Macroeconomics Qualifying Exam Part 2 May, 2010 Claremont Graduate University

advertisement

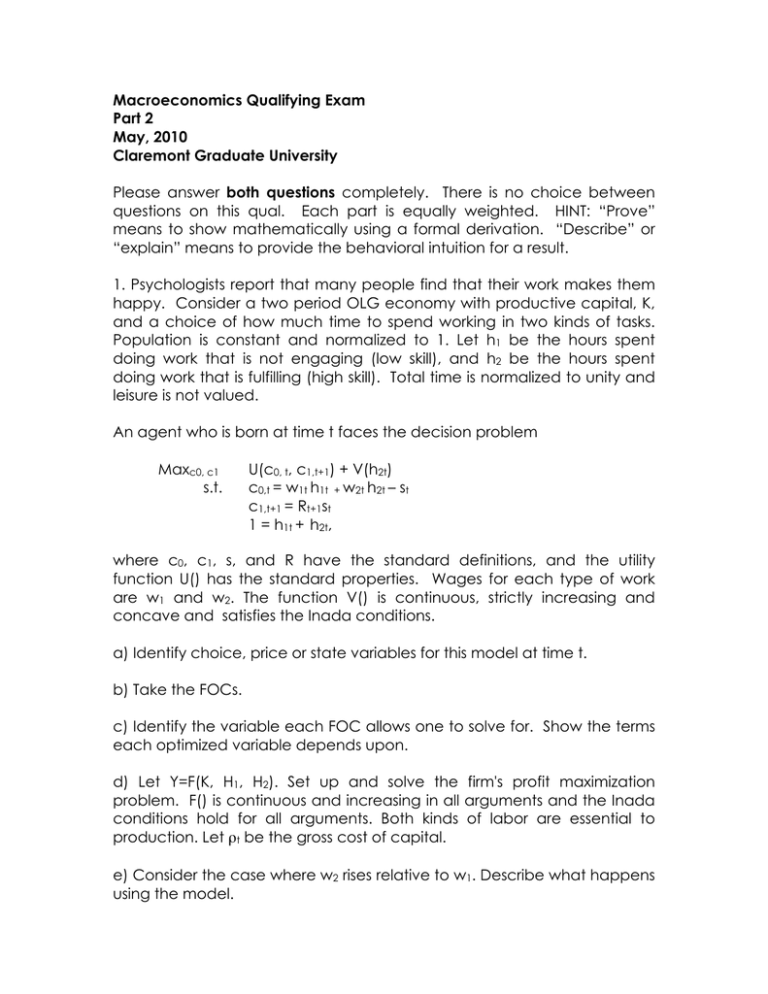

Macroeconomics Qualifying Exam

Part 2

May, 2010

Claremont Graduate University

Please answer both questions completely. There is no choice between

questions on this qual. Each part is equally weighted. HINT: “Prove”

means to show mathematically using a formal derivation. “Describe” or

“explain” means to provide the behavioral intuition for a result.

1. Psychologists report that many people find that their work makes them

happy. Consider a two period OLG economy with productive capital, K,

and a choice of how much time to spend working in two kinds of tasks.

Population is constant and normalized to 1. Let h1 be the hours spent

doing work that is not engaging (low skill), and h2 be the hours spent

doing work that is fulfilling (high skill). Total time is normalized to unity and

leisure is not valued.

An agent who is born at time t faces the decision problem

Maxc0, c1

s.t.

U(c0, t, c1,t+1) + V(h2t)

c0,t = w1t h1t + w2t h2t – st

c1,t+1 = Rt+1st

1 = h1t + h2t,

where c0, c1, s, and R have the standard definitions, and the utility

function U() has the standard properties. Wages for each type of work

are w1 and w2. The function V() is continuous, strictly increasing and

concave and satisfies the Inada conditions.

a) Identify choice, price or state variables for this model at time t.

b) Take the FOCs.

c) Identify the variable each FOC allows one to solve for. Show the terms

each optimized variable depends upon.

d) Let Y=F(K, H1, H2). Set up and solve the firm's profit maximization

problem. F() is continuous and increasing in all arguments and the Inada

conditions hold for all arguments. Both kinds of labor are essential to

production. Let ρt be the gross cost of capital.

e) Consider the case where w2 rises relative to w1. Describe what happens

using the model.

f) Define a competitive equilibrium for this model C3: clearly, completely,

and concisely.

g) Find all steady states for this model.

h) Draw (but don't derive) a phase portrait for this model. Identify steady

states, their stability properties, and put in arrows of motion.

i) Lifetime utility might be higher if h2 were higher.

explain why all work cannot be fulfilling (i.e. h1 = 0).

Use the model to

2. Consider an infinitely-lived representative agent (Cass) economy. In this

model, people value having children, b, even though they are costly. The

agent’s decision problem at time t is described by

Maxct, bt

s.t.

βt {U(ct) + ηV(bt)}

ct = wt + rt kt - it - bt dt

kt+1 = (1-δ)kt +it,

where c is consumption, b is kids (assumed continuous to make problem

easier but a rule could be used to convert continuous children into

discrete children), d is the cost of a child, w is wage, k is capital, i is

investment, r is the interest rate, δ ∈ [0,1] is depreciation, β∈ (0,1) is the

discount rate, η > 0 is the relative utility weight on children, and the utility

functions U(.) and V(.) have the standard properties including the Inada

conditions. Population growth is given by Nt+1= Ntbt.

a. Is this a planning problem or a market problem? Justify your answer.

Identify choice and state variables.

b. Find the agent’s first order conditions (FOCs) for an optimal solution to

this problem. You may use Rt = rt+1-δ.

c. Identify the variables the agent’s optima solve for in (b) with a star (*)

and show which other variables these depend on from the agent’s

perspective.

d. Set up and solve the profit maximization problem for a representative

firm in a perfectly competitive market with production function Y=F(K, N),

where Y is output, K is aggregate capital, and F(K,N) has the standard

properties. Let rt be the gross cost of capital. Identify how prices Rt and wt

are determined through the firm's problem.

e. State the capital market equilibrium condition for this model. Show the

dependence of all terms on the state variable(s). Write this equation in per

capita terms. Only kt+1 should be on the left hand side of the equation.

f. Carefully and completely, define a general equilibrium for this model.

g. What additional condition is required to ensure that the equilibrium is an

optimal solution? State it. What does this rule out?

h. Write down the other version of this problem. That is, if the original

problem is a planning problem write down the market problem, or viceversa.

i. Let btdt = γKt, for γ ∈ (0,1). Using the planning version of the model,

derive a condition for the golden rule.

Prove or disprove: golden rule

capital is higher when people like children (η,γ>0).