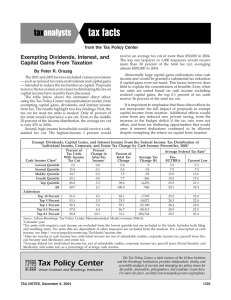

24-May-07 PRELIMINARY RESULTS Lowest Quintile Second Quintile

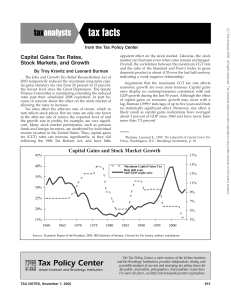

advertisement

24-May-07 http://www.taxpolicycenter.org PRELIMINARY RESULTS Table T07-0150 Distribution of Capital Gains and Tax Rates on Gains by Cash Income Percentiles, 2010 1 Tax Units3 Cash Income Percentile2 Number (thousands) Percent of Total Returns with Percent of Capital Gains Returns with (thousands) Gains Percent of Returns in Class Total Gains ($ millions) Percent of Total Gains Tax on Gains Average Tax Marginal Tax ($ millions) Rate (Percent) Rate (Percent) Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All 30,349 30,951 30,935 30,943 30,945 154,718 19.6 20.0 20.0 20.0 20.0 100.0 1,598 2,709 3,858 7,487 14,934 30,770 5.2 8.8 12.5 24.3 48.5 100.0 5.3 8.8 12.5 24.2 48.3 19.9 2,519 6,177 10,006 28,438 622,386 673,818 0.4 0.9 1.5 4.2 92.4 100.0 4.1 47.3 140.0 1,113.4 74,389.2 75,705.3 0.2 0.8 1.4 3.9 12.0 11.2 0.3 0.9 2.2 8.3 14.8 14.1 Addendum Top 10 Percent Top 5 Percent Top 1 Percent Top 0.5 Percent Top 0.1 Percent 15,472 7,734 1,547 774 155 10.0 5.0 1.0 0.5 0.1 9,315 5,537 1,325 686 146 30.3 18.0 4.3 2.2 0.5 60.2 71.6 85.6 88.7 94.2 590,415 556,930 455,160 410,198 313,200 87.6 82.7 67.5 60.9 46.5 72,708.7 69,778.5 57,174.7 51,548.3 39,777.9 12.3 12.5 12.6 12.6 12.7 15.0 15.1 14.5 14.5 14.6 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). (1) Calendar year. Capital gains are net positive long-term gains. Tax on gains is the difference between current-law income tax and tax that would be owed if long-term capital gains were set to the minimum of the current value and zero. Average tax rate is total tax divided by net positive long-term gains. Marginal tax rate is weighted by net positive long-term capital gains. (2) Tax units with negative cash income are excluded from the lowest quintile but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.