) impose an 8.5% business consumption tax (BCT); and (f) allow taxpayers to choose between the current tax system and an alternative simplified tax system. The alternative tax system eliminates all adjustments to income, itemized deductions, tax credits, and the estate tax and has a standard deduction of $12,500 ($25,000 for joint returns), personal exemptions of $3,500, and rates of 10 percent up to $50,000 ($100,000 for joint returns) and 25 percent above that level. Interest, dividends, capital gains, and non-wage business income would be excluded from tax under the alternative system. Dollar values for the alternative tax system are indexed for inflation; the refundable credit amount is indexed by the average growth rate of CPI and medical care expenses. Taxpayers are assumed to choose the tax system that minimizes tax liability. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -4.0 0.4 1.2 1.1 2.3 4.5 7.1 8.9 10.3 8.9 7.8 6.7