Preventing Corruption + Managing Obama’s

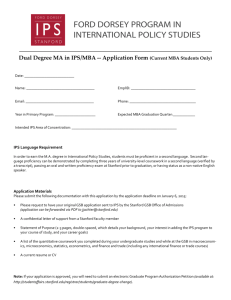

advertisement