Macroeconomic Qualifying Exam-303 Module Claremont Graduate University May, 2006

advertisement

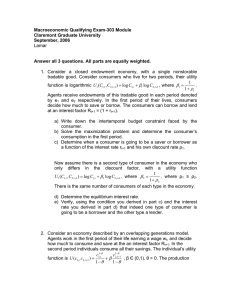

Macroeconomic Qualifying Exam-303 Module Claremont Graduate University May, 2006 Lamar Answer 2 of 3 questions. All parts are equally weighted. 1. Consider a “small” endowment-open economy, with a single nonstorable tradable good. Agents receive endowments of this tradable good in each period. Since the economy is “small” consumers face an exogenous world interest factor Rt+1, where Rt+1=(1+rt+1). Each country has perishable endowments e1,e2. Population is normalized to 1. The utility function of this economy is logarithmic U (C1,t , C 2,t +1 ) = log C1,t + β log C 2,t +1 . a) Set up the consumer problem and find optimal savings. b) Determine the optimal consumption levels. The Current Account (CA) of a country is given by its saving, i.e.,CA1 = e1-C1,t. c) Suppose the following supply shock, endowment in period 1 falls and the endowment in period 2 rises in such way that the present value of wealth is unchanged. Find the effect on the current account balance CA1. Interpret your result. Hint: Express the optimal consumption level C1 as a function of the present value of wealth (W). d) Suppose now other supply shock, the endowment in period 1 falls with no change in the endowment in period 2. Find the effect on the current account balance CA1. Interpret your result. Compare your result with your finding in c). e) Suppose there is an exogenous change in the world discount interest factor. Find the effect of such a change on the Current Account Balance. 2. Consider a standard Overlapping Generations Model with productive capital where agents live two periods, working when young and retired when old. Population growth is given by Nt+1 = (1+n)Nt, where Nt is the number of youngsters at time t, and n > -1. Consumers maximize lifetime utility, which is given by, U (c1,t , c 2,t +1 ) = c11,−t θ 1−θ +β c12−,tθ+1 1−θ , β Є (0,1), θ > 0, θ ≠ 1. Net production is given by a Cobb-Douglas production function, Y − δK = F ( K , N ) − δK = K α N 1−α − δK . a) Derive the agent optimality conditions. Find optimal savings. b) Obtain firm’s first order conditions on their choice of labor and capital. c) Write down the Capital Market Equilibrium Condition. d) Assume now that θ =1, find steady states, and derive the phase portrait including arrows of motion. e) Show the stability and uniqueness properties of all steady states. f) Now assume α >1, redo e) and sketch the phase portrait. Justify your answer. 3. Consider an Overlapping Generations Model with production, and population growth given by Nt+1 = (1+n)Nt, where Nt is the number of youngsters at time t, and n > -1. Agents work when young and enjoy retirement when old. Assume we have a Pay-As-You-Go (PAYG) social security system. Utility is separable and given by U (c1,t , c2,t +1 ) = U (c1,t ) + β U (c2,t +1 ) . a) Write down the government budget constraint in per capita terms. b) Derive first order conditions for the consumer. c) From what you found in b) show graphically and analytically the effect of taxes on savings and capital accumulation. d) Now suppose there is a permanent reduction in the fertility rate n of the population, starting next generation. Reducing the benefits to the old generation is politically unfeasible; in order to keep the social security benefits constant, the social security administration increases the contributions by young people to match the benefits to be paid to the old. This question asks you to the effects over capital accumulation of a reduction in the fertility rate of the population while keeping social security payments. If your answer is ambiguous, at least try to identify the effects at play.