Artist Space Development: Financing Chris Walker, Urban Institute, 2007

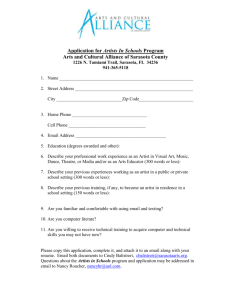

advertisement