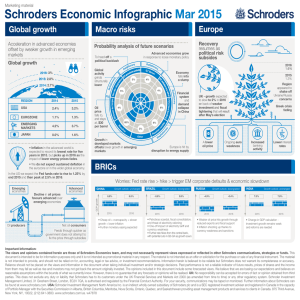

313.5 2.8 £ bn

advertisement

About us At Schroders, asset management is our only business and our goals are completely aligned with those of our clients – the creation of long-term value to assist them in meeting their future financial requirements. We manage £313.5 billion on behalf of institutional and retail investors, financial institutions and high net worth clients from around the world, invested in a broad range of active strategies across equities, fixed income, multi-asset, alternatives and real estate. We employ more than 3,700 talented people worldwide operating from 38 offices in 28 countries across Europe, Asia, the Americas, the Middle East and Africa, close to the markets in which we invest and close to our clients. Schroders has developed under stable ownership for over 200 years and long-term thinking drives our approach to investing, building client relationships and growing our business. Annual General Meeting Our Annual General Meeting will be held at 11.30 a.m. on 28 April 2016 at 31 Gresham Street, London EC2V 7QA. Dividend The Board is recommending a final dividend of 58.0 pence, payable on 5 May 2016. This brings the total dividend payable for the year to 87.0 pence. Cover image This has been taken from a Schroders marketing campaign that denotes our trusted heritage and advanced thinking. Highlights Assets under management Shareholders’ equity £313.5bn £2.8bn (2014: £300.0 billion) (2014: £2.5 billion) Net new business Basic earnings per share £13.0bn 171.1p Profit before tax and exceptional items* Total dividend per share £609.7m 87.0p (2014: £24.8 billion) (2014: £565.2 million) Profit before tax £589.0m (2014: £517.1 million) *See note 1(b) on page 103 for details of exceptional items. (2014: 152.7 pence) (2014: 78.0 pence) Schroders at a glance We have built a diversified business across client channels, asset classes and regions. We are diverse by: Clients Assets We manage assets on behalf of institutional and retail investors, financial institutions and high net worth clients from around the world. No single client accounts for more than 2 per cent. of revenues. We invest in a broad range of asset classes across equities, fixed income, multi-asset, alternatives and real estate. In addition to institutional segregated mandates, we manage more than 590 funds in 19 countries. Assets under management Assets under management Institutional 58% Equities 42% Intermediary 32% Multi-asset 25% Wealth Management 10% Fixed Income 19% Emerging Market Debt, Commodities and Real Estate 4% Wealth Management 10% We have a long-term focus We take a long-term view as we seek to meet the firm’s strategic objectives, whether that is through strengthening client relationships, investing for organic and inorganic growth, or finding new ways to innovate to meet the demands of the future. Creating enduring client relationships We seek to build long-term relationships with our clients and to gain a deep understanding of their investment objectives. We have a strong financial position At 31 December 2015, shareholders’ equity was £2.8 billion. Maintaining a strong financial position enables us to take a long-term view of growth opportunities. We have no debt and hold capital significantly in excess of regulatory requirements. 2 Schroders | Annual Report and Accounts 2015 Investment capital is the capital held in excess of operating and regulatory requirements. It allows us to invest in both organic and inorganic growth opportunities. Investment capital increased from £725 million in 2014 to £942 million in 2015. Strategic report: Overview Award highlights of 2015 Britain’s Most Admired Companies 2015/16, Management Today CEO of the Decade 2015 Awards for Excellence in Asset Management, Financial News Best International Fund Group, International Fund and Product Awards 2015, Professional Adviser Domestic clients team Winner, European Awards 2015, WealthBriefing Asset Manager of the Year 2015, Better Society Awards, Charity Times Geography We operate from 38 offices in 28 countries, managing local and international investment strategies and solutions on behalf of local and international clients. Assets under management Asia Pacific We generated net inflows in Institutional and Intermediary of £8.6 billion (2014: £5.4 billion), across a broad range of fixed income, multi-asset and equity strategies. By client domicile UK 41% Asia Pacific 25% Europe, Middle East and Africa 21% Americas 13% For more information on Asia Pacific, see page 7. For more information on the UK, see page 88. Americas Growing our presence in the US is a strategic priority. Challenging market conditions led to net outflows of £1.3 billion (2014: outflows of £0.3 billion) in the US, Canada and Latin America in 2015. Europe, Middle East and Africa Demand from intermediary investors for fixed income, multi-asset and equity products led to net inflows in Asset Management in the region of £3.9 billion (2014: £5.9 billion). In 2015 we established a presence in South Africa. For more information on the Americas, see page 45. Investing in innovation We develop investment products and solutions to meet the changing needs of our clients. We also invest our own capital in building a track record in new investment strategies. Investment capital 2013 2014 2015 For more information on Europe, Middle East and Africa, see page 158. Growing our business Our focus remains on the long term and we continue to invest in organic growth opportunities across the business, while remaining vigilant of inorganic opportunities. We have a ‘Highest Standards’ Asset Manager Rating from the independent ratings agency, 515 Fitch. This is the highest possible rating for 725 an asset manager and recognises our long 942 history, diversified business model and financial stability. £m UK Strong demand from institutional clients for fixed income and multi-asset strategies drove net new business of £1.9 billion in the UK (2014: £13.8 billion). Our Wealth Management business in the UK generated net new business of £0.2 billion (2014: £0.5 billion). For more information about our structure see page 16. For more information about our business model see page 14. Schroders | Annual Report and Accounts 2015 3 Chairman’s statement Board succession Succession planning has been a long-term priority for the Board, particularly for the role of Chief Executive. Michael Dobson will be succeeded as Chief Executive by Peter Harrison on 4 April 2016. We are focused on delivering for our clients and shareholders over the long term. Profit before tax and exceptional items 609.7m £ (2014: £565.2 million) Total dividend per share 2011 2012 2013 2014 2015 4 pence per share Results 2015 was a year of uncertainty for global markets, which saw the first interest rate rises in the US since 2006, fears of a Chinese hard landing and continued pressure on commodity prices. Despite this, Schroders delivered record results. Profit before tax and exceptional items increased 8 per cent. to £609.7 million (2014: £565.2 million). Our highly diversified business model led to our winning net new business of £13.0 billion (2014: £24.8 billion) and assets under management ended the year at £313.5 billion (2014: £300.0 billion). Our policy is to increase dividends progressively in line with the trend in profitability. In accordance with our policy, the Board will recommend to shareholders at the Annual General Meeting a final dividend of 58.0 pence (2014: 54.0 pence). This will bring the total dividend for the year to 87.0 pence (2014: 78.0 pence), an increase of 12 per cent. The final dividend will be paid on 5 May 2016 to shareholders on the register at 29 March 2016. 39 43 58 78 87 Schroders | Annual Report and Accounts 2015 In Michael Dobson we have been fortunate to have a truly exceptional Chief Executive lead the Group for over 14 years. During this time the Group has weathered financial crises, turmoil in global markets, increased competition and an increase in regulatory scrutiny of culture and conduct within financial services. Against this backdrop Michael has developed and maintained a strong, client-focused culture that is core to Schroders. Under his leadership, the firm has delivered record results and assets under management have more than tripled, generating significant value for shareholders. On behalf of the Board, I would like to thank Michael for his enormous contribution to our success. Massimo Tosato will retire from the Board and leave the firm at the end of 2016. Massimo has also made a significant contribution to the Group over the past 21 years as head of our successful Distribution business. He leaves at the end of the year with our thanks and best wishes for the future. We have also had change in our non-executive Directors. Luc Bertrand retired as Senior Independent Director following the 2015 Annual General Meeting and was succeeded by Philip Howard. Luc had been a member of the Board since 2006 and we benefited greatly from his experience and expertise. In July 2015, we announced the appointment of Rhian Davies as a non-executive Director and member of the Audit and Risk Committee. Rhian will take over from Ashley Almanza as Chair of this Committee at the conclusion of the 2016 Annual General Meeting when Ashley leaves the Board. We are sorry to see Ashley leave, but we understand that his commitments at G4S have made it increasingly difficult for him to continue with us. Strategic report: Overview Whilst change is inevitable, Schroders thrives on continuity and stability. The appointment of Peter Harrison is evidence of our long-term succession planning and the Board’s desire to promote someone from within who understands Schroders’ unique culture. Peter was the Board’s unanimous choice and we wish him well as he takes the firm forward. I will retire from the Board on 4 April 2016 when Michael Dobson will become Chairman. A Chief Executive becoming Chairman is unusual in corporate governance terms and we have consulted with shareholders and considered the provisions of the UK Corporate Governance Code in making this decision. The Board unanimously believes this is in the best interests of the Company and its shareholders, with his appointment ensuring stability and continuity with clients, shareholders, strategic and commercial partners and regulators. Philip Howard, our Senior Independent Director, led the Board’s deliberations over my successor and Philip Howard provides more detail on those deliberations on page 57. I played no part in choosing my successor, but I am fully supportive of the decision to appoint Michael. I have greatly enjoyed being part of Schroders and it has been a privilege to have led the Board and to have worked with such a talented management team. Over the years I have met many employees across the world and I have always been struck by their enthusiasm, talent and, most importantly, the pride they have in working for Schroders and doing the right thing for clients, the firm and shareholders. At a time when regulators and commentators are questioning corporate culture and how boards can embed an appropriate culture across a diverse business, I can say with confidence that the right culture is well and truly embedded within this firm. This is a unique organisation that always strives to do the right thing. I am sure our clients, employees and shareholders will be reassured that this approach will continue. Our people are our most important asset and retaining talent is a key strategic objective. For more details on how we train and develop our employees and our approach to diversity, see page 22. Our newly-formed Data Insights team focuses on developments in data analytics to complement the traditional research of our investment professionals. For more on the team’s work, see page 27. Working with almost 800 charities, foundations and endowments, we are the largest investment manager of charity assets in the UK. For more on our work in this sector, see page 35. Our Board has continued to evolve through 2015. For more details on our Board members, see page 46. Andrew Beeson Chairman Schroders | Annual Report and Accounts 2015 5