Improving Homeownership Opportunities for Hispanic Families A Review of the Literature

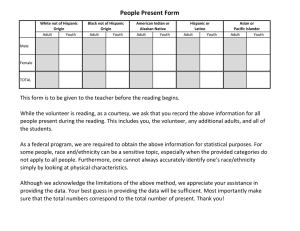

advertisement