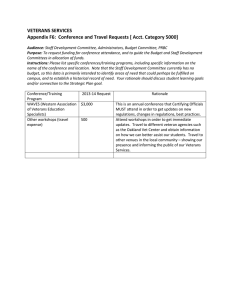

Uninsured Veterans and Family Members: Summary

advertisement