8-Feb-10 PRELIMINARY RESULTS

advertisement

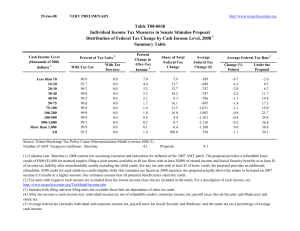

8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 25.1 31.4 34.9 40.4 40.1 36.5 32.3 23.5 12.5 2.6 1.1 31.2 With Tax Increase 0.0 0.8 1.0 1.3 0.5 0.3 0.1 0.2 26.8 84.8 91.2 2.7 Percent Change in After-Tax Income 4 2.8 1.7 1.0 0.7 0.6 0.5 0.3 0.2 -0.4 -3.0 -5.8 -0.7 Share of Total Federal Tax Change -3.1 -8.2 -7.0 -5.3 -4.3 -7.4 -4.3 -8.0 9.1 26.8 111.9 100.0 1 Average Federal Tax Change ($) -156 -268 -252 -248 -265 -256 -230 -262 932 17,476 138,298 482 Average Federal Tax Rate5 Change (% Points) -2.6 -1.6 -0.9 -0.6 -0.5 -0.4 -0.2 -0.2 0.3 2.3 4.2 0.5 Under the Proposal 3.4 2.8 6.9 11.4 14.4 17.2 19.1 21.6 24.7 27.4 32.0 21.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4. Number of AMT Taxpayers (millions). Baseline: 6.6 Proposal: 5.4 (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 25.1 31.4 34.9 40.4 40.1 36.5 32.3 23.5 12.5 2.6 1.1 31.2 0.0 0.8 1.0 1.3 0.5 0.3 0.1 0.2 26.8 84.8 91.2 2.7 Percent Change in After-Tax Income 4 2.8 1.7 1.0 0.7 0.6 0.5 0.3 0.2 -0.4 -3.0 -5.8 -0.7 Share of Total Federal Tax Change -3.1 -8.2 -7.0 -5.3 -4.3 -7.4 -4.3 -8.0 9.1 26.8 111.9 100.0 Average Federal Tax Change Dollars -156 -268 -252 -248 -265 -256 -230 -262 932 17,476 138,298 482 Percent -43.6 -35.8 -11.5 -5.2 -3.5 -2.1 -1.2 -0.8 1.2 9.1 15.2 2.6 1 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.2 -0.2 -0.2 -0.4 -0.3 -0.9 -0.3 0.5 2.4 0.0 Under the Proposal 0.1 0.4 1.4 2.5 3.0 8.8 8.9 25.9 19.4 8.2 21.5 100.0 Average Federal Tax Rate 5 Change (% Points) -2.6 -1.6 -0.9 -0.6 -0.5 -0.4 -0.2 -0.2 0.3 2.3 4.2 0.5 Under the Proposal 3.4 2.8 6.9 11.4 14.4 17.2 19.1 21.6 24.7 27.4 32.0 21.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,215 24,797 22,579 17,421 13,134 23,358 15,172 24,845 7,879 1,244 656 168,027 Percent of Total 9.7 14.8 13.4 10.4 7.8 13.9 9.0 14.8 4.7 0.7 0.4 100.0 Average Income (Dollars) 5,908 16,936 28,073 39,342 50,658 69,602 98,034 154,274 318,727 768,616 3,278,481 89,404 Average Federal Tax Burden (Dollars) 357 747 2,198 4,742 7,567 12,242 18,959 33,511 77,629 193,001 911,059 18,538 Average AfterTax Income 4 (Dollars) 5,551 16,189 25,875 34,600 43,091 57,361 79,074 120,762 241,098 575,615 2,367,423 70,866 Average Federal Tax Rate 5 6.0 4.4 7.8 12.1 14.9 17.6 19.3 21.7 24.4 25.1 27.8 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 2.8 4.2 4.6 4.4 10.8 9.9 25.5 16.7 6.4 14.3 100.0 0.8 3.4 4.9 5.1 4.8 11.3 10.1 25.2 16.0 6.0 13.0 100.0 0.2 0.6 1.6 2.7 3.2 9.2 9.2 26.7 19.6 7.7 19.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 6.6 Proposal: 5.4 (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 19.3 19.2 24.2 32.1 24.2 17.1 14.5 7.1 6.5 3.1 0.1 20.4 0.0 1.1 0.7 0.2 0.1 0.0 0.1 0.0 43.4 80.4 88.5 1.3 Percent Change in After-Tax Income 4 2.1 0.8 0.5 0.5 0.3 0.3 0.2 0.1 -0.6 -2.9 -5.8 -0.2 Share of Total Federal Tax Change -20.3 -28.7 -25.7 -19.7 -12.9 -22.4 -10.6 -5.4 24.9 42.4 178.8 100.0 Average Federal Tax Change Dollars -113 -119 -130 -149 -138 -150 -147 -78 1,545 16,173 128,011 86 Percent -21.7 -9.2 -4.3 -2.5 -1.5 -1.0 -0.7 -0.2 2.0 8.2 13.2 0.8 1 Share of Federal Taxes Change (% Points) -0.2 -0.3 -0.3 -0.2 -0.2 -0.3 -0.2 -0.2 0.1 0.3 1.4 0.0 Under the Proposal 0.6 2.3 4.7 6.3 7.0 18.0 13.2 20.2 10.6 4.6 12.5 100.0 Average Federal Tax Rate 5 Change (% Points) -1.9 -0.7 -0.5 -0.4 -0.3 -0.2 -0.2 -0.1 0.5 2.1 4.0 0.2 Under the Proposal 6.9 7.0 10.4 14.9 18.1 21.4 23.3 24.2 25.2 28.3 34.5 20.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,695 15,726 12,959 8,637 6,106 9,784 4,704 4,486 1,049 171 91 75,772 15.4 20.8 17.1 11.4 8.1 12.9 6.2 5.9 1.4 0.2 0.1 100.0 Average Income (Dollars) 5,914 16,831 27,940 39,191 50,583 68,911 96,752 149,576 321,073 754,752 3,190,369 51,323 Average Federal Tax Burden (Dollars) 522 1,293 3,032 5,983 9,303 14,903 22,648 36,244 79,447 197,396 973,531 10,504 Average AfterTax Income 4 (Dollars) 5,392 15,537 24,908 33,207 41,280 54,008 74,104 113,332 241,626 557,357 2,216,839 40,819 Average Federal Tax Rate 5 8.8 7.7 10.9 15.3 18.4 21.6 23.4 24.2 24.7 26.2 30.5 20.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.8 6.8 9.3 8.7 7.9 17.3 11.7 17.3 8.7 3.3 7.5 100.0 2.0 7.9 10.4 9.3 8.2 17.1 11.3 16.4 8.2 3.1 6.5 100.0 0.8 2.6 4.9 6.5 7.1 18.3 13.4 20.4 10.5 4.2 11.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 19.8 37.6 44.6 44.8 49.1 53.3 42.3 28.1 13.6 2.6 1.3 35.3 0.0 0.0 0.4 3.3 1.6 0.7 0.1 0.0 23.4 85.2 91.4 5.1 Percent Change in After-Tax Income 4 2.5 1.9 1.4 1.0 0.8 0.5 0.3 0.3 -0.3 -3.1 -5.8 -1.1 Share of Total Federal Tax Change -0.3 -1.3 -2.2 -1.9 -1.8 -3.5 -2.5 -7.4 6.6 22.6 91.8 100.0 Average Federal Tax Change Dollars -114 -316 -383 -354 -382 -315 -240 -317 805 17,691 137,358 1,288 Percent -37.5 -55.9 -28.4 -11.9 -7.7 -3.4 -1.5 -1.0 1.0 9.2 15.5 3.9 1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.3 -0.4 -1.4 -0.7 0.5 2.6 0.0 Under the Proposal 0.0 0.0 0.2 0.5 0.8 3.7 6.4 28.5 23.9 10.1 25.7 100.0 Average Federal Tax Rate 5 Change (% Points) -2.3 -1.8 -1.4 -0.9 -0.8 -0.5 -0.2 -0.2 0.3 2.3 4.2 0.8 Under the Proposal 3.9 1.4 3.4 6.6 9.0 12.8 16.5 20.8 24.5 27.3 31.6 22.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,095 3,373 4,561 4,231 3,895 8,857 8,368 18,811 6,581 1,028 539 62,623 3.4 5.4 7.3 6.8 6.2 14.1 13.4 30.0 10.5 1.6 0.9 100.0 Average Income (Dollars) 4,940 17,442 28,314 39,539 50,793 70,578 98,940 156,176 318,135 771,528 3,241,902 152,719 Average Federal Tax Burden (Dollars) 304 564 1,346 2,974 4,970 9,365 16,609 32,861 77,273 192,775 885,351 33,013 Average AfterTax Income 4 (Dollars) 4,636 16,878 26,968 36,565 45,823 61,214 82,331 123,316 240,862 578,753 2,356,551 119,706 Average Federal Tax Rate 5 6.2 3.2 4.8 7.5 9.8 13.3 16.8 21.0 24.3 25.0 27.3 21.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.6 1.4 1.8 2.1 6.5 8.7 30.7 21.9 8.3 18.3 100.0 0.1 0.8 1.6 2.1 2.4 7.2 9.2 30.9 21.2 7.9 17.0 100.0 0.0 0.1 0.3 0.6 0.9 4.0 6.7 29.9 24.6 9.6 23.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 60.1 63.4 54.6 53.6 64.4 49.4 36.6 16.4 9.0 2.3 0.2 53.4 0.2 0.3 2.6 1.7 0.2 0.0 0.0 0.0 34.6 92.6 96.6 1.2 Percent Change in After-Tax Income 4 5.8 3.8 1.7 1.0 0.9 0.7 0.6 0.1 -0.4 -2.7 -6.0 0.9 Share of Total Federal Tax Change 9.9 38.0 23.2 15.8 11.8 17.3 7.9 2.2 -1.7 -5.3 -19.3 100.0 Average Federal Tax Change Dollars -416 -674 -469 -356 -405 -401 -425 -160 863 15,670 135,750 -355 Percent 92.3 85.6 -80.7 -9.4 -5.7 -3.4 -2.2 -0.5 1.1 9.0 15.2 -5.0 1 Share of Federal Taxes Change (% Points) -0.6 -2.1 -1.1 -0.4 -0.1 0.4 0.5 1.1 0.5 0.4 1.3 0.0 Under the Proposal -1.1 -4.3 0.3 8.0 10.2 25.7 18.6 23.3 8.2 3.4 7.7 100.0 Average Federal Tax Rate 5 Change (% Points) -6.2 -4.0 -1.7 -0.9 -0.8 -0.6 -0.4 -0.1 0.3 2.1 4.3 -0.7 Under the Proposal -12.8 -8.6 0.4 8.8 13.2 16.5 19.7 22.7 24.5 25.3 32.7 13.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,304 5,449 4,772 4,273 2,807 4,174 1,797 1,307 193 33 14 27,175 8.5 20.1 17.6 15.7 10.3 15.4 6.6 4.8 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,774 16,933 28,154 39,404 50,563 69,037 97,064 144,888 321,478 753,921 3,150,113 49,021 Average Federal Tax Burden (Dollars) -451 -788 581 3,803 7,092 11,777 19,532 33,070 77,757 174,978 895,707 7,144 Average AfterTax Income 4 (Dollars) 7,225 17,720 27,573 35,602 43,470 57,261 77,532 111,817 243,721 578,943 2,254,406 41,877 Average Federal Tax Rate 5 -6.7 -4.7 2.1 9.7 14.0 17.1 20.1 22.8 24.2 23.2 28.4 14.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.2 6.9 10.1 12.6 10.7 21.6 13.1 14.2 4.7 1.8 3.2 100.0 1.5 8.5 11.6 13.4 10.7 21.0 12.2 12.8 4.1 1.7 2.7 100.0 -0.5 -2.2 1.4 8.4 10.3 25.3 18.1 22.3 7.7 2.9 6.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 63.6 77.7 68.9 68.1 73.6 63.0 52.2 36.7 15.6 2.1 1.0 55.4 0.2 0.2 1.6 1.3 0.3 0.1 0.0 0.1 23.4 92.9 96.9 3.5 Percent Change in After-Tax Income 4 6.2 4.6 2.3 1.5 1.3 0.8 0.5 0.4 -0.3 -3.6 -6.5 -0.6 Share of Total Federal Tax Change -4.6 -18.1 -14.4 -10.6 -8.7 -13.7 -8.7 -20.1 11.3 41.7 146.0 100.0 Average Federal Tax Change Dollars -447 -859 -658 -538 -571 -471 -396 -472 796 20,239 150,182 502 Percent 64.0 56.8 989.8 -16.7 -8.7 -4.3 -2.2 -1.4 1.0 9.9 16.1 2.1 1 Share of Federal Taxes Change (% Points) -0.1 -0.4 -0.3 -0.3 -0.2 -0.4 -0.4 -1.0 -0.3 0.7 2.6 0.0 Under the Proposal -0.3 -1.0 -0.3 1.1 1.9 6.4 7.9 29.1 23.7 9.6 21.8 100.0 Average Federal Tax Rate 5 Change (% Points) -6.9 -5.0 -2.3 -1.4 -1.1 -0.7 -0.4 -0.3 0.3 2.6 4.6 0.4 Under the Proposal -17.7 -13.9 -2.6 6.8 11.8 15.1 17.7 21.3 25.4 29.3 33.5 21.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,635 5,388 5,564 5,003 3,876 7,421 5,569 10,848 3,616 526 248 50,838 5.2 10.6 11.0 9.8 7.6 14.6 11.0 21.3 7.1 1.0 0.5 100.0 Average Income (Dollars) 6,478 17,070 28,138 39,431 50,726 70,003 98,591 155,168 316,702 767,436 3,235,110 113,062 Average Federal Tax Burden (Dollars) -699 -1,514 -66 3,219 6,541 11,032 17,846 33,439 79,631 204,812 932,000 23,668 Average AfterTax Income 4 (Dollars) 7,177 18,583 28,204 36,212 44,185 58,971 80,745 121,729 237,071 562,624 2,303,109 89,393 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -10.8 -8.9 -0.2 8.2 12.9 15.8 18.1 21.6 25.1 26.7 28.8 20.9 0.3 1.6 2.7 3.4 3.4 9.0 9.6 29.3 19.9 7.0 14.0 100.0 0.4 2.2 3.5 4.0 3.8 9.6 9.9 29.1 18.9 6.5 12.6 100.0 -0.2 -0.7 0.0 1.3 2.1 6.8 8.3 30.2 23.9 9.0 19.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0042 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2017 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 4.0 3.8 5.5 8.0 7.7 9.9 12.5 7.7 8.7 2.4 1.0 7.0 0.0 0.0 0.0 0.3 0.3 0.3 0.0 0.2 29.2 75.3 90.2 2.4 Percent Change in After-Tax Income 4 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.0 -0.4 -2.2 -5.2 -1.0 Share of Total Federal Tax Change -0.1 -0.4 -0.5 -0.4 -0.3 -0.6 -0.6 -0.8 5.8 14.1 83.6 100.0 Average Federal Tax Change Dollars -13 -15 -18 -25 -29 -38 -53 -47 1,041 13,006 126,071 734 Percent -6.3 -4.1 -2.1 -1.3 -1.0 -0.6 -0.4 -0.2 1.5 7.2 13.7 5.2 1 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 -0.1 -0.1 -0.3 -0.4 -1.1 -0.7 0.2 2.6 0.0 Under the Proposal 0.1 0.4 1.1 1.5 1.3 4.8 6.8 20.4 19.2 10.3 34.1 100.0 Average Federal Tax Rate 5 Change (% Points) -0.2 -0.1 -0.1 -0.1 -0.1 -0.1 -0.1 0.0 0.3 1.7 3.8 0.8 Under the Proposal 3.0 2.0 3.1 4.9 5.5 8.7 12.9 16.8 21.4 24.8 31.5 17.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,117 6,783 6,705 4,064 2,488 4,128 2,835 4,144 1,447 281 171 35,193 6.0 19.3 19.1 11.6 7.1 11.7 8.1 11.8 4.1 0.8 0.5 100.0 Average Income (Dollars) 6,279 17,295 27,823 39,113 50,430 70,261 98,110 154,364 326,836 775,689 3,329,917 87,173 Average Federal Tax Burden (Dollars) 201 357 877 1,921 2,804 6,172 12,746 25,916 68,777 179,595 923,643 14,239 Average AfterTax Income 4 (Dollars) 6,078 16,938 26,946 37,192 47,626 64,089 85,364 128,448 258,059 596,095 2,406,274 72,935 Average Federal Tax Rate 5 3.2 2.1 3.2 4.9 5.6 8.8 13.0 16.8 21.0 23.2 27.7 16.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.4 3.8 6.1 5.2 4.1 9.5 9.1 20.9 15.4 7.1 18.6 100.0 0.5 4.5 7.0 5.9 4.6 10.3 9.4 20.7 14.6 6.5 16.1 100.0 0.1 0.5 1.2 1.6 1.4 5.1 7.2 21.4 19.9 10.1 31.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.