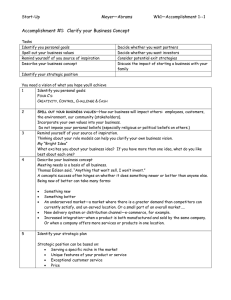

Financial Requirement Session 22-23 J0704-Business Plan

advertisement

Financial Requirement Session 22-23 J0704-Business Plan Give them the reasons to invest in you The best we can do is size up the chances, calculate the risk involved, estimated our ability to deal with them, and then make our plans with confidence – Henry Ford II J0704-Business Plan The Elements of Financial Requirement •Financial requirement summary •Start up cost •Fund raised and fund needed •Investment offering •Potential risk •Exit option J0704-Business Plan Financial Summary •Key assumption •Break even point •Expectation of overall in the first year •Expectation of growing after peak performance reached •Peak performance of: •Sales •Cost of sales •Non cost sales operating expenses •Profit J0704-Business Plan Financial Sources • Two methods of financing : – Debt – Equity J0704-Business Plan Financial requirement summary • • Write an opening summary entitled Loan Request Summary or Investment Offering Summary Loan Request Summary : – – – – – How much money do you need ? What do you plan to use it for ? How can the money improve your business? How are you going to pay it back ? If your plan for the above doesn’t work, what is your back up plan ? J0704-Business Plan Financial requirement summary • Investment Offering Summary – – Describe the equity offering and the structure for the investors’ involvement Exit option. For the investors’ possible exit, there are several options. The owner of funding partner will eventually : • • • • • Purchase the investors’ interest at certain point Replace their interest with bank loan at specified point Sell share via second round private offering or to a larger company Go public Use other exit options J0704-Business Plan Start up cost • • Describe the total start up costs, explaining major items or anything that is not easily identifiable in the schedule of start up cost. Include a schedule, or table, detailing of the items, the estimated amount of each expense, actual cost and dates paid and the balance to be paid and the dates the items will be paid J0704-Business Plan Fund Raised and Fund Needed • • • Total start-up cost Total amount raised so far, with a breakdown of individual amounts from different sources, identifying the sources in general terms Total amount needed, which should be the difference between the total start-up cost and the total amount raised, listing the anticipated source and payback J0704-Business Plan Potential Risk • • For both lenders and investors, it is better to address your business risks in the beginning, because it will make the lenders and investors more confident that you have weighed and mitigated the downside as well as the upside potential of your business The most common risk : – – Company – as a start-up, the risk of uncertainty Industry – the risk of changing trends J0704-Business Plan Potential Risk – Market & competition : • • • • – – the risk of market change The risk that market acceptance may take longer than planned The risk of competing with better, well-established competitor The risk of new competition Strategies – the risk that new strategy may not receive the expected buyer response Products or services : • • the risk that buyers do not accept the products or service The risk that competitors will make changes to their products or services J0704-Business Plan Potential Risk – Marketing & sales : • • – Management & Organization : • – The risk that the marketing plan is not effective The risk that sales do not meet the market share The risk that the management & personnel cannot meet the challenges of your business plan Operations : • • • The risk of losing supplier or distributors The risk of competitors developing new technology or production technique The risk of poor inventory control or cash flow control J0704-Business Plan Potential Risk – Financial pro forma – the risk that projections cannot match reality – Financial requirement • • the risk that the funds you seek cannot obtained The risk that the funds requested are insufficient for the venture to succeed J0704-Business Plan Exit options • • • • • A hand down – turning the company over to your heirs A buyout – selling your shares to other stockholders A sale – selling your business to individuals An acquisition – selling your business to another existing company An IPO (initial public offering) – selling shares in the company to the public J0704-Business Plan