Global and China Gypsum Board Industry Report, 2012-2013 July 2013

advertisement

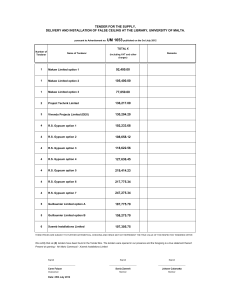

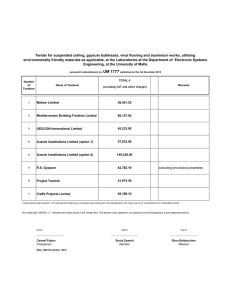

Global and China Gypsum Board Industry Report, 2012-2013 July 2013 STUDY GOAL AND OBJECTIVES METHODOLOGY This report provides the industry executives with strategically significant Both primary and secondary research methodologies were used competitor information, analysis, insight and projection on the in preparing this study. Initially, a comprehensive and exhaustive competitive pattern and key companies in the industry, crucial to the search of the literature on this industry was conducted. These development and implementation of effective business, marketing and sources included related books and journals, trade literature, R&D programs. marketing literature, other product/promotional literature, annual reports, security analyst reports, and other publications. REPORT OBJECTIVES Subsequently, telephone interviews or email correspondence To establish a comprehensive, factual, annually updated and cost- was conducted with marketing executives etc. Other sources effective information base on market size, competition patterns, included related magazines, academics, and consulting market segments, goals and strategies of the leading players in the companies. market, reviews and forecasts. To assist potential market entrants in evaluating prospective acquisition and joint venture candidates. To complement the organizations’ internal competitor information INFORMATION SOURCES The primary information sources include Company Reports, and National Bureau of Statistics of China etc. gathering efforts with strategic analysis, data interpretation and insight. To suggest for concerned investors in line with the current development of this industry as well as the development tendency. To help company to succeed in a competitive market, and Copyright 2012 ResearchInChina understand the size and growth rate of any opportunity. Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com Abstract Since 2006, China has issued a dozen of laws & regulations and policies on promoting new building materials. As a kind of ideal material to construct green building, the gypsum board can not China Gypsum Board Output, 2006-2013 (mln sq meters) only maximize housing functions to meet the specific needs for living and working, but also go with the tide of developing green economy. In 2003-2012, China’s gypsum board output soared from 173 million sq meters to 2.121 billion sq meters, with the CAGR of 28.48%. The floor space of buildings completed determines the demand for gypsum boards in a direct way. In 2012, the floor space of buildings completed nationwide saw a steep decline year-on-year, leading to the nationwide growth in demand for gypsum boards dropping by roughly 12% year-on-year to 2.5 billion sq meters. As a result, the gypsum board output growth rate was on a year-onyear dive by 14.37%. It is estimated that China’s demand for gypsum boards will keep up with the growth by around 10%-15% with the synergy of increasing urbanization rate and market penetration rate as well as house remolding. Copyright 2012ResearchInChina Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com In the gypsum board market of China, Beijing New Building Material (Group) holds precedence under the severe competition circumstances. And no other domestic counterparts featuring small production scale but foreign industrial players including Germany-based Knauf, Australia-based Boral and France-based Saint-Gobain, are in the position to compete with Beijing New Building Material (Group). In 2012, the gypsum board output of Beijing New Building Material (Group) hit 1.044 billion sq meters, accounting for 49.2% of China’s Saint-Gobain is one of the first transnational building material corporations that have marched into the Chinese market, with 54 subsidiaries all across China. In the gypsum board product field, in particular, it has established three production bases in China respectively in Shanghai, Changzhou and Huludao with the collective output hitting 90 million sq meters so far. And it has stretched its commercial arm towards Northeast China and North China from East China to develop its gypsum board business. total. In particular, the company’s “dragon” gypsum board products are oriented to high-end product market with the market occupancy surpassing 50%, while its “Taishan” gypsum board products are targeted at low- and medium-end markets. With the advantages in scale and product line, the “Taishan” gypsum board products are more competitive in the market. Beijing New Building Material (Group) is still accelerating the capacity layout in around China. In 2012, the gypsum board capacity of the company recorded 1.65 billion sq meters, of which, “Dragon” brand’s contributed 450 million sq meters while “Taishan” 1.2 billion sq meters. Thus far, the company has had seven production lines under construction with the collective capacity The report analyzes the supply and demand scale in global and China gypsum board market, and highlights major industrial players both at home and abroad. expecting 260 million sq meters. The estimates show its expectation of 2 billion sq meters of gypsum board capacity by 2015 will be realized in advance. Copyright 2012ResearchInChina Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com Table of contents 1. Gypsum Products 1.1 Gypsum Ore and Application 1.1.1 Breif Introduction 1.1.2 Grading & Application 1.2 Classification of Gypsum Products 2. Development of Global Gypsum Board Ind ustry 2.1 Supply 2.2 Demand 3. Development of China Gypsum Board Indu stry 3.1 Reserves and Distribution of Gypsum Resou rces 3.2 Supply 3.3 Market Structure 3.3.1 Regional Pattern 3.3.2 Enterprise Competition 3.4 Demand 3.4.1 Real Estate Market 3.4.2 Demand Structure 3.4.3 Demand Scale 4.Key Foreign Companies 4.1 Saint-Gobain 4.1.1 Profile 4.1.2 Operation 4.1.3 Gypsum Board Business 4.1.4 Gypsum Board Business in China 4.2 Knauf 4.2.1 Profile 4.2.2 Gypsum Board Business in China 4.3 Boral 4.3.1 Profile 4.3.2 Operation 4.3.3 Gypsum Board Business in China 4.4 LAFARGE 4.4.1 Profile 4.4.2 Operation 4.4.3 Gypsum Board Business in China 4.5 Etex 4.5.1 Profile 4.5.2 Operation 4.5.3 Gypsum Board Business 4.6 USG 4.6.1 Profile 4.6.2 Operation 4.6.3 Gypsum Board Business 4.7 National Gypsum (NGC) 5. Leading Chinese Companies 5.1 Beijing New Building Material (Group) 5.1.1 Profile 5.1.2 Operation 5.1.3 Revenue Structure 5.1.4 Gross Margin 5.1.5 Capacity and Planning of Gypsum Boar d 5.2 Zhongxing Gypsum Board 5.3 Jason Plasteboard Group 5.4 Baier Group 5.5 Dehua TB New Decoration Material Co., Ltd. 5.5.1 Profile 5.5.2 Operation 5.6 Hangzhou King Coconut Holding Group Co., Ltd. 5.7 Xuefeng Building Material Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com Selected Charts Grading and Application of Gypsum Classification of Gypsum Products Global Gypsum Output by Region, 2011-2012 Gypsum Supply of America, 2008-2012 Plasterboard Sales in America, 2008-2012 Main Plasterboard Manufacturers in America Main Plasterboard Manufacturers in Europe Per Capita Plasterboard Consumption Worldwide, 2011 Plasterboard Consumption Demand Structure in the US, 2011 Proved Reserves of Gypsum Ore, 2006-2011 Plasterboard Output in China, 2006-2013 China Plasterboard Output by Region, 2012 China Plasterboard Market Structure by Enterprise, 2011 Market Layout of Main Plasterboard Companies in China, 2012 Capacities of Three Major Foreign Plasterboard Companies in China, 2012 China Plasterboard Market Structure by Product Grade, 2011 Investment in Real Estate in China and Growth Rate, 2006-2013 Floor Space of Building Completed and Growth Rate in China, 2006-2013 Floor Space of Building under Construction and Growth Rate in China, 2006-2013 Floor Space of Residence Completed and Growth Rate in China, 2006-2013 Floor Space of Residence under Construction and Growth Rate in China, 2006-2013 Floor Space of Commercial Properties Completed and Growth Rate in China, 2006-2013 Floor Space of Commercial Properties under Construction and Growth Rate in China, 2006-2013 Floor Space of Office Buildings Completed and Growth Rate in China, 2006-2013 Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com Selected Charts Floor Space of Office Buildings under Construction and Growth Rate in China, 2006-2013 China Plasterboard Consumption Demand Structure, 2011 Demand in China Plasterboard Market, 2010-2015E Net Sales and Net Income of Saint-Gobain, 2007-2012 Net Sales and Operating Income of Saint-Gobain by Business, 2012 Financial Indices of Construction Products Sector of Saint-Gobain, 2008-2012 Sales and Operating Income from Construction Products Sector of Saint-Gobain, 2008-2012 Gypsum Building Material Business of Saint-Gobain Revenue of Saint-Gobain in China, 2002-2012 Revenue and Total Profit of Subsidiaries under Saint-Gobain Gypsum Building Material (China), 2007-2009 Revenue and Total Profit of Main Subsidiaries under Knauf China, 2007-2009 Revenue and Net Income of Boral, FY2007-FY2013 Revenue of Boral by Product, FY2012 Revenue and EBIT from Building Products Business of Boral, 2010-2012 Revenue from Building Products Business of Boral by Product, 2012 Revenue of LAFARGE by Business, 2010-2012 Revenue and Net Income of LAFARGE, 2007-2013 Revenue and Net Income of Etex, 2007-2012 Revenue of Etex by Product, 2012 Gypsum Building Material Subsidiaries Purchased by Etex, 2011 Revenue and Net Income of USG, 2007-2013 Revenue of USG by Business, 2010-2013 Plasterboard Shipment and Price of USG, 2007-2013 Main Subsidiaries under North American Gypsum Revenue and Operating Profit (Negative Value) of North American Gypsum, 2010-2013 Gypsum Mines & Gypsum Board Plants of NGC in the US. Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com Selected Charts Revenue and Net Income of Beijing New Building Material (Group), 2007-2013 Revenue of Beijing New Building Material (Group) by Product, 2010-2012 Revenue of Beijing New Building Material (Group) by Region, 2010-2012 Gross Margin of Beijing New Building Material (Group) by Product, 2009-2012 Plasterboard Capacity of Beijing New Building Material (Group), 2008-2015E Ongoing Plasterboard Investment Projects of Beijing New Building Material (Group), 2013 Revenue and Total Profit of Baier Building Materials, 2007-2009 Revenue and Net Income of Dehua TB New Decoration Material Co., Ltd., 2008-2013 Revenue and Net Income of Prada Group, 2008-2012 Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com How to Buy You can place your order in the following alternative ways: Choose type of format 1.Order online at www.researchinchina.com PDF (Single user license) …………..1,200 USD 2.Fax order sheet to us at fax number:+86 10 82601570 Hard copy 3. Email your order to: report@researchinchina.com ………………….……. 1,300 USD PDF (Enterprisewide license)…....... 1,900 USD 4. Phone us at +86 10 82600828/ 82601561 Party A: Name: Address: Contact Person: E-mail: ※ Reports will be dispatched immediately once full payment has been received. Tel Fax Payment may be made by wire transfer or Party B: Name: Address: Beijing Waterwood Technologies Co., Ltd (ResearchInChina) Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Liao Yan Phone: 86-10-82600828 credit card via PayPal. Contact Person: E-mail: report@researchinchina.com Fax: 86-10-82601570 Bank details: Beneficial Name: Beijing Waterwood Technologies Co., Ltd Bank Name: Bank of Communications, Beijing Branch Bank Address: NO.1 jinxiyuan shijicheng,Landianchang,Haidian District,Beijing Bank Account No #: 110060668012015061217 Routing No # : 332906 Bank SWIFT Code: COMMCNSHBJG Title Format Cost Total Room 502, Block 3, Tower C, Changyuan Tiandi Building, No. 18, Suzhou Street, Haidian District, Beijing, China 100080 Phone: +86 10 82600828 ● Fax: +86 10 82601570 ● www.researchinchina.com ● report@researchinchina.com