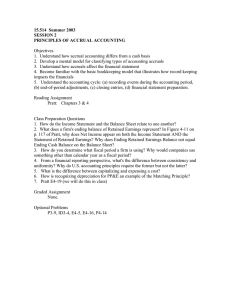

Pretest Chapter 22

advertisement

Pretest Chapter 22 1. Accounting changes are often made and the monetary impact is reflected in the financial statements of a company even though, in theory, this may be a violation of the accounting concept of a. materiality. b. consistency. c. conservatism. d. objectivity. 2. A company changes from percentage-of-completion to completed-contract, which is the method used for tax purposes. The entry to record this change should include a a. debit to Construction in Process. b. debit to Cumulative Effect of Change in Accounting in the amount of the difference on prior years, net of tax. c. debit to Retained Earnings in the amount of the difference on prior years, net of tax. d. credit to Deferred Tax Liability. 3. When a company decides to switch from capitalizing certain marketing costs to expensing these costs, this change should be handled similarly to a a. change in accounting principle. b. change in accounting estimate. c. prior period adjustment. d. correction of an error. Pretest Chapter 22 4. If, at the end of a period, a company erroneously excluded some goods from its ending inventory and also erroneously did not record the purchase of these goods in its accounting records, these errors would cause a. the ending inventory and retained earnings to be understated. b. the ending inventory, cost of goods sold, and retained earnings to be understated. c. no effect on net income, working capital, and retained earnings. d. cost of goods sold and net income to be understated. 5. Accrued salaries payable of $ 17,000 were not recorded at December 31, 2004. Office supplies on hand of $ 8,000 at December 31, 2005 were erroneously treated as expense instead of supplies inventory. Neither of these errors was discovered nor corrected. The effect of these two errors would cause a. 2005 net income to be understated $ 25,000 and December 31, 2005 retained earnings to be understated $ 8,000. b. 2004 net income and December 31, 2004 retained earnings to be understated $ 17,000 each. c. 2004 net income to be overstated $9,000 and 2005 net income to be understated $ 8,000. d. 2005 net income and December 31, 2005 retained earnings to be understated $ 8,000 each.