2 0 1

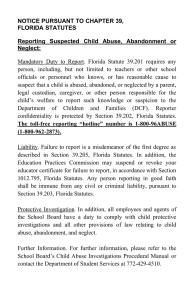

advertisement