The Engineering Economist Copyright © 2005 Institute of Industrial Engineers DOI: 10.1080/00137910590949887

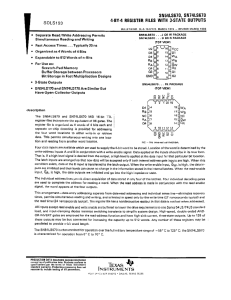

advertisement