24-Jun-08 PRELIMINARY RESULTS

advertisement

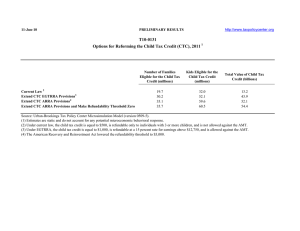

24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 1 Summary Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Benefit 0.3 10.9 24.7 29.5 27.8 28.7 33.9 29.0 1.7 0.9 0.2 21.1 Without Tax Benefit 99.7 89.1 75.3 70.5 72.2 71.3 66.1 71.1 98.3 99.1 99.8 78.9 Benefit as Percent of After-Tax Income 4 0.1 0.4 1.4 1.5 1.2 1.0 0.9 0.4 0.0 0.0 0.0 0.5 Share of Total Federal Tax Benefits 0.1 2.9 12.3 13.8 11.7 22.7 17.7 18.3 0.2 0.0 0.0 100.0 Average Federal Tax Benefit ($) 3 56 297 442 461 488 584 441 17 14 3 309 Average Federal Tax Rate 5 Change due to CTC -0.1 -0.4 -1.2 -1.3 -1.0 -0.8 -0.7 -0.3 0.0 0.0 0.0 -0.4 With CTC 4.9 4.7 9.6 13.6 16.1 18.1 19.8 22.9 26.3 27.2 30.8 21.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current-law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 Detail Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Benefit 3 Without Tax Benefit 0.3 10.9 24.7 29.5 27.8 28.7 33.9 29.0 1.7 0.9 0.2 21.1 99.7 89.1 75.3 70.5 72.2 71.3 66.1 71.1 98.3 99.1 99.8 78.9 Benefit as Percent of After-Tax Income 4 0.1 0.4 1.4 1.5 1.2 1.0 0.9 0.4 0.0 0.0 0.0 0.5 Share of Total Federal Tax Benefits 0.1 2.9 12.3 13.8 11.7 22.7 17.7 18.3 0.2 0.0 0.0 100.0 Average Federal Tax Benefits Dollars 3 56 297 442 461 488 584 441 17 14 3 309 As Percent of Tax 1.0 7.4 11.1 8.5 6.0 4.2 3.3 1.4 0.0 0.0 0.0 1.9 1 Share of Federal Taxes Change due to CTC With CTC 0.0 0.0 -0.2 -0.2 -0.2 -0.2 -0.2 0.1 0.3 0.1 0.4 0.0 0.2 0.7 1.9 2.9 3.5 10.0 10.1 24.8 17.2 7.5 21.2 100.0 Average Federal Tax Rate 5 Change due to CTC -0.1 -0.4 -1.2 -1.3 -1.0 -0.8 -0.7 -0.3 0.0 0.0 0.0 -0.4 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 17,702 23,850 19,060 14,270 11,634 21,361 13,920 19,094 5,424 967 517 148,478 Percent of Total 11.9 16.1 12.8 9.6 7.8 14.4 9.4 12.9 3.7 0.7 0.4 100.0 Average Income (Dollars) 5,646 14,889 24,753 34,784 44,854 61,599 86,725 134,972 286,202 679,484 3,169,574 73,156 Average Federal Tax Burden (Dollars) 279 759 2,674 5,183 7,666 11,630 17,752 31,276 75,158 185,081 974,574 16,317 Average AfterTax Income 4 (Dollars) 5,367 14,130 22,079 29,601 37,188 49,969 68,973 103,696 211,044 494,403 2,195,000 56,838 Average Federal Tax Rate 5 5.0 5.1 10.8 14.9 17.1 18.9 20.5 23.2 26.3 27.2 30.8 22.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.9 3.3 4.3 4.6 4.8 12.1 11.1 23.7 14.3 6.1 15.1 100.0 1.1 4.0 5.0 5.0 5.1 12.7 11.4 23.5 13.6 5.7 13.4 100.0 0.2 0.8 2.1 3.1 3.7 10.3 10.2 24.7 16.8 7.4 20.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC 4.9 4.7 9.6 13.6 16.1 18.1 19.8 22.9 26.3 27.2 30.8 21.9 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 Detail Table - Single Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Benefit 3 Without Tax Benefit 0.0 1.7 3.4 2.7 1.9 1.6 1.6 0.9 0.0 0.0 0.1 1.6 100.0 98.3 96.6 97.3 98.2 98.5 98.4 99.2 100.0 100.0 99.9 98.4 Benefit as Percent of After-Tax Income 4 0.0 0.1 0.2 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1 Share of Total Federal Tax Benefits 0.0 12.5 34.1 19.7 12.6 14.0 5.6 1.4 0.0 0.0 0.0 100.0 Average Federal Tax Benefits Dollars 0 10 40 34 27 20 20 6 0 0 1 18 As Percent of Tax 0.0 0.8 1.1 0.5 0.3 0.2 0.1 0.0 0.0 0.0 0.0 0.2 1 Share of Federal Taxes Change due to CTC With CTC 0.0 0.0 -0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.9 3.2 6.2 7.3 8.3 18.5 11.4 16.4 10.1 4.4 13.1 100.0 Average Federal Tax Rate 5 Change due to CTC 0.0 -0.1 -0.2 -0.1 -0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,955 14,600 9,674 6,480 5,356 7,912 3,172 2,833 722 128 70 64,251 20.2 22.7 15.1 10.1 8.3 12.3 4.9 4.4 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,641 14,704 24,648 34,824 44,816 60,701 85,935 131,136 288,214 676,848 3,103,832 40,773 Average Federal Tax Burden (Dollars) 414 1,267 3,672 6,471 8,864 13,396 20,613 32,973 80,157 197,763 1,071,199 8,908 Average AfterTax Income 4 (Dollars) 5,226 13,437 20,976 28,354 35,952 47,305 65,322 98,163 208,058 479,085 2,032,633 31,864 Average Federal Tax Rate 5 7.4 8.6 14.9 18.6 19.8 22.1 24.0 25.1 27.8 29.2 34.5 21.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.8 8.2 9.1 8.6 9.2 18.3 10.4 14.2 7.9 3.3 8.3 100.0 3.3 9.6 9.9 9.0 9.4 18.3 10.1 13.6 7.3 3.0 6.9 100.0 0.9 3.2 6.2 7.3 8.3 18.5 11.4 16.3 10.1 4.4 13.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC 7.4 8.6 14.7 18.5 19.7 22.0 24.0 25.1 27.8 29.2 34.5 21.8 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Benefit 3 Without Tax Benefit 1.2 14.5 27.8 36.6 42.2 40.7 42.6 34.8 2.0 1.1 0.2 31.1 98.9 85.5 72.2 63.4 57.8 59.3 57.5 65.2 98.0 98.9 99.8 68.9 Benefit as Percent of After-Tax Income 4 0.3 0.5 1.5 2.0 2.0 1.4 1.1 0.5 0.0 0.0 0.0 0.6 Share of Total Federal Tax Benefits 0.1 1.1 5.3 8.0 9.6 24.4 23.7 27.3 0.3 0.0 0.0 100.0 Average Federal Tax Benefits Dollars 15 78 346 615 796 755 768 536 20 16 3 514 As Percent of Tax 5.5 15.2 21.5 17.4 13.4 7.5 4.6 1.7 0.0 0.0 0.0 1.8 1 Share of Federal Taxes Change due to CTC With CTC 0.0 0.0 -0.1 -0.1 -0.2 -0.3 -0.3 0.0 0.4 0.2 0.5 0.0 0.0 0.1 0.4 0.7 1.2 5.6 9.0 28.7 20.6 9.1 24.6 100.0 Average Federal Tax Rate 5 Change due to CTC -0.3 -0.5 -1.4 -1.8 -1.8 -1.2 -0.9 -0.4 0.0 0.0 0.0 -0.4 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,097 4,051 4,643 3,924 3,647 9,762 9,336 15,384 4,527 808 426 58,860 3.6 6.9 7.9 6.7 6.2 16.6 15.9 26.1 7.7 1.4 0.7 100.0 Average Income (Dollars) 4,837 15,431 24,834 34,857 44,948 62,665 87,166 136,073 285,667 679,937 3,121,378 121,659 Average Federal Tax Burden (Dollars) 269 516 1,612 3,538 5,950 10,061 16,568 30,952 74,355 182,958 940,865 28,234 Average AfterTax Income 4 (Dollars) 4,568 14,916 23,222 31,319 38,997 52,605 70,598 105,121 211,312 496,979 2,180,513 93,424 Average Federal Tax Rate 5 5.6 3.3 6.5 10.2 13.2 16.1 19.0 22.8 26.0 26.9 30.1 23.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.9 1.6 1.9 2.3 8.5 11.4 29.2 18.1 7.7 18.6 100.0 0.2 1.1 2.0 2.2 2.6 9.3 12.0 29.4 17.4 7.3 16.9 100.0 0.0 0.1 0.5 0.8 1.3 5.9 9.3 28.7 20.3 8.9 24.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC 5.3 2.8 5.1 8.4 11.5 14.9 18.1 22.4 26.0 26.9 30.1 22.8 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Benefit 3 Without Tax Benefit 0.7 35.8 69.4 72.2 66.9 60.1 55.7 20.2 2.2 0.3 0.2 50.7 99.3 64.2 30.6 27.8 33.1 39.9 44.3 79.8 97.8 99.7 99.8 49.3 Benefit as Percent of After-Tax Income 4 0.1 1.1 3.5 3.4 2.6 1.8 1.1 0.2 0.0 0.0 0.0 1.9 Share of Total Federal Tax Benefits 0.1 6.2 25.7 25.5 15.7 19.5 6.1 1.1 0.0 0.0 0.0 100.0 Average Federal Tax Benefits Dollars As Percent of Tax 7 178 822 1,028 969 868 722 202 30 5 3 615 -1.5 -27.9 56.2 23.1 13.2 7.4 3.8 0.7 0.0 0.0 0.0 10.1 1 Share of Federal Taxes Change due to CTC With CTC -0.1 -0.9 -2.4 -1.6 -0.4 0.8 1.1 1.7 0.8 0.3 0.8 0.0 -0.9 -3.2 2.3 9.5 11.6 27.3 17.1 17.8 7.6 2.8 8.2 100.0 Average Federal Tax Rate 5 Change due to CTC -0.1 -1.2 -3.3 -3.0 -2.2 -1.4 -0.8 -0.2 0.0 0.0 0.0 -1.6 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,489 4,914 4,397 3,489 2,285 3,168 1,185 732 129 19 11 22,867 10.9 21.5 19.2 15.3 10.0 13.9 5.2 3.2 0.6 0.1 0.1 100.0 Average Income (Dollars) 6,356 14,990 24,884 34,573 44,845 60,613 85,666 127,507 292,846 672,753 3,045,089 38,999 Average Federal Tax Burden (Dollars) -441 -636 1,465 4,449 7,351 11,687 18,800 30,736 73,958 181,312 933,636 6,112 Average AfterTax Income 4 (Dollars) 6,797 15,626 23,420 30,124 37,494 48,926 66,866 96,771 218,888 491,441 2,111,453 32,887 Average Federal Tax Rate 5 -6.9 -4.3 5.9 12.9 16.4 19.3 22.0 24.1 25.3 27.0 30.7 15.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.8 8.3 12.3 13.5 11.5 21.5 11.4 10.5 4.2 1.5 3.8 100.0 2.3 10.2 13.7 14.0 11.4 20.6 10.5 9.4 3.8 1.3 3.1 100.0 -0.8 -2.2 4.6 11.1 12.0 26.5 16.0 16.1 6.8 2.5 7.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC -7.0 -5.4 2.6 9.9 14.2 17.9 21.1 24.0 25.2 27.0 30.7 14.1 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Benefit Without Tax Benefit 1.4 43.2 79.7 84.7 82.6 81.1 80.4 61.4 3.6 2.1 0.4 63.2 98.6 56.8 20.3 15.3 17.4 18.9 19.7 38.6 96.4 97.9 99.6 36.8 Benefit as Percent of After-Tax 4 Income 0.3 1.4 4.0 4.2 3.6 2.7 2.0 0.9 0.0 0.0 0.0 1.3 Share of Total Federal Tax Benefits 0.1 2.8 11.8 13.5 11.6 22.9 18.1 18.8 0.2 0.0 0.0 100.0 Average Federal Tax Benefits Dollars As Percent of Tax 17 221 955 1,277 1,374 1,384 1,386 935 36 30 6 931 -2.6 -19.4 101.4 31.2 19.4 12.3 7.8 2.9 0.1 0.0 0.0 4.5 Share of Federal Taxes Change due to CTC 0.0 -0.2 -0.5 -0.5 -0.4 -0.7 -0.4 0.5 0.9 0.4 1.0 0.0 With CTC -0.2 -0.8 0.0 1.4 2.3 7.7 10.0 29.1 20.4 8.6 21.6 100.0 5 Average Federal Tax Rate Change due to CTC -0.3 -1.5 -3.8 -3.7 -3.1 -2.2 -1.6 -0.7 0.0 0.0 0.0 -1.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2008 1 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,776 5,557 5,511 4,690 3,752 7,363 5,827 8,962 2,595 436 212 47,814 5.8 11.6 11.5 9.8 7.9 15.4 12.2 18.7 5.4 0.9 0.4 100.0 Average Income (Dollars) 5,898 15,197 24,900 34,744 44,854 61,821 87,024 135,841 282,902 676,229 3,150,935 92,771 Average Federal Tax Burden (Dollars) -652 -1,137 942 4,090 7,086 11,297 17,733 31,856 75,206 187,274 969,698 20,884 Average After4 Tax Income (Dollars) 6,550 16,334 23,958 30,653 37,768 50,524 69,291 103,985 207,696 488,955 2,181,237 71,887 Average Federal Tax 5 Rate Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.1 -7.5 3.8 11.8 15.8 18.3 20.4 23.5 26.6 27.7 30.8 22.5 0.4 1.9 3.1 3.7 3.8 10.3 11.4 27.5 16.6 6.7 15.1 100.0 0.5 2.6 3.8 4.2 4.1 10.8 11.8 27.1 15.7 6.2 13.5 100.0 -0.2 -0.6 0.5 1.9 2.7 8.3 10.4 28.6 19.5 8.2 20.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. Note: Tax units with (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC -11.3 -8.9 -0.1 8.1 12.7 16.0 18.8 22.8 26.6 27.7 30.8 21.5 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Benefit Without Tax Benefit 0.0 0.2 1.2 1.1 1.8 2.9 2.8 1.7 0.3 0.1 0.0 1.3 100.0 99.8 98.8 98.9 98.2 97.1 97.2 98.3 99.7 99.9 100.0 98.7 Benefit as Percent of After-Tax 4 Income 0.0 0.0 0.1 0.0 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Benefits 0.3 1.0 9.4 6.5 9.4 38.3 19.2 14.8 0.9 0.1 0.0 100.0 Average Federal Tax Benefits Dollars 0 1 10 14 23 41 33 21 4 2 0 15 As Percent of Tax 0.2 0.2 0.8 0.6 0.6 0.6 0.3 0.1 0.0 0.0 0.0 0.1 Share of Federal Taxes Change due to CTC 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 With CTC 0.1 0.7 1.3 1.1 1.6 7.4 8.0 19.8 19.0 10.3 30.7 100.0 5 Average Federal Tax Rate Change due to CTC 0.0 0.0 0.0 0.0 -0.1 -0.1 0.0 0.0 0.0 0.0 0.0 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2008 1 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,972 6,525 3,880 2,027 1,758 4,029 2,494 3,021 1,039 218 124 28,106 10.6 23.2 13.8 7.2 6.3 14.3 8.9 10.8 3.7 0.8 0.4 100.0 Average Income (Dollars) 6,620 14,858 24,363 34,496 44,970 61,893 86,278 135,091 292,533 682,870 3,120,404 73,692 Average Federal Tax Burden (Dollars) 175 412 1,339 2,204 3,697 7,381 12,881 26,354 73,417 188,438 991,718 14,287 Average After4 Tax Income (Dollars) 6,445 14,445 23,024 32,292 41,272 54,513 73,398 108,737 219,115 494,432 2,128,686 59,404 Average Federal Tax 5 Rate 2.6 2.8 5.5 6.4 8.2 11.9 14.9 19.5 25.1 27.6 31.8 19.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.0 4.7 4.6 3.4 3.8 12.0 10.4 19.7 14.7 7.2 18.7 100.0 1.2 5.7 5.4 3.9 4.4 13.2 11.0 19.7 13.6 6.5 15.8 100.0 0.1 0.7 1.3 1.1 1.6 7.4 8.0 19.8 19.0 10.2 30.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. Note: Elderly tax (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC 2.6 2.8 5.5 6.4 8.2 11.9 14.9 19.5 25.1 27.6 31.8 19.4 24-Jun-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0139 Child Tax Credit (CTC) Distribution of Federal Tax Benefits by Cash Income Level, 2008 Detail Table - Tax Units with Eligible Children Only Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Benefit 3 Without Tax Benefit 1.4 50.6 92.9 98.0 98.5 99.6 99.3 78.5 4.7 2.7 0.5 74.9 98.6 49.4 7.2 2.0 1.5 0.4 0.7 21.5 95.4 97.3 99.5 25.1 Benefit as Percent of After-Tax Income 4 0.2 1.6 4.7 4.8 4.3 3.4 2.5 1.2 0.0 0.0 0.0 1.7 Share of Total Federal Tax Benefits 0.1 2.9 12.3 13.8 11.7 22.7 17.7 18.3 0.2 0.0 0.0 100.0 Average Federal Tax Benefits Dollars As Percent of Tax 14 260 1,115 1,470 1,634 1,697 1,709 1,194 47 40 9 1,096 -3.9 -32.3 111.2 36.0 23.1 15.0 9.7 3.8 0.1 0.0 0.0 5.8 1 Share of Federal Taxes Change due to CTC With CTC 0.0 -0.2 -0.7 -0.7 -0.5 -0.9 -0.4 0.6 1.2 0.5 1.2 0.0 -0.2 -0.7 -0.1 1.5 2.4 7.9 10.2 28.8 20.3 8.4 21.4 100.0 Average Federal Tax Rate 5 Change due to CTC -0.3 -1.7 -4.5 -4.2 -3.7 -2.8 -2.0 -0.9 0.0 0.0 0.0 -1.3 Baseline Distribution of Income and Federal Taxes for Tax Units with Eligible Children Only 1 by Cash Income Level, 2008 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,482 5,148 5,077 4,295 3,285 6,145 4,757 7,045 1,996 334 161 41,874 8.3 12.3 12.1 10.3 7.8 14.7 11.4 16.8 4.8 0.8 0.4 100.0 Average Income (Dollars) 5,775 15,120 24,871 34,697 44,816 61,740 87,060 135,851 284,080 677,829 3,206,263 85,250 Average Federal Tax Burden (Dollars) -365 -804 1,003 4,080 7,088 11,307 17,685 31,700 75,895 188,412 989,975 18,924 Average AfterTax Income 4 (Dollars) 6,139 15,925 23,868 30,617 37,728 50,432 69,375 104,151 208,185 489,417 2,216,288 66,326 Average Federal Tax Rate 5 -6.3 -5.3 4.0 11.8 15.8 18.3 20.3 23.3 26.7 27.8 30.9 22.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 2.2 3.5 4.2 4.1 10.6 11.6 26.8 15.9 6.4 14.5 100.0 0.8 3.0 4.4 4.7 4.5 11.2 11.9 26.4 15.0 5.9 12.9 100.0 -0.2 -0.5 0.6 2.2 2.9 8.8 10.6 28.2 19.1 8.0 20.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) Calendar year. Benefits of the CTC are measured against a current law baseline. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. With CTC -6.6 -7.0 -0.5 7.5 12.2 15.6 18.4 22.5 26.7 27.8 30.9 20.9