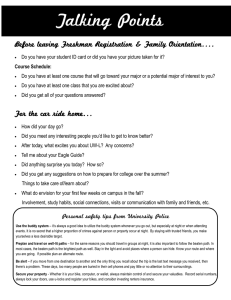

UNIT 2 + -

advertisement

UNIT 2

RECORDING

=

ASSETS

DR. CR.

+

'

TRANSACTIONS

-

DR.

OWNER'SEOUITY

DR.

CR.

+

LIABILITIES

-

.

I

.

WITHDRAWAT ,R

+

DR.

I.

+

I

-

I

CR.

EXPENSES

REVENUE

+

DR.

+

DR.

CR.

I

CR.

I

JOURNALENTRIES

In the preceding learning unit, transactions were recorded in T accounts because students find it easier to analyze transactions with T accounts. This learning unit makes the transition from T accounts to Journal Entries, the first step of

the accounting process.

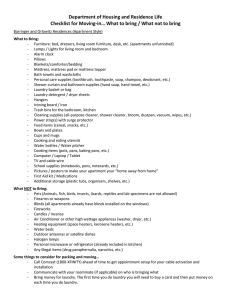

JOURNALIZING TRANSACTIONS

DR.

CR.

ANALYZING TRANSACI'IONS

Assets

+

Liabilities

Account Debited

Account Credited

Owner IS Equity

1. Darin Jones, a sophomore at State University, started the

Quick Clean Laundry Service with a $100 cash investment.

Cash

Capital. Darin Jones

100

I

100

I

2. On Sept. 1, paid $50 for 5 months of ads in the school newspaper.

Pr~id

Advertising

50

Cash

Capital,Darin Jones

XXX

XXX

100

100

Prepaid Advertising

Cash

50

Laundry Supplies

25

LaundryEquipment

Cash

48

50

I

~

50

I

3. On Sept. 1, purchased Laundry Supplies for $25 cash.

Laundry S~plies

25

25

Cash

I

Cash

25

I

4. On Sept. 1, purchased

Laundry Eq\l:i.pment

48

$48 of Laundry Equipment

Accounts Payable

I

paying

down.

$8

40

I

Cash

8

40

Accounts Payable

8

I

5. Darin made an additional investment

of $50.

Capital.

Cash

Capital,Darin Jones

50

6. Paid one-fourth the amount owed on the Laundry Equipment.

Cash

Accounts Payable

Accounts Payable

10

10

10

7. Darin withdrew$20 for personaluse.

Cash

Withdrawals.Darin Jones

20

20

Withdrawals,Darin Jones 20

Cash

~

50

Darin

I

Jones

50

[

I

50

10

Cash

I

I

20

I

8. Cash collected for Laundry Services performed during the month

amounted to $140. $10 was also due for services rendered.

~

140

Laundry Revenue

I

I

150

Cash

Accounts Receivable

Laundry Revenue

140

10

150

Accounts

Receivable

10

I

9. Paid $75 for the use of washers and dryers for September.

Cash

Washer/DJ:yer~e

75

I

10. Received

75

75

75

I

$5 on account.

Cash

AccountsReceivable

Cash

5

Washer/Dryer Expense

Cash

I

5

5

Accounts Receivable

I

5

11. On Sept. 26, two students paid $10 for next week I s Laundry Service.

Cash

20

Unearned LaundryRevenue

I

12. Paid monthly phone bill of $10.

Cash

10

I

I

20

Telephone~se

10

I

8

Cash

UnearnedLaundry

Revenue

20

Telephone Expense

10

Cash

20

10

II.

(1)

(5)

(8)

(10)

(11)

-

100

50

140

5

-2Q

315

Bal.

117

Accounts

(8)

10

Accounts

(6) 10

50

25

8

10

20

75

JQ

198

(2)

(3)

(4)

(6)

(7)

(9)

(12)

Receivable

I (10)

GENERAL LEDGER

Payable

(4)

40

I

Capital.

1

Unearned

Darin

(1)

(5)

LaunCb:y Revenues

I (11) 20

Withdrawals,

Darin

Jones

(7) 201

5

Washer Dryer

~se

(9) 7S1

Pre~aid

Advertising

I

(2)

50

LaunCb:y

(3)

25

Sup.plies

LaunCb:y

(4)

48

E~ipment

Jones

100

50

!

Laundry

Revenue

1(8)

150

Tele~hone ~nse

(12) 10 I

!

III.

TRIAL

Quick

BALANCE

Clean Laundry

Service

Trial

Balance

September

30, 1991

Cash

Accounts Receivable

Prepaid Advertising

Laundry Supplies

Laundry Equipment

Accounts Payable

Unearned Laundry Revenue

Capital,

Darin Jones

Withdrawals,

Darin Jones

Laundry Revenue

Washer/Dryer

Expense

Telephone Expense

$117

5

50

2S

48

$ 30

20

150

20

150

7S

-ll.

$350

$350

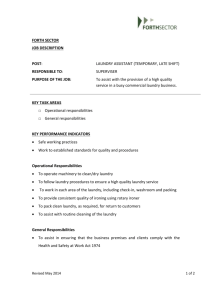

Note: Transaction

No.1 has been formally

journalized

and posted below.

PR stands for Post Reference.

The relevant

account number or General

Journal page number is placed in the PR column at the time of posting.

IV.

DATE

ACCOUNTTITLE

GENERAL JOURNAL

AND EXPLANATION

PR

Page

DEBIT

Sept.

1

Cash

1

Capital,

To record

Darin

cash

Sept.

Sept.

00

100

00

investment.

GENERAL LEDGER

CASH

PR

EXPLANATION

1

DATE

100

100

Jones

v.

DATE

CREDIT

II

I

1

I

ACCOUNT

NO.1

DEBIT

II

100

l");l\.RTN r(')N'R

PR

DEBIT

EXPLANATION

1

1

9

BALANCE

CREDIT

I

00

100

NO lO(

BALANCE

CREDIT

100

00

00

100

00