February 2016 For Financial Intermediary, Institutional and Consultant use only.

February 2016 For Financial Intermediary, Institutional and Consultant use only.

Not for redistribution under any circumstances.

Schroders

Responsible Investment Report

Global and International Equities

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

At Schroders

Responsible principles drive our investment decisions and the way we manage funds. From choosing the right assets to engaging with our investments, positive principles guide our actions.

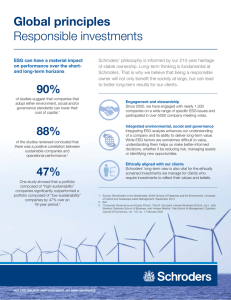

Our responsible approach isn’t merely a recent attempt to follow market trends, nor is it separate from our mainstream investment processes. While Schroders has always considered the impact of responsible investment issues, over the past 15 years we have formalized how we responsibly engage and manage our investments. Schroders has been a member of the Principles of

Responsible Investment (PRI) since 2007. We see ourselves as long-term stewards of our clients’ capital and this means looking beyond the numbers.

Our approach involves engaging with companies about their activities and helping them manage risks to drive better performance. Our investment experience and academic research show that companies with good environmental, social and governance (ESG) management often perform better and can deliver superior returns over time, both for investors and society. We firmly believe that companies with sustainable business models will be better investments over time. The following pages outline our approach to managing clients’ assets responsibly in Global and

International Equities.

2

Alex Tedder

Head of Global Equities

“Active management relies on a thorough assessment of opportunities and risks, as well as the responsibility to be an active owner in the companies we invest with.”

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

ESG solutions

3

1. Schroders Global and International Equities

Three layers of ESG integration

2. Segregrated accounts with client specific ethical restrictions

Ethical screening

3. Stewardship

Screening, engagement and monitoring outcomes

4. Our committment to ESG and socially responsible investment

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

1. Schroders Global and

International Equities

ESG Integration

Embedded within every stage of our investment process

Detailed and insightful research is the foundation for idea generation, stock selection and portfolio construction at Schroders. This is exemplified by the approach adopted by Schroders’ Global and International Equity team where fundamental, bottom up research drives the composition of portfolios and investment outcomes.

The Team’s philosophy is anchored around unanticipated growth and is based on the principle that companies delivering earnings above the level anticipated by consensus outperform the broader market. Through a process of fundamental stock research and analysis, combined with a detailed assessment of the fundamental risks of owning each stock, we seek to identify those companies which will deliver positive earnings surprise

(we term this ‘a positive growth gap’). We believe such stocks will outperform as their higher growth characteristics are recognised by the market.

Our analysis is forward-looking, with a significant proportion of our appraisal based on a 3-5 year time-horizon.

Risk to the sustainability of longer-term growth is therefore a key consideration when determining the trajectory of longer term growth, and it is in this context that the evaluation of non-financial risks, including ESG factors, are central to our expectations.

We also believe that ESG has a fundamental bearing on as assessment of quality, another characteristic that is prominent within companies in which we look to invest in. Academic studies consistently support the premise that strong ESG policies result in a lower cost of capital, which not only reduces risk but also has the potential to contribute to enhanced returns.

This document outlines Schroders’ Global and International Equity team’s investment approach which is consistently applied across the assets managed by the team.

Investment process

Step 1:

Filter universe

Local research coverage of

2,000 stocks

Step 2: Research -local expertise/global perspective

Step 3:

Stock selection

Step 4: Portfolio construction

Quant screens confirm/challenge our views and risk control

Global sector overlay

Local research grades

1 and 2

Best ideas

Portfolio

1,600 Stocks

– Schroders’ regional equity analysts maintain company models using proprietary valuation framework

– Assessment of ESG risks are integrated within this analysis and analyst rating

– Stocks graded 1-4 based on local opportunity set

Source: Schroders

500 Stocks 130–150 Stocks

– Schroders’ Global & International

Equity team and Global Sector

Specialists (GSS) engnage with regional analysts to evaluate stock recommendations

– Financial and ESG analysis is re-framed in the context of a global opportunity set and global comparators

– GSS stock recommendations to the team are based on:

1. Potential earnings surprise i.e. positive

‘Growth Gap’

2. Fundamental risk assessment

(incorporating operational, financial, strategic, geopolitical, management and

ESG risks)

Portfolio

– The team’s four Portfolio

Managers build high conviction portfolios, integrating clientspecific guidelines, ethical screening and SRI exclusion, as applicable

– Stocks are weighted based on upside fundamental risk assessment and portfolio characteristics

4

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

Three primary layers of ESG integration

ESG factors are integrated into our investment decisions in three distinct stages of our process: Research, Portfolio Construction and Engagement

1. Research

Our Global Sector Specialists leverage the work of Schroders’ dedicated ESG team to assess issues and exposures when incorporating the ESG implications for stocks we are analyzing. The ESG team consists of nine specialists, who have on average 11 years’ investment experience. We use a proprietary ESG Guidance

Document (drafted by ESG Team) which highlights key ESG risks for over 170 GICS sub-sectors. We also use a wealth of external sources, for example we receive quarterly portfolio ESG ratings on invested stocks. We believe that ESG evaluation by investors is a critical component to assessing company quality. Within the Global

Equity team, we adopt a flexible framework for our formal analysis of ESG items. These include (but are not limited to):

Environmental

Climate change mitigation and adaptation

Environmental risks and pollution

Renewable energy

Resource depletion

Overall environmental leadership

Social

Animal welfare

Child and slave labor

Community relations

Labor practices

Predatory lending

Governance

Dual-class share structure

Executive compensation

Majority voting

Division of management roles

Disclosure and transparency

Operational

Financial

Strategic

Geo-political

Probability of Earnings

Surprise

Assessment of Downside

Risk

Risk of owning the Stock

Management

Environmental, Social &

Corporate Governance

Expected

Volatility

Source: Schroders

We believe integrating ESG analysis enhances our understanding of a company and its ability to deliver long-term value. While ESG factors are sometimes difficult to value, understanding them helps to make betterinformed decisions. ESG considerations are used to identify risks and opportunities at the stock selection stage rather than to define an investable universe. At Schroders, ESG is not just a negative screen, our work on sustainability helps us identify companies that are expected to benefit from:

– Sustainable competitive advantage

– Exposure to growth industries

– Above-trend earnings growth

– Attractive cash flow generation and attractive returns on capital

Drawing from a wealth of resources, our analysts incorporate a well informed view on ESG considerations in all of their research notes, which may also impact the discount rate or risk premium applied when evaluating a company.

5

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

2. Stock selection and portfolio construction

There are a wide range of fundamental risks which ultimately define the risk of owning a stock. These range from financial considerations such as the strength of a company’s balance sheet to operational and ESG considerations such as a company’s exposure to a particular regulatory risk. We have analysed the impact of these risks over time on stock prices to establish a well-designed and consistent framework toward evaluating fundamental risk. We utilize a formal scoring system with weighted risk scores in different categories, which results in a specific risk score for each stock that we own. These scores then become a key factor in determining the position size of stocks in the portfolio. A formal ESG score is assigned within the context of our fundamental risk scoring system, and this feeds directly into the decision making around whether to own a stock, and in what size.

3. Engagement

Using Schroders’ position as an active investor to be good stewards by engaging with company management on ESG issues

At Schroders, we believe that the Environmental, Social and Governance (ESG) performance of the companies in which our clients’ assets are invested should focus on delivering long-term shareholder value.

We believe that being a responsible owner can lead to better long-term results for clients, as well as helping society at large. We have been investing for over 200 years and are known as a long-term investor. As a result, companies and their management are willing to engage with us on their strategy, risks, environmental and social performance, and their governance. We believe this should lead to stronger financial returns for both the company and its shareholders.

The following chart is taken from an academic study analysing engagements with over 600 US public companies over a ten year period. This figure plots the cumulative monthly abnormal returns around the initial engagements from 1 month prior to the engagement month to 18 months afterwards. For each event month, the average abnormal returns are calculated using an equal-weighted portfolio of all target firms that initiated engagements in Month 0. The results clearly illustrate that companies that implemented change as a result of successful engagements on ESG issues generated significant outperformance over time.

Cumulative abnormal return monthly return (%)

5

4

3

2

1

0

-1

8

6

7

-1 0 1 2 3 4 5

All engagements

6 7 8 9

Successful engagements

10

Source: Active Ownership, Dimson, Karakas and Li, December 2012.

11 12 13 14

Unsuccessful engagements

15 16 17 18

Event window in months

6

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

7

The key to success is the ability to measure outcomes and we have a long track record of promoting sustainable business practices. During 2015, global equity teams alone held 14,454 company meetings. ESG factors are regularly discussed at these meetings. Our dedicated ESG team also undertook 495 specialist ESG engagements, interacting with a total of 373 companies across 33 countries globally to understand how they are addressing issues we have identified, and encourage the companies to take appropriate actions where we are concerned they are not doing so. We expect engagements to become increasingly important as responsible business practices are recognised as important drivers to a company’s competitive position, success and profitability. By engaging on our own and with other investors, we hope to speed up the process. Our track record for engaging with companies around ESG issues is shown in the chart below:

400

300

200

Total number of ESG engagements since 2000

600

500

100

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Source: Schroders. Engagement success is determined as ‘achieved’ or ‘almost achieved’. Governance engagements are included from

2014 onwards.

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

2. Segregated accounts with client

specific ethical restrictions

Ethical screening

Developing screens to meet our clients’ social, responsible and ethical investment objectives.

Schroders’ long-term view is also vital for the US$ 44 billion (as of December 31, 2015) of ethically screened investments we manage for clients who require investments to reflect their values and beliefs. These assets have helped us to develop a sophisticated and active screening process that excludes stocks from portfolios that fail to meet clients’ criteria. Using a range of research services we can, for example, determine a company’s exposure to controversial activities such as tobacco, pornography, nuclear power to animal testing. Screens are tailored to specific client requirements.

Schroders ethically screened assets have grown at a faster pace than group AUM. 87% of these assets outperformed their benchmarks over three year period to July 31, 2014 (gross of fees, based on US$ 42 billion of restricted accounts of which three years performance is available for US$ 35 billion).*

Schroders has a group wide policy on cluster munitions and run US$ 8.4 billion in line with terrorist state exclusions due to implementation of the USA Patriot Act (as of December 31, 2014).

* Source: Schroders. Past performance is no guarantee o future results. Performance for other periods would vary.

Year

2015

2014

2013

2012

Ethical AUM (USD bn)

2011

2010

2009

2008

Source: Schroders, as of February 29, 2016

44.1

43.3

41.9

24.4

17.6

12.8

6.1

5.3

Percentage of overall group AUM

9.6

9.3

9.6

7.0

6.1

4.2

2.6

3.3

Our Global and International Equity team works with our clients to tailor mandates and investment guidelines to their specific objectives and needs. We currently manage a number of ethically screened mandates for our clients which include SRI and Shariah compliant mandates.

8

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

3. Stewardship

Screening, engagement and monitoring outcomes

In 2013 the life and pensions company that offers the oldest ethical assets in the UK market approached

Schroders about how we might update the investment process around Stewardship for the 21st century. Schroders was selected to manage the mandate on the basis of our strong capabilities and innovative approach.

Our process recognizes the importance of engagement and outcomes , providing more robust results than the traditional pure exclusions investment model. We utilize a three layer Responsible Investment process in which investors can evaluate a portfolio’s environmental and social performance as well as financial performance; this provides explicit recognition of the impact engagement has upon improving the economic system. The investment process is also more accountable, with a shorter policy document and a clear process for excluding companies.

The three layers of stewardship investment process

L a y e r 1

Screening of universe

ESG analyst review

L a y e r 2

Portfolio construction

Company specific

ESG plan

L a y e r 3

Engagement

Measuring outcomes

9

Source: Schroders.

Pre purchase Purchase 3 Years

At Layer 1 , the focus is on a company’s products and services . The ESG team screens the investable universe in-line with the policy of the fund. These exclusions are determined in consultation with the Committee of Reference (CoR). The CoR is an independent committee sitting between the client and Schroders. The screening process uses multiple sources of external data to establish a list of prohibited names. An additional sense check of the universe is provided by Schroders’ ESG analysts. The fund manager is then free to construct the portfolio from the screened universe.

With Layer 2 , the focus is around the ESG assessment of how a company does business. In our experience, companies are rarely black or white in terms of the development of their ESG processes and disclosure, which can be affected by the geographies and sectors in which they operate and by a company’s leadership. The

Stewardship criteria recognize that these differences exist and so sets out, at first, the policies we would expect a company to have in place (depending on its sector) and then the performance indicators to demonstrate the implementation of its policies. The funds’ holdings are analyzed against their disclosure of these policies or data sets, and a company specific ESG engagement plan will be created focusing on priority areas where ESG can be improved. We will engage with a company using cross-desk holdings at Schroders and we will collaborate

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y 10 with our peers. Engagements and requests for changes are monitored and tracked over time in our database and we will re-visit requests for change on a regular (i.e. within a year) basis. Should a company be deemed to have failed to make material improvements against our engagement objectives within a three year period, then it will be added to the exclusion list.

Layer 3 is focused on outcomes and impact. We believe that this is what makes this process unique, innovative and brought into the 21st century. Layer 3 sets medium- to long-term portfolio level ESG targets which are aligned with the outcomes of the layer 2 engagement process. These targets are quantifiable portfolio level measures of the extent to which the fund is achieving the ESG results aligned with the

Stewardship (client) philosophy. Data tools enable us to track this in a transparent manner.

We work with clients to set success targets on ESG issues such as:

– Equal opportunities policy

– Employee engagement

– Health and safety

– Board independence

– Climate change

– Waste

For example, we aim for 100% of invested companies in the Stewardship products to have an equal opportunities policy by 2020 and disclosure of supporting data by 2025.

The product:

– Links Stewardship objectives to portfolio ESG performance

– Provides tangible assessment of portfolio ESG performance. E.g. carbon footprint or the percentage of holdings with health and safety data

– Aligns Stewardship philosophy and performance with planetary social and environmental challenges

We believe that this is a unique proposition within the investment industry as it goes beyond simply integrating

ESG engagement and analysis into the investment process and establishes measurable medium- and longterm ESG portfolio outcomes. These ESG targets reflect the key concerns raised by the client and would likely evolve over time in response to technological innovations and changes in regulation and scientific analysis, among other factors. The goal is to deliver a portfolio in which our investments generate a positive impact .

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T | G L O B A L E Q U I T Y

4. Our commitment to ESG and

socially responsible investment

Schroders has been engaging with companies on governance issues for many years and we have been actively voting at annual general meetings (AGMs) since 1998. We have had a formal Corporate Governance function since 1998 and a formal Responsible Investment (RI) function since 2000. As a result, we have substantial experience in the offering and integration of RI products into the investment process. Our RI programs fall under four broad banners: Ethical Screening, Voting, Engagement and Integration.

While the impact of ESG issues have been considered for many years across numerous investment processes we initiated a process in 2009 to explicitly capture equity analysts’ evaluations of companies’ ESG performance.

In addition to the evolution of our equity integration, we are developing our responsible investment process within Schroder Property Investment Management and within our Fixed Income offerings.

We are involved in many industry bodies and networks which have an influence on the development and promotion of ESG, including the UNPRI (United Nations Principles for Responsible Investment), ICGN

(International Corporate Governance Network), NAPF (National Association of Pension Funds), UKSIF (UK

Sustainable Investment and Finance Association), ABI (Association of British Insurers) and CDP (formerly the

Carbon Disclosure Project). Through our leadership and participation in these forums we collaborate with other asset managers and asset owners on the development of ESG principles and practices.

Through our Corporate Responsibility Committee, Schroders oversees our own environmental and social activities to ensure that we hold ourselves accountable to the same standards that we use to assess other companies.

Timeline of expanding our ESG capabilities

We have translated these principles into action through a number of initiatives

Joined the UK Sustainable

Investment and Finance

Association (2000) and the

European Sustainable

Investment Forum in 2005

1998 2000

Published corporate governance and socially responsible policies in 1998 and 2001

2005 2007

Signed the UN Principles for Responsible Investment and complied with the

UK Stewardship Code

Launched cur first climate change fund

Managed $43 billion of ethically-screened mandates

(9% of total AUM)

2008-2011 2013 2014

Developed responsible investment policies with our property (2008) and fixed income (2011) offerings

Appointed to manage

A $4 billion Friends Life stewardship mandate

Launched

Schroder

QEP Global

ESG strategy

2015

Source: Schroders

11

S C H R O D E R S R E S P O N S I B L E I N V E S T M E N T

Important information: The views and opinions contained herein are those of the Responsible Investing team, and do not necessarily represent Schroder Investment

Management North America Inc.’s house view. These views and opinions are subject to change. All investments involve risk, including the risk of loss of principal. Companies/ issuers/sectors mentioned are for illustrative purposes only and should not be viewed as a recommendation to buy/sell. This report is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations. Information herein has been obtained from sources we believe to be reliable but Schroder Investment Management North America Inc. (SIMNA) does not warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the document when taking individual investment and / or strategic decisions. The opinions stated in this document include some forecasted views. We believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee that any forecasts or opinions will be realized. No responsibility can be accepted for errors of fact obtained from third parties. While every effort has been made to produce a fair representation of performance, no representations or warranties are made as to the accuracy of the information or ratings presented, and no responsibility or liability can be accepted for damage caused by use of or reliance on the information contained within this report. Past performance is no guarantee of future results. Further information about Schroders can be found at www.schroders.com/ us. © Schroder Investment Management North America Inc. 875 Third Ave – 22nd Floor, New York, NY 10022 (212) 641-3800.

BRO-RIGLBLEQ