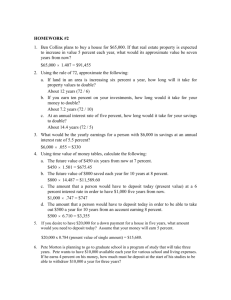

Consumer Education Unit 4 Test: Savings & Investment

advertisement

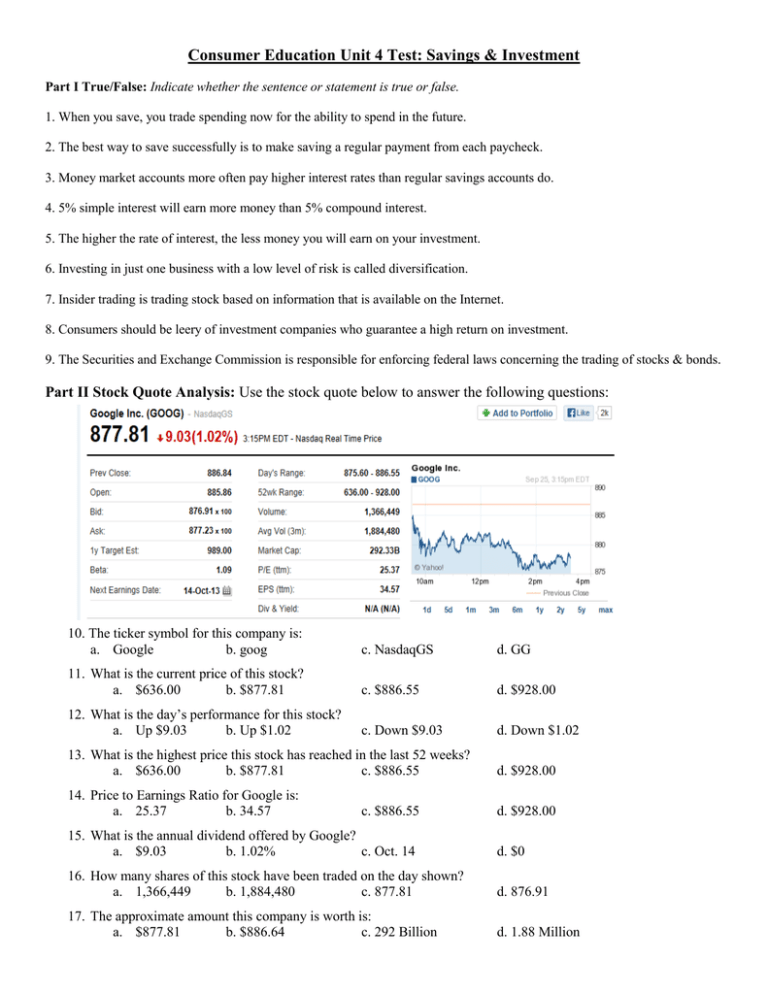

Consumer Education Unit 4 Test: Savings & Investment Part I True/False: Indicate whether the sentence or statement is true or false. 1. When you save, you trade spending now for the ability to spend in the future. 2. The best way to save successfully is to make saving a regular payment from each paycheck. 3. Money market accounts more often pay higher interest rates than regular savings accounts do. 4. 5% simple interest will earn more money than 5% compound interest. 5. The higher the rate of interest, the less money you will earn on your investment. 6. Investing in just one business with a low level of risk is called diversification. 7. Insider trading is trading stock based on information that is available on the Internet. 8. Consumers should be leery of investment companies who guarantee a high return on investment. 9. The Securities and Exchange Commission is responsible for enforcing federal laws concerning the trading of stocks & bonds. Part II Stock Quote Analysis: Use the stock quote below to answer the following questions: 10. The ticker symbol for this company is: a. Google b. goog c. NasdaqGS d. GG 11. What is the current price of this stock? a. $636.00 b. $877.81 c. $886.55 d. $928.00 12. What is the day’s performance for this stock? a. Up $9.03 b. Up $1.02 c. Down $9.03 d. Down $1.02 13. What is the highest price this stock has reached in the last 52 weeks? a. $636.00 b. $877.81 c. $886.55 d. $928.00 14. Price to Earnings Ratio for Google is: a. 25.37 b. 34.57 d. $928.00 c. $886.55 15. What is the annual dividend offered by Google? a. $9.03 b. 1.02% c. Oct. 14 d. $0 16. How many shares of this stock have been traded on the day shown? a. 1,366,449 b. 1,884,480 c. 877.81 d. 876.91 17. The approximate amount this company is worth is: a. $877.81 b. $886.64 c. 292 Billion d. 1.88 Million Part III: Investment Analysis: Use the investment risk pyramid below to answer the following questions: 18. The largest area of the pyramid that should comprise the bulk of your assets is: a. b. c. d. Summit Middle Base None of these 19. Which level in the pyramid can an investor have the highest potential return on investment? a. Summit b. Middle c. Base d. None of these 20. Which level would a retired, senior citizen want the majority of their assets invested in? a. Summit b. Middle c. Base d. None of these 21. A person who buys apartments and rents them out as an investment and income source would be in which level of the pyramid? a. Summit b. Middle c. Base d. None of these Part III: Multiple Choice – Savings & Investment Concepts 22. Which one of the following is NOT a retirement account option? a. Certificate of Deposit b.401 (k) c. 403(b) d. Roth IRA 23. What is the most common retirement option in corporate America? a. Certificate of Deposit b.401 (k) c. 403(b) d. Roth IRA 24. Which of the following is NOT true about investing? a. Investing early can earn more money than investing larger dollar amounts b. Compound interest yields a greater return than simple interest c. Most millionaires are inactive investors in the stock market d. Over the long-term, investing in the stock market is not a wise strategy 25. What investment option offers the least amount of risk? a. Junk Bonds b. S & P 500 index fund c. Blue-chip stocks d. Government bonds 26. Which of the following investments is the most liquid? a. Real Estate Property b. 5-year Treasury bill c. Savings Account balance d. McDonalds common stock 27. Which one of the following examples would be the most diversified portfolio? a. 10% in cash, 10% in bonds, 80% in the stock market b. 30% in cash, 35% in the stock market, 35% in bonds c. 50% mutual funds, 50 % in government bonds d. 50% cash, 50% mutual funds 28. Which one of the following individuals has the greatest chance of financial security by the retirement age of 65? a. 20 year old who invests $200 a month earning 8% interest b. 30 year old who invests $200 a month earning 10% interest c. 35 year old who invests $300 a month earning 8% interest d. 40 year old investing $400 a month earning 10% interest 29. According to the Rule of 72, a $1,000 investment at 4% would take how long to double? a. 4 years b. 10 years c. 18 years d. 25 years 30. Financial institutions that offer memberships to people who share a common bond, such as people in a particular profession, company, or labor union are ____. a. savings banks b. credit unions c. savings and loan associations d. commercial banks 31. A written promise to pay a debt by a specified date is called a ____. a. yield b. bond c. bank deposit d. Dividend 32. If you deposit $200 in an account that pays 6 percent simple interest per year, which of the following would be the balance in your savings account at the end of the first year? a. $210 b. $250 c. $212 d. $206 33. Interest that is paid on the principal and on previously earned interest, assuming that the interest is left in the account, is called ____. a. simple interest b. compound interest c. interest d. flexible interest 34. Savings accounts are ____. a. offered by any savings institution b. a place in which you can deposit money c. a way you can earn interest d. all of the above 35. The dollar value printed on a bond is the ____. a. number of the bond b. face value of the bond c. interest of the bond d. term of the bond 36. As a school teacher, Liz can choose to join a financial institution with other school employees that offers her a membership when she deposits her money there or opens a checking account. This type of financial institution is known as a ____. a. savings bank b. savings and loan c. commercial bank d. credit union 37. The chance that an investment will decrease in value is a ____. a. choice b. trade c. risk d. certainty 38. Which of the following is a tax-deferred retirement savings plan offered to employees by their employer? a. 401(k) plan b. individual retirement account c. investment clubs d. Securities and Exchange Commission 39. A unit of ownership in a corporation is a ____. a. dividend b. bond c. share of stock d. capital gain or loss 40. A company that specializes in helping people buy or sell stocks and bonds is ____. a. a brokerage firm b. market dealership c. a money manager d. a finance company 41. The profit you earn from selling stock at a higher price than you paid is called a ____. a. capital loss b. capital gain c. windfall d. Refund 42. What is the name of the agency that is responsible for enforcing laws concerning the trading of stocks and bonds? a. CRD b. NASD c. SEC d. NASDAQ 43. Denny and his wife, Missy, want to diversify their investments to reduce their risk. They have decided to participate with many other investors in an organization that owns stock in many businesses that have a variety of risks. What type of investment plan have they chosen? a. a prospectus b. an individual retirement account c. a 401(k) d. a mutual fund 44. Which one of the following is an example of dollar-cost averaging? a. Jon invested $5,000 of his Christmas bonus last year in the stock market b. Joan deducts $200 from each paycheck that is automatically deposited into a retirement account c. Erica used his tax return of $3,000 to invest into a retirement account d. Doug invested $1,000 last summer and plans to invest another $1,000 in the winter 45. The time value of money refers to the concept of: a. Investing higher dollar amounts b. Investing in higher yielding accounts c. Importance of investing early d. Dollar-cost averaging Part IV Short Answer (5 points) 46. You were given an initial investment amount at the beginning of the stock market simulation. If this was your real money to invest, list three alternatives of what and how you could have invested this money. Of those three pick one and explain why you would choose that investment and why? Include details and specifics as to why you think this would be a successful investment. Short Answer Grading Rubric Item 3 alternative investments 0-2 points 1 or more investment options are missing from the student’s response. 0-1 point Investment choice No alternative chosen or alternative chosen did not include details or reasons why it would be successful. 3 points Student’s response includes 3 alternatives. Each alternative listed is a valid and realistic investment option. 2 points Student includes examples, details and fully explains why this investment option would be successful.