COMPREHENSIVE ANNUAL FINANCIAL REPORT CITY OF COLUMBIA, SOUTH CAROLINA

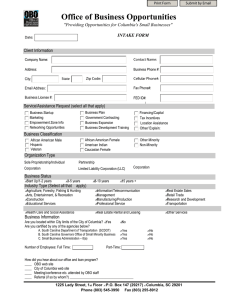

advertisement