8-Feb-10 PRELIMINARY RESULTS

advertisement

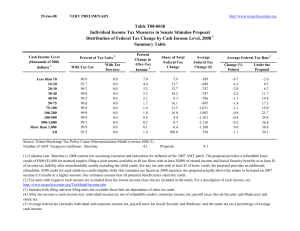

8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 25.9 55.5 70.3 84.4 90.1 95.3 98.9 99.3 98.5 73.1 50.3 78.3 With Tax Increase 0.0 0.9 0.5 0.7 0.3 0.1 0.1 0.1 1.1 26.2 49.3 0.8 Percent Change in After-Tax Income 4 2.9 2.5 2.9 3.0 3.0 3.0 3.8 4.4 4.0 1.1 0.0 3.1 Share of Total Federal Tax Change Average Federal Tax Change ($) 0.7 2.8 4.7 5.0 4.7 11.2 12.3 35.8 20.7 2.1 -0.1 100.0 -161 -398 -735 -1,009 -1,264 -1,703 -2,878 -5,097 -9,320 -6,089 686 -2,108 Average Federal Tax Rate5 Change (% Points) -2.7 -2.4 -2.6 -2.6 -2.5 -2.5 -2.9 -3.3 -2.9 -0.8 0.0 -2.4 Under the Proposal 3.4 2.8 6.9 11.4 14.4 17.2 19.1 21.6 24.7 27.4 32.0 21.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4. Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 5.4 (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phaseout threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 25.9 55.5 70.3 84.4 90.1 95.3 98.9 99.3 98.5 73.1 50.3 78.3 0.0 0.9 0.5 0.7 0.3 0.1 0.1 0.1 1.1 26.2 49.3 0.8 Percent Change in After-Tax Income 4 2.9 2.5 2.9 3.0 3.0 3.0 3.8 4.4 4.0 1.1 0.0 3.1 Share of Total Federal Tax Change 0.7 2.8 4.7 5.0 4.7 11.2 12.3 35.8 20.7 2.1 -0.1 100.0 Average Federal Tax Change Dollars Percent -161 -398 -735 -1,009 -1,264 -1,703 -2,878 -5,097 -9,320 -6,089 686 -2,108 -44.5 -45.4 -27.4 -18.3 -14.8 -12.4 -13.3 -13.3 -10.6 -2.8 0.1 -10.0 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.3 -0.3 -0.2 -0.3 -0.3 -1.0 -0.1 0.6 2.2 0.0 Under the Proposal 0.1 0.4 1.4 2.5 3.0 8.8 8.9 25.9 19.4 8.2 21.5 100.0 Average Federal Tax Rate5 Change (% Points) -2.7 -2.4 -2.6 -2.6 -2.5 -2.5 -2.9 -3.3 -2.9 -0.8 0.0 -2.4 Under the Proposal 3.4 2.8 6.9 11.4 14.4 17.2 19.1 21.6 24.7 27.4 32.0 21.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,215 24,797 22,579 17,421 13,134 23,358 15,172 24,845 7,879 1,244 656 168,027 Percent of Total 9.7 14.8 13.4 10.4 7.8 13.9 9.0 14.8 4.7 0.7 0.4 100.0 Average Income (Dollars) 5,908 16,936 28,073 39,342 50,658 69,602 98,034 154,274 318,727 768,616 3,278,481 89,404 Average Federal Tax Burden (Dollars) 363 878 2,680 5,502 8,566 13,689 21,608 38,347 87,880 216,566 1,048,670 21,128 Average AfterTax Income 4 (Dollars) 5,546 16,058 25,393 33,839 42,092 55,914 76,426 115,927 230,847 552,050 2,229,811 68,276 Average Federal Tax Rate 5 6.1 5.2 9.6 14.0 16.9 19.7 22.0 24.9 27.6 28.2 32.0 23.6 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.6 2.8 4.2 4.6 4.4 10.8 9.9 25.5 16.7 6.4 14.3 100.0 0.8 3.5 5.0 5.1 4.8 11.4 10.1 25.1 15.9 6.0 12.7 100.0 0.2 0.6 1.7 2.7 3.2 9.0 9.2 26.8 19.5 7.6 19.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 31.2 Proposal: 5.4 (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 20.0 52.4 63.7 84.0 95.3 98.4 98.9 98.9 96.1 75.2 50.0 68.4 0.0 1.2 0.3 0.2 0.1 0.1 0.0 0.0 3.3 24.2 49.3 0.5 Percent Change in After-Tax Income 4 2.1 1.6 1.8 1.8 2.1 2.4 3.6 4.1 4.8 2.8 0.2 2.7 Share of Total Federal Tax Change 1.7 4.7 7.0 6.5 6.5 15.4 15.3 25.0 14.3 3.2 0.5 100.0 Average Federal Tax Change Dollars Percent -114 -241 -431 -602 -853 -1,266 -2,606 -4,475 -10,968 -14,926 -4,571 -1,061 -21.8 -17.0 -12.9 -9.4 -8.5 -7.9 -10.4 -11.0 -11.9 -6.5 -0.4 -9.1 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.2 0.0 0.1 0.2 -0.2 -0.4 -0.3 0.1 1.1 0.0 Under the Proposal 0.6 2.3 4.7 6.3 7.0 18.0 13.2 20.2 10.6 4.6 12.5 100.0 Average Federal Tax Rate5 Change (% Points) -1.9 -1.4 -1.5 -1.5 -1.7 -1.8 -2.7 -3.0 -3.4 -2.0 -0.1 -2.1 Under the Proposal 6.9 7.0 10.4 14.9 18.1 21.4 23.3 24.2 25.2 28.3 34.5 20.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,695 15,726 12,959 8,637 6,106 9,784 4,704 4,486 1,049 171 91 75,772 15.4 20.8 17.1 11.4 8.1 12.9 6.2 5.9 1.4 0.2 0.1 100.0 Average Income (Dollars) 5,914 16,831 27,940 39,191 50,583 68,911 96,752 149,576 321,073 754,752 3,190,369 51,323 Average Federal Tax Burden (Dollars) 523 1,415 3,333 6,436 10,018 16,020 25,107 40,640 91,961 228,495 1,106,113 11,651 Average AfterTax Income 4 (Dollars) 5,391 15,415 24,607 32,755 40,565 52,891 71,645 108,935 229,112 526,257 2,084,256 39,672 Average Federal Tax Rate 5 8.8 8.4 11.9 16.4 19.8 23.3 26.0 27.2 28.6 30.3 34.7 22.7 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.8 6.8 9.3 8.7 7.9 17.3 11.7 17.3 8.7 3.3 7.5 100.0 2.1 8.1 10.6 9.4 8.2 17.2 11.2 16.3 8.0 3.0 6.3 100.0 0.7 2.5 4.9 6.3 6.9 17.8 13.4 20.7 10.9 4.4 11.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 21.1 43.4 68.3 72.9 76.3 90.3 98.8 99.5 99.1 73.1 50.8 85.8 0.0 0.1 0.6 2.6 0.7 0.2 0.1 0.1 0.6 26.1 48.9 1.2 Percent Change in After-Tax Income 4 3.1 2.7 3.9 3.7 3.3 3.0 3.7 4.5 4.0 0.9 0.0 3.1 Share of Total Federal Tax Change 0.1 0.7 2.1 2.5 2.6 7.2 11.1 44.8 26.9 2.2 -0.2 100.0 Average Federal Tax Change Dollars Percent -142 -445 -1,031 -1,333 -1,487 -1,817 -2,971 -5,338 -9,185 -4,779 856 -3,583 -42.8 -64.2 -51.7 -33.7 -24.5 -16.7 -15.4 -14.1 -10.5 -2.2 0.1 -9.5 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.2 -0.2 -0.3 -0.4 -1.5 -0.3 0.8 2.5 0.0 Under the Proposal 0.0 0.0 0.2 0.5 0.8 3.7 6.4 28.5 23.9 10.1 25.7 100.0 Average Federal Tax Rate5 Change (% Points) -2.9 -2.6 -3.6 -3.4 -2.9 -2.6 -3.0 -3.4 -2.9 -0.6 0.0 -2.4 Under the Proposal 3.9 1.4 3.4 6.6 9.0 12.8 16.5 20.8 24.5 27.3 31.6 22.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,095 3,373 4,561 4,231 3,895 8,857 8,368 18,811 6,581 1,028 539 62,623 3.4 5.4 7.3 6.8 6.2 14.1 13.4 30.0 10.5 1.6 0.9 100.0 Average Income (Dollars) 4,940 17,442 28,314 39,539 50,793 70,578 98,940 156,176 318,135 771,528 3,241,902 152,719 Average Federal Tax Burden (Dollars) 332 694 1,995 3,952 6,075 10,866 19,340 37,881 87,262 215,245 1,021,854 37,884 Average AfterTax Income 4 (Dollars) 4,608 16,749 26,319 35,587 44,718 59,712 79,600 118,295 230,873 556,283 2,220,048 114,835 Average Federal Tax Rate 5 6.7 4.0 7.1 10.0 12.0 15.4 19.6 24.3 27.4 27.9 31.5 24.8 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.1 0.6 1.4 1.8 2.1 6.5 8.7 30.7 21.9 8.3 18.3 100.0 0.1 0.8 1.7 2.1 2.4 7.4 9.3 30.9 21.1 8.0 16.6 100.0 0.0 0.1 0.4 0.7 1.0 4.1 6.8 30.0 24.2 9.3 23.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 60.3 70.4 88.8 95.8 97.0 98.4 99.7 98.7 94.3 71.4 41.5 87.2 0.2 0.3 1.1 0.1 0.2 0.0 0.0 0.0 5.3 28.4 58.3 0.4 Percent Change in After-Tax Income 4 5.9 4.7 4.8 4.4 4.4 4.3 4.2 3.6 2.6 0.6 -0.3 4.1 Share of Total Federal Tax Change 2.2 9.9 13.5 14.4 11.4 22.2 12.4 11.3 2.7 0.3 -0.2 100.0 Average Federal Tax Change Dollars Percent -424 -821 -1,274 -1,521 -1,834 -2,401 -3,119 -3,916 -6,206 -3,552 5,638 -1,663 95.5 128.3 -91.9 -30.6 -21.5 -17.4 -14.0 -10.6 -7.3 -1.8 0.6 -19.7 Share of Federal Taxes Change (% Points) -0.6 -2.8 -2.6 -1.3 -0.2 0.7 1.2 2.4 1.1 0.6 1.5 0.0 Under the Proposal -1.1 -4.3 0.3 8.0 10.2 25.7 18.6 23.3 8.2 3.4 7.7 100.0 Average Federal Tax Rate5 Change (% Points) -6.3 -4.9 -4.5 -3.9 -3.6 -3.5 -3.2 -2.7 -1.9 -0.5 0.2 -3.4 Under the Proposal -12.8 -8.6 0.4 8.8 13.2 16.5 19.7 22.7 24.5 25.3 32.7 13.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,304 5,449 4,772 4,273 2,807 4,174 1,797 1,307 193 33 14 27,175 8.5 20.1 17.6 15.7 10.3 15.4 6.6 4.8 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,774 16,933 28,154 39,404 50,563 69,037 97,064 144,888 321,478 753,921 3,150,113 49,021 Average Federal Tax Burden (Dollars) -444 -640 1,386 4,967 8,521 13,776 22,226 36,826 84,827 194,200 1,025,820 8,451 Average AfterTax Income 4 (Dollars) 7,218 17,573 26,768 34,437 42,042 55,261 74,837 108,062 236,651 559,721 2,124,293 40,570 Average Federal Tax Rate 5 -6.6 -3.8 4.9 12.6 16.9 20.0 22.9 25.4 26.4 25.8 32.6 17.2 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 1.2 6.9 10.1 12.6 10.7 21.6 13.1 14.2 4.7 1.8 3.2 100.0 1.5 8.7 11.6 13.4 10.7 20.9 12.2 12.8 4.1 1.7 2.6 100.0 -0.5 -1.5 2.9 9.2 10.4 25.0 17.4 21.0 7.1 2.8 6.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of it (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 63.8 82.4 94.4 98.2 98.8 99.3 99.8 99.9 99.0 68.0 41.5 94.4 0.2 0.2 0.4 0.1 0.1 0.0 0.0 0.0 0.8 31.9 58.3 0.8 Percent Change in After-Tax Income 4 6.6 5.8 6.4 5.8 5.4 4.8 5.0 5.2 4.0 0.6 -0.4 4.1 Share of Total Federal Tax Change 0.7 3.3 5.5 5.7 5.1 11.4 12.1 37.4 18.9 0.9 -1.1 100.0 Average Federal Tax Change Dollars Percent -470 -1,063 -1,728 -1,998 -2,289 -2,706 -3,832 -6,064 -9,182 -3,010 7,600 -3,457 69.6 81.2 -172.1 -42.7 -27.7 -20.4 -18.0 -15.5 -10.3 -1.3 0.7 -12.5 Share of Federal Taxes Change (% Points) -0.1 -0.5 -0.7 -0.6 -0.4 -0.6 -0.5 -1.0 0.6 1.1 2.9 0.0 Under the Proposal -0.3 -1.0 -0.3 1.1 1.9 6.4 7.9 29.1 23.7 9.6 21.8 100.0 Average Federal Tax Rate5 Change (% Points) -7.3 -6.2 -6.1 -5.1 -4.5 -3.9 -3.9 -3.9 -2.9 -0.4 0.2 -3.1 Under the Proposal -17.7 -13.9 -2.6 6.8 11.8 15.1 17.7 21.3 25.4 29.3 33.5 21.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,635 5,388 5,564 5,003 3,876 7,421 5,569 10,848 3,616 526 248 50,838 5.2 10.6 11.0 9.8 7.6 14.6 11.0 21.3 7.1 1.0 0.5 100.0 Average Income (Dollars) 6,478 17,070 28,138 39,431 50,726 70,003 98,591 155,168 316,702 767,436 3,235,110 113,062 Average Federal Tax Burden (Dollars) -676 -1,309 1,004 4,679 8,259 13,267 21,282 39,031 89,608 228,061 1,074,582 27,626 Average AfterTax Income 4 (Dollars) 7,154 18,379 27,134 34,752 42,467 56,736 77,309 116,137 227,094 539,375 2,160,527 85,435 Average Federal Tax Rate 5 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total -10.4 -7.7 3.6 11.9 16.3 19.0 21.6 25.2 28.3 29.7 33.2 24.4 0.3 1.6 2.7 3.4 3.4 9.0 9.6 29.3 19.9 7.0 14.0 100.0 0.4 2.3 3.5 4.0 3.8 9.7 9.9 29.0 18.9 6.5 12.3 100.0 -0.1 -0.5 0.4 1.7 2.3 7.0 8.4 30.2 23.1 8.5 19.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0040 Administration's FY2011 Budget Proposals Major Individual Income Tax Provisions Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2017 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 4.2 14.5 29.2 51.0 61.5 80.0 97.1 98.3 98.1 81.7 59.7 52.6 0.0 0.1 0.1 0.4 0.2 0.1 0.0 0.1 0.8 15.7 39.9 0.5 Percent Change in After-Tax Income 4 0.3 0.5 0.6 1.2 2.0 2.1 4.0 4.4 5.3 2.5 0.6 2.7 Share of Total Federal Tax Change 0.1 0.8 1.7 2.6 3.4 8.0 13.8 33.2 27.4 6.0 3.1 100.0 Average Federal Tax Change Dollars Percent -16 -84 -167 -426 -919 -1,319 -3,302 -5,435 -12,842 -14,395 -12,398 -1,929 -7.7 -19.7 -16.3 -18.4 -24.9 -17.7 -20.7 -17.4 -15.5 -7.0 -1.2 -11.4 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.2 -0.4 -0.8 -1.5 -0.9 0.5 3.5 0.0 Under the Proposal 0.1 0.4 1.1 1.5 1.3 4.8 6.8 20.4 19.2 10.3 34.1 100.0 Average Federal Tax Rate5 Change (% Points) -0.3 -0.5 -0.6 -1.1 -1.8 -1.9 -3.4 -3.5 -3.9 -1.9 -0.4 -2.2 Under the Proposal 3.0 2.0 3.1 4.9 5.5 8.7 12.9 16.8 21.4 24.8 31.5 17.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2017 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,117 6,783 6,705 4,064 2,488 4,128 2,835 4,144 1,447 281 171 35,193 6.0 19.3 19.1 11.6 7.1 11.7 8.1 11.8 4.1 0.8 0.5 100.0 Average Income (Dollars) 6,279 17,295 27,823 39,113 50,430 70,261 98,110 154,364 326,836 775,689 3,329,917 87,173 Average Federal Tax Burden (Dollars) 204 426 1,025 2,322 3,694 7,453 15,995 31,304 82,660 206,996 1,062,111 16,901 Average AfterTax Income 4 (Dollars) 6,075 16,869 26,798 36,791 46,736 62,808 82,114 123,059 244,176 568,693 2,267,806 70,272 Average Federal Tax Rate 5 3.3 2.5 3.7 5.9 7.3 10.6 16.3 20.3 25.3 26.7 31.9 19.4 Share of PreTax Income Share of PostTax Income Share of Federal Taxes Percent of Total Percent of Total Percent of Total 0.4 3.8 6.1 5.2 4.1 9.5 9.1 20.9 15.4 7.1 18.6 100.0 0.5 4.6 7.3 6.1 4.7 10.5 9.4 20.6 14.3 6.5 15.7 100.0 0.1 0.5 1.2 1.6 1.6 5.2 7.6 21.8 20.1 9.8 30.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples and allow it against the AMT; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend child tax credit refundability with a $3,000 refundability threshold, extend the $1,000 credit, and allow against the AMT; (f) extend the higher 35 percent child and dependent care tax credit rate, raise the phase-out threshold to $85,000, and allow against the AMT; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets and repeal the 8 percent and 18 percent rates for assets held for more than 5 years; (j) limit value of itemized deduction s to 28 percent; (k) maintain the estate tax at its 2009 parameters; (l) extend the 2001 and 2003 tax cuts for low and middle income individuals including marriage penalty relief, the 10,15, 25, 28 percent brackets, the 15 percent rate on capital gains and qualified dividends for taxpayers in those brackets. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.