Professor Vipin 2014 Insurance Claims

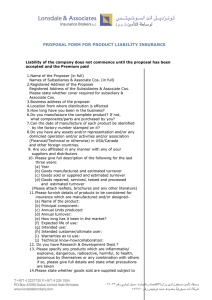

advertisement

Professor Vipin 2014 Insurance Claims A business enterprise normally gets itself insured against the loss of asset on the happening of certain events such fire, flood, theft, earthquake etc. Sometimes, an enterprise also gets itself insured against consequential loss of profit due to decreased turnover in addition to loss of asset. Hence this chapter deals with two types of policies. Claim for loss of asset. Claim for loss of profit. Insurance contracts (except life insurance) are contracts of indemnity whereby one party, called the insurer, undertakes to indemnify the loss suffered by the other party, called the insured, on the happening of some unforeseen event in consideration of a fixed sum of money, called the premium. Loss of Stock Policy To determine claim for loss of asset, the value of asset at the date of fire is considered. The value can be obtained from accounting records. But in case of loss of stock, the value of stock is to be estimated if stock ledger are destroyed by fire or not maintained. To estimate value of stock following procedure is adopted Step I – Prepare Memorandum trading A/c This account is prepared from starting date of accounting year till the date of fire to ascertain the closing stock for the purpose of claim. Particulars To Opening Stock To Purchases To Direct Expenses To Gross Profit Amount Particulars By Sales By Closing Stock Amount Closing stock comes as a balancing figure. Gross profit is calculated as: 1. Same as last year 2. Analysing trend and taking average or weighted average of past years gross profit ratios 3. Preparing last accounting year trading account. Note: Before taking previous year gross profit rate one must consider that: www.VipinMKS.com Page 1 Professor Vipin 2014 1. Previous year opening and closing is valued at cost. 2. Any price level changes are eliminated in current year figures. 3. If there are any abnormal items, then they are separated and treated as: Particulars To Opening Stock To Purchases To Direct Expenses To Gross Profit Amount Amount (Normal) (Abnormal) Particulars By Sales By Closing Stock Amount Amount (Normal) (Abnormal) 4. Sometimes goods are recorded as purchases but not received physically or recorded as sales but not yet dispatched. In such cases principle to be applied is that whether goods were there in godown at date of fire. Example: goods sold but not yet dispatched are deducted from sales OR Goods received but not recorded as purchases are added to purchases. 5. Goods not for sale such as withdrawn for personal use, theft of stock, free samples etc. should be ascertained and adjusted to derive a reasonable estimate of value of stock lost in fire. Step II – Determine Claim for loss of asset Particulars Value of stock on the date of fire Add: Cost of Abnormal stock (if any) Less: Value of salvaged stock Amount of loss of stock Amount Step III – Application of Average clause Why and when it is applied? As general insurance is a contract of indemnity, claim for loss of asset is restricted to the value of asset destroyed by the fire. For this purpose value of stock on the date of fire is known as Insurable Amount and actual amount insured is given in the question. Therefore two situations may arise:1. Insured amount > Insurable amount, i.e., Over – Insurance, claim is admissible to full amount of loss. 2. Insured amount < Insurable amount, i.e., Under – Insurance, average clause is applicable as follows. www.VipinMKS.com Page 2 Professor Vipin 2014 Loss of Profit Policy Besides, loss of asset, fire results in dislocation of the business. It affects production, sales and consequently profits during dislocation period. A normal fire insurance policy covers the material damage to the property like building, machinery and other plant against the risks of destruction by fire. However in the event of fire, it is not possible for him to erect new buildings and it may take months or years to do so. Moreover there are some fixed expenses known as standing charges which are to be paid irrespective of business activity. Thirdly to fulfill orders on time he may have to incur extra cost. For these purpose, a business enterprise takes a policy called “Loss of profit” OR “Consequential loss” policy to cover the following: Net profits before Taxation. Loss on account of standing charges. The standing charges to be covered as follows: Interest on debentures, mortgages, loans & bank overdrafts Rent ,rates & taxes Salaries to permanent staff & wages to skilled employees Company’s contribution to the provident fund, gratuity fund Director’s fees , auditors fees, legal expenses Traveling expenses, motor car expenses Insurance premium, advertising Office expenses Postage, telegrams & telephone, printing & stationery Electric energy and / or power charges Maintenance of building, plant & machinery Depreciation (excluding stocks and stores) Miscellaneous standing charges not exceeding 5% of the amount of the standing charges specified. Increased cost of workings. Increased cost of workings A claim for loss of profits can be established only if: 1. The insured’s premises, or the property therein, are destroyed or damaged by the peril defined in the policy; and 2. The insured’s business carried on the premises is interrupted or interfered with as a result of such damage. Terms Used 1. Period of claim: It is the indemnity period or dislocation period whichever is earlier. 2. Loss of turnover (Short sales): Standard turnover – Actual turnover 3. Standard turnover: It is turnover for the corresponding period in the preceding year and generally adjusted for the trend of business by including “Special Circumstances Clause” www.VipinMKS.com Page 3 Professor Vipin 2014 Steps to calculate claim for loss of profit Step I – Ascertain Period of Claim Step II – Calculate gross profit ratio based on the trading results of last year Give due regards to any “Special Circumstances Clause”. Step III – Calculate turnover lost in claim period. Particulars Turnover for corresponding claim period in preceding year Add/Less: Special circumstances clause (if any) Less: Actual turnover during claim period Turnover lost during the claim period Amount Step IV – Calculate Gross profit during claim period Step V – Calculate sum insurable Particulars Turnover for the 12 months preceding the date of fire Add/Less: Special circumstances clause (if any) Adjusted Turnover Agreed GP Ratio Sum Insurable Amount Step VI – Calculate amount of net claim for increased cost of working Particulars Amount Gross Claim Less: Savings insured standing charges Net Claim for increased cost of working www.VipinMKS.com Page 4 Professor Vipin 2014 Gross Claim is Lower of following Actual expenses Proportionate increased cost of working Maximum saving of liability of the insurer Step VII – Calculate total claim by adding Gross profit lost during claim period (step 4) Net claim for increased cost of working (step 6) Step VIII - Application of average clause Notes: 1. Unless otherwise stated, all standing charges should be treated as insured standing charges. 2. Unless otherwise stated, actual turnover in the claim period should be deemed to be reduction in turnover avoided. Example 1 From the following data compute the consequential loss claim: a. b. c. d. e. f. g. h. i. j. Financial year ends on 31st December, Turnover Rs. 200000 Indemnity period: 6 months Period of interruption – 1st July to 31st October Net Profit: Rs. 18000 Standing charges: Rs. 42000 out of which Rs. 10000 has not been insured Sum assured: Rs. 50000 Standard turnover: Rs. 65000 Turnover in the period of interruption Rs. 25000 out of which Rs. 6000 was from a rented place at Rs. 600 per month Annual turnover: Rs. 240000 Savings in standing charges: Rs. 4725 per annum www.VipinMKS.com Page 5 Professor Vipin 2014 k. Date of fire – night of 30th June l. It was agreed between the insurer and the insured that the business trends would lead to an increase of 10% in the turnover. Solution 1 Particulars Computation of Short of Sales: Standard Turnover Add: 10% increase in turnover Amount Less: Sales during the dislocation period Short Sales Gross Profit on short sales @ 25% Add: Increased cost of working, limited to GP of Rs. 6000 Less: Savings in Expenses or Standing Charges (4725/3) Gross Claim 65000 6500 71500 25000 46500 11625 1500 13125 1575 11550 Since the sum assured is less than the amount for which the policy should have been taken, the average clause shall apply. Amount for which policy should have taken: 25% of Rs. 264000 (240000 + 24000) = Rs. 66000 Amount of claim = 11550 x 50000/66000 = Rs. 8750 Working Note: Particulars Gross Profit Rate: Net Profit Add: Insured Standing charges (4200010000) Gross Profit Turnover Gross Profit Rate www.VipinMKS.com Amount 18000 32000 50000 200000 25% Page 6 Professor Vipin 2014 Increased Cost of Working (Lowest of the following) = 2400 x 50000/66000 = Rs. 2000 Gross Profit on additional sales: 25% of Rs. 6000 = Rs. 1500 The amount of Rs. 13125 (gross profit on short sales and increased working expenses) is within the overall limit of 20% of Rs. 71500 Example 2 A fire occurred in the premises of a businessman on 31st January 1997, which destroyed most of the building. However, stock worth Rs. 5940 was salvaged. The company’s insurance covers the following: Stock: Rs. 900000; Building: Rs. 1200000; Loss of profit (including standing charges): Rs. 375000; Period of indemnity: 6 months The summarized P&L is as follows: Particulars Turnover Closing Stock Opening Stock Purchases Standing charges Variable expenses Amount Amount 3000000 787500 3787500 618750 2718750 251250 120000 3708750 78750 The transactions for month of January 1997 were as under: Particulars Turnover Payment to Creditors Trade Creditors: Balance on 1/1/97 Trade Creditors: Balance on 31/1/97 Amount 150000 160020 226000 230980 The company’s business was disrupted until 30/04/97 during which period the reduction in the turnover amounted to Rs. 270000 as compared with the turnover of same period corresponding to the previous year. www.VipinMKS.com Page 7 Professor Vipin 2014 Building was worth Rs. 1500000 on the date of the fire and three-quarter of its value was lost by fire. You are required to submit the claim for insurance for loss of stock, loss of building and loss of profit. Solution 2 Claim for Loss of Stock Memorandum Trading Account for month ending Jan 31st 1997 Particulars To Opening Stock To Purchases (note 2) To Gross Profit @ 15% Amount 787500 165000 22500 Particulars By Sales By Closing Stock (bal fig) 975000 Particulars Closing stock Less: Stock salvaged Claim for Stock Amount 150000 825000 975000 Amount 825000 5940 819060 Claim for Loss of Profit: Particulars Short Sales Gross Profit (note 3) Gross Profit on Short Sales Amount 270000 11% 29700 Claim for Loss of Building Loss of building (3/4th of 1500000) Rs. 1125000. The building is insured for Rs. 1200000 only. Hence the claim is subject to the average clause presuming that the policy contains such a clause. = 1125000 x 1200000/1500000 = Rs. 900000 Total claim (Rs. 819060 + Rs. 29700 + Rs. 900000) = Rs. 1748760 www.VipinMKS.com Page 8 Professor Vipin 2014 Working Notes 1. Rate of Gross Profit for the year ending 31st December 1996 Trading Account Particulars To opening stock To Purchases To Gross Profit Amount 618750 2718750 450000 Particulars By Sales By Closing Stock 3787500 Amount 3000000 787500 3787500 2. Rate of gross profit comes to 15% (Rs. 450000/3000000) Particulars To Bank To Bank Balance c/d Amount 160020 230980 391000 Particulars By Balance b/d By Purchases (bal fig) Amount 226000 165000 391000 3. Calculation of gross profit ratio for loss of profit Particulars Sales for 1996 Net Profit + Insured Charges: Net Profit Standing charges (Assumed all insured) Rate of GP (11%) www.VipinMKS.com Amount Amount 3000000 78750 251250 330000 Page 9