RESOLUTION NO. 12/2010-11 HUMBOLDT UNION HIGH SCHOOL DISTRICT, PROVIDING FOR THE

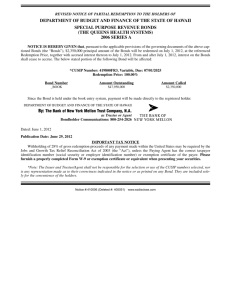

advertisement