8‐Mar‐11 PRELIMINARY RESULTS With Tax Change (%

advertisement

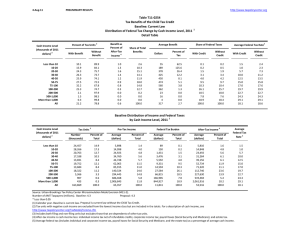

8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 0.0 0.2 2.1 6.0 12.6 24.6 54.5 80.4 92.8 71.1 35.5 24.4 With Tax Increase 0.0 0.0 0.0 0.0 0.1 0.0 0.2 0.4 0.3 0.8 0.8 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.3 0.7 1.6 2.4 2.5 0.2 0.0 1.2 Share of Total Federal Tax Change Average Federal Tax Change ($) 0.0 0.0 0.1 0.3 1.2 7.1 14.5 46.2 29.2 1.1 0.2 100.0 0 0 ‐6 ‐22 ‐100 ‐344 ‐1,123 ‐2,582 ‐5,541 ‐1,165 ‐487 ‐697 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.5 ‐1.3 ‐1.8 ‐1.9 ‐0.2 0.0 ‐0.9 Under the Proposal 2.7 2.9 8.0 12.5 15.1 17.4 19.1 21.7 24.2 25.4 29.8 20.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 37.1 Proposal: 4.5 (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.2 2.1 6.0 12.6 24.6 54.5 80.4 92.8 71.1 35.5 24.4 0.0 0.0 0.0 0.0 0.1 0.0 0.2 0.4 0.3 0.8 0.8 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.3 0.7 1.6 2.4 2.5 0.2 0.0 1.2 Share of Total Federal Tax Change 0.0 0.0 0.1 0.3 1.2 7.1 14.5 46.2 29.2 1.1 0.2 100.0 Average Federal Tax Change Dollars Percent 0 0 ‐6 ‐22 ‐100 ‐344 ‐1,123 ‐2,582 ‐5,541 ‐1,165 ‐487 ‐697 0.0 ‐0.1 ‐0.3 ‐0.5 ‐1.4 ‐3.0 ‐6.1 ‐7.8 ‐7.2 ‐0.7 ‐0.1 ‐4.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.1 0.1 0.1 0.2 ‐0.2 ‐0.9 ‐0.5 0.3 0.9 0.0 Under the Proposal 0.1 0.5 1.9 3.0 3.8 10.5 10.1 24.8 17.2 7.7 20.3 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.5 ‐1.3 ‐1.8 ‐1.9 ‐0.2 0.0 ‐0.9 Under the Proposal 2.7 2.9 8.0 12.5 15.1 17.4 19.1 21.7 24.2 25.4 29.8 20.5 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 17,312 24,697 21,652 16,234 12,917 22,699 14,156 19,612 5,778 1,040 527 157,348 11.0 15.7 13.8 10.3 8.2 14.4 9.0 12.5 3.7 0.7 0.3 100.0 Average Income (Dollars) 5,740 15,548 25,815 36,228 46,559 64,055 90,186 141,017 297,117 704,874 3,114,806 74,905 Average Federal Tax Burden (Dollars) 156 446 2,065 4,543 7,148 11,500 18,348 33,164 77,435 180,518 928,825 16,040 Average After‐ Tax Income 4 (Dollars) 5,584 15,102 23,749 31,685 39,411 52,555 71,838 107,853 219,682 524,356 2,185,981 58,865 Average Federal Tax Rate 5 2.7 2.9 8.0 12.5 15.4 18.0 20.3 23.5 26.1 25.6 29.8 21.4 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.8 3.3 4.7 5.0 5.1 12.3 10.8 23.5 14.6 6.2 13.9 100.0 1.0 4.0 5.6 5.6 5.5 12.9 11.0 22.8 13.7 5.9 12.4 100.0 0.1 0.4 1.8 2.9 3.7 10.3 10.3 25.8 17.7 7.4 19.4 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Number of AMT Taxpayers (millions). Baseline: 37.1 Proposal: 4.5 (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.1 0.3 0.2 0.8 3.6 8.1 27.1 71.0 39.1 27.2 3.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.3 0.4 0.4 0.0 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.5 0.8 0.1 0.0 0.2 Share of Total Federal Tax Change 0.0 0.1 0.1 0.1 1.0 9.1 11.4 39.3 37.5 1.1 0.3 100.0 Average Federal Tax Change Dollars Percent 0 0 0 0 ‐7 ‐42 ‐134 ‐490 ‐1,901 ‐333 ‐158 ‐57 0.0 0.0 0.0 0.0 ‐0.1 ‐0.3 ‐0.6 ‐1.5 ‐2.5 ‐0.2 0.0 ‐0.6 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.1 0.1 0.1 0.0 ‐0.1 ‐0.2 0.0 0.1 0.0 Under the Proposal 0.8 3.0 6.3 7.8 8.7 19.2 11.6 17.3 9.5 4.1 11.5 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.2 ‐0.4 ‐0.6 ‐0.1 0.0 ‐0.1 Under the Proposal 6.9 7.8 13.1 17.1 19.1 21.5 23.6 24.0 24.7 26.7 31.7 20.5 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,339 15,074 11,420 7,675 5,979 8,606 3,332 3,161 777 135 75 68,932 17.9 21.9 16.6 11.1 8.7 12.5 4.8 4.6 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,702 15,388 25,653 36,154 46,529 63,176 89,421 138,347 301,624 699,552 2,969,061 43,096 Average Federal Tax Burden (Dollars) 395 1,192 3,347 6,189 8,886 13,595 21,265 33,756 76,359 186,739 941,733 8,875 Average After‐ Tax Income 4 (Dollars) 5,307 14,196 22,306 29,965 37,643 49,581 68,156 104,592 225,265 512,813 2,027,328 34,221 Average Federal Tax Rate 5 6.9 7.8 13.1 17.1 19.1 21.5 23.8 24.4 25.3 26.7 31.7 20.6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 2.4 7.8 9.9 9.3 9.4 18.3 10.0 14.7 7.9 3.2 7.5 100.0 2.8 9.1 10.8 9.8 9.5 18.1 9.6 14.0 7.4 2.9 6.4 100.0 0.8 2.9 6.3 7.8 8.7 19.1 11.6 17.4 9.7 4.1 11.5 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.9 5.7 8.9 26.0 65.3 90.6 96.4 77.0 37.6 47.1 0.0 0.0 0.0 0.0 0.1 0.1 0.3 0.2 0.2 0.2 0.1 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.1 0.1 0.6 1.8 2.8 2.9 0.3 0.0 1.6 Share of Total Federal Tax Change 0.0 0.0 0.0 0.1 0.1 3.6 13.4 49.6 31.8 1.3 0.3 100.0 Average Federal Tax Change Dollars Percent 0 0 ‐2 ‐21 ‐21 ‐328 ‐1,358 ‐3,019 ‐6,227 ‐1,351 ‐588 ‐1,537 ‐0.1 0.0 ‐0.2 ‐0.8 ‐0.4 ‐3.5 ‐8.0 ‐9.1 ‐8.0 ‐0.8 ‐0.1 ‐5.5 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.1 0.1 ‐0.2 ‐1.2 ‐0.6 0.5 1.3 0.0 Under the Proposal 0.0 0.0 0.3 0.7 1.2 5.7 8.9 28.5 21.0 9.5 24.0 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 ‐0.1 0.0 ‐0.5 ‐1.5 ‐2.1 ‐2.1 ‐0.2 0.0 ‐1.2 Under the Proposal 2.0 0.9 3.5 6.9 9.9 14.1 17.3 21.1 24.1 25.3 29.4 21.4 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,234 4,170 4,955 4,507 4,093 10,218 9,299 15,488 4,807 872 432 61,357 3.6 6.8 8.1 7.4 6.7 16.7 15.2 25.2 7.8 1.4 0.7 100.0 Average Income (Dollars) 4,855 16,049 25,947 36,385 46,670 65,116 90,700 142,026 296,329 705,965 3,076,442 124,139 Average Federal Tax Burden (Dollars) 97 140 898 2,529 4,636 9,486 17,038 33,030 77,657 179,674 906,168 28,132 Average After‐ Tax Income 4 (Dollars) 4,758 15,909 25,049 33,855 42,034 55,629 73,662 108,996 218,672 526,290 2,170,274 96,007 Average Federal Tax Rate 5 2.0 0.9 3.5 7.0 9.9 14.6 18.8 23.3 26.2 25.5 29.5 22.7 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.1 0.9 1.7 2.2 2.5 8.7 11.1 28.9 18.7 8.1 17.4 100.0 0.2 1.1 2.1 2.6 2.9 9.7 11.6 28.7 17.9 7.8 15.9 100.0 0.0 0.0 0.3 0.7 1.1 5.6 9.2 29.6 21.6 9.1 22.7 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.6 7.2 16.0 39.3 64.5 89.3 92.9 94.2 60.8 30.3 25.2 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.1 0.0 0.2 0.0 0.0 Percent Change in After‐Tax Income 4 0.0 0.0 0.1 0.2 0.9 2.0 2.8 2.3 1.4 0.1 0.0 1.1 Share of Total Federal Tax Change 0.0 0.1 1.1 2.0 9.7 36.3 25.8 20.3 4.7 0.1 0.0 100.0 Average Federal Tax Change Dollars Percent 0 ‐1 ‐21 ‐50 ‐358 ‐1,002 ‐1,903 ‐2,321 ‐3,033 ‐349 ‐239 ‐380 0.0 0.1 ‐19.0 ‐1.5 ‐5.3 ‐8.5 ‐9.7 ‐7.1 ‐4.1 ‐0.2 0.0 ‐6.9 Share of Federal Taxes Change (% Points) ‐0.1 ‐0.5 ‐0.1 0.5 0.2 ‐0.5 ‐0.6 0.0 0.2 0.2 0.5 0.0 Under the Proposal ‐2.0 ‐6.5 0.4 9.5 12.9 29.1 17.9 19.8 8.1 3.0 7.8 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 ‐0.1 ‐0.1 ‐0.8 ‐1.6 ‐2.1 ‐1.7 ‐1.0 ‐0.1 0.0 ‐0.9 Under the Proposal ‐14.4 ‐10.2 0.3 9.0 13.8 17.1 20.0 22.9 23.8 24.2 30.3 12.5 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,591 5,154 4,929 3,666 2,515 3,380 1,265 815 144 23 11 24,547 10.6 21.0 20.1 14.9 10.3 13.8 5.2 3.3 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,700 15,615 26,048 36,129 46,554 63,109 88,944 133,109 297,557 690,153 2,968,549 40,709 Average Federal Tax Burden (Dollars) ‐963 ‐1,588 109 3,296 6,758 11,766 19,661 32,732 73,897 167,328 899,093 5,481 Average After‐ Tax Income 4 (Dollars) 7,663 17,203 25,938 32,834 39,796 51,343 69,283 100,377 223,660 522,825 2,069,456 35,228 Average Federal Tax Rate 5 ‐14.4 ‐10.2 0.4 9.1 14.5 18.6 22.1 24.6 24.8 24.3 30.3 13.5 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.7 8.1 12.9 13.3 11.7 21.4 11.3 10.9 4.3 1.6 3.2 100.0 2.3 10.3 14.8 13.9 11.6 20.1 10.1 9.5 3.7 1.4 2.6 100.0 ‐1.9 ‐6.1 0.4 9.0 12.6 29.6 18.5 19.8 7.9 2.8 7.2 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.5 6.8 18.0 35.1 60.7 85.3 96.8 98.4 78.9 30.2 48.3 0.0 0.0 0.1 0.0 0.2 0.1 0.1 0.1 0.2 0.4 0.4 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.1 0.2 0.7 1.7 3.1 3.8 3.2 0.2 0.0 2.1 Share of Total Federal Tax Change 0.0 0.0 0.2 0.4 1.5 8.8 16.8 47.8 23.8 0.6 0.1 100.0 Average Federal Tax Change Dollars Percent 0 ‐1 ‐19 ‐69 ‐292 ‐894 ‐2,224 ‐4,119 ‐6,823 ‐1,084 ‐262 ‐1,552 0.0 0.0 2.5 ‐2.8 ‐5.1 ‐8.3 ‐12.1 ‐12.1 ‐8.6 ‐0.6 0.0 ‐7.7 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 ‐0.1 0.1 0.1 ‐0.1 ‐0.5 ‐1.4 ‐0.2 0.7 1.6 0.0 Under the Proposal ‐0.4 ‐1.5 ‐0.5 1.3 2.3 8.2 10.2 29.0 21.1 9.0 21.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 ‐0.1 ‐0.2 ‐0.6 ‐1.4 ‐2.5 ‐2.9 ‐2.3 ‐0.2 0.0 ‐1.7 Under the Proposal ‐19.0 ‐14.6 ‐3.0 6.6 11.7 15.5 17.9 21.2 24.7 26.7 30.6 19.9 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 3,083 5,815 5,901 4,869 3,878 7,541 5,764 8,849 2,661 441 204 49,155 6.3 11.8 12.0 9.9 7.9 15.3 11.7 18.0 5.4 0.9 0.4 100.0 Average Income (Dollars) 6,320 15,806 26,013 36,200 46,599 64,350 90,504 141,489 294,315 703,453 3,108,044 93,484 Average Federal Tax Burden (Dollars) ‐1,200 ‐2,311 ‐769 2,451 5,745 10,840 18,459 34,139 79,382 189,156 952,100 20,195 Average After‐ Tax Income 4 (Dollars) 7,520 18,118 26,782 33,748 40,854 53,510 72,045 107,350 214,934 514,298 2,155,944 73,289 Average Federal Tax Rate 5 ‐19.0 ‐14.6 ‐3.0 6.8 12.3 16.9 20.4 24.1 27.0 26.9 30.6 21.6 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.4 2.0 3.3 3.8 3.9 10.6 11.4 27.3 17.0 6.8 13.8 100.0 0.6 2.9 4.4 4.6 4.4 11.2 11.5 26.4 15.9 6.3 12.2 100.0 ‐0.4 ‐1.4 ‐0.5 1.2 2.2 8.2 10.7 30.4 21.3 8.4 19.6 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8‐Mar‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0058 Administration's FY2012 Budget Proposals Extend and Index 2011 AMT Patch Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.2 0.7 3.5 28.6 59.1 83.4 65.6 43.4 12.4 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.3 0.4 0.8 1.2 0.1 Percent Change in After‐Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.1 0.4 1.0 1.7 0.3 0.0 0.5 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.1 1.5 7.9 36.4 49.1 4.1 0.9 100.0 Average Federal Tax Change Dollars Percent 0 0 0 0 ‐5 ‐30 ‐291 ‐1,116 ‐4,012 ‐1,538 ‐592 ‐299 0.0 0.0 0.0 0.0 ‐0.2 ‐0.5 ‐2.4 ‐4.3 ‐5.6 ‐0.9 ‐0.1 ‐2.3 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.1 0.0 ‐0.4 ‐0.7 0.2 0.7 0.0 Under the Proposal 0.1 0.6 1.4 1.6 1.7 7.3 7.3 18.9 19.1 10.7 31.0 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 ‐0.1 ‐0.3 ‐0.8 ‐1.3 ‐0.2 0.0 ‐0.4 Under the Proposal 2.9 2.5 4.3 5.9 6.6 10.1 13.1 17.7 22.1 24.3 30.0 17.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,320 6,471 5,095 2,996 2,253 4,442 2,467 2,980 1,119 244 132 30,543 7.6 21.2 16.7 9.8 7.4 14.5 8.1 9.8 3.7 0.8 0.4 100.0 Average Income (Dollars) 6,373 15,653 25,549 36,070 46,527 64,493 89,209 141,614 304,594 710,007 3,095,739 75,561 Average Federal Tax Burden (Dollars) 185 390 1,107 2,133 3,054 6,510 11,950 26,147 71,350 173,918 927,763 13,196 Average After‐ Tax Income 4 (Dollars) 6,189 15,263 24,442 33,937 43,473 57,983 77,259 115,468 233,245 536,089 2,167,976 62,365 Average Federal Tax Rate 5 2.9 2.5 4.3 5.9 6.6 10.1 13.4 18.5 23.4 24.5 30.0 17.5 Share of Pre‐ Tax Income Share of Post‐ Tax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.6 4.4 5.6 4.7 4.5 12.4 9.5 18.3 14.8 7.5 17.7 100.0 0.8 5.2 6.5 5.3 5.1 13.5 10.0 18.1 13.7 6.9 15.0 100.0 0.1 0.6 1.4 1.6 1.7 7.2 7.3 19.3 19.8 10.5 30.3 100.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0509‐7). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would allow non‐refundable credits against tentative AMT and index the AMT exemption, rate bracket thresholds, and phaseout‐out exemption threshold to inflation after 2011. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.