12-Oct-10 PRELIMINARY RESULTS Percent Share of Total

advertisement

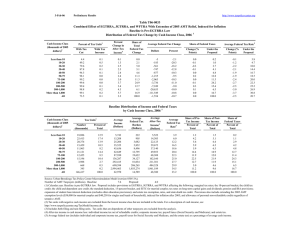

12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2014 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 24.6 32.3 37.1 42.2 41.6 37.9 34.5 23.8 10.3 1.9 0.9 32.4 3 With Tax Increase 11.1 13.8 20.3 22.6 23.5 29.3 36.9 52.6 79.0 97.2 98.8 29.5 Percent Change in After-Tax 4 Income 2.6 1.7 1.0 0.7 0.6 0.4 0.2 0.1 -0.7 -3.4 -6.8 -0.9 Share of Total Federal Tax Change -2.4 -6.9 -5.6 -4.1 -3.3 -5.2 -2.6 -2.8 10.6 23.0 99.1 100.0 Average Federal Tax Change ($) -138 -259 -241 -228 -233 -212 -163 -115 1,483 18,599 154,407 576 Average Federal Tax Rate Change (% Points) -2.4 -1.6 -0.9 -0.6 -0.5 -0.3 -0.2 -0.1 0.5 2.6 4.9 0.7 5 Under the Proposal 3.4 2.8 7.7 11.8 14.8 17.2 18.9 21.6 24.9 27.8 33.5 21.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 5.7 Proposal: 4.6 (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 24.6 32.3 37.1 42.2 41.6 37.9 34.5 23.8 10.3 1.9 0.9 32.4 11.1 13.8 20.3 22.6 23.5 29.3 36.9 52.6 79.0 97.2 98.8 29.5 Percent Change in After-Tax Income 4 2.6 1.7 1.0 0.7 0.6 0.4 0.2 0.1 -0.7 -3.4 -6.8 -0.9 Share of Total Federal Tax Change -2.4 -6.9 -5.6 -4.1 -3.3 -5.2 -2.6 -2.8 10.6 23.0 99.1 100.0 Average Federal Tax Change Dollars -138 -259 -241 -228 -233 -212 -163 -115 1,483 18,599 154,407 576 Percent -41.7 -37.1 -10.6 -5.0 -3.2 -1.8 -0.9 -0.4 2.0 10.2 17.0 3.4 Share of Federal Taxes Change (% Points) -0.1 -0.3 -0.2 -0.2 -0.2 -0.5 -0.4 -1.0 -0.2 0.5 2.6 0.0 Under the Proposal 0.1 0.4 1.5 2.6 3.3 9.1 9.2 25.1 17.8 8.2 22.5 100.0 Average Federal Tax Rate5 Change (% Points) -2.4 -1.6 -0.9 -0.6 -0.5 -0.3 -0.2 -0.1 0.5 2.6 4.9 0.7 Under the Proposal 3.4 2.8 7.7 11.8 14.8 17.2 18.9 21.6 24.9 27.8 33.5 21.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,395 24,950 21,464 16,563 13,107 22,796 14,829 22,547 6,681 1,152 598 161,771 Percent of Total 10.1 15.4 13.3 10.2 8.1 14.1 9.2 13.9 4.1 0.7 0.4 100.0 Average Income (Dollars) 5,731 15,992 26,534 37,088 47,849 65,785 92,580 145,308 302,126 725,130 3,175,497 81,418 Average Federal Tax Burden (Dollars) 332 699 2,270 4,590 7,330 11,523 17,646 31,564 73,598 183,150 909,071 16,876 Average AfterTax Income 4 (Dollars) 5,399 15,293 24,264 32,498 40,519 54,262 74,933 113,745 228,527 541,980 2,266,427 64,542 Average Federal Tax Rate 5 5.8 4.4 8.6 12.4 15.3 17.5 19.1 21.7 24.4 25.3 28.6 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.7 3.0 4.3 4.7 4.8 11.4 10.4 24.9 15.3 6.3 14.4 100.0 0.9 3.7 5.0 5.2 5.1 11.9 10.6 24.6 14.6 6.0 13.0 100.0 0.2 0.6 1.8 2.8 3.5 9.6 9.6 26.1 18.0 7.7 19.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 5.7 Proposal: 4.6 (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy 1 Distribution of Federal Tax Change by Cash Income Level, 2014 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 18.2 19.1 26.4 34.2 26.3 16.3 14.4 7.1 5.4 3.3 0.0 20.9 10.9 16.6 25.7 26.3 28.7 38.6 47.5 64.9 87.4 95.3 99.9 27.6 Percent Change in After-Tax Income 4 1.8 0.7 0.5 0.4 0.2 0.2 0.1 -0.2 -1.2 -3.7 -6.9 -0.5 Share of Total Federal Tax Change -9.2 -13.8 -11.2 -8.6 -4.7 -6.2 -1.3 7.4 19.4 24.9 103.1 100.0 Average Federal Tax Change Dollars -92 -105 -113 -128 -92 -80 -39 224 2,643 19,117 143,956 166 Percent -18.5 -8.4 -3.4 -2.1 -1.0 -0.6 -0.2 0.7 3.4 10.1 15.3 1.7 Share of Federal Taxes Change (% Points) -0.2 -0.3 -0.3 -0.3 -0.2 -0.4 -0.2 -0.2 0.2 0.4 1.6 0.0 Under the Proposal 0.7 2.6 5.3 6.7 7.8 18.1 12.0 19.1 9.8 4.6 13.1 100.0 Average Federal Tax Rate5 Change (% Points) -1.6 -0.7 -0.4 -0.4 -0.2 -0.1 0.0 0.2 0.9 2.7 4.8 0.4 Under the Proposal 7.1 7.2 12.0 16.0 18.9 21.4 23.5 24.4 26.0 29.4 35.9 21.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,785 15,609 11,803 7,961 6,076 9,192 3,953 3,918 873 155 85 71,749 16.4 21.8 16.5 11.1 8.5 12.8 5.5 5.5 1.2 0.2 0.1 100.0 Average Income (Dollars) 5,738 15,863 26,403 37,030 47,870 65,017 91,214 140,835 305,307 710,840 3,020,093 46,638 Average Federal Tax Burden (Dollars) 500 1,254 3,287 6,056 9,155 13,964 21,455 34,092 76,717 189,624 941,138 9,646 Average AfterTax Income 4 (Dollars) 5,238 14,610 23,116 30,975 38,715 51,053 69,759 106,743 228,590 521,216 2,078,955 36,992 Average Federal Tax Rate 5 8.7 7.9 12.5 16.4 19.1 21.5 23.5 24.2 25.1 26.7 31.2 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.0 7.4 9.3 8.8 8.7 17.9 10.8 16.5 8.0 3.3 7.7 100.0 2.3 8.6 10.3 9.3 8.9 17.7 10.4 15.8 7.5 3.0 6.7 100.0 0.9 2.8 5.6 7.0 8.0 18.5 12.3 19.3 9.7 4.3 11.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy 1 Distribution of Federal Tax Change by Cash Income Level, 2014 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 20.0 39.0 44.5 45.4 52.8 55.1 43.9 28.1 11.3 1.6 1.1 36.7 19.2 17.0 21.4 29.9 26.4 26.2 34.5 50.5 77.8 97.5 98.6 39.7 Percent Change in After-Tax Income 4 2.4 1.9 1.4 1.0 0.9 0.5 0.2 0.2 -0.6 -3.4 -6.8 -1.3 Share of Total Federal Tax Change -0.3 -1.4 -1.9 -1.7 -1.8 -3.1 -1.9 -4.0 8.3 20.7 87.0 100.0 Average Federal Tax Change Dollars -108 -307 -353 -327 -375 -288 -185 -197 1,269 18,498 152,387 1,384 Percent -40.6 -66.7 -27.8 -12.0 -7.7 -3.1 -1.2 -0.6 1.7 10.1 17.2 4.7 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.4 -0.4 -1.5 -0.6 0.5 2.8 0.0 Under the Proposal 0.0 0.0 0.2 0.6 1.0 4.3 7.3 28.1 21.8 10.1 26.6 100.0 Average Federal Tax Rate5 Change (% Points) -2.2 -1.9 -1.3 -0.9 -0.8 -0.4 -0.2 -0.1 0.4 2.5 4.9 1.0 Under the Proposal 3.3 0.9 3.4 6.5 9.3 13.3 16.6 21.0 24.7 27.6 33.0 22.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,149 3,779 4,683 4,384 4,031 9,255 8,936 17,410 5,581 957 490 61,925 3.5 6.1 7.6 7.1 6.5 15.0 14.4 28.1 9.0 1.6 0.8 100.0 Average Income (Dollars) 4,856 16,580 26,660 37,167 47,976 66,869 93,299 146,871 301,626 728,191 3,139,514 136,599 Average Federal Tax Burden (Dollars) 267 460 1,269 2,726 4,853 9,156 15,651 30,965 73,087 182,477 884,342 29,414 Average AfterTax Income 4 (Dollars) 4,590 16,121 25,391 34,441 43,123 57,712 77,648 115,906 228,540 545,714 2,255,172 107,185 Average Federal Tax Rate 5 5.5 2.8 4.8 7.3 10.1 13.7 16.8 21.1 24.2 25.1 28.2 21.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.7 1.5 1.9 2.3 7.3 9.9 30.2 19.9 8.2 18.2 100.0 0.2 0.9 1.8 2.3 2.6 8.1 10.5 30.4 19.2 7.9 16.6 100.0 0.0 0.1 0.3 0.7 1.1 4.7 7.7 29.6 22.4 9.6 23.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy 1 Distribution of Federal Tax Change by Cash Income Level, 2014 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 61.7 67.0 56.9 56.3 62.2 51.3 37.3 16.5 8.7 1.7 0.0 55.6 5.1 3.0 6.0 7.4 8.5 14.8 23.8 41.9 70.3 96.6 99.0 10.3 Percent Change in After-Tax Income 4 5.8 4.1 1.8 1.0 0.9 0.7 0.5 0.1 -0.6 -3.1 -6.9 0.9 Share of Total Federal Tax Change 11.0 42.4 25.3 15.1 11.2 16.6 7.1 1.0 -2.7 -5.6 -21.6 100.0 Average Federal Tax Change Dollars -405 -689 -464 -335 -364 -372 -375 -77 1,323 16,777 146,185 -335 Percent 84.5 81.3 -83.1 -9.6 -5.5 -3.4 -2.0 -0.3 1.8 10.1 16.9 -5.3 Share of Federal Taxes Change (% Points) -0.7 -2.5 -1.3 -0.4 0.0 0.5 0.6 1.1 0.6 0.5 1.6 0.0 Under the Proposal -1.3 -5.3 0.3 7.9 10.8 26.8 19.2 21.5 8.3 3.4 8.4 100.0 Average Federal Tax Rate5 Change (% Points) -6.2 -4.3 -1.7 -0.9 -0.8 -0.6 -0.4 -0.1 0.4 2.4 4.9 -0.8 Under the Proposal -13.6 -9.6 0.4 8.5 13.2 16.5 19.8 22.9 24.5 26.1 34.0 13.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,328 5,290 4,676 3,883 2,649 3,843 1,615 1,055 174 28 13 25,605 9.1 20.7 18.3 15.2 10.4 15.0 6.3 4.1 0.7 0.1 0.1 100.0 Average Income (Dollars) 6,522 15,961 26,716 37,061 47,582 64,966 91,867 136,677 299,733 701,148 2,976,702 44,717 Average Federal Tax Burden (Dollars) -479 -847 559 3,473 6,624 11,079 18,581 31,428 72,065 165,968 865,789 6,333 Average AfterTax Income 4 (Dollars) 7,001 16,808 26,157 33,588 40,958 53,886 73,287 105,249 227,668 535,181 2,110,914 38,385 Average Federal Tax Rate 5 -7.4 -5.3 2.1 9.4 13.9 17.1 20.2 23.0 24.0 23.7 29.1 14.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.3 7.4 10.9 12.6 11.0 21.8 13.0 12.6 4.6 1.7 3.3 100.0 1.7 9.1 12.5 13.3 11.0 21.1 12.1 11.3 4.0 1.6 2.7 100.0 -0.7 -2.8 1.6 8.3 10.8 26.3 18.5 20.4 7.7 2.9 6.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 64.1 79.2 70.0 70.7 73.6 64.9 54.7 38.1 13.7 1.9 0.6 57.6 2.2 2.0 4.1 4.9 5.7 10.9 19.2 38.1 72.7 97.3 99.3 19.2 Percent Change in After-Tax Income 4 6.2 4.8 2.4 1.6 1.3 0.8 0.5 0.4 -0.5 -3.8 -7.3 -0.7 Share of Total Federal Tax Change -4.4 -17.5 -13.3 -9.6 -8.1 -12.5 -7.5 -15.0 12.5 36.9 138.4 100.0 Average Federal Tax Change Dollars -433 -847 -645 -534 -557 -455 -356 -406 1,088 20,365 162,210 544 Percent 62.9 56.5 539.2 -18.9 -9.3 -4.4 -2.1 -1.3 1.5 10.5 17.5 2.6 Share of Federal Taxes Change (% Points) -0.1 -0.4 -0.3 -0.3 -0.3 -0.5 -0.4 -1.1 -0.2 0.7 3.0 0.0 Under the Proposal -0.3 -1.2 -0.4 1.0 2.0 6.8 8.7 28.4 22.0 9.7 23.3 100.0 Average Federal Tax Rate5 Change (% Points) -6.9 -5.2 -2.4 -1.4 -1.2 -0.7 -0.4 -0.3 0.4 2.8 5.2 0.5 Under the Proposal -18.0 -14.5 -2.9 6.2 11.3 15.0 17.6 21.1 25.3 29.5 34.7 21.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,749 5,590 5,566 4,882 3,929 7,405 5,694 9,988 3,118 490 231 49,780 5.5 11.2 11.2 9.8 7.9 14.9 11.4 20.1 6.3 1.0 0.5 100.0 Average Income (Dollars) 6,253 16,191 26,627 37,104 47,874 66,154 93,283 146,051 300,423 724,847 3,138,297 102,631 Average Federal Tax Burden (Dollars) -690 -1,498 -120 2,830 5,977 10,345 16,802 31,168 75,027 193,721 925,885 21,174 Average AfterTax Income 4 (Dollars) 6,942 17,689 26,747 34,274 41,897 55,808 76,481 114,883 225,396 531,126 2,212,412 81,457 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.0 -9.3 -0.5 7.6 12.5 15.6 18.0 21.3 25.0 26.7 29.5 20.6 0.3 1.8 2.9 3.6 3.7 9.6 10.4 28.6 18.3 7.0 14.2 100.0 0.5 2.4 3.7 4.1 4.1 10.2 10.7 28.3 17.3 6.4 12.6 100.0 -0.2 -0.8 -0.1 1.3 2.2 7.3 9.1 29.5 22.2 9.0 20.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12-Oct-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0243 Administration's FY2011 Budget Proposals Major Individual Income and Corporate Tax Provisions Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2014 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 4.4 3.8 6.8 7.4 8.5 12.0 12.0 6.0 4.8 1.3 0.5 7.1 28.2 26.6 47.5 60.1 64.8 67.9 72.7 83.9 92.2 97.5 99.1 55.3 Percent Change in After-Tax Income 4 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.2 -0.4 -1.0 -3.0 -6.6 -1.5 Share of Total Federal Tax Change 0.0 0.0 0.2 0.5 0.4 0.9 1.1 4.6 9.0 13.2 70.1 100.0 Average Federal Tax Change Dollars -2 0 10 47 50 71 128 441 2,434 16,741 151,444 996 Percent -0.9 -0.1 0.9 2.3 1.6 1.1 1.1 1.8 3.7 9.6 16.2 7.5 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 -0.1 -0.1 -0.4 -0.5 -1.0 -0.7 0.2 2.6 0.0 Under the Proposal 0.1 0.5 1.3 1.6 1.6 5.9 7.1 18.5 17.7 10.6 35.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.3 0.8 2.3 4.7 1.3 Under the Proposal 3.3 2.3 4.2 5.6 6.6 9.6 12.7 17.4 22.2 26.3 33.6 17.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2014 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,141 6,773 5,562 3,452 2,280 4,211 2,785 3,346 1,188 253 148 32,167 6.7 21.1 17.3 10.7 7.1 13.1 8.7 10.4 3.7 0.8 0.5 100.0 Average Income (Dollars) 6,199 16,256 26,342 36,971 47,737 66,263 91,958 145,447 307,476 728,374 3,239,966 79,440 Average Federal Tax Burden (Dollars) 208 366 1,083 2,019 3,122 6,296 11,576 24,853 65,860 175,013 935,528 13,258 Average AfterTax Income 4 (Dollars) 5,992 15,891 25,259 34,953 44,615 59,967 80,382 120,594 241,616 553,360 2,304,438 66,182 Average Federal Tax Rate 5 3.4 2.3 4.1 5.5 6.5 9.5 12.6 17.1 21.4 24.0 28.9 16.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.5 4.3 5.7 5.0 4.3 10.9 10.0 19.0 14.3 7.2 18.8 100.0 0.6 5.1 6.6 5.7 4.8 11.9 10.5 19.0 13.5 6.6 16.1 100.0 0.1 0.6 1.4 1.6 1.7 6.2 7.6 19.5 18.4 10.4 32.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Current policy extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. The proposal would: (a) extend the higher EITC credit value for families with 3 children and higher phase-out thresholds for married couples; (b) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (c) create automatic 401(k)s and IRAs; (d) extend the American Opportunity Tax Credit; (e) extend the $3,000 child tax credit refundability threshold; (f) raise the child and dependent care tax credit phase-out threshold to $85,000; (g) change the threshold for the 36-percent tax bracket to $250,000 less the standard deduction and two personal exemptions for married couples filing jointly and $200,000 less the standard deduction and one personal exemption for single filers, indexed for inflation after 2009; (h) set the thresholds for the personal exemption phase-out and limitation on itemized deductions to $250,000 of AGI (married) and $200,000 (single), indexed for inflation after 2009; (i) impose a 20 percent rate on capital gains and qualified dividends for taxpayers in the top two tax brackets; (j) limit value of itemized deductions to 28 percent. Business provisions included were making the research and experimentation tax credit permanent, taxing carried interest as ordinary income, repealing LIFO, international corporate tax reforms, and reforms affecting the tax treatment of financial institutions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.