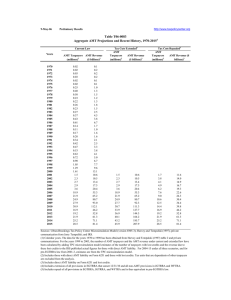

10-Nov-06 PRELIMINARY RESULTS 1970 1971

advertisement

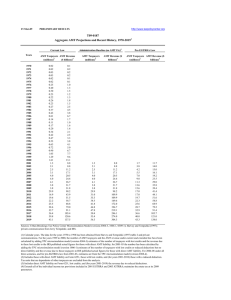

10-Nov-06 http://www.taxpolicycenter.org PRELIMINARY RESULTS T06-0267 1 Aggregate AMT Projections and Recent History, 1970-2017 Current Law Years 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 AMT Taxpayers AMT Revenue (millions)2 ($ billions)3 0.02 0.02 0.03 0.03 0.02 0.02 0.25 0.40 0.50 0.23 0.22 0.26 0.23 0.27 0.37 0.43 0.61 0.14 0.11 0.17 0.20 0.34 0.42 0.47 0.53 0.63 0.72 0.90 1.05 1.29 1.61 1.3 2.1 2.5 3.3 3.5 3.5 23.4 26.5 29.3 32.4 18.5 20.9 24.0 27.2 31.0 35.1 39.1 0.1 0.2 0.2 0.2 0.1 0.1 1.0 1.3 1.5 1.2 1.3 1.8 1.5 2.5 4.5 3.8 6.7 1.7 1.0 1.6 1.6 2.1 2.5 3.3 3.8 4.1 5.0 6.7 7.7 9.6 13.1 8.8 8.8 11.2 15.0 20.7 23.9 69.8 86.3 97.6 117.4 49.4 57.2 65.9 75.2 86.7 100.0 114.8 Tax Cuts Extended4 AMT AMT Revenue Taxpayers ($ billions)3 (millions)2 1.3 2.1 2.5 3.3 3.5 3.5 23.4 26.5 29.3 32.4 35.1 38.1 41.1 43.6 46.7 49.6 52.6 8.8 8.8 11.2 15.0 20.7 23.9 69.8 86.3 97.6 117.4 132.4 150.2 169.7 189.7 212.6 238.0 265.2 Tax Cuts Repealed5 AMT Taxpayers AMT Revenue ($ (millions)2 billions)3 1.7 3.8 4.2 5.1 6.4 8.1 10.2 12.3 14.2 16.5 18.5 20.9 24.1 27.2 31.0 35.2 39.2 11.7 14.0 15.0 17.1 19.8 23.4 28.4 33.2 37.3 43.4 49.5 57.2 66.0 75.3 86.7 100.0 114.9 Sources: Urban-Brookings Tax Policy Center Microsimulation Model (versions 0304-3 and 1006-1); Harvey and Tempalski (1997); private communication from Jerry Tempalski; and IRS. (1) Calendar years. The data for the years 1970 to 1998 has been obtained from Harvey and Tempalski (1997) table 2 and private communications. For the years 1999 to 2000, the number of AMT taxpayers and the AMT revenue under current and extended law have been calculated by adding TPC microsimulation model (version 0304-3) estimates of the number of taxpayers with lost credits and the revenue due to these lost credits to the IRS published actual figures for those with direct AMT liability; for 200104 the number has been calculated by adding the TPC microsimulation model (version 1006-1) estimates of the number of taxpayers with lost credits or reduced deductions but no direct liability and the revenue due to those taxpayers to IRS published actual figures for those with direct AMT liability. For 2005-15 under all three scenarios, and for pre-EGTRRA law from 2001-4, estimates are from the TPC microsimulation model (version 1006-1). (2) Includes those with direct AMT liability on Form 6251, those with lost credits, and (for years 2001-2017) those with a reduced deduction. Tax units that are dependents of other taxpayers are excluded from the analysis. (3) Includes direct AMT liability on Form 6251, lost credits, and (for years 2001-2017) the revenue due to reduced deductions. (4) Includes extension of all provisions in current law that sunset in 2010. (5) Pre-EGTRRA law.