THE URBAN INSTITUTE A Primer on

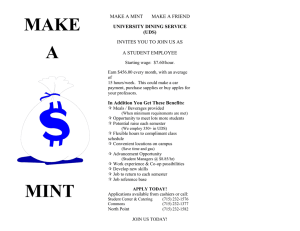

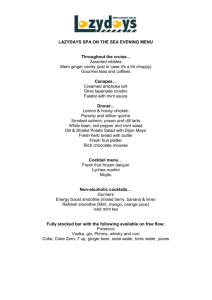

advertisement