REFINING AN ORGANIZATION’S PERFORMANCE On the Road

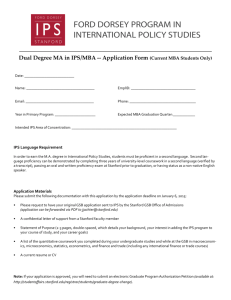

advertisement