Unit 3 Test: Banking, Budgeting & Taxes True/ False:

advertisement

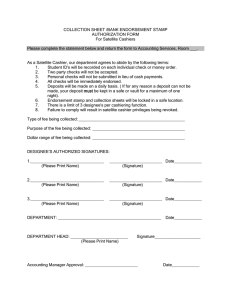

Unit 3 Test: Banking, Budgeting & Taxes True/ False: Mark A for True and B for False on your answer sheet. 1. Fixed Expenses are bills that are the exact same amount every month. 2. The most dangerous type of check endorsement is the blank endorsement because anyone can cash the check. 3. If an individual fails to pay their income taxes they can be charged with tax evasion and sent to jail. 4. Individuals must report all income earned, including all tips and cash received as part of their employment. 5. Sales tax is collected at the same rate for citizens in all counties in Illinois. 6. Citizens of all states must pay federal and state income taxes. 7. When budgeting for expenses you should pay yourself first. 8. Because of compound interest, APR is higher than APY. 9. If a check differs from what is written in words and numbers, the amount in numbers governs. 10. When you make a mistake on a check you can draw a line through your mistake, list the correct amount and put your initials. 11. Banks charge a fee for a stop-payment order and on any NSF checks. 12. All banks charge a monthly service fee to have a checking account. 13. By law, banks are not required to honor checks more than 6 months old. 14. Net Income is a higher dollar amount than Gross Income. 15. An excise tax is also known as a sin tax. 16. The term liquidity refers to how quickly an asset or savings option can be turned into cash. Multiple Choice: Select the best answer for each question and mark that letter on your answer sheet 17. Which one of the following would be considered a Fixed Expense? A. Grocery Bill B. Electricity Bill C. Mortgage Payment D. Clothing Expenses 18. Which one of the following would be NOT be considered a Flexible Expense? A. Electricity Bill B. Student Loan C. Entertainment Expenses D. Gasoline Expenses 19. What is the generally recommended amount that you should save from you net pay? A. 2-5% B. 8-10% C. 20-25% D. 25-30% 20. As a consumer, most bills arrive on a _____ basis. A. Weekly B. Monthly C. Quarterly D. annual 21. In what order should the following items be used to handle unexpected expenses? A. Savings, Insurance, Credit B. Insurance, Savings, Credit C. Credit, Savings, Insurance D. Credit, Insurance, Savings 22. Which one of the following is NOT a possible deduction from your paycheck? A. Health Insurance B. Social Security Tax C. Federal Income Tax D. School District Tax 23. As a consumer it is advised that your monthly mortgage or rent payment should be closest to what percentage of your net income? A. 10% B. 25% C. 50% D. 75% 24. Checks listed in your check register but do not appear on your bank statement are known as: A. Certified Checks B. Outstanding Checks C. Cashier’s Checks D. Cancelled Checks 25. Which one of the following would NOT be considered a guaranteed form of payment? A. Personal Check B. Certified Check C. Money Order D. Cashier’s Check 26. A check that has been cashed and cleared by your bank is called a: A. Cancelled Check B. Certified Check C. Outstanding Check D. Cashier’s Check 27. The FDIC insures deposits on all savings accounts up to ________ through December 31, 2013. A. $250,000 B. $200,000 C. $100,000 D. No Amount Insured 28. When using a ____ card the amount of your purchase is automatically deducted from your checking account. A. Debit Card B. Credit Card C. Gift Card D. Traveler’s Check 29. Which tax form is filled out by your employer, stating your total earnings, state and federal income tax paid for the year and is required to be returned to you by January 31 of the following year? A. 1040 EZ B. 1099 INT C. W2 D. W4 30. Which one of the following items could not be used as a deduction to lower your taxable income. A. Charitable donations B. Property Tax C. Interest on Student Loan D. Savings Account Interest 31. Which one of the following does not have an Excise Tax? A. Gasoline B. Hotel C. Alcohol D. Beauty Salon 32. Taxes must be filed and postmarked to the IRS by _______ of each year. A. April 1 B. April 15 C. April 20 D. April 30 33. Claiming which number of allowances on your W4 would lead to the largest possible tax return? A. 0 B. 1 C. 2 D. 3 34. Which one of these people would have the greatest amount of taxes deducted from their net pay? A. Single, 1 dependents B. Married, no dependents C. Single, 0 dependents D. Married, 1 dependent 35. The 1st set of numbers listed on the bottom left of a check is the _________ and the 2nd set of numbers is_________. A. Bank’s routing number; your check number B. Bank’s routing number; your account number C. Your account number; bank’s routing number D. Your account number; bank’s ABA number 36. All of the following are advantages of online banking EXCEPT: A. Easy to access from computers and mobile devices B. Saves money on stamps & additional checks C. Is less time consuming than writing checks D. Eliminates the threat of identity theft 37. Overdraft protection will take money out of your _________ account if your checking account is overdrawn. A. Checking B. Savings C. Money Market D. Certificate of Deposit 38. A check is endorsed on the side opposite of which part on the front of a check? A. “Pay to the Order of” B. Amount of the check written in numbers C. Your signature D. None of these 39. A check that is endorsed with the words, “For Deposit Only,” is a ________ endorsement A. Restrictive B. Blank C. Traditional D. Special 40. A check that is signed over to another person is a _______ endorsement. A. Restrictive C. Traditional B. Blank D. Special 41. When compounding your interest the best method to earn the most interest would be compounding: A. Daily B. Monthly C. Quarterly D. Annually 42. If an individual is going over their budget in an attempt to make immediate changes to their budget for the next month, which of the following is an expense category that cannot be reduced? A. Entertainment B. Clothing C. Dining Out D. Car Payment 43. ___________ provides the convenience and safety of having your payroll check electronically placed into the bank account(s) of your choice. A. Direct Withdrawal B. Direct Deposit C. Certificate of Deposit D. Certificate of Withdrawal 44. A member owned and controlled financial Institution is known as a _______ a. Credit Union B. Bank C. Savings & Loan D. Stock Brokerage Graphical Analysis: Use Figure 3-1 to answer the following questions 45. Which of the following categories comprised the largest amount expenses? a. Transportation b. Life c. Housing Figure 3-1 d. Savings 46. What category would student loans be under? a. Savings c. Debt Repayment b. Transportation d. Housing 47. According the figure 3-1, if the household income was $1,000 per month, how much is allocated to savings? a. $1 c. $100 b. $10 d. $1,000 Use the paystub below to answer questions 49-50: 48. The Take-home pay for Victoria J. Buchannon on the above paystub is: a. $2,933.69 b. $1,785.16 c. $1,735.16 d. $50.00 49. Of the deductions listed on the paystub which taxes can the employee possibly get as a refund when filing their end of the year taxes? a. Social Security & Federal Tax c. Unemployment & Social Security Tax b. Federal & State Tax d. Medicare & State Tax 50. Which of the following amounts from this paycheck reflects the tax used to fund retirement in America? a. $43.84 b. $2.64 c. $187.47 d. $82.14