ISA 315 Understanding the entity and its environment and John Zarb

advertisement

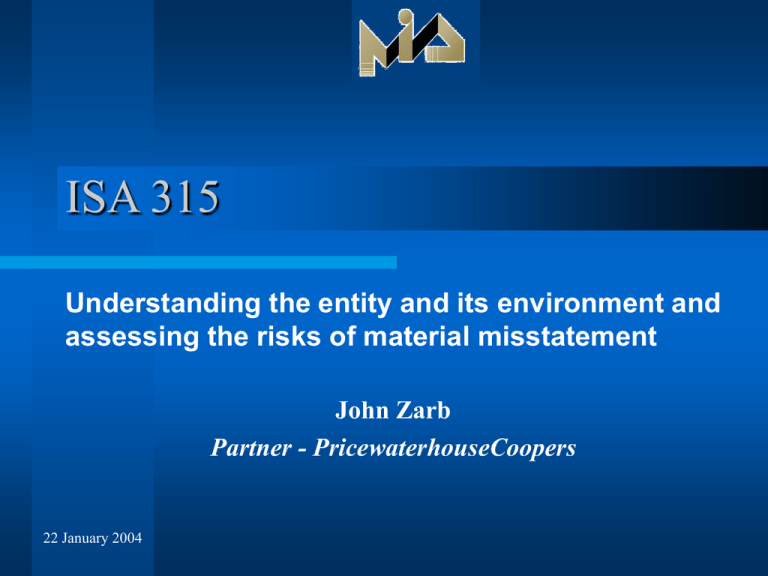

ISA 315 Understanding the entity and its environment and assessing the risks of material misstatement John Zarb Partner - PricewaterhouseCoopers 22 January 2004 Introduction Auditors cannot approach their work with a fixed audit program which they expect will work in all circumstances They must understand their client, identify and assess audit risk, and plan their work accordingly ISA 315 deals with understanding and assessing risk Followed by ISA 330, dealing with responding to risk 2 Nothing new in all this Has long been a fundamental principle (eg., ISA 200 – Objective and general principles) But has obviously become a source of additional concern, as the quality of audits is being questioned And key questions arise: – Can an auditor do away with not looking at controls at all? – Are auditors really understanding their clients’ businesses? – Are they focusing hard enough on misstatement risk? Equally hard questions are being asked about whether substantive testing is exhaustive enough, but that is not the subject of ISA 315 3 An overview of ISA 315 Explains the procedures to be followed, and sources of information. Makes team discussions mandatory. Defines what level of understanding is required – a key section of the standard Requires an assessment of the risks which can impact the audit at financial statement or assertion level Requires identification of significant risks requiring special emphasis or risks for which substantive tests alone do not suffice (important concept) Also deals with communication and documentation 4 ISA 315 - The process Perform procedures, hold internal team discussions. Consider: Industry, external factors Nature of the entity Objectives, strategies, risks Financial perform. measures Internal control measures Assess the risks of material misstatements Identify special risks, risk where substantive tests do not suffice Document and report RESPOND TO RISK – ISA 330 5 1 Procedures to be performed No surprises here – enquiries, analytical procedures, observation and inspection To be applied as appropriate Enquiries may need to extend beyond those charged with governance or accounting (eg., to sales or production management, internal audit, etc) The process is continuous, dynamic – may be linked with other aspects of the audit Must be linked to discussion among the engagement team 6 Discussion among the audit team The members of the team should discuss the susceptibility … to material misstatements Disseminate information, share insights Particular emphasis to be given to fraud risk (ISA 240) Judgement is required in deciding what is informed on what – must be linked to roles, responsibilities Discussion will emphasise the need to maintain professional scepticism throughout the engagement 7 2 Understanding the entity By far the most voluminous part of the standard Supported by appendices with examples Considers the topic under five discrete headings: – – – – Industry, regulatory and other external factors Nature of the entity Objectives and strategies and related business riskss Measurement and review of the entity’s financial performance – Internal control – a topic explored in some detail 8 Industry, regulatory, external factors The starting point – what is the environment in which the client operates? Sources of information: – – – – – The client Trade journals News media Regulatory updates IFRS updates We need to know enough about a business to enable us to understand where risks which could result in misstatements could come from 9 External risks - examples Audit impact A bank audit – liberalisation leads to new banks being set up, and to increased competition for corporate customers A communications company – in a fast moving industry, technological advances which reduce the cost of capital infrastructure are common Could lead to lowering of credit controls and to a higher risk of bad debts Issues such as impairment testing on fixed assets assume added importance 10 Nature of the entity ‘Nature of the entity’ refers to: – The entity’s operations – Its ownership and governance – The types of investments it makes, or plans to make – The way the entity is structured – How the entity is financed Examples in ISA 315 Full awareness of all related parties? Complex structures give rise to risk – allocation of goodwill, impairment, SPE’s, extent of consolidation, etc Auditor should understand and consider the appropriateness of the entity’s accounting policies 11 Objectives and strategies … … and the related business risks Again, an obvious point, already a feature of a good audit, eg: An importer of motor cars embarks on an aggressive growth programme, supported by low cost HP facilities Nothing improper or unwise, but could lead to the risk of a higher incidence of credit losses, and this must be addressed 12 Measurement and review An auditor should understand how performance is measured or reviewed within a company – To improve his own understanding, and the quality of his analytical review processes – To understand the pressures which may result in management actions which increase the risk of misstatements The understanding must include external influences (eg., the expectations of banks, market analysts) Watch out for performance-based bonus or incentive remuneration 13 Coming to the crucial point … … internal controls To what extent is the auditor required, in all circumstances, to understand or test internal controls? Short answers: – ISA 315 does not deal at all with testing – there is no suggestion that testing controls is a must – ISA 315 gives guidance re the onus on the auditor to consider controls risk The auditor should obtain an understanding of internal control relevant to the audit – The lesser needs of small companies are frequently mentioned; this standard is not impractical 14 Internal controls We have a definition: Internal control is the process designed and effected by [management] to provide reasonable assurance about the achievement of the entity’s objectives with regard to: – reliability of financial reporting – effectiveness and efficiency of operations, and – compliance with applicable laws and regulations. 15 Internal control components ISA 315 sets out five components: – The control environment – The entity’s risk assessment process – The information system, including the related business processes, relevant to financial reporting and communication – Control activities – Monitoring controls Introducing the elements of the COSO framework, which is new The standard sets out what we have to do in relation to each of these components Plus a 6 page appendix going into controls in more detail 16 Controls relevant to the audit Usually, those controls which pertain to the entity’s objective of preparing financial statements Subject to the requirements of the ISA, a matter of professional judgement Size of entity and materiality are clearly indicated as matters affecting this judgement This standard does not do away with the judgements we make today, even in small companies where consideration of controls may be futile, but some minimum rules apply 17 Control environment The auditor should obtain an understanding of the control environment A mandatory step already in ISA 400 ISA 315 gives more guidance on the control environment, but does not change the principles at stake 18 Entity’s risk assessment processes The auditor should obtain an understanding of the entity’s process for identifying business risks relevant to financial reporting objectives and deciding about actions to address those risks, and the results thereof A new step – risk assessment processes were not previously mentioned Entails judgement – what is material and relevant The logical conclusion is that it must be linked to the auditor’s prior understanding of external factors, nature of entity, objectives and strategies, etc 19 The information system The auditor should obtain an understanding of the information system, including the related business processes, relevant to financial reporting, including … A long existing requirement Even in the smallest business, where no reliance whatsoever is placed on controls, we need to demonstrate an understanding of how the entity’s accounting processes work (eg., types of transactions, capturing data, books of account, posting sources, main systems and data files, etc) 20 Control activities The auditor should obtain a sufficient understanding of control activities to assess the risks of material misstatement at the assertion level and to design further audit procedures responsive to assessed risks Auditor is not required to understand all control activities related to each significant class of transactions, account balance, disclosure, etc The emphasis must be on controls in those areas where material misstatements are more likely As now, except for a mandatory understanding required on IT risks, auditor must exercise judgement …. 21 … but needs to be consistent Example: Review of external environment Indicates sharp increase in market competition in a slow economy Review of business objectives and strategies Indicates aggressive campaign based on low interest credit terms Understanding controls over HP debtors becomes necessary. Indicates aggressive campaign based on low interest credit terms 22 ISA 315 - The process Perform procedures, hold internal team discussions. Consider: Industry, external factors Nature of the entity Objectives, strategies, risks Financial perform. measures Internal control measures Assess the risks of material misstatements Identify special risks, risk where substantive tests do not suffice Document and report RESPOND TO RISK – ISA 330 23 Assessing risk The auditor should identify and assess the risks of material misstatement at the financial statement level, and at the assertion level for classes of transactions, account balances and disclosures We are required to: – Relate identified risks to what can go wrong at assertion level – Consider potential magnitude of the risks in the context of the financial statements – Consider the likelihood that the risks could result in a material misstatement of the financial statements 24 This is the nub of this standard It is not enough, for a very small client, to sidestep this assessment and simply adopt a ‘high risks approach’ audit An assessment of risk is required in all cases: – Even if this is a very brief record of the auditor’s thought processes, client discussions and the outcome – Clients, even small ones, will differ in the risks they present 25 Examples of risks given Operations in unstable regions Operations in volatile markets Complex regulation Going concern, liquidity issues Capital, credit constraints Industry changes Changes in the supply chain New products and services New lines of business Expanding into new locations Acquisitions, reorganisations Businesses likely to be sold Complex alliances, JV’s Off B/S finance, SPE’s, offshore Related party transactions Lack of qualified personnel Changes in key personnel Dominant leader Weak internal conrols Changes in IT environment Non-routine transactions Aggressive accounting policies 26 Evaluating risk How does one measure potential impact and likelihood? IAS 315 does not define a detailed process for this, which must be a matter of professional judgement The standard however gives some warnings: – A weak control environment is likely to affect a number of assertions and may impact the financial statements as a whole – Concerns about the integrity of management may lead the auditor to conclude that the risks are such that an audit cannot be concluded – Leading to a qualification or disclaimer, or to withdrawing from the engagement 27 Significant risks The auditor should determine which of the risks identified are, in the auditor’s judgement, risks that require special audit consideration Significant risks ‘arise on most audits’ Particular attention required on: – Risks of material fraud – Complex or related party transactions – Information involving a wide range of measurement uncertainty – Transactions outside the normal course of business 28 Significant risks (continued) For significant risks, to the extent that the auditor has not already done so, the auditor should evaluate the design of the entity’s related controls, including relevant control activities, and determine whether they have been implemented 29 Significant risks (continued) Significant risks often apply to non-routine items But management can still put in place ad-hoc procedures (eg, management review of projections on sales potential of a new product) Before rushing into substantive testing, the auditor needs to understand what management itself has done 30 Risks for which substantive … … procedures alone do not provide sufficient appropriate audit evidence The auditor should evaluate the design and determine the implementation of the entity’s controls … The end requirement is the same as for significant risks. The key question is – when do such circumstances arise? 31 Typical example given When processing is highly automated, and the audit trail less easy to follow, such that an auditor has no option but to understand and test the proper operation of the system concerned To which one could add another: When substantive testing is likely to focus on what transactions are reported, rather than omitted Substantive testing usually emphasises the balance sheet approach. Will it pick up material frauds impacting the profit and loss account? 32 Communicating, documenting Both obviously are mandatory steps Documentation should cover: – – – – – – – The discussion among the engagement team Key elements of the understanding obtained The sources of information The risk assessment process The identified and assessed risks Significant risks evaluated Risks evaluated for which substantive procedures alone … 33 Applicability of the standard Audits of financial statements for periods beginning on or after December 15, 2004 Standard seen as applicable to all companies, large or otherwise A particular mention on small companies is in fact encountered throughout the ISA Apart from the guidance given in Practice Statement 1005 34 ‘Small company’ references Para 34 – small entities have less formal objectives and strategies; we need to observe, and enquire with management Para 40 – same for measuring performance, but management will always have some key indicators Para 48 – when judging relevance of controls, size of entity is a valid consideration Para 66 – controls are more limited, and more easily overridden, in small entities Para 79 – in small companies, risk assessment processes are less formal The message is clear – this standard Etc conveys principles applicable to all audits 35 ISA 315 - The process Perform procedures, hold internal team discussions. Consider: Industry, external factors Nature of the entity Objectives, strategies, risks Financial perform. measures Internal control measures Assess the risks of material misstatements Identify special risks, risk where substantive tests do not suffice Document and report RESPOND TO RISK – ISA 330 36