7-Jul-08 PRELIMINARY RESULTS

advertisement

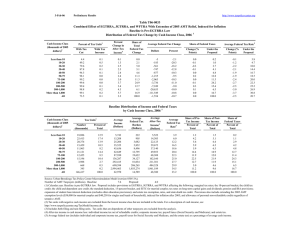

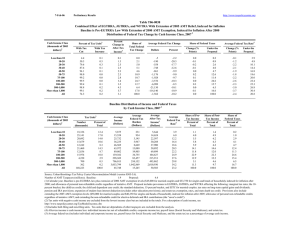

7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Summary Table Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All With Tax Increase Percent Change in After-Tax Income 4 100.0 100.0 99.1 96.9 94.7 91.3 68.5 15.1 3.4 4.7 0.9 78.6 -45.2 -16.0 -8.4 -5.4 -4.0 -2.1 -0.2 1.9 3.6 4.9 7.6 0.0 Percent of Tax Units 3 With Tax Cut 0.0 0.1 1.0 3.1 5.3 8.7 31.5 84.9 96.6 95.3 99.1 21.4 Share of Total Federal Tax Change n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Average Federal Tax Change ($) 2,478 2,345 1,918 1,663 1,521 1,057 153 -2,044 -7,696 -24,706 -165,569 0 Average Federal Tax Rate Change (% Points) 42.8 15.1 7.4 4.6 3.2 1.6 0.2 -1.5 -2.6 -3.5 -5.1 0.0 5 Under the Proposal 48.0 20.6 18.8 20.2 21.3 21.8 22.1 23.4 25.0 26.0 28.6 24.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 (1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.1 1.0 3.1 5.3 8.7 31.5 84.9 96.6 95.3 99.1 21.4 100.0 100.0 99.1 96.9 94.7 91.3 68.5 15.1 3.4 4.7 0.9 78.6 Percent Change in After-Tax Income 4 -45.2 -16.0 -8.4 -5.4 -4.0 -2.1 -0.2 1.9 3.6 4.9 7.6 0.0 Share of Total Federal Tax Change n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Average Federal Tax Change Dollars 2,478 2,345 1,918 1,663 1,521 1,057 153 -2,044 -7,696 -24,706 -165,569 0 Percent 815.2 275.5 64.9 29.4 18.0 8.2 0.8 -5.8 -9.4 -11.8 -15.1 0.0 Share of Federal Taxes Change (% Points) 1.5 2.0 1.3 0.9 0.6 0.8 0.1 -1.5 -1.6 -0.9 -3.2 0.0 Under the Proposal 1.6 2.7 3.3 3.7 4.1 10.7 9.9 23.8 15.5 6.7 17.8 100.0 Average Federal Tax Rate 5 Change (% Points) 42.8 15.1 7.4 4.6 3.2 1.6 0.2 -1.5 -2.6 -3.5 -5.1 0.0 Under the Proposal 48.0 20.6 18.8 20.2 21.3 21.8 22.1 23.4 25.0 26.0 28.6 24.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,869 24,210 19,551 14,651 11,772 21,849 14,261 20,780 5,991 1,037 549 152,206 Percent of Total 11.1 15.9 12.9 9.6 7.7 14.4 9.4 13.7 3.9 0.7 0.4 100.0 Average Income (Dollars) 5,791 15,525 25,891 36,328 46,879 64,443 90,653 141,322 298,058 709,945 3,271,258 78,753 Average Federal Tax Burden (Dollars) 304 851 2,956 5,663 8,460 12,965 19,849 35,041 82,257 209,164 1,100,278 18,905 Average AfterTax Income 4 (Dollars) 5,487 14,674 22,935 30,664 38,419 51,478 70,805 106,281 215,800 500,781 2,170,979 59,848 Average Federal Tax Rate 5 5.3 5.5 11.4 15.6 18.1 20.1 21.9 24.8 27.6 29.5 33.6 24.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.1 4.2 4.4 4.6 11.8 10.8 24.5 14.9 6.1 15.0 100.0 1.0 3.9 4.9 4.9 5.0 12.4 11.1 24.2 14.2 5.7 13.1 100.0 0.2 0.7 2.0 2.9 3.5 9.8 9.8 25.3 17.1 7.5 21.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.2 0.5 2.7 11.0 54.1 87.9 89.7 98.1 4.9 100.0 100.0 100.0 99.8 99.5 97.3 89.0 45.9 12.1 10.3 1.9 95.1 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -46.2 -16.9 -9.6 -6.8 -5.1 -2.6 -0.4 2.0 6.7 9.9 13.5 -3.6 38.6 44.9 26.4 16.8 12.9 13.4 1.3 -7.8 -13.8 -8.3 -25.1 100.0 Average Federal Tax Change Dollars 2,480 2,358 2,097 1,987 1,875 1,253 285 -1,948 -14,111 -48,007 -272,812 1,201 Percent 559.6 171.0 52.0 28.2 19.1 8.4 1.2 -5.2 -15.8 -21.5 -22.8 11.6 Share of Federal Taxes Change (% Points) 3.9 4.4 2.1 1.0 0.5 -0.5 -1.1 -2.6 -2.5 -1.3 -3.9 0.0 Under the Proposal 4.7 7.4 8.0 7.9 8.4 18.0 10.8 14.9 7.7 3.2 8.9 100.0 Average Federal Tax Rate 5 Change (% Points) 42.7 15.3 8.1 5.5 4.0 2.0 0.3 -1.4 -4.7 -6.8 -8.5 2.7 Under the Proposal 50.3 24.3 23.8 24.9 25.0 25.6 26.4 26.0 25.1 24.9 28.8 26.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,329 15,065 9,973 6,679 5,440 8,438 3,482 3,187 775 137 73 65,926 18.7 22.9 15.1 10.1 8.3 12.8 5.3 4.8 1.2 0.2 0.1 100.0 Average Income (Dollars) 5,808 15,372 25,806 36,304 46,834 63,483 89,596 136,971 301,048 706,590 3,221,367 43,953 Average Federal Tax Burden (Dollars) 443 1,378 4,032 7,042 9,828 14,991 23,399 37,545 89,599 223,668 1,199,047 10,357 Average AfterTax Income 4 (Dollars) 5,365 13,994 21,774 29,262 37,006 48,492 66,197 99,426 211,449 482,922 2,022,320 33,597 Average Federal Tax Rate 5 7.6 9.0 15.6 19.4 21.0 23.6 26.1 27.4 29.8 31.7 37.2 23.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.5 8.0 8.9 8.4 8.8 18.5 10.8 15.1 8.1 3.3 8.1 100.0 3.0 9.5 9.8 8.8 9.1 18.5 10.4 14.3 7.4 3.0 6.7 100.0 0.8 3.0 5.9 6.9 7.8 18.5 11.9 17.5 10.2 4.5 12.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.2 0.3 4.0 9.6 11.6 11.6 38.3 92.3 98.2 96.5 99.3 45.2 99.8 99.7 96.0 90.4 88.4 88.4 61.6 7.7 1.8 3.5 0.7 54.8 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -52.7 -15.2 -7.5 -4.3 -3.0 -1.7 -0.1 2.0 3.1 4.2 6.8 1.9 -4.6 -8.1 -7.5 -5.0 -3.9 -8.0 -0.8 31.8 30.5 16.4 59.5 100.0 Average Federal Tax Change Dollars 2,462 2,343 1,792 1,383 1,196 946 96 -2,148 -6,792 -21,221 -146,393 -1,864 Percent 850.6 384.6 91.3 34.1 18.1 8.5 0.5 -6.2 -8.4 -10.2 -13.8 -5.7 Share of Federal Taxes Change (% Points) 0.3 0.5 0.5 0.4 0.3 0.8 0.6 -0.2 -0.6 -0.4 -2.1 0.0 Under the Proposal 0.3 0.6 0.9 1.2 1.5 6.2 9.1 28.9 20.1 8.7 22.4 100.0 Average Federal Tax Rate 5 Change (% Points) 49.7 14.6 6.9 3.8 2.5 1.4 0.1 -1.5 -2.3 -3.0 -4.6 -1.4 Under the Proposal 55.5 18.4 14.5 15.0 16.6 18.5 20.2 22.8 25.0 26.2 28.5 23.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,074 3,858 4,668 4,033 3,611 9,428 9,159 16,573 5,019 866 454 60,003 3.5 6.4 7.8 6.7 6.0 15.7 15.3 27.6 8.4 1.4 0.8 100.0 Average Income (Dollars) 4,959 16,077 25,882 36,342 47,049 65,728 91,242 142,634 297,518 710,981 3,218,936 131,312 Average Federal Tax Burden (Dollars) 289 609 1,963 4,059 6,618 11,205 18,315 34,618 81,143 207,132 1,064,804 32,861 Average AfterTax Income 4 (Dollars) 4,669 15,468 23,919 32,283 40,432 54,523 72,926 108,016 216,375 503,849 2,154,133 98,451 Average Federal Tax Rate 5 5.8 3.8 7.6 11.2 14.1 17.1 20.1 24.3 27.3 29.1 33.1 25.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.5 1.9 2.2 7.9 10.6 30.0 19.0 7.8 18.6 100.0 0.2 1.0 1.9 2.2 2.5 8.7 11.3 30.3 18.4 7.4 16.6 100.0 0.0 0.1 0.5 0.8 1.2 5.4 8.5 29.1 20.7 9.1 24.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 1.4 6.1 13.2 36.0 55.6 87.4 88.4 97.9 7.5 100.0 100.0 100.0 98.6 93.9 86.7 64.0 44.3 12.6 11.6 2.1 92.5 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -35.9 -14.3 -6.8 -4.3 -3.2 -1.9 -0.3 0.5 2.3 3.9 7.3 -4.0 17.4 35.0 22.9 14.8 8.8 10.2 0.9 -1.4 -2.2 -1.4 -5.4 100.0 Average Federal Tax Change Dollars 2,476 2,320 1,660 1,363 1,237 976 211 -518 -5,040 -19,480 -152,469 1,395 Percent -559.6 -356.4 113.4 28.9 15.8 7.8 1.0 -1.6 -6.3 -10.1 -14.5 20.0 Share of Federal Taxes Change (% Points) 3.0 6.2 3.2 0.8 -0.4 -2.6 -2.6 -3.1 -1.5 -0.7 -2.1 0.0 Under the Proposal 2.4 4.2 7.2 11.0 10.8 23.4 14.0 14.2 5.5 2.0 5.3 100.0 Average Federal Tax Rate 5 Change (% Points) 38.4 14.9 6.4 3.8 2.6 1.5 0.2 -0.4 -1.7 -2.8 -4.8 3.3 Under the Proposal 31.5 10.7 12.0 16.8 19.4 21.2 23.1 24.6 25.0 25.2 28.6 19.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,322 4,998 4,576 3,596 2,360 3,458 1,350 861 146 23 12 23,751 9.8 21.0 19.3 15.1 9.9 14.6 5.7 3.6 0.6 0.1 0.1 100.0 Average Income (Dollars) 6,457 15,560 26,059 36,319 46,775 63,384 89,702 133,083 299,845 688,183 3,150,036 42,212 Average Federal Tax Burden (Dollars) -443 -651 1,464 4,720 7,845 12,463 20,480 33,299 79,890 192,740 1,054,382 6,981 Average AfterTax Income 4 (Dollars) 6,900 16,211 24,595 31,598 38,930 50,921 69,222 99,785 219,956 495,443 2,095,653 35,231 Average Federal Tax Rate 5 -6.9 -4.2 5.6 13.0 16.8 19.7 22.8 25.0 26.6 28.0 33.5 16.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.5 7.8 11.9 13.0 11.0 21.9 12.1 11.4 4.4 1.6 3.7 100.0 1.9 9.7 13.5 13.6 11.0 21.0 11.2 10.3 3.8 1.4 2.9 100.0 -0.6 -2.0 4.0 10.2 11.2 26.0 16.7 17.3 7.0 2.7 7.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.1 0.2 3.3 9.0 14.5 19.1 48.9 92.2 98.6 96.2 99.6 36.3 99.9 99.8 96.7 91.0 85.5 80.9 51.1 7.8 1.5 3.8 0.4 63.7 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -36.8 -13.3 -5.7 -3.3 -2.2 -1.1 0.4 2.3 3.1 4.4 6.9 1.3 -13.7 -26.1 -16.8 -10.4 -7.0 -9.4 3.6 49.9 39.1 21.5 69.9 100.0 Average Federal Tax Change Dollars 2,466 2,262 1,415 1,040 874 600 -299 -2,478 -6,501 -21,903 -147,835 -974 Percent -379.9 -190.8 138.8 23.8 11.5 5.0 -1.6 -7.1 -7.9 -10.2 -13.4 -4.1 Share of Federal Taxes Change (% Points) 0.6 1.1 0.7 0.5 0.4 0.7 0.3 -0.9 -0.8 -0.6 -2.1 0.0 Under the Proposal 0.4 0.5 1.2 2.3 2.9 8.5 9.8 27.8 19.2 8.0 19.2 100.0 Average Federal Tax Rate 5 Change (% Points) 40.7 14.3 5.5 2.9 1.9 0.9 -0.3 -1.7 -2.2 -3.1 -4.6 -1.0 Under the Proposal 30.0 6.8 9.4 14.9 18.1 19.6 20.9 22.9 25.5 27.2 29.5 23.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,622 5,438 5,576 4,721 3,754 7,400 5,710 9,472 2,828 461 223 48,340 5.4 11.3 11.5 9.8 7.8 15.3 11.8 19.6 5.9 1.0 0.5 100.0 Average Income (Dollars) 6,059 15,808 25,990 36,356 46,865 64,701 91,138 142,281 295,238 707,684 3,240,318 99,549 Average Federal Tax Burden (Dollars) -649 -1,186 1,020 4,370 7,590 12,076 19,356 35,015 81,826 214,684 1,102,591 23,900 Average AfterTax Income 4 (Dollars) 6,708 16,993 24,970 31,986 39,275 52,624 71,782 107,266 213,412 492,999 2,137,727 75,649 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -10.7 -7.5 3.9 12.0 16.2 18.7 21.2 24.6 27.7 30.3 34.0 24.0 0.3 1.8 3.0 3.6 3.7 10.0 10.8 28.0 17.4 6.8 15.0 100.0 0.5 2.5 3.8 4.1 4.0 10.7 11.2 27.8 16.5 6.2 13.0 100.0 -0.2 -0.6 0.5 1.8 2.5 7.7 9.6 28.7 20.0 8.6 21.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 Note: Tax units with children are those claiming an exemption for children at home or away from home. 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7-Jul-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0158 2001-06 Tax Cuts with AMT Patch Extended: Lump-Sum Financing Distribution of Federal Tax Change by Cash Income Level, 2010 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.3 0.6 3.6 20.4 78.0 93.3 94.9 98.7 16.3 100.0 100.0 100.0 99.7 99.4 96.4 79.6 22.0 6.7 5.1 1.3 83.7 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change -38.6 -16.2 -9.4 -6.0 -4.0 -1.5 0.1 2.4 5.8 7.1 10.1 1.0 -37.5 -95.8 -54.8 -26.1 -16.5 -19.9 0.6 50.6 85.9 47.8 165.5 100.0 Average Federal Tax Change Dollars 2,472 2,438 2,250 2,025 1,719 843 -37 -2,623 -12,832 -35,631 -214,317 -594 Percent 1,311.9 570.6 151.5 78.5 39.9 9.3 -0.2 -8.7 -15.9 -17.0 -19.5 -3.5 Share of Federal Taxes Change (% Points) 1.4 3.5 2.1 1.0 0.7 1.0 0.3 -1.1 -2.4 -1.4 -5.0 0.0 Under the Proposal 1.5 4.1 3.3 2.2 2.1 8.6 8.5 19.4 16.7 8.6 25.0 100.0 Average Federal Tax Rate 5 Change (% Points) 37.5 15.7 8.8 5.6 3.7 1.3 0.0 -1.9 -4.2 -5.0 -6.7 -0.8 Under the Proposal 40.3 18.5 14.6 12.8 12.8 15.2 16.9 19.5 22.4 24.5 27.5 20.5 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,624 6,801 4,213 2,230 1,665 4,090 2,642 3,340 1,159 232 134 29,149 9.0 23.3 14.5 7.7 5.7 14.0 9.1 11.5 4.0 0.8 0.5 100.0 Average Income (Dollars) 6,599 15,491 25,543 36,101 47,123 64,954 90,263 140,671 303,912 713,164 3,222,371 79,238 Average Federal Tax Burden (Dollars) 188 427 1,485 2,580 4,307 9,058 15,270 30,040 80,907 210,201 1,099,335 16,813 Average AfterTax Income 4 (Dollars) 6,410 15,063 24,058 33,521 42,816 55,897 74,993 110,631 223,005 502,963 2,123,036 62,425 Average Federal Tax Rate 5 2.9 2.8 5.8 7.2 9.1 13.9 16.9 21.4 26.6 29.5 34.1 21.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 4.6 4.7 3.5 3.4 11.5 10.3 20.3 15.3 7.2 18.6 100.0 0.9 5.6 5.6 4.1 3.9 12.6 10.9 20.3 14.2 6.4 15.6 100.0 0.1 0.6 1.3 1.2 1.5 7.6 8.2 20.5 19.1 10.0 30.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). Number of AMT Taxpayers (millions). Baseline: 18.2 Proposal: 5.5 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. 1) Calendar year. Baseline is pre-EGTRRA law. Includes major individual income and estate tax provisions in EGTRRA 2001, JGTRRA 2003, WFTRA 2004, TIPRA 2006, PPA 2006, TIPA 2007, and ESA 2008. Assumes that the AMT exemption is $62,550 for married couples filing jointly and $42,500 for unmarried individuals, indexed for inflation after 2007, and that personal non-refundable credits are allowed regardless of tentative AMT. Cost of the tax cuts is financed with a $2,483 lump-sum levy on all non-dependent tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.