Changing Policy. Improving Lives. Louisiana Film Tax Credits: Costly Giveaways to Hollywood

advertisement

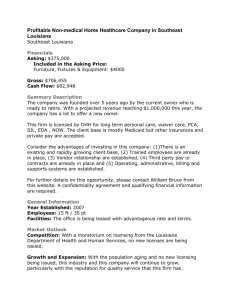

Changing Policy. Improving Lives. Louisiana Film Tax Credits: Costly Giveaways to Hollywood By Tim Mathis Imagine you run a business and the government hands you a check to cover one-third of your total expenses. If you’re in the movie business in Louisiana, there is no need to use your imagination. Because that’s exactly what state government does to lure the film industry. The Louisiana film tax credit program—born in 1992 and vastly expanded in 2002—has mushroomed into one of the nation’s costliest.1 As the state’s investments in education, health care, infrastructure, and other critical services have faced a series of severe cuts, the subsidies paid to Hollywood continue to grow—29 percent over the most recent fiscal year. Louisiana paid $231 million in credits in 2011-12, bringing the state’s total film spending to more than $1 billion over the past decade (Figure 1). “ Louisiana lawmakers ought to rein in the growing costs to state taxpayers by capping or reducing these Unfortunately, the returns to the state on this investment, like many subsidies and reallocating of the movies made here, have been a flop. While the subsidies have helped create film industry jobs that weren’t here before, many of these those dollars... positions are temporary and have come at a steep cost to taxpayers, who paid an average of more than $60,000 per direct job. ” Louisiana lawmakers ought to rein in the growing costs to state taxpayers by capping or reducing these subsidies and reallocating those dollars into endeavors that over the long haul will likely be more productive in creating jobs and building a strong economy. Background Louisiana in 1992 was the first state to roll out a major film subsidy program. A decade later, in 2002, the Legislature greatly expanded the film credits, which spurred significant growth in the state’s film industry. Movie projects—and jobs— came to the state as new film studios, camera and lighting services, soundstages and post-production facilities sprouted up. Although the program was originally slated to begin phasing out in 2010, the Legislature instead decided to make it permanent in 2009. Louisiana subsidizes the film industry by issuing tax credits to production companies. The tax credits can be used to reduce the amount owed in state income tax. But companies that owe no state taxes can still profit from the credits by selling them back to the state or to third parties. This is the case with many out-of-state motion picture investors. The Motion Picture Industry Development Tax Credit, administered by the Louisiana Department of Economic Development (LED), currently allows: • Film productions that spend more than $300,000 to qualify for a tax credit of 30 percent of all in-state expenditures such as set construction, wardrobes, makeup, lighting and sound editing, facility and vehicle rentals, food and lodging, and visual effects. A Louisiana Budget Project Report August 2012 1 • An additional tax credit of 5 percent on payroll spent on Louisiana residents (those who maintain a permanent home and spend more than six months each year within the state) working on film sets, as long as the salary does not exceed $1 million.2 State officials insist that the movie tax credit program is a success, pointing to the increase in the number of films shot in Louisiana. And, by that measure, they are right: An estimated 118 films were produced in Louisiana in 2010, up from only one in 2002. But simply increasing the number of films shot in the state is not the appropriate standard of success. Many economists argue that government subsidies that help small “infant” industries struggling to get off the ground can be appropriate in some circumstances. But such initial support should not turn into permanent corporate welfare, as it has with film industry tax credits in Louisiana. If subsidies do not lead to a self-sustaining industry, able to compete and provide permanent jobs without government help, then the state needs to invest elsewhere. By this more appropriate standard, Louisiana’s film tax credit program has failed. Rather than creating permanent, good-paying jobs, Louisiana’s program simply “rents” jobs, many of which would disappear without the subsidy. Figure 1: Louisiana has spent more than $1 billion on subsidies to film productions.* (in millions) $250 $231.0 $200 $179.5 $165.6 $150 $134.6 $92.0 $100 $70.4 $47.4 $50 $0 $101.0 $0.0 $1.5 $1.5 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Louisiana Department of Revenue * Investment, Employment and Infrastructure Subsidies Louisiana Can’t Afford Louisiana spends more than any other state on film tax credits, when measured as a percentage of the state general fund.3 This spending spree has helped Louisiana to lure a large number of “runaway productions” from Hollywood, films that seek out the economic benefits of tax breaks. As other states and countries offer their own tax credits to film productions, Louisiana responds by offering increasingly lucrative incentives just to keep up (see Appendix A and C for more detail). What has the state received for all this investment? The short answer: Not much. One common justification for government subsidies is that the state treasury ultimately ought to benefit from film industry jobs and spending, with more funds available for investments in education, health care, infrastructure, public safety and other vital services. But a recent independent study tells a much different story. In 2010, film production in Louisiana generated $27 million in state tax revenues and $17.3 million in local tax revenues, according to an analysis by the BaxStarr Consulting Group. This compares to the $196.8 million the state spent on film tax credits.4 In other words, for every dollar of revenue the state received, the state paid $7.29. People are getting rich on this deal, and it’s not Louisiana taxpayers. Those findings were backed up by an earlier report from Greg Albrecht, the chief economist of the Louisiana Legislative Fiscal Office. Albrecht’s 2005 study estimates that state government can expect to recover only 16 to 18 percent of tax revenue lost to film tax credits. And according to the latest figures from LED, Louisiana recovered approximately 16 percent in 2008, 14.2 percent in 2009, and 13.7 percent in 2010.5 2 Film tax credits are not the only entertainment media subsidy on which Louisiana loses money. The Live Performance Production Tax Credit Program—which subsidizes theater productions—costs taxpayers $4.17 for every dollar earned. The Digital Interactive Media Tax Credit Program (which subsidizes video-game makers and smart-phone applications developers) costs $10.69 for every tax dollar earned. The most recent LED-sponsored study on film tax credits points out that productions are spending more of their overall budgets within Louisiana—almost two-thirds in 2010. This is not surprising, given that Louisiana’s generous subsidy only applies to in-state expenditures and more locally-owned firms are able to provide services. But even if productions spent their entire budgets on goods and services in Louisiana, the state would not be able to recoup its losses. Instead, the state’s justification recalls that old business fable about losing money on every sale but making it up on volume. For example, suppose the state were able to collect the maximum amount of taxes from those employed with the film industry—6 percent on income taxes and 4 percent on sales taxes. The revenue would still fall far short of the 35 percent lost through subsidies. Film subsidies don’t pay for themselves, and the general public ultimately bears the cost of these expensive outlays. Another argument for film subsidies is that the money production companies spend in Louisiana creates ripple effects throughout the state’s economy, or what economists refer to as “multiplier effects.” As film productions spend money on goods and services in Louisiana, they support an array of individuals and businesses that, in turn, spend that money in the local economy. But Albrecht’s analysis says the multiplier effects are “quite small.”6 Much of that spending goes towards goods and services produced outside of Louisiana and salaries paid to non-residents who are less likely to spend a significant portion of their earnings in-state. Because the state government must balance its operating budget each year, every dollar that is spent on tax credits is a dollar that isn’t available for services that people look to state government to provide, such as education and health care.7 Because the subsidy is open-ended, available to any production that applies, it will become more fiscally unsustainable the more it succeeds in attracting productions to the state. On the other hand, if Louisiana were to cancel or scale back its film subsidy program, it would immediately free up money to spend on more urgent priorities. Transferable Tax Credits Benefit the Wealthy and Don’t Help the Economy Louisiana’s film tax credits are “transferable” and “refundable.” That means any tax credit not used by a production company earning the credit—either because the company’s Louisiana income tax liability is less than the amount of the credits earned, or because the company owes no state income tax—may be transferred to another Louisiana taxpayer. Corporations and individuals that buy the credits can then use them to offset their state tax liability. Unused credits can also be sold directly back to the state for 85 percent of their original value. Twenty-six states and Puerto Rico make their film tax credits either transferable or refundable.8 Only three states, including Louisiana, allow both. While anyone is free to reduce their state tax liability with film credits, the reality is that most of the benefits flow to a few wealthy taxpayers. Brokers generally sell credits in $10,000 units, making them almost exclusively available to higher income earners.9 Many buyers use them to lower their liability on their state income taxes. For example, a wealthy taxpayer can pay a broker $7,500 for $10,000 in state-certified tax credits that reduce their tax liability, for a net gain of $2,500. In 2009, 2,056 individual Louisiana taxpayers claimed credits out of more than 2 million individual income tax returns processed—only one-tenth of 1 percent. Nearly two-thirds of those claiming the credit—63.1 percent—reported net incomes above $1 million, while 92.2 percent had taxable incomes above $250,000. Most of the people claiming credits are unaffiliated with the film industry and use them to reduce their tax liabilities. “In fact,” writes Albrecht, “the purchase of credits by these residents is largely a reallocation of their savings portfolio.”10 In other words, wealthy taxpayers who claim credits are more likely to save and invest their additional disposable income rather than spend it in the state’s economy. This cuts down on any stimulating effect on our economy. Louisiana Budget Project | www.labudget.org P.O. Box 66558, Baton Rouge, LA, 70898 | 225.929.5266 3 Louisiana is one of 15 states where film tax credits are refundable, which essentially turns the program into a grant by allowing companies and individuals to simply sell their certified credits back to the state instead of transferring them to a third party through a broker. While brokers typically charge a transaction fee to transfer the credits to another taxpayer, the state will buy them back for 85 cents on the dollar. Last year alone, for example, Louisiana paid $26.3 million to Warner Brothers for the film Green Lantern. Since the state upped the buy-back program from 74 percent of face value to 85 percent, the amount directly paid to film productions rose from zero in 2008-09 to $110 million in 2011-12. The buy-back program now constitutes 48 percent of the film subsidy program (Figure 2).11 Figure 2: Film Tax Credits Claimed* (in millions) $250 $200 $150 $100 $50 Subsidizing Episodic Employment in Louisiana $0 In traditional economic development deals, the state makes an 2009 2010 2011 2012 investment in infrastructure—or temporary tax abatement—to Applied Against Corporation Income Taxes incentivize the location of a factory or office in the state. The jobs Applied Against Individual Income Taxes created by the state’s investment continue to exist without further Credits Sold Back to State assistance from the state. Employment in film production, on the other hand, is mostly short-term, as shown in Louisiana’s film industry Source: Louisiana Department of Revenue * employment data. After almost a decade of investment in film tax Investment, Employment and Infrastructure credits, the number of direct jobs in the film industry in 2010 was 2,829, and just over 2,500 in 2011, according the federal Bureau of Labor Statistics (Figure 3). That’s a cost per direct job of more than $60,000, based on the cost of film tax credits in 2010. More importantly, in order to keep many of those jobs in Louisiana, the state must continue to pay year after year.12 While some businesses have sprouted up across the state to serve the motion picture industry, the vast majority of positions subsidized by the credit are temporary. According to an estimate from the Office of Entertainment Industry Development, average employment in the state film industry lasts between four and six months. This leaves many workers unemployed afterwards, although some are able to move from one production to another over the course of a year. However great the job growth, the fact remains that the state must continue to pay in order to retain the jobs, which is an unwise use of public funds. In addition to their high cost to taxpayers and small numbers, jobs in the film industry are highly unstable from month to month. That tells us that most of the jobs are temporary and part-time. According to the Louisiana Workforce Commission, which reports monthly job numbers, there were 7,821 employees in the motion picture and sound recording industry in Louisiana as of June 2008. Within seven months, employment had declined by 74 percent, down to 2,054 (see Appendix B). Low-income families receive support in the form of income assistance or unemployment insurance benefits. These are designed to be temporary, structured to help families during financial crises until they can secure full-time employment. In contrast, Louisiana practices corporate welfare through the film tax credit program, permanently subsidizing a multi-million dollar industry. Louisiana Leads the Race to the Bottom Since Louisiana began subsidizing the film industry, more than 40 other states and Puerto Rico have followed. States are throwing money at film productions, trying to outdo each other by offering bigger and better subsidies. “The rapid spread of film tax subsidies across the country is a classic case of a race to the bottom,” wrote Robert Tannenwald in a report for the Center on Budget and Policy Priorities.14 In 2008, Michigan created numerous film tax credits for up to 42 percent of total expenditures, and Georgia increased its own state tax credit by up to 30 percent. A year later, Louisiana raised the investor credit from 25 percent to 30 percent and eliminated a planned phase-down. Louisiana Budget Project | www.labudget.org P.O. Box 66558, Baton Rouge, LA, 70898 | 225.929.5266 4 But states are now starting to wake up to the fact that these giveaways are unaffordable and unrealistic. In recent years, nine states have suspended or eliminated their film subsidy programs.15 Ultimately, it’s a race that no state can win. By offering a permanent, open-ended subsidy, Louisiana is effectively held hostage by a highly mobile film industry. Recommendations As the film credit program is currently structured, there is no limit to Louisiana’s potential revenue losses. Although film subsidies have generated new economic activity in Louisiana that would not otherwise have come, the program is not selfsustaining, and the jobs created require continuing subsidies. In the meantime, the money spent to bring film productions to Louisiana is money that is not being spent to educate children, build roads, provide health-care to the poor or any other activities that help create jobs and promote long-term economic growth. Figure 3: Film subsidies produce meager employment in Louisiana.* 5000 3948 4000 3056 3000 2156 2000 1000 2829 2543 1515 2176 2510 1814 926 896 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages (NAICS 51211 Motion picture and video production, 51212 Motion picture and video distribution, 51219 Postproduction and other related industries, and 7115 Independent artists, writers, and performers). * According to BLS, 2011 data is “preliminary.” While a case could be made for eliminating film subsidies altogether, this would be politically impractical given the strong support the program enjoys from the public and state policymakers. It also would be unfair to those who have made large infrastructure investments in Louisiana with the expectations that subsidies would continue. Still, there are several options to protect taxpayers by reining in the uncontrolled growth of this program, while still giving filmmakers an incentive to choose Louisiana. • Lower the generosity of the tax credits over a set period of time. Louisiana needs to limit the cost to taxpayers without pulling the rug out from under the industry. Rather than eliminating the subsidies outright, legislators can phase down the amount of the tax credit over a number of years to give the film industry time to stand on its own with less public support. • Place a monetary cap on the total amount of tax credits that can be claimed in a given fiscal year, as other states have done. Several states have capped their film credit programs or otherwise limited the amount of money they appropriate for them. In December 2011, Gov. Rick Snyder of Michigan signed a bill that lowered the tax credit from 42 to 32 percent of expenses, and converted the tax credit program into a direct appropriation financed through the state general fund. “In doing this,” wrote Harry David at the Tax Foundation, “Michigan recognizes, if only implicitly, that tax credits are indeed subsidies.”16 If Louisiana followed suit, it would provide fiscal constraints and greater certainty in the annual budgeting process, while increasing transparency as the public becomes more aware of the true cost of film subsidies. Louisiana Budget Project | www.labudget.org P.O. Box 66558, Baton Rouge, LA, 70898 | 225.929.5266 5 Louisiana could also look to New Mexico, which capped its program at $50 million per year. In a process known as a “rolling cap,” the state allows productions to carry leftover tax credits over into the ensuing fiscal year once the cap is reached. Not only does this make film subsidies part of the general appropriations process, it also provides the industry with the predictability it needs to make investment decisions. States that have Suspended, Unfunded, or Eliminated Film Subsidy Programs Since 2010 Arizona Eliminated Arkansas No Funds Appropriated Idaho No Funds Appropriated Indiana Expired Iowa Suspended Maine No Funds Appropriated New Jersey Suspended South Dakota Expired Washington Eliminated The film industry will argue that only an open-ended, permanent subsidy will provide the certainty it needs to invest in a two- or three-year production in Source: The Tax Foundation. Louisiana. But legislators should keep in mind that public school teachers, nurses and doctors at charity hospitals, public safety officers, and others who rely on state spending decisions also need certainty to be successful. Any meaningful reform to Louisiana’s film program should stop the state from handing out a blank check to rent-seeking productions. There are multiple ways a cap can work. Legislators could cap the total amount of film credits per year or they could limit how much each production can receive. Either way, these changes would reduce costs compared to the current open-ended film tax credits. • Eliminate the transferability of film tax credits. The current system of transferability is inefficient, and creates profits for middlemen and others who have no connection to film production. As a state consultant noted in a recent study: “(T)he process involves accountants, lawyers, and other middlemen, who also must be paid for their services…Every step in this process chips away some of the value from the incentive.”17 Since most film productions have little or no tax liability, their credits often get sold to brokers at a discount. This diminishes the impact of the tax credit for the film production that was supposed to benefit from the subsidy in the first place, while wealthy taxpayers with no connection to the project get a break on their tax bill. If legislators decide that film production is important enough to continue subsidizing with taxpayer dollars, a better system would be to only make the credit refundable. This would make the program more like a traditional appropriation, and would increase the efficiency of the program by cutting out the middleman. Moreover, productions often receive a refund check within 30 days of filing their tax return— a better deal for filmmakers than waiting months for a broker to sell the tax credit.18 Conclusion Policymakers need to stop focusing on Louisiana’s box office rankings and worry more about the rankings that matter— Louisiana’s ranking as one of the poorest, unhealthiest, and least educated states in the country. Spurring long-term job growth is critical to improving the state’s economy, and tax dollars are best spent toward investments that lead to highquality and, more importantly, lasting jobs. Otherwise, Louisiana is not creating jobs, we’re just renting them. About the Louisiana Budget Project The Louisiana Budget Project (LBP) provides independent, nonpartisan research and analysis of Louisiana fiscal issues and their impact on Louisiana families and businesses. We seek to bring wider prosperity to Louisiana though a deeper understanding of the state budget, broadening fiscal policy debates, and increasing public participation in decision-making. As part of the State Fiscal Analysis Initiative’s 42 state budget projects that are coordinated by the national Center on Budget and Policy Priorities, we uphold a commitment to issuing work that is Credible, Timely, and Accessible. Louisiana Budget Project | www.labudget.org P.O. Box 66558, Baton Rouge, LA, 70898 | 225.929.5266 6 ___________________________ End Notes 1 Tannenwald, Robert. “State Film Subsidies: Not Much Bang for Too Many Bucks.” Center on Budget and Policy Priorities. December 2010. http://www.cbpp.org/files/11-17-10sfp.pdf 2 R.S. 47:6007 3 Based on calculations by the Louisiana Budget Project. 4 Baxter, Cheryl Louise. “Fiscal & Economic Impact Analysis of Louisiana’s Entertainment Initiatives.” Bax Starr Consulting Group, LLC. April, 2011. http://www.louisianaentertainment.gov/images/louisiana_entertainment_2011_economic_impact_analysis.pdf 5 Baxter, 25. 6 Albrecht, 4. 7 Ibid., 3. 8 Luther, William. “Movie Production Incentives: Blockbuster Support for Lackluster Policy.” Tax Foundation. January 2010. http://www.taxfoundation.org/files/sr173.pdf 9 Dorothy Pomerantz. “Tinseltown Tax.” Forbes. March 27, 2006. 10 Albrecht, 6. 11 Louisiana Department of Revenue. 12 Grand, John. “Motion Picture Tax Incentives: There’s No Business Like Show Business.” State Tax Notes. March 2006. http://taxprof.typepad.com/taxprof_blog/files/2006-2997-1.pdf 13 14 15 16 Christopherson, Susan and Ned Rightor. “The Creative Economy as ‘Big Business’: Evaluating State Strategies to Lure Filmmakers.” Journal of Planning, Education, and Research. December 21, 2009. Tannenwald, Robert. “Press Release: Tax Subsidies to Attract Film and TV Productions Don’t Pay Off for States.” Nov. 2010. http://www.cbpp.org/files/11-17-10sfp-pr.pdf Henchman, Joseph. “More States Abandon Film Tax Incentives as Programs’ Ineffectiveness Becomes More Apparent.” Tax Foundation. June 2011. David, Harry. “Michigan Scales Back Its Movie Production Incentives Program.” Tax Foundation Tax Policy Blog. January 4, 2012. http://taxfoundation.org/blog/michigan-scales-back-its-movie-production-incentives-program 17 Baxter, 46. 18 Ibid. Louisiana Budget Project | www.labudget.org P.O. Box 66558, Baton Rouge, LA, 70898 | 225.929.5266 7 Appendix A Motion Picture Investor Tax Credit as of 6/2012 Fiscal Year 2006 2007 2008 2009 2010 2011 2012 Applied against Applied against Amount Paid Corporation Individual on Credits Sold Income Taxes Income Taxes Back to State $25,463,708 $27,573,849 $5,879,724 $3,906,030 $10,930,128 $22,792,352 $48,647,591 $35,849,392 $101,436,142 $83,510,837 $96,244,187 $130,005,471 $88,625,853 $71,297,653 $0 $0 $0 $0 $23,280,222 $62,660,337 $109,722,108 Total $61,313,100 $129,009,991 $89,390,561 $100,150,217 $164,215,821 $174,078,542 $229,667,352 LA Motion Picture Incentive Program as of 6/2012 Fiscal Year 2005 2006 2007 2008 2009 2010 2011 2012 to date Total Applied against Applied against Corporation Individual Income or Income Taxes Franchise Taxes $83,670 $8,107,801 $4,102,238 $1,658,005 $185,798 $768,754 $4,982,979 $931,238 $20,820,483 $1,953,664 $977,452 $1,526,703 $916,070 $631,294 $593,385 $411,897 $418,633 $7,429,098 *Sales & Use Tax Exclusion expired 1/1/2006 Source: Louisiana Department of Revenue Sales & Use * Tax Rebate $8,827 N/A N/A N/A N/A N/A N/A N/A $8,827 Buy backs Total N/A N/A N/A unknown unknown unknown unknown $0 $0 $2,046,161 $9,085,253 $5,628,941 $2,574,075 $817,092 $1,362,139 $5,394,876 $1,349,871 $28,258,408 Appendix B Monthly Employment in Louisiana’s Motion Picture and Sound Recording Industry (01/2001 through 09/2011) 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 01 02 03 Source: Louisiana Workforce Commission 04 05 06 07 08 09 10 11 Appendix C YEAR ID NUMBER PRODUCTION NAME 2006 2007 2008 2010 2010 2009 2010 2011 2009 2010 2009 2010 2011 2009 2010 2010 2009 2010 2010 2009 2009 2010 2011 2009 2010 2010 2010 2010 2010 2010 2011 2010 2009 2010 2010 2009 2010 2009 2010 2009 2010 2010 2010 2011 2010 2010 2010 2010 2010 0480‐2009 0480‐2009 0480‐2009 0480‐2009 0491‐2009 0493‐2009 0493‐2009 0493‐2009 0495‐2009 0495‐2009 0509‐2009 0509‐2009 0509‐2009 0513‐2009 0513‐2009 0516‐2009 0524‐2009 0524‐2009 0525‐2009 0528‐2009 0533‐2009 0533‐2009 0533‐2009 0535‐2009 0535‐2009 0541‐2009 0542‐2009 0543‐2009 0544‐2009 0544‐2009 0544‐2009 0545‐2009 0548‐2008 0555‐2009 0561‐2009 0565‐2009 0565‐2009 0582‐2010 0582‐2010 0586‐2010 0586‐2010 0587‐2010 0588‐2010 0588‐2010 0589‐2010 0592‐2010 0593‐2010 0598‐2010 0600‐2010 Global Assets Global Assets Global Assets Global Assets Brawler The Fantastic Flying Books of Mr. Morris Lessmore The Fantastic Flying Books of Mr. Morris Lessmore The Fantastic Flying Books of Mr. Morris Lessmore Jaws of the Mississippi Jaws of the Mississippi the Sean Payton Show the Sean Payton Show the Sean Payton Show Snatched Snatched The Mechanic Julia X Julia X Secretariat EA Sports Commercials Mortician Mortician Mortician Saintsatioinal Saintsatioinal Seconds Apart Area 51 Scream of the Banshee Drive Angry Drive Angry Drive Angry Quad Fair 2 Fight or Flight Earthbound Hungry Rabbit Jumps The 6 Month Rule The 6 Month Rule Red Red Treme ‐ Season 1 Treme ‐ Season 1 the Gates Flypaper Flypaper the Ledge If God is Willing and the Creek Don't Rise LA Art Show the Power of Few Swamp Shark SUBTOTALS: $ 673,026,990.89 $ 121,084,796.40 $ 1,011,662,442.74 $ 201,908,106.27 ACTUAL LA ACTUAL LA ACTUAL LA ACTUAL TOTAL COMPANY NAME (FINAL) EXPENDITURES TAX EXPENDITURES PAYROLL BUDGET CREDITS Wishlist Picture $ 381,985.98 $ 54,837.72 $ 758,128.92 $ 114,595.79 Wishlist Picture $ 308,461.78 $ 84,607.91 $ ‐ $ 92,538.53 Wishlist Picture $ 1,826.00 $ 1,826.00 $ ‐ $ 547.80 Wishlist Picture $ 2,200.00 $ ‐ $ ‐ $ 660.00 River Pilot Productions $ 517,828.00 $ 92,242.00 $ 545,000.00 $ 155,348.40 Moonbot Studios $ 208,233.00 $ 122,767.00 $ 2,392,271.00 $ 62,469.90 Moonbot Studios $ 1,688,645.00 $ 1,238,127.00 $ ‐ $ 506,593.50 Moonbot Studios $ 8,778.00 $ ‐ $ ‐ $ 2,633.40 Active Entertainment $ 816,314.65 $ 244,894.40 $ 1,503,166.43 $ 244,894.40 Active Entertainment $ 574,157.10 $ 172,247.13 $ ‐ $ 172,247.13 Horizon $ 986,252.15 $ 191,146.00 $ 5,383,866.60 $ 295,875.65 Horizon $ 1,563,289.48 $ 714,368.00 $ ‐ $ 468,986.84 Horizon $ 2,194,146.94 $ 970,140.00 $ ‐ $ 658,244.08 Snatched the Movie, LLC $ 1,952,273.64 $ 732,610.58 $ 2,115,091.02 $ 585,682.09 Snatched the Movie, LLC $ 57,495.00 $ 28,125.00 $ ‐ $ 17,248.50 Nu Image $ 2,356,142.00 $ 8,402.00 $ 5,931,054.00 $ 706,842.60 Julia X LLC $ 66,201.00 $ ‐ $ 1,285,251.00 $ 19,860.30 Julia X LLC $ 502,761.00 $ 67,208.00 $ ‐ $ 150,828.30 Walt Disney $ 1,089,596.00 $ ‐ $ 8,175,000.00 $ 326,878.80 Horizon $ 469,970.30 $ 234,552.22 $ 494,471.04 $ 140,991.09 Mortician US, LLC $ 179,139.00 $ 85,443.45 $ 629,001.67 $ 53,741.70 Mortician US, LLC $ 207,265.97 $ 15,914.28 $ ‐ $ 62,179.79 Mortician US, LLC $ 23,138.46 $ 3,840.82 $ ‐ $ 6,941.54 Horizon $ 2,602,229.64 $ 561,350.00 $ 5,019,361.38 $ 780,668.89 Horizon $ 887,082.74 $ 502,325.00 $ ‐ $ 266,124.82 Signature Pictures $ 356,292.23 $ 10,860.38 $ 365,747.05 $ 106,887.67 Signature Pictures $ 699,893.92 $ 52,020.40 $ 700,447.86 $ 209,968.18 Signature Pictures $ 532,289.01 $ 10,824.00 $ 533,545.39 $ 159,686.70 Nu Image $ 2,263,400.00 $ 1,305.00 $ 3,848,089.00 $ 679,020.00 Driven Financing, LLC/Driven Productions, LLC $ 186,213.00 $ 62,255.00 $ 2,380,295.00 $ 55,863.90 Driven Financing, LLC/Driven Productions, LLC $ 103,520.00 $ ‐ $ ‐ $ 31,056.00 Quad Fair Productions $ 314,392.50 $ 18,631.61 $ 514,352.00 $ 94,317.75 Marquis Productions $ 548,962.70 $ 59,801.67 $ 775,000.00 $ 164,688.81 Earthbound Productions $ 256,193.86 $ 33,331.00 $ 5,832,926.00 $ 76,858.16 Endgame $ 3,061,704.24 $ 575,009.00 $ 3,717,051.00 $ 918,511.27 The 6 Month Rule, LLC $ 16,790.91 $ ‐ $ 1,290,699.00 $ 5,037.27 The 6 Month Rule, LLC $ 891,212.55 $ 195,400.67 $ ‐ $ 267,363.77 Summit Entertainment $ 47,050.00 $ 2,895.00 $ 64,093,094.00 $ 14,115.00 Summit Entertainment $ 9,100,125.61 $ 2,225,306.00 $ ‐ $ 2,730,037.68 HBO $ 6,429,236.00 $ 2,481,980.00 $ 38,617,493.00 $ 1,928,770.80 HBO $ 24,162,442.00 $ 8,631,426.00 $ ‐ $ 7,248,732.60 20th Century Fox $ 21,847,220.00 $ 6,273,190.00 $ 28,499,522.00 $ 6,554,166.00 After Dark / Signature Films $ 708,798.51 $ 31,502.65 $ 10,250,000.00 $ 212,639.55 After Dark / Signature Films $ 520,298.87 $ 3,435.00 $ ‐ $ 156,089.66 Signature Pictures $ 540,806.27 $ 10,000.00 $ 502,836.00 $ 162,241.88 30 Acres & a Mule Productions / HBO $ 980,233.00 $ ‐ $ 2,843,934.00 $ 294,069.90 Art Show Productions $ 13,666,065.00 $ 3,112,111.00 $ 20,025,000.00 $ 4,099,819.50 Power of Few Prods $ 3,769,628.52 $ 796,803.96 $ 4,510,000.00 $ 1,130,888.56 Swamp Productions, LLC $ 12,216.94 $ 3,826.96 $ 327,784.00 $ 3,665.08 $ 6,054,239.82 ACTUAL LA PAYROLL TAX CREDITS $ 2,741.89 $ 4,230.40 $ 91.30 $ ‐ $ 4,612.10 $ 6,138.35 $ 61,906.35 $ ‐ $ 12,244.72 $ 8,612.36 $ 9,557.30 $ 35,718.40 $ 48,507.00 $ 36,630.53 $ 1,406.25 $ 420.10 $ ‐ $ 3,360.40 $ ‐ $ 11,727.61 $ 4,272.17 $ 795.71 $ 192.04 $ 28,067.50 $ 25,116.25 $ 543.02 $ 2,601.02 $ 541.20 $ 65.25 $ 3,112.75 $ ‐ $ 931.58 $ 2,990.08 $ 1,666.55 $ 28,750.45 $ ‐ $ 9,770.03 $ 144.75 $ 111,265.30 $ 124,099.00 $ 431,571.30 $ 313,659.50 $ 1,575.13 $ 171.75 $ 500.00 $ ‐ $ 155,605.55 $ 39,840.20 $ 191.35 $ 207,962,346.09 TOTAL TAX CREDITS CERTIFIED CERTIFIED DATE $ 117,337.68 $ 96,768.93 $ 639.10 $ 660.00 $ 159,960.50 $ 68,608.25 $ 568,499.85 $ 2,633.40 $ 257,139.12 $ 180,859.49 $ 305,432.95 $ 504,705.24 $ 706,751.08 $ 622,312.62 $ 18,654.75 $ 707,262.70 $ 19,860.30 $ 154,188.70 $ 326,878.80 $ 152,718.70 $ 58,013.87 $ 62,975.51 $ 7,133.58 $ 808,736.39 $ 291,241.07 $ 107,430.69 $ 212,569.20 $ 160,227.90 $ 679,085.25 $ 58,976.65 $ 31,056.00 $ 95,249.33 $ 167,678.89 $ 78,524.71 $ 947,261.72 $ 5,037.27 $ 277,133.80 $ 14,259.75 $ 2,841,302.98 $ 2,052,869.80 $ 7,680,303.90 $ 6,867,825.50 $ 214,214.69 $ 156,261.41 $ 162,741.88 $ 294,069.90 $ 4,255,425.05 $ 1,170,728.75 $ 3,856.43 6/2/2011 6/2/2011 6/2/2011 6/2/2011 2/16/2011 3/31/2011 3/31/2011 3/31/2011 1/11/2011 1/11/2011 6/22/2011 6/22/2011 6/22/2011 11/15/2011 11/15/2011 4/19/2011 11/15/2011 11/15/2011 10/7/2011 3/17/2011 11/15/2011 11/15/2011 11/15/2011 2/2/2011 2/2/2011 3/17/2011 1/11/2011 5/5/2011 1/19/2011 12/2/2011 12/2/2011 2/24/2011 1/24/2011 5/4/2011 4/19/2011 12/14/2011 12/14/2011 3/17/2011 3/17/2011 1/24/2011 1/24/2011 1/20/2011 7/12/2011 7/12/2011 4/19/2011 9/6/2011 3/24/2011 3/24/2011 11/15/2011 2011 2010 2010 2010 2011 2010 2011 2009 2010 2009 2010 2010 2010 2011 2011 2010 2010 2011 2010 2009 2010 2011 2009 2010 2010 2011 2011 2010 2010 2010 2010 2010 2010 2011 2010 2010 2010 2009 2010 2010 2010 2011 2010 2011 2010 2011 2010 2010 2010 2011 2010 2011 2010 0600‐2010 0601‐2010 0605‐2010 0605‐2010 0605‐2010 0606‐2011 0606‐2011 0607‐2010 0607‐2010 0612‐2010 0612‐2010 0615‐2010 0617‐2010 0617‐2010 0617‐2010 0618‐2010 0619‐2010 0619‐2010 0622‐2010 0624‐2010 0625‐2010 0625‐2010 0626‐2010 0626‐2010 0630‐2010 0630‐2010 0632‐2010 0632‐2010 0637‐2010 0640‐2010 0642‐2010 0643‐2010 0643‐2010 0643‐2010 0645‐2010 0647‐2010 0647‐2010 0652‐2010 0652‐2010 0654‐2010 0655‐2010 0655‐2010 0656‐2010 0656‐2010 0657‐2010 0657‐2010 0658‐2010 0661‐2010 0662‐2010 0662‐2010 0666‐2010 0666‐2010 0667‐2010 Swamp Shark The Big Uneasy the Fields the Fields the Fields Emancipated Emancipated Green Lantern Green Lantern Real World 24 Real World 24 Killing Karma (aka Inside Out) Fury Fury Fury Butter Ghostbreakers Ghostbreakers Sunday Best 3 Billy the Exterminator ‐ Season 2 Billy the Exterminator ‐ Season 3 Billy the Exterminator‐ Season 3 Rivka ‐ the Series Rivka ‐ the Series Haywire Haywire Weather Wars Weather Wars the Chaperone The Courier Catch .44 Transit Transit Transit New Orleans Tourism Trespass Trespass Swamp People Swamp People Sports Trivia Clash Never Back Down II Never Back Down II Chasing the Hawk Chasing the Hawk Dragon Eyes Dragon Eyes My Alien Mother Escapee Carjacked Carjacked Season of the Witch Season of the Witch Weapon Swamp Productions, LLC The Notions Department Gideon Productions Gideon Productions Gideon Productions Horizon Horizon Warner Brothers Warner Brothers MTV MTV WWE LMS / Motion Picture Corporation LMS / Motion Picture Corporation Fury Investments, LLC Carving Films Slow Children at Play Slow Children at Play BET / Viacom A & E Exterminator Productions, LLC Exterminator Productions, LLC Louisiana Motion Pictures, LLC Louisiana Motion Pictures, LLC ascension films ascension films Active Entertainment Active Entertainment WWE Films in Motion Catch 44 Productions Signature Pictures Signature Pictures Signature Pictures Tropic Films, Inc. Nu Image Nu Image CCCM Projects, LLC/A & E CCCM Projects, LLC/A & E Leverage Entertainment Signature Pictures Signature Pictures WWE WWE After Dark / Signature Films After Dark / Signature Films Leverage Entertainment Films in Motion Films in Motion Films in Motion Films in Motion Films in Motion LMS / Motion Picture Corporation $ 250,678.06 $ 542,425.37 $ 12,127,455.00 $ 163,093.00 $ 3,891.00 $ 409,590.51 $ 17,950.00 $ 3,370,292.00 $ 110,627,262.00 $ 346,994.00 $ 2,750,085.00 $ 5,122,579.00 $ 509,175.00 $ 792,673.00 $ 1,023,817.00 $ 8,772,834.34 $ 453,437.00 $ 399,890.00 $ 3,532,535.00 $ 982,125.00 $ 1,488,332.00 $ 195.00 $ 1,045,721.00 $ 9,735.00 $ 547,602.42 $ ‐ $ 855,580.00 $ 1,328,845.00 $ 5,712,179.00 $ 8,683,210.81 $ 8,738,186.00 $ 4,623,973.10 $ 155,122.35 $ 364,711.58 $ 405,837.00 $ 16,354,459.00 $ 18,064,903.00 $ 486,948.00 $ 26,866.00 $ 1,206,776.02 $ 4,213,590.50 $ 730,972.49 $ 5,529,013.00 $ 3,777.00 $ 3,155,867.00 $ 1,159,878.98 $ 380,788.59 $ 1,775,096.18 $ 1,175,580.73 $ 892,742.52 $ 7,239,459.38 $ 238,775.92 $ 1,237,746.00 $ 2,777.03 $ 216,190.37 $ 3,146,256.00 $ 11,598.00 $ ‐ $ 167,305.00 $ ‐ $ 228,548.00 $ 15,267,160.00 $ 13,682.00 $ 211,743.00 $ 1,876,602.00 $ ‐ $ ‐ $ 942.11 $ 1,347,475.00 $ 1,590.00 $ 22,375.00 $ 107,208.00 $ 99,784.00 $ 100,430.00 $ ‐ $ 51,400.00 $ ‐ $ 77,546.30 $ 17,163.30 $ 3,415.27 $ 174,656.04 $ 2,285,718.00 $ 2,154,207.10 $ 1,475,759.00 $ 1,036,916.11 $ 34,380.90 $ 8,274.62 $ 42,863.00 $ 1,608,241.00 $ 1,495,570.00 $ 74,253.00 $ 4,900.00 $ 349,253.47 $ 915,433.21 $ 119.77 $ 2,130,970.00 $ ‐ $ 804,845.53 $ 88,306.72 $ 105,287.30 $ 882,383.73 $ 469,400.21 $ 118,431.73 $ 2,110,550.94 $ 7,194.66 $ 486,564.00 $ ‐ $ 1,103,489.99 $ 14,445,535.00 $ 905,000.00 $ ‐ $ 477,534.29 $ ‐ $ 3,500,000.00 $ 133,904,525.00 $ 3,234,465.00 $ ‐ $ 6,192,446.00 $ 1,459,653.00 $ ‐ $ 1,059,517.00 $ 11,450,000.00 $ 565,000.00 $ 454,978.00 $ 6,504,698.00 $ 2,495,175.00 $ 3,331,990.00 $ ‐ $ 1,819,836.00 $ ‐ $ 619,016.00 $ 62,443.15 $ ‐ $ 2,257,428.00 $ 7,482,011.00 $ 15,467,935.00 $ 10,280,000.00 $ 4,900,000.00 $ 700,000.00 $ ‐ $ 508,423.00 $ 23,389,959.00 $ 13,279,563.00 $ 2,755,824.00 $ ‐ $ 1,235,550.00 $ 5,364,322.00 $ ‐ $ 6,836,069.00 $ ‐ $ 4,724,339.79 $ ‐ $ 382,426.09 $ 1,852,134.96 $ 3,063,000.00 $ ‐ $ 8,343,786.48 $ ‐ $ 5,766,973.98 $ 75,203.42 $ 162,727.61 $ 3,638,236.50 $ 48,927.90 $ 1,167.30 $ 122,877.15 $ 5,385.00 $ 1,011,087.60 $ 33,188,178.60 $ 104,098.20 $ 825,025.50 $ 1,536,773.70 $ 152,752.50 $ 237,801.90 $ 307,145.10 $ 2,631,850.30 $ 136,031.10 $ 119,967.00 $ 1,059,760.50 $ 294,637.50 $ 446,499.60 $ 58.50 $ 313,716.30 $ 2,920.50 $ 164,280.73 $ ‐ $ 256,674.00 $ 398,653.50 $ 1,713,653.70 $ 2,604,963.24 $ 2,621,455.80 $ 1,387,191.93 $ 46,536.71 $ 109,413.47 $ 121,751.10 $ 4,906,337.70 $ 5,419,470.90 $ 146,084.40 $ 8,059.80 $ 362,032.81 $ 1,264,077.15 $ 219,291.75 $ 1,658,703.90 $ 1,133.10 $ 946,760.10 $ 347,963.69 $ 114,236.58 $ 532,528.85 $ 352,674.22 $ 267,822.76 $ 2,171,837.81 $ 71,632.78 $ 371,323.80 $ 138.85 $ 10,809.52 $ 157,312.80 $ 579.90 $ ‐ $ 8,365.25 $ ‐ $ 11,427.40 $ 763,358.00 $ 684.10 $ 10,587.15 $ 93,830.10 $ ‐ $ ‐ $ 47.11 $ 67,373.75 $ 79.50 $ 1,118.75 $ 5,360.40 $ 4,989.20 $ 5,021.50 $ ‐ $ 2,570.00 $ ‐ $ 3,877.32 $ 858.17 $ 170.76 $ 8,732.80 $ 114,285.90 $ 107,710.36 $ 73,787.95 $ 51,845.81 $ 1,719.05 $ 413.73 $ 2,143.15 $ 80,412.05 $ 74,778.50 $ 3,712.65 $ 245.00 $ 17,462.67 $ 45,771.66 $ 5.99 $ 106,548.50 $ ‐ $ 40,242.28 $ 4,415.34 $ 5,264.37 $ 44,119.19 $ 23,470.01 $ 5,921.59 $ 105,527.55 $ 359.73 $ 24,328.20 $ 75,342.27 $ 173,537.13 $ 3,795,549.30 $ 49,507.80 $ 1,167.30 $ 131,242.40 $ 5,385.00 $ 1,022,515.00 $ 33,951,536.60 $ 104,782.30 $ 835,612.65 $ 1,630,603.80 $ 152,752.50 $ 237,801.90 $ 307,192.21 $ 2,699,224.05 $ 136,110.60 $ 121,085.75 $ 1,065,120.90 $ 299,626.70 $ 451,521.10 $ 58.50 $ 316,286.30 $ 2,920.50 $ 168,158.04 $ 858.17 $ 256,844.76 $ 407,386.30 $ 1,827,939.60 $ 2,712,673.60 $ 2,695,243.75 $ 1,439,037.74 $ 48,255.75 $ 109,827.21 $ 123,894.25 $ 4,986,749.75 $ 5,494,249.40 $ 149,797.05 $ 8,304.80 $ 379,495.48 $ 1,309,848.81 $ 219,297.74 $ 1,765,252.40 $ 1,133.10 $ 987,002.38 $ 352,379.03 $ 119,500.94 $ 576,648.04 $ 376,144.23 $ 273,744.34 $ 2,277,365.36 $ 71,992.51 $ 395,652.00 11/15/2011 9/21/2011 1/20/2011 6/28/2011 6/28/2011 3/31/2011 3/31/2011 3/17/2011 3/17/2011 6/28/2011 6/28/2011 1/24/2011 4/19/2011 4/19/2011 11/15/2011 3/17/2011 5/23/2011 12/14/2011 1/19/2011 2/16/2011 11/15/2011 11/15/2011 1/11/2011 1/11/2011 9/21/2011 9/21/2011 6/2/2011 6/2/2011 3/24/2011 6/28/2011 1/11/2011 1/24/2011 4/19/2011 4/19/2011 11/15/2011 2/15/2011 3/24/2011 11/15/2011 11/15/2011 3/24/2011 3/24/2011 3/24/2011 6/28/2011 6/28/2011 5/23/2011 5/23/2011 3/24/2011 2/24/2011 6/22/2011 6/22/2011 5/23/2011 5/23/2011 5/5/2011 2011 2010 2011 2010 2011 2010 2010 2010 2010 2010 2010 2011 2010 2010 2011 2010 2011 2010 2010 2010 2010 2011 2010 2011 2010 2010 2011 2010 2011 2010 2011 2010 2011 2010 2011 2010 2011 2010 2011 2010 2011 2011 2011 2011 2011 2011 2011 0667‐2010 0668‐2010 0668‐2010 0669‐2010 0669‐2010 0670‐2010 0671‐2010 0672‐2010 0674‐2010 0675‐2010 0679‐2010 0679‐2010 0680‐2010 0681‐2010 0681‐2010 0684‐2010 0684‐2010 0686‐2010 0688‐2010 0689‐2010 0690‐2010 0690‐2010 0691‐2010 0691‐2010 0696‐2010 0698‐2010 0698‐2010 0699‐2010 0699‐2010 0700‐2010 0700‐2010 0703‐2010 0703‐2010 0704‐2010 0704‐2010 0705‐2010 0705‐2010 0706‐2010 0706‐2010 0707‐2011 0713‐2011 0714‐2011 0716‐2011 0717‐2011 0724‐2011 0734‐2011 0777‐2011 Weapon Paranormal Plantation Paranormal Plantation The Twilight Saga: Breaking Dawn The Twilight Saga: Breaking Dawn Shark Night 3D From the Rough Zombie Hamlet The Lucky One Mysterious Island Dungeons and Dragons 3 Dungeons and Dragons 3 On the Road The Philly Kid The Philly Kid Killer Joe Killer Joe Adicolor Reboot America The Young & the Restless Worst Prom Ever Worst Prom Ever Haunting in Georgia Haunting in Georgia Voodoo Experience 2010 Toya: A Family Affair Toya: A Family Affair So Undercover So Undercover the Door the Door Meeting Evil Meeting Evil Code Red ‐ Jay Electronica Code Red ‐ Jay Electronica Morrison National Commercials ‐ Slate 2 Morrison National Commercials ‐ Slate 2 Looper Looper The Grief Tourist Universal Soldier 4 Stash House Playing the Field Medallion Dark Circles Freelancers The Boxcar Children LMS / Motion Picture Corporation Leverage Entertainment Leverage Entertainment TSBD Louisiana, LLC TSBD Louisiana, LLC Global Incentives / Independent From the Rough Prods. Zombie Hamlet LLC Warner Brothers Leverage Entertainment Dungeons and Dragons 3 Financing Dungeons and Dragons 3 Financing Spad Films NOLA Philly Kid Financing/Philly Kid Productions Philly Kid Financing/Philly Kid Productions Voltage Pictures Killer Joe Productions Emporia Productions Event Producers, Inc. Sony Viacom / MTV Viacom / MTV Haunting Productions Haunting Productions Rehage Entertainment Sunday Best, LLC/BET Sunday Best, LLC/BET Bluefin Productions Bluefin Productions LMS LMS Motion Picture Corporation of America Motion Picture Corporation of America Mountain Dew (Ease) Mountain Dew (Ease) Morrison Productions/Twisted Fiction Morrison Productions/Twisted Fiction Looper Investments, LLC Looper Investments, LLC TGT, LLC Unisol 4 Financing, LLC Stash House Financing, LLC Playing Financing, LLC/Playing Productions, LLC Medal Financing, LLC/Medal Productions, LLC Dark Cirle Financing, LLC Georgia Film Fund Three Productions, LLC Moonbot Studios LA $ 432,349.00 $ 259,265.82 $ 107,044.38 $ 46,120,154.00 $ 62,860,759.40 $ 17,150,321.00 $ 4,829,474.00 $ 625,975.01 $ 21,982,696.00 $ 1,657,537.79 $ 350,151.48 $ 1,849,145.07 $ 1,918,225.00 $ 353,251.00 $ 2,089,470.72 $ 8,148,189.48 $ 188,129.00 $ 347,244.00 $ 422,020.00 $ 567,997.88 $ 1,863,623.23 $ 24,438.28 $ 4,987,835.46 $ 1,112,812.00 $ 1,408,648.00 $ 944,893.00 $ 62,912.00 $ 3,624,881.00 $ 7,758,986.00 $ 1,728,883.00 $ 85,151.00 $ 8,785.00 $ 5,251,738.00 $ 199,161.94 $ 150,903.67 $ 453,698.46 $ 281,278.41 $ 4,923,070.00 $ 26,946,589.00 $ 403,181.65 $ 9,222,087.10 $ 3,143,373.23 $ 23,681,006.90 $ 28,140,371.00 $ 2,555,934.21 $ 10,718,166.00 $ 393,533.00 $ 16,018.00 $ 96,549.98 $ 56,230.00 $ 4,701,150.00 $ 4,497,599.00 $ 2,847,572.00 $ 1,816,260.00 $ 138,765.37 $ 5,075,525.00 $ 126,781.00 $ 14,940.24 $ 345,197.86 $ 831,102.00 $ ‐ $ 592,167.96 $ 1,415,252.47 $ 34,765.00 $ 102,753.00 $ 204,682.00 $ 273,400.42 $ 944,029.52 $ 5,441.96 $ 1,328,829.00 $ 11,712.00 $ ‐ $ 191,027.00 $ 2,088.00 $ 1,013,250.00 $ 2,183,149.00 $ 276,316.00 $ ‐ $ ‐ $ 884,355.00 $ 69,654.58 $ ‐ $ 122,072.21 $ 86,249.85 $ 589,428.00 $ 5,971,899.00 $ 110,368.00 $ 1,879,277.23 $ 632,513.08 $ 2,632,349.00 $ 4,208,848.00 $ 574,719.44 $ 1,331,048.00 $ 294,901.00 $ ‐ $ 429,505.00 $ ‐ $ 216,422,068.00 $ ‐ $ 28,909,000.00 $ 6,405,000.00 $ 750,000.00 $ 26,320,016.00 $ 1,704,782.00 $ 3,982,320.68 $ ‐ $ 2,799,497.00 $ 3,383,376.55 $ ‐ $ 9,705,000.00 $ ‐ $ 397,811.00 $ 486,295.00 $ 622,394.00 $ 2,085,342.82 $ ‐ $ 7,983,388.00 $ ‐ $ 5,824,332.00 $ 4,098,603.00 $ ‐ $ 13,899,678.00 $ ‐ $ 1,895,050.00 $ ‐ $ 8,785.00 $ 5,643,883.00 $ 355,165.61 $ ‐ $ 835,941.16 $ ‐ $ 35,707,161.00 $ ‐ $ 600,000.00 $ 11,461,130.66 $ 3,866,112.68 $ 28,575,679.00 $ 32,177,073.00 $ 2,720,829.49 $ 15,175,443.00 $ 397,255.00 $ 129,704.70 $ 77,779.75 $ 32,113.31 $ 13,836,046.20 $ 18,858,227.82 $ 5,145,096.30 $ 1,448,842.20 $ 187,792.50 $ 6,594,808.80 $ 497,261.34 $ 105,045.44 $ 554,743.52 $ 575,476.50 $ 105,975.30 $ 626,841.22 $ 2,444,456.84 $ 56,438.70 $ 104,173.20 $ 126,606.00 $ 170,399.36 $ 559,086.97 $ 7,331.48 $ 1,496,350.64 $ 333,843.60 $ 422,594.40 $ 283,467.90 $ 18,873.60 $ 1,087,464.30 $ 2,327,695.80 $ 518,664.90 $ 25,545.30 $ 2,635.50 $ 1,575,521.40 $ 59,748.58 $ 45,271.10 $ 136,109.54 $ 84,383.52 $ 1,476,921.00 $ 8,083,976.70 $ 120,954.50 $ 2,766,626.13 $ 943,011.97 $ 7,104,302.07 $ 8,442,111.30 $ 766,780.26 $ 3,215,449.80 $ 118,059.90 $ 800.90 $ 4,827.50 $ 2,811.50 $ 235,057.50 $ 224,879.95 $ 142,378.60 $ 90,813.00 $ 6,938.27 $ 253,776.25 $ 6,339.05 $ 747.01 $ 17,259.89 $ 41,555.10 $ ‐ $ 29,608.40 $ 70,762.62 $ 1,738.25 $ 5,137.65 $ 10,234.10 $ 13,670.02 $ 47,201.48 $ 272.10 $ 66,441.45 $ 585.60 $ ‐ $ 9,551.35 $ 104.40 $ 50,662.50 $ 109,157.45 $ 13,815.80 $ ‐ $ ‐ $ 44,217.75 $ 3,482.73 $ ‐ $ 6,103.61 $ 4,312.49 $ 29,471.40 $ 298,594.95 $ 5,518.40 $ 93,963.86 $ 31,625.65 $ 131,617.45 $ 210,442.40 $ 28,735.97 $ 66,552.40 $ 14,745.05 $ 130,505.60 $ 82,607.25 $ 34,924.81 $ 14,071,103.70 $ 19,083,107.77 $ 5,287,474.90 $ 1,539,655.20 $ 194,730.77 $ 6,848,585.05 $ 503,600.39 $ 105,792.46 $ 572,003.41 $ 617,031.60 $ 105,975.30 $ 656,449.61 $ 2,515,219.47 $ 58,176.95 $ 109,310.85 $ 136,840.10 $ 184,069.39 $ 606,288.45 $ 7,603.58 $ 1,562,792.09 $ 334,429.20 $ 422,594.40 $ 293,019.25 $ 18,978.00 $ 1,138,126.80 $ 2,436,853.25 $ 532,480.70 $ 25,545.30 $ 2,635.50 $ 1,619,739.15 $ 63,231.31 $ 45,271.10 $ 142,213.15 $ 88,696.02 $ 1,506,392.40 $ 8,382,571.65 $ 126,472.90 $ 2,860,589.99 $ 974,637.62 $ 7,235,919.52 $ 8,652,553.70 $ 795,516.24 $ 3,282,002.20 $ 132,804.95 5/5/2011 5/5/2011 5/5/2011 11/15/2011 11/15/2011 4/19/2011 3/17/2011 2/15/2011 9/21/2011 1/26/2011 12/14/2011 12/14/2011 5/10/2011 12/14/2011 12/14/2011 4/19/2011 9/21/2011 5/23/2011 12/2/2011 5/23/2011 5/5/2011 5/5/2011 6/2/2011 6/2/2011 11/18/2011 11/1/2011 11/1/2011 6/28/2011 6/28/2011 3/24/2011 3/24/2011 7/12/2011 7/12/2011 6/28/2011 6/28/2011 6/28/2011 6/28/2011 11/15/2011 11/15/2011 7/29/2011 11/18/2011 11/18/2011 12/2/2011 12/2/2011 7/29/2011 11/18/2011 12/2/2011