Global and China Small and Medium-sized Display Device Industry Report, 2009- 2010

advertisement

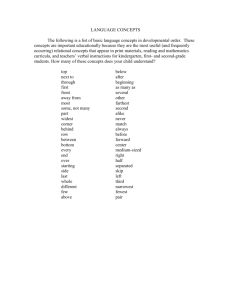

Global and China Small and Medium-sized Display Device Industry Report, 20092010 Generally speaking, the display devices below 10 inches are defined as small & medium-sized display devices. Year 2010 has witnessed several significant changes in small & medium-sized panel industry. Firstly, Japanese enterprises have experienced downslide in revenue. Japanese small & medium-sized panel manufacturers are mainly export-oriented due to the narrow domestic market. The already high prices of Japanese products have been further driven up by the JPY appreciation in 2009 and 2010. Although Japanese products deliver excellent performance and hold irreplaceable positions in many fields, manufacturers still prefer to reduce the purchase of Japanese products over cost concerns. Sharp, Epson Imaging Devices (EID) and Hitachi Displays, especially EID, have suffered various degrees of decline. As early as 2006, EID misjudged the situation and focused on the exclusive TFD technology, which resulted in the serious lag in TFT-LCD field and the downslide for four successive years. Other Japanese small & medium-sized panel manufacturers like NEC, Mitsubishi Electric and Sony Mobile Display give priority to supplying parent company. NEC and Mitsubishi Electric see poor performance and shrunk demand for small & medium-sized panels. Secondly, the originally large-sized TFT-LCD centered manufacturers have increased their investment in small & medium-sized field. Traditional small & medium-sized panel manufacturers energetically expand the revenue from other fields while cutting down the investment in their main businesses. Along with the mushrooming of high-generation TFT-LCD production lines above G5, the competitiveness of existing large-sized TFT-LCD production lines of G5 and below fall sharply in the large-size field, which brings no choice but only to increase the investment in small & mediumsized field. HannStar has experienced the most significant growth. Formerly almost without any products in small & medium-sized panel field, it took advantage of the explosive development of netbook in 2009 and aggressively entered the small & medium-sized field. The revenue of HannStar from small & medium-sized field in 2009 almost sextupled that in 2008. In 2010, HannStar has entered digital photo frame and mobile phone fields, and the shipment has risen substantially by over four folds from 2009, but the revenue has not seen clear increase. LG Display, originally with little investment in small & medium-sized field, has become the display screen supplier for Apple iPhone 4 and iPad after defeating Sharp. The display screen of iPhone 4 currently has the highest pixel density among the same size display screens, almost reaching the limit of visual resolution. Traditional small & medium-sized panel manufacturers cannot withstand the aggressive price offensive from traditional large-sized TFT-LCD manufacturers, so, they expand the investment in other fields. A case in point, Wintek, once the mobile phone display screen manufacturer with the global largest shipment, increased its investment in touch screen field in 2009. The touch screen revenue occupied 29% of the total revenue of Wintek in2009,and climbed sharply to 63% in 2010, and is estimated to reach 76% in 2011. Nevertheless, Varitronix proclaimed downright retreat from mobile phone display field at the end of 2009 while enhancing the investment in on-board display field. Thirdly, mergers and acquisitions have sprung up continuously. Taiwan Innolux purchased Toppoly, the largest supplier of Nokia mobile phone screens, and at the end of 2009, Innolux and ChiMei Optoelectronics were merged into Taiwan’s No.1 and global No.3 TFT-LCD manufacturer as well as the small & medium-sized panel manufacturer with the largest shipment worldwide. On the other hand, the deeply trapped EID also tried to merge with Sony Mobile Display. At the end of 2009, LG Display acquired the OLED business of KODAK, the OLED originator, and AUO bought TMD’s LTPS TFT-LCD plant in Singapore. AM-OLED turns out to be the hottest subject in 2010. After years of perseverance, Samsung Mobile Display (SMD), incorporated by the display business of Samsung SDI and the small and medium-sized display business of Samsung Electronics, has achieved breakthrough in AM-OLED field with greatly increased shipment. As Samsung, HTC and Lenovo have launched AM-OLED mobile phones on a large scale, the demand for AM-OLED has exceeded the supply. LG Display and AUO have also increased the investment in OLED field. However, only SMD has achieved mass production of AM-OLED, and suppliers have absolute advantages, consequently, a majority of the manufacturers refuse to adopt OLED as the main display screen. Just as they have done in lithium battery, polysilicon, and LED fields, mainland China enterprises are swarming into the OLED field, with proclaimed investment of at least RMB30 billion. What deserves to be mentioned is that OLED field has extremely high technical thresholds. For example, RiTdisplay, the world’s second largest OLED manufacturer founded in 2000, can only manufacture the increasingly downfallen PM-OLED instead of AM-OLED despite a decade’s efforts. RiTdisplay currently devotes itself to the exploitation of touch screen field and might ultimately withdraw from the OLED field. While Japan’s Tohoku Pioneer Corporation, the world’s first enterprise achieving mass production of OLED, cannot realize mass production of AM-OLED at present. Another threshold of OLED is the need for TFT-LCD production line, LTPS TFT-LCD production line may as well, which also shapes the major reason why the global No.2~5 OLED enterprises, all without TFT-LCD production lines, cannot carry out mass production of AM-OLED. It is also why AUO took the purchase of TMD’s LTPS TFT-LCD plant as the first step into the OLED field. As for mainland China, except Tianma, all the other manufacturers who attempt to enter OLED field possess no TFT-LCD production lines. Table of Contents • 1. Profile of Small & Medium-sized Panel • 1.1 Definition and Classification • 1.2 TFT-LCD Profile • 1.3 TFT-LCD Industry Chain • 2. Status Quo and Future of Small & Mediumsized Panel Industry • 3.2 Manufacture • 3.3 Preparation Materials • 3.4 Status Quo and Future • 3.5 Visionox • 3.6 RiTdisplay • 3.7 Irico • 3.8 Sichuan CCO Display Technology Co., Ltd. (CCO) • 2.1 Industrial Scale of Small & Medium-sized Panel • 2.2 Current Technology of Small & Medium-sized Panel • 2.3 Downstream Application of Small & Mediumsized Panel 4. Downstream Market of Small & Mediumsized Display • 4.1 Mobile Phone • 4.2 Smart Phone Market and Industry • 4.3 Status Quo and Future of Mobile Phone Display Screen • 4.4 Market Pattern of Mobile Phone Display Screen • 4.5 E-reader • • • • 2.4 Regional Distribution of Small & Medium-sized Panel 2.5 Comparison among Small & Medium-sized Panel Manufacturers 2.6 Japanese Small & Medium-sized Panel • 3. OLED • 4.6 Cost Analysis of E-reader & iPad • 3.1 Profile • 4.7 E Ink Holdings Inc. • 4.8 Digital Camera • 5.16 Sharp • 4.9 Digital Photo Frame • 5.17 Hitachi Display • 4.10 Tablet PC (iPad) and Netbook • 5.18 BYD Electronic • 4.11 On-board Display • 5. Small & Medium-sized Panel Manufacturers • 5.1 TMD • 5.2 HannStar • 5.3 Chunghwa Picture Tubes, Ltd. (CPT) • 5.4 Chimei Innolux Corporation • 5.5 Giantplus Technology Co., Ltd. • 5.6 AUO • 5.7 Wintek • 5.8 Truly Semiconductors Ltd. (Truly Semi.) • 5.9 Tianma • 5.10 BOE • 5.11 SMD • 5.12 EID • 5.13 LG Display • 5.14 Varitronix • 5.15 Lead Communications Ltd. Selected Charts • • • • • • • • • • • • • • • • • • • • • Classification of Display Technology TFT-LCD Manufacturing Technology Phase ?: ARRAY TFT-LCD Manufacturing Technology Phase II: CELL TFT-LCD Manufacturing Technology Phase III: MODULE Taiwan LCD Industry Chain Revenue and Growth of Global Small & Medium-sized Panel Industry, 2004-2011 Global Small & Medium-sized Panel Shipment, 2004-2011 Output Value of Global Small & Medium-sized Panel by Technology, 2009-2010 Global Small & Medium-sized Panel Shipment by Technology, 2009-2010 Output Value of Global Small & Medium-sized Panel by Application, 2010 Global Small & Medium-sized Panel Shipment by Application, 2010 Output Value of Global Small & Medium-sized Panel by Region, 2010 Global Small & Medium-sized Panel Shipment by Region, 2010 Market Share of Global Major Small & Medium-sized Panel Manufacturers by Revenue, 2009 Market Share of Global Major Small & Medium-sized Panel Manufacturers by Revenue, 2010 Market Share of Global Major Small & Medium-sized Panel Manufacturers by Shipment, 2009 Market Share of Global Major Small & Medium-sized Panel Manufacturers by Shipment, 2010 Revenue of Japanese LCD Companies, 2004-2009 OLED Framework PMOLED Driving Principle AMOLED Driving Principle • • • • • • • • • • • • • • • • • • • • • • • • Three Realization Modes of Full Color OLED Comparison among Three Color Matrixes of Full Color OLED OLED Manufacturing Process Global OLED Output Value and Growth, 2006-2013E Global OLED Output Value by Technology, 2006-2013E Shipment of AM-OLED & PM-OLED, 2006-2013E PM-OLED Shipment by Application, 2007-2010 AM-OLED Shipment by Application, 2007-2013E Market Share of Global Major OLED Manufacturers by Revenue, 2009 Global Mobile Phone Shipment, 2007-2014E Global Mobile Phone Quarterly Shipment and Annual Growth, 2007Q1-2010Q2 Global Mobile Phone Quarterly Shipment by Region, 2007Q1-2010Q2 Global Mobile Phone Quarterly Shipment by Technology, 2007Q1-2010Q2 Global CDMA/WCDMA Mobile Phone Shipment by Region, 2006-2010 Shipment of Global Major Mobile Phone Manufacturers, 2010Q1-Q2 Shipment of Various Operating Systems by Mobile Phone Manufacturer Global Mobile Phone Display Screen Shipment by Technology, 2007-2014E Global Mobile Phone Display Screen Shipment by Size, 2007-2014E Market Share of Global Major Mobile Phone Display Screen Manufacturers by Shipment, 2010 Market Share of Global Major Mobile Phone Display Screen Manufacturers by Revenue, 2010 Nokia Mobile Phone Display Screen Shipment by Major Supplier, 2010 Smart Phone Display Screen Shipment by Major Supplier, 2010 Market Share of Major Mobile Phone Display Screen Manufacturers in China by Revenue, 2010 Market Share of Major E-reader Manufacturers, 2010 • • • • • • • • • • • • • • • • • • • • • • • • • Cost Structure of E-reader, 2009 Cost Structure of E-reader, 2010 Cost Structure of iPad, 2010 Revenue, Gross Margin, and Operating Margin of E Ink Holdings Inc., 2005-2011E Digital Camera Shipment, 2004-2011E Market Share of Global Major Digital Camera Manufacturers (by Sales Volume), 2009 Market Share of Global Digital Camera Display Screen Suppliers (by Shipment), 2010 Digital Photo Frame Shipment and Growth, 2005-2011E Major Manufacturers of Digital Photo Frame Panel, 2010 Market Share of Major Tablet PC and Netbook Suppliers Market Share of Major On-board Panel Manufacturers, 2010 On-board Panel Distribution by Size, 2010 Revenue and Operating Margin of HannStar, 2003-2010 Revenue and Operating Margin of HannStar, 2009Q1-2010Q2 Small & Medium-size Shipment of HannStar, 2009Q1-2010Q2 Revenue and Operating Margin of CPT, 2004-2010 Revenue of CPT by Product, 2010Q1&Q2 CPT Large-sized TFT-LCD Panel Shipment and ASP, 2007Q1-2010Q2 CPT Small & Medium-sized TFT-LCD Panel Shipment and Revenue, 2007Q12010Q2 CPT TFT-LCD Revenue by Application, 2010Q1&Q2 Capacity of CPT Production Lines, 2010Q2 Revenue, Gross Margin, and EBITDA of Chimei Innolux, 2009Q1-2010Q2 Revenue of Chimei Innolux by Application, 2009Q1-2010Q2 Revenue of Chimei Innolux by Size, 2009Q1-2010Q2 Small & Medium-sized Panel Revenue and Shipment of Chimei Innolux, 2009Q12010Q2 • • • • • • • • • • • • • • • • • • • • • • • • • • Capacity of Chimei Innolux Production Lines, 2010Q2 Global Distribution of Giantplus Revenue and Gross Margin of Giantplus, 2002-2010 Revenue and Operating Margin of AUO, 2004-2011E AUO Small & Medium-sized Panel Revenue and Average Price, 2009Q1-2010Q4 Revenue of AUO by Application, 2009Q1-2010Q2 Capacity of AUO Production Lines, 2010Q2 Revenue and Gross Margin of Wintek, 2003-2011E Revenue and Operating Margin of Wintek, 2003-2011E Global Distribution of Wintek Revenue of Wintek by Product, 2006-2011E Wintek Client Structure, 2009-2010 Gross Margin, Net Profit Margin, and Operating Margin of Truly Semi., 2001-2009 Revenue and Gross Margin of Truly Semi., 2002-2010 LC Product Revenue of Truly Semi. by Technology, 2006-2009 Revenue and Total Profit of Tianma, 2005-2010 Revenue of Tianma by Technology, 2010 Revenue and EBITDA of SMD, 2009-2013E Quarterly Revenue and Operating Margin of SMD, 2009Q1-2010Q4 SMD Shipment and Average Selling Price, 2009Q1-2010Q4 SMD AM-OLED Capacity, 2009Q1-2012Q4 Revenue of EID by Technology, FY2006-FY2009 Revenue and Gross Margin of LG DISPLAY, 2002-2009 Revenue and Operating Margin of LG DISPLAY, 2002-2009 Quarterly Shipment and Average Price of LG DISPLAY, 2009Q2-2010Q2 Quarterly Application of LG DISPLAY Products, 2009Q2-2010Q2 • • • • • • • • • • • • • • • • • • • • • • • • • • Quarterly Output of LG DISPLAY Production Lines, 2009Q2-2010Q2 Revenue and Operating Margin of LG INNOTEK, 2005-2011E Revenue and Operating Margin of Varitronix, 2002-2008 Revenue of Varitronix by Region, 2007-2009 Revenue and Operating Margin of Sharp LCD Sector, 2005Q1-2009Q3 Revenue and Gross Margin of BYD Electronic, 2004-2010 Revenue of BYD Electronic by Sector, 2006-2010 Revenue of BYD Electronic by Region, 2009-2010 Operating Margin of Global Major Small & Medium-sized Panel Manufacturers, 20092010 Revenue of Global Major Small & Medium-sized Panel Manufacturers, 2007-2010 Capacity of Global Major OLED Production Lines, 2008-2012E Products of RiTdisplay Smart Phone Operating System Shipment, 2008-2010 TMD Revenue, 2003-2010 TMDisplay TFT-LCD Panel Production Line Parameters of Typical CPT Small & Medium-sized Products Profile and Financial Data of CPT Mainland Companies, 2009 Small & Medium-sized Products of Chimei Innolux Parameters of Giantplus Small & Medium-sized Products Mobile Phone TFT-LCD Products of AUO Small & Medium-sized Products of LG DISPLAY TFT-LCM Products of Lead Communications Ltd. TFT-LCD Panel Production Line of Hitachi Displays Mobile Phone Application Product Parameters of Hitachi Displays TFT-LCM Products of BYD Electronic Production Lines of BYD Electronic How to Buy Product details How to Order USD File Single user 2,200 PDF Enterprisewide 3,300 PDF Publication date: Sep. 2010 By email: report@researchinchina.com By fax: 86-10-82601570 By online: www.researchinchina.com For more information, call our office in Beijing, China: Tel: 86-10-82600828 Website: www.researchinchina.com