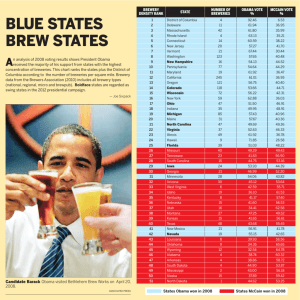

A P 2008 C

advertisement