China woes create Asian buying opportunity Talking Point

advertisement

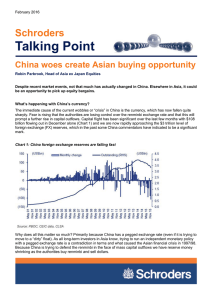

January 2015 Talking Point China woes create Asian buying opportunity Robin Parbrook, Head of Asia ex Japan Equities What’s happening with China’s currency? The immediate cause of the current wobbles or “crisis” in China is the currency, which has now fallen quite sharply. Fear is rising that the authorities are losing control over the renminbi exchange rate and that this will prompt a further rise in capital outflows. Capital flight has been significant over the last few months with $108 billion flowing out in December alone (Chart 1) and we are now rapidly approaching the $3 trillion level of foreign exchange (FX) reserves, which in the past some China commentators have indicated to be a significant mark. Chart 1: China foreign exchange reserves are falling fast Source: PBOC, CEIC data, CLSA Why does all this matter so much? Primarily because China has a pegged exchange rate (even if it is trying to move to a “dirty” float). As all long-term investors in Asia know, trying to run an independent monetary policy with a pegged exchange rate is a contradiction in terms and what caused the Asian financial crisis in 1997/98. Because China is trying to defend the renminbi in the face of mass capital outflows we have reserve money shrinking as the authorities buy renminbi and sell dollars. Despite significant intervention the currency is still falling. This is not a good place for any central bank to be in, particularly when you are coming off the end of one of the largest credit bubbles ever seen in the history of modern finance. The tightening of liquidity is of course raising worries about the fragile financial system and causing a selloff in risk assets. Chart 2 sums up the situation well - China has now moved into the bottom left quadrant. Schroder Investment Management Australia Limited ABN 22 000 443 274 Australian Financial Services Licence 226473 Level 20 Angel Place, 123 Pitt Street, Sydney NSW 2000 Talking Point: January 2016 Chart 2: Four stages of EM Crisis Source: CHA-AM Advisors Where next? So where does China go from here? If the outflows continue, we think the consequences could be significant. The problems of an over-lent banking system and, in particular, a weak and overleveraged corporate sector will soon become apparent. We now think the authorities are running out of options (hence the policy flip-flops and uncertainty). However, with equity markets in China off very sharply we have at last moved on from the false belief that many pundits in financial markets used to peddle that the authorities had some magic wand to make all the problems disappear. The end game looks increasingly clear – a more material fall in the renminbi is likely, significant bad debts will start to appear, and nominal GDP growth will be sub 5% (at best). We are likely to see further falls in A-share equity markets which still look very materially overvalued and we can in due course expect volatility in the Chinese bond markets both on and offshore. No full-blown financial crisis We plan to discuss in more detail how we see the Chinese credit bubble potentially unravelling in our soon-tobe-published “Year of the Monkey” annual report. We should, however, highlight that we still think a full-blown financial crisis is unlikely in China unless we see further significant policy mistakes and flip-flopping. China still controls the banks, runs a large current account surplus, has a starting point of relatively low central government debt/GDP so can absorb some of the bad debts and has a high savings rate with a partially closed capital account. On a positive note, we are also seeing some rebalancing in China as services growth outstrips industrial growth, and the Eastern seaboard (the “good” provinces) look much healthier than inland and Northern provinces. Asian equity valuations reflect gloom With markets starting to discount a very gloomy outlook for China and panic setting in we have started to raise the equity exposure of some of our portfolios. The outlook for the region may be poor but as mentioned above, we don’t forecast a renewed financial crisis. Lower commodity prices should eventually help Asian economies and Asian stockmarkets are now back to the levels they fell to during the eurozone crisis of 2011. In a nutshell, we increasingly believe a pessimistic outlook is discounted in the region. We have reduced our hedges and started to accumulate selected blue chip names in Taiwan and Hong Kong – mostly Asian-listed Schroder Investment Management Australia Limited 2 Talking Point: January 2016 global leaders in the technology and manufacturing space, often stocks that should benefit from a falling renminbi. We have also added to defensive yield names, some of which have been sold off heavily due to redemption pressures on income funds. We remain cautious on ASEAN equities, however, where valuations in the main look high and earnings expectations are still unrealistic (consensus expectations are for an acceleration in 2016 earnings growth despite rising deflationary pressures and sluggish economies). China is relatively easy – we are staying very much on the sidelines. We are happy to wait and see if “good” China (private sector technology, internet, service, consumer related) names come our way as the panic and turmoil spreads. Overall we will use further falls in Asian equities as an opportunity to invest in good quality businesses. The situation is not pretty and China is truly in a difficult spot but investors should always remember there is no correlation between GDP growth and stockmarket returns in Asia – least of all in China as Chart 3 most dramatically shows. Rising bad debts, collapsing Asian equity markets and turmoil in China are, we believe, a buying opportunity as the long awaited economic cycle and creative destruction kick in. Chart 3: Maybe a ‘new’ China economic model will lead to better stockmarkets Source: MSCI, Factset. Important Information: Opinions, estimates and projections in this article constitute the current judgement of the author as of the date of this article. They do not necessarily reflect the opinions of Schroder Investment Management Australia Limited, ABN 22 000 443 274, AFS Licence 226473 ("Schroders") or any member of the Schroders Group and are subject to change without notice. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by us. Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this article. Except insofar as liability under any statute cannot be excluded, Schroders and its directors, employees, consultants or any company in the Schroders Group do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this article or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this article or any other person. This document does not contain, and should not be relied on as containing any investment, accounting, legal or tax advice. Schroders may record and monitor telephone calls for security, training and compliance purposes. Schroder Investment Management Australia Limited 3