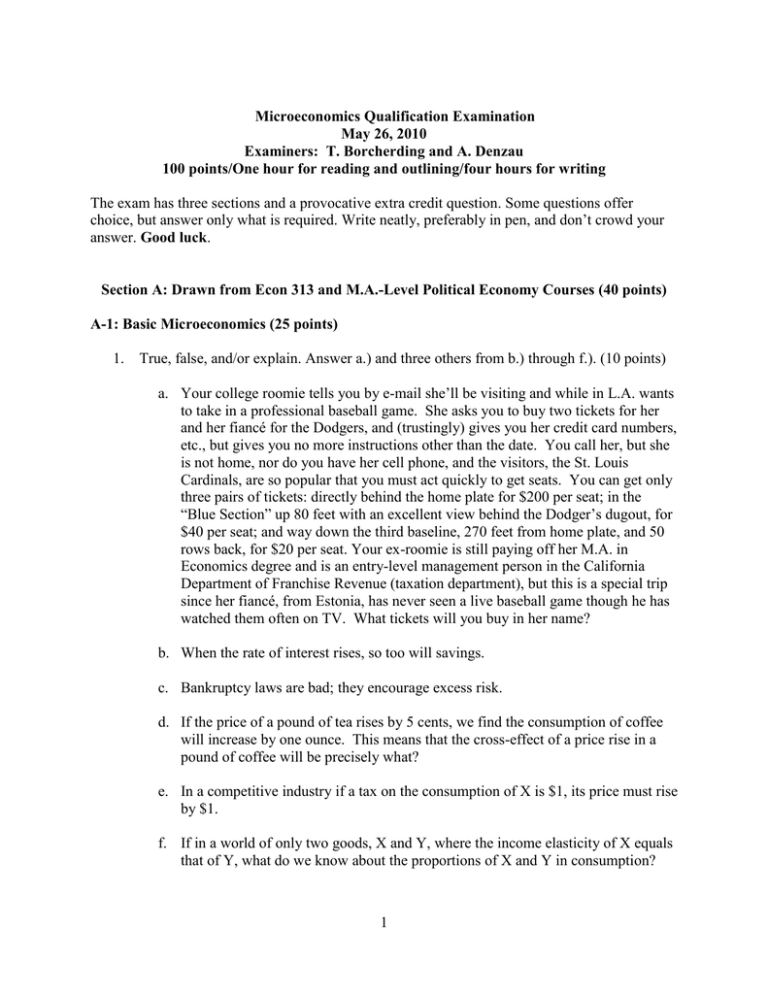

Microeconomics Qualification Examination May 26, 2010

advertisement

Microeconomics Qualification Examination May 26, 2010 Examiners: T. Borcherding and A. Denzau 100 points/One hour for reading and outlining/four hours for writing The exam has three sections and a provocative extra credit question. Some questions offer choice, but answer only what is required. Write neatly, preferably in pen, and don’t crowd your answer. Good luck. Section A: Drawn from Econ 313 and M.A.-Level Political Economy Courses (40 points) A-1: Basic Microeconomics (25 points) 1. True, false, and/or explain. Answer a.) and three others from b.) through f.). (10 points) a. Your college roomie tells you by e-mail she’ll be visiting and while in L.A. wants to take in a professional baseball game. She asks you to buy two tickets for her and her fiancé for the Dodgers, and (trustingly) gives you her credit card numbers, etc., but gives you no more instructions other than the date. You call her, but she is not home, nor do you have her cell phone, and the visitors, the St. Louis Cardinals, are so popular that you must act quickly to get seats. You can get only three pairs of tickets: directly behind the home plate for $200 per seat; in the “Blue Section” up 80 feet with an excellent view behind the Dodger’s dugout, for $40 per seat; and way down the third baseline, 270 feet from home plate, and 50 rows back, for $20 per seat. Your ex-roomie is still paying off her M.A. in Economics degree and is an entry-level management person in the California Department of Franchise Revenue (taxation department), but this is a special trip since her fiancé, from Estonia, has never seen a live baseball game though he has watched them often on TV. What tickets will you buy in her name? b. When the rate of interest rises, so too will savings. c. Bankruptcy laws are bad; they encourage excess risk. d. If the price of a pound of tea rises by 5 cents, we find the consumption of coffee will increase by one ounce. This means that the cross-effect of a price rise in a pound of coffee will be precisely what? e. In a competitive industry if a tax on the consumption of X is $1, its price must rise by $1. f. If in a world of only two goods, X and Y, where the income elasticity of X equals that of Y, what do we know about the proportions of X and Y in consumption? 1 2. A Simple Problem (10 points) A price-searching firm faces the inverse demand curve, P = A – 5q. The intercept, A, is a random number, 100 or 200, with equal probabilities. The average cost is constant at 10. i) The firm sets its price, but does not know what A will be until after its decision is made. What should that price be if it is risk neutral? ii) Suppose, the firm could find out, in advance and with certainty what A would be? How much would the firm be willing, to pay for this information? iii) How would your answer change, if you were told the firm is currently owned by a recent widow with five children and no other source of income? Should she sell her firm? To whom is she likely to do that? 3. Cribbed from “Ask an Economist” in the Financial Times. (5 points) Last Saturday a young Londoner wrote in that his laundry lady seemed really happy to wash and press his sheets, drawers, shirts, etc. He asked if this meant he could ask her to lower her prices by 5 or 10 percent? What was the Economist’s answer? A-2: Neo-institutional Economics and Political Economy (15 points) Answer only one of the three below: 1. Since the 1970s the theory of the firm, as enunciated by Coase, Alchian and Demsetz, Williamson, et al., hones in on transactions cost in predicting firm governance structures. a. What are the key issues in predicting these structures in the Coase, Alchian and Demsetz, Williamson, et al. model? Give examples. b. How does this model alter when one brings in cultural issues? Give examples. c. How does it alter when neuro-economics issues are introduced as in Akerlof and Thaler’s new best seller, Nudge? Give examples. 2. Twenty years after his death, Hayek is a rock star of economics, mentioned along with Friedman, Samuelson, Arrow, Coase, and Hayek’s close friend Keynes as the top scholars of the 20th century. Unlike the four more contemporary economists, neither Hayek nor Keynes assumed the individual was wholly rational, but was subject to “animal spirits,” appetites, and emotions. Both men argued that irrationality was mitigated, but never “cured,” by institutional constraints that developed as correctives. 2 a. How, in the face of firmly established neuro-scientific facts, do institutions arise to control the vagaries of “animal spirits”? b. Why do the views of Hayek and Keynes differ so much on the favored institutional solutions and how is this reflected in the current debate over dealing with the current economic calamity and avoiding them in the future? c. Given the fact of globalization can sub-parts of the international institutional system go their own way, some taking the Hayekian path while others go down the Keynesian one? 3. There are two sorts of people in society X: A’s and B’s. A’s are awful sorts, genetically selfish, total economic men (and women). B’s are very benign folks, genetically cooperative. The problem is that the B’s cannot distinguish ex-ante a B from an A, so when they deal with one of the latter, the B type always regrets it. Below is the payoff matrix of A’s and B’s interacting with A and B shown separately: A deals with an (A payoffs shown) A 2 B 6 B deals with an (B payoffs shown) A 0 B 4 Suppose Darwinian survival is proportional to the payoffs A and B each received. So if PA > PB then A has a “fitness” advantage and her genes will thrive and B will diminish in the population. The opposite holds for PB > PA. Reproduction is asexual so the A’s and B’s spontaneously and asexually reproduce every period. Given that there is no “natural” way for B to tell an A from a B ex ante: a. Starting out with say half A’s and half B’s, what will be the long-run ratio of A’s to B’s? b. If the B’s do figure out an ex-ante method to tell A’s from B’s, things do happens, but such a method has a cost. Tell how the ratio of A to B people alters as that cost-perinteraction rises from 1 to 2 to 3 to 4. c. Draw some inferences from this simple model. 3 Section B: Drawn from Econ 316 (30 points) Answer question 1 or 2, but not both. 1) Consider a firm whose technology can be represented by the production function: q = L0.25K0.25 . Suppose the firm is the only firm in its output market, and faces a market demand represented by Q = 40 – p. a. Derive the firm’s output choice. b. Let the wage be 4, and the capital rental rate 1. What is the profit-maximizing level of output? The level of profit? c. The government now raises levies a tax of t per unit on the market in which the firm sells. What is the new optimal output choice? d. What is the rate of t that maximizes government revenue from this tax? What is the size of the tax? 2) A farmer can work L hours on his farm or consume S hours of leisure, where L+2=120. The farmer’s utility function is U = X 1/3 S 2/3 where X is his consumption of the composite market consumption good. The farmer’s production function on his farm is Y = L. He sells Y for a price Py. The farmer farms alone. a. Model the farmer’s optimal decision problem, showing the first-order conditions and interpreting their economic meanings. b. Calculate for Py = 1 the values of L, S, Y and X and indicate their shadow prices. c. Then do this for Py = 4, and interpret the economics of the changes that are implied. d. Now assume that the farmer can hire outside labor at a wage of 5. How does this affect c)? Section C: Drawn from Econ 317 (30 points) Answer question 1 or 2, but not both. 1) Consider the interaction of a pair of individuals from two different societies: the Tourist and the Native. The Native is suspicious of tourists, and usually doesn’t like interacting with them. However, they know that Tourists do come in 2 varieties: xenophoBes and xenophiLes: B or L. The Bs are more likely – 80% of the time, and this has conditioned the Native’s expectation of not liking the typical tourist. 4 However, tourists can attempt to speak the Native’s language, Xenish. For the B tourist, this is costly at a cost D > 0. For the L, who loves meeting others, it is costless. So whenever a Tourist meets a Native, the Tourist is expected to speak first, and then the Native chooses to Cooperate or Not cooperate. The payoff to all of Not cooperating is zero. If a Native Cooperates with an L Tourist , they each get a payoff of 6. If a Native Cooperates with a B Tourist, the Native loses 2, and the B gets 3. a. Draw the resulting game tree. Assume that D = 7. b. Draw the resulting game tree. c. Is there a separating equilibrium? If so, show that it is one. 2) Consider the following principal-agent situation. We have a principal P and an agent, A. P wants to hire A for a one-time project. If A works for P, A can choose high effort,3, or low effort, 2. The agent has outside opportunities worth Uo = 2.5. Profits are either high, 400, or low, 100. If A chooses high effort, then profits are 400 with probability, 0.75 , and 100 with probability, 0.25; and if A chooses low effort, then profits are 400 with probability, 0.25 , and 100 with probability, 0.75. P simply maximizes expected profits from the project, less the expected wages to the agent, A. A maximizes expected utility as follows, given a wage, w, and effort choice, e: U(w, e) = w1/2 - e. P will design a contract, A will then accept it or not, and if accepted, A then chooses an effort level. a. Show how to implement eL and eH if effort is unobservable, but profit is observable. b. Which effort level would the principal wants to implement? Section D: An Extra Credit Question (up to 5 points of lost credit) Tyler Cowen in his Marginal Revolution blog poses this question: Suppose one day the sun goes through some sort of once-in-a-ten-billion year paroxysm and shoots out genetically debilitating rays that causes all mammalian life to have its fertility cut by 100%. The eruption is only for a milli-second and affects only one half the globe. What are the long-run consequences for the global economy, polity, and society as well as the various political entities of the world? Do not assume this demographic cataclysm is anything as dramatic as what befell the dinosaurs following the asteroidal bombardment millions and millions of years ago. Spend no more than 50 to 75 words on this. (Talk about it amongst yourselves after the exam, since the Cowen Conjecture is now the subject of much lunchtime discussion.) 5