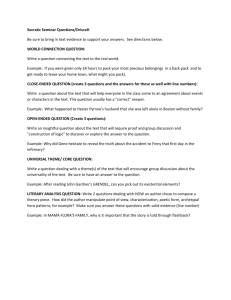

ENTRE- 521

advertisement

ENTRE- 521 Autumn 2004 Corporate Entrepreneurship and Innovation Meeting at: Balmer 304, Mondays 6.15- 9.30 Instructor: Sandip Basu Office: 222 Lewis Hall, Phone: 206 543-6706 Office hours: Monday 4.00pm- 6.00pm or by appointment E-mail: sb4@u.washington.edu Class website: http://staff.washington.edu/sb4/CorporateEntrepreneurship I. COURSE OBJECTIVES AND FORMAT The competitiveness of large, established corporations is continuously being challenged in today’s fast changing environment. In an effort to find ways to stay competitive, executives in these organizations are recognizing the critical role that entrepreneurial thinking plays in creating opportunities for growth and renewal. This course will focus on how entrepreneurial skills and processes can be applied effectively in corporations. It will examine the theory and best practices associated with the process of converting new ideas to new products, technologies and businesses, within the boundaries of a large corporation. The central focus of the course is therefore to examine how large corporations can become more adept at creating opportunities for change, capitalizing on them, and reacting to disruptive changes in the environment. Accordingly, the course objectives are two fold: (1) to develop an awareness and understanding of the range, scope, and complexity of issues involved in the creation of an organizational climate that helps recognize, nurture, and grow entrepreneurial activities within large firms; and (2) to gain insight into the effective commercial exploitation of technological and organizational innovations in such a context. The course will be taught primarily through case discussions, supplemented with lectures, films and external speakers. During the course, the participants will be placed in the role of a project manager or key decision maker and asked to address issues related to the creation and reinforcement of both an individual business venture and an innovative parent organization. 1 II. ASSIGNMENTS & GRADING Grading will be determined as follows: • • • Individual classroom contribution Group projects Final exam (individual case analysis) 35% 30% 35% The final grade awarded will be on the curve with the mean grade per the school norms. Class Contribution. During case discussions, class contribution is essential because not only your learning but also that of the entire class depends upon it. Your class contribution will be based on: (1) evidence of careful preparation of cases and readings, (2) ability to summarize key concepts and recommendations in the articles and important information in the cases, and (3) the clarity and insightfulness of your recommendations on the cases based on convincing qualitative and quantitative analysis. It is crucial that your preparation for each class be thorough and consistent from class to class. This includes reviewing the assigned readings and cases for that session and preparing for discussion of the indicated questions. Group Projects. The group project presents an exciting opportunity to apply the concepts and skills developed in this course to take your own business ideas to their hypothetical fruition, within the boundaries of a real corporation. The plan for the venture will be developed stage-wise over the period of the course, and class time is available for presentation and discussion of these various stages. In the last session, each group will put all the modules together and present an integrated plan for 15 minutes to the class, as well as submit a five-page report (12 pt., 1.5 space, not including tables and figures) to the instructor. Performance on the project will be evaluated on 1) quality of ideas at each stage, 2) clarity and skill displayed in the presentation and written report. Detailed information for conducting the group projects will be provided during the first class session. Final Exam. Students can work individually or in teams of two to analyze a specific case that will be distributed in the last day of class. This analysis must again be around five-pages long (12 pt., 1.5 space, not including tables and figures) and address the important issues in the case that you are asked to evaluate. Exam performance will be assessed based on whether the recommendations for each of these issues are clear and thoughtful, and whether arguments for proposing them are convincing and theoretically driven. Any material might be referred to while writing the exam. Classmates outside the team could be consulted prior to writing the exam, but not during it. 2 III. TEXT & READINGS Textbook: McGrath, R.G.; & MacMillan, I.C.; “The entrepreneurial mindset: Strategies for continuously creating opportunity in an age of uncertainty”; Harvard Business School Press, 2000 (henceforth called “EMS”). Strongly Recommended Book (not necessarily during course): Christensen, C.M., & Raynor, M.E.; “The innovator’s solution: Creating and sustaining successful growth”; Harvard Business School Press, 2003. Readings: ENTRE-521, Autumn 2004 Course Pack available at the Balmer Copy Center Some readings from the physical or on-line library resources as indicated Other readings in class as distributed by the instructor IV. DETAILED SYLLABUS Monday, October 4th Corporate Entrepreneurship: Imperatives and Difficulties Issues: What is CE and why is it important? Why do corporations find it difficult to practice it? Readings: EMS Chapters 1,2 Markindes, C.; “Strategic innovation in established corporations”; Sloan Management Review; Spring 1998 (course pack) Christensen, C.M. & Overdorf, M.; “Meeting the challenge of disruptive change”; Harvard Business Review; March-April 2000 (course pack) Case: Intel Corporate Venturing, Darden case # UVA-ENT-0011 (course pack) • How would you describe the culture at Intel? Why has this firm been so successful? What role has the culture played in its success? • How would you approach the four distinct problems that Hake faces at the end of the case? • Does growing Green Businesses require radical or incremental reform? Monday, October 11th Recognizing Opportunity Issues: How can corporate managers be better at recognizing opportunities or creating new ones? How can one determine whether an idea is a workable opportunity? Toolkit: Opportunity recognition frameworks 3 Readings: EMS Chapters 3-6 Drucker, P.F.; “The discipline of innovation”; Harvard Business Review; August 2002 (course pack) Sarasvathy, S.; & Kotha, S.; “Management of Knightian Uncertainty in the New Economy: The RealNetworks Case”; E-Commerce and Entrepreneurship, 2001 (course pack) Case: CNBC (A): NBC and its start-up friends; HBS case 300-090 (course pack) • What are the main challenges facing Pamela Thomas-Graham as the new CEO of CNBC.com, a venture within a giant, established corporation? What are advantages does CNBC.com get as part of NBC and GE? Are there any disadvantages? • What advice would you give Thomas-Graham about how to avoid the problems that new ventures face in dealing with the corporate mainstream? And about how to deal with complex alliances and shared ownership (NBC and NBCi)? • What should be the future organization’s model? Should CNBC.com remain a separate venture? Video: The Triumph of the Nerds • Is it luck or foresight that results in a successful opportunity? Monday, October 18th Championing Ideas Issues: What are requisites of an internal entrepreneur in a large corporation? What can a venture manager do to ensure adequate support for the venture? Toolkit: Managing political processes Readings: EMS Chapter 7 Ginsberg, A., & Hay, M.; “Confronting the challenges of corporate entrepreneurship”; European Management Journal; December 1994 (course pack) Block, Z. & Macmillan, I.C.; “The internal politics of venturing”; Chapter 11, “Corporate Venturing: Creating new businesses within the firm”; Free Press: NY, 1993 (course pack) Case: “Internal entrepreneurship at the Dow Chemical Company”; IMD case # 3-1117 (course pack) • What is your evaluation of Ian Telford, the internal entrepreneur? • How adequately did his superiors support Telford? • What are some limits that his actions need to be within? Group Work: Development of a venture idea within the context of a real corporation 4 Monday, October 25th Creating the Climate Issues: What are the ingredients for an enterprising organization and what role do leaders play? Toolkit: Distributed model of entrepreneurship Readings: EMS Chapter 12 Amabile, T.M.; “How to kill creativity”; Harvard Business Review; September- October 1998 (course pack) O’Connor, G.C., & Rice, M.P.; “Opportunity recognition and breakthrough innovation in large established firms”; California Management Review, Winter 2001 (on-line) Case: “3M Optical Systems: Managing corporate entrepreneurship”, HBS case # 9-395-017 (course pack) • As Andy Wong, how would you handle the authorization for expenditure (AFE) for the re-launch of the privacy screen? • As Paul Guehler, would you approve the AFE if Wong sent it up to you? • How effective has Wong been as a front-line manager? How effective has Guehler been as 3M’s Division President? • What makes 3M perhaps the most consistently entrepreneurial large company in the world? Group Work: Assessment of corporation’s innovation process, and mechanisms to generate corporate support Monday, November 1st Incubating Ventures Issues: How should emerging new business ideas from within be supported to maximize benefits to the corporation? Toolkit: Real options reasoning Readings: EMS Chapter 8 Kanter, R.M.; “Swimming in newstreams: Mastering innovation dilemmas”; California Management Review; Summer 1989 (on-line) Burgelman, R.A.; “Designs for corporate entrepreneurship in established firms”; California Management Review; Spring 1984 (on-line) Case: “Lucent Technology Ventures”, HBS case # 9-300-085 (course pack) • From the point of view of the specific NVG enterprises and their founders, assess the benefits and also the problems or tensions associated with starting up within a giant company. Have these 5 ventures encountered the typical dilemmas of newstreams versus mainstreams? • What, if anything, can Socolof and the NVG do to increase the advantages and minimize the tensions to ensure speedier and easier development of ventures within Lucent? • What should Socolof recommend to upper management about the next phase of the New Ventures Group? What has the NVG done well? What has it done poorly? In light of problems at Lucent, should the NVG continue in its present form, change its form, or disband? Guest Speaker: Mr. David J. Smukowski, Senior Director, Boeing Ventures Monday, November 8th External Venturing Issues: How can external sources of knowledge be used as potential opportunities to realize corporate objectives? Toolkit: Learning through networks Readings: Chesbrough, H.W.; “Making sense of corporate venture capital”; Harvard Business Review; March 2002 (course pack) Brody, P., & Ehrlich, D.; “Can big companies become successful venture capitalists?”; McKinsey Quarterly; 2, 1998 (course pack) Case: “Intel Corporation: Berkeley investment project ”, HBS case # 9-600-069 (course pack) • Why did Intel decide to Invest in Berkeley Networks? Why did Berkeley Networks invite Intel to Invest? • How does Intel Capital’s investment process differ from that of any good private venture capitalist? • What is Intel learning from its investment in Berkeley Networks? What is Berkeley Networks learning from Intel? • If you were an entrepreneur, would you want Intel as an investor in your startup? Why or why not? • What should Keith Larson do? Group Work: Evaluation of venture potential and proposed structure Monday, November 15th Allocating Resources Issues: What mechanisms work best for allocating resources to and monitoring new ventures? Toolkit: Discovery based planning Readings: EMS Chapter 10, 11 6 Clayton, J, Gambill, B., Harned D.; “The curse of too much capital: Building new businesses and large corporations”; McKinsey Quarterly; 3, 1999 (course pack) Chesbrough, H.W., & Teece, D.J.; “Organizing for innovation: When is virtual virtuous”; Harvard Business Review; August 2002 (course pack) Case: “Pandesic- The challenge of a new business venture (A)”, HBS case # 399-129 (course pack) • What is your assessment of Pandesic’s strategy? • What forces influenced the early development of the strategy? • What should Harold Hughes do? Guest Speaker: Ian Sands, Director, Innovations Group, Microsoft Corporation Monday, November 22nd Commercializing Innovation Issues: What are important considerations while entering new markets, commercializing new products and promoting new technologies? Toolkit: Selling to mainstream markets Readings: EMS Chapter 9 Moore, G.A.; “High tech marketing enlightenment”; Chapter 2, “Crossing the Chasm: Marketing and selling high-tech products to mainstream customers”; HarperBusiness: NY, 1999 (course pack) Shapiro, C.; & Varian, H.R.; “The art of standard wars”; California Management Review; Winter 1999 (on-line) Case: “Hewlett- Packard: The flight of the Kittyhawk”, HBS case # 9- 697-060 (course pack) • What are the strengths and weaknesses of the way HP structured and supported the Kittyhawk development team? • How would characterize the way the team approached the market for the Kittyhawk? Can you pinpoint the correct and wrong turns they made? • What, if any, are the root causes for the program’s failure? Could HP have avoided program failure by addressing these root causes? Group Work: Planning for resource needs, complementary assets and commercialization Monday, November 29th Reacting to Change Issues: How can corporations recognize and effectively react to disruptive environmental changes? Toolkit: Spotting disruptive technology 7 Readings: EMS Chapter 13 D’Aveni, R.; “The empire strikes back: counter revolutionary strategies for industry leaders”; Harvard Business Review; November 2002 (course pack) Bower, J., & Christensen, C.; “Disruptive technologies: Catching the wave”; Harvard Business Review; January 1995 (course pack) Case: “The Browser Wars, 1994-1998”, HBS Case 9-798-094 (course pack) • How did Netscape outsmart its competitors? • How was Microsoft able to catch-up with Netscape? • What are the similarities and differences in Netscape's and Microsoft's approach to competitive strategy? • What was Netscape's response to Microsoft? Did it help or hurt Netscape market position? Why or why not? • What role, if any, did AOL play in Microsoft's strategy? Wrap-up: Key takeaways from the course Monday, December 6th Presentation of group projects Feedback on the course and instructor 8