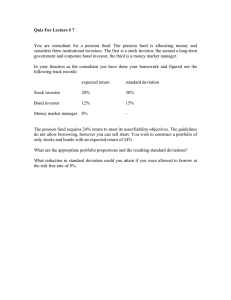

SPECIAL REPORT (Tabloid Format): BusinessWorld. Manila: May 30, 2005. pg. 1

advertisement

SPECIAL REPORT (Tabloid Format): Guide to Bonds & Other Fixed- Income; [13] Louise Constantino, Trader, Hongkong and Shanghai Banking Corp.. BusinessWorld. Manila: May 30, 2005. pg. 1 http://proquest.umi.com/pqdweb?did=846698591&sid=3&Fmt=3&clientId=68814&RQT= 309&VName=PQD Abstract (Document Summary) An investor who wants to keep his principal intact while earning interest may consider a "buy and hold" strategy. When an investor purchases a bond and holds it to maturity, he will receive interest payments and receive the face value of the bond at maturity. When an investor buys a bond and holds it to maturity and the market value of the bond falls, the investor would not be affected unless he changes his strategy and tries to sell the bond. On the other hand, if an investor holds on to a bond, he would be unable to invest the principal at higher market rates. If the bond purchased is callable, the investor faces the risk that his principal would be returned to him prior to maturity. He may also be forced to reinvest his bond proceeds at lower rates since issuers of callable bonds would redeem their bonds when interest rates are falling. It is also important to consider the credit quality of the issuer. While a bond with a lower credit rating may offer a higher yield, it also carries greater risk that the issuer would default on his obligations, i.e., he will not be able to repay the principal and pay interest. Full Text (747 words) (Copyright 2005. Financial Times Information Limited - Asia AfricaIntelligence Wire. All Material Subject to Copyright.) Before choosing or formulating an investment strategy, an investor must first determine his investment goals and time frames as well as his appetite for risk. 1. Diversification Generally, it is always good to diversify or to avoid putting all assets in a single asset class or investment. Choosing bond investments with different characteristics would protect an investor from the possibility that any one issuer will default on its obligation to pay interest and repay the principal. Also, choosing different types of bonds (government, corporate, asset-backed securities, etc.) would protect an investor from losses in a particular market sector. If one sector or asset class is in the midst of a downturn, the rise in the value of another class of assets may help offset the negative impact. 2. Earning of Interest and Preservation of Principal An investor who wants to keep his principal intact while earning interest may consider a "buy and hold" strategy. When an investor purchases a bond and holds it to maturity, he will receive interest payments and receive the face value of the bond at maturity. When an investor buys a bond and holds it to maturity and the market value of the bond falls, the investor would not be affected unless he changes his strategy and tries to sell the bond. On the other hand, if an investor holds on to a bond, he would be unable to invest the principal at higher market rates. If the bond purchased is callable, the investor faces the risk that his principal would be returned to him prior to maturity. He may also be forced to reinvest his bond proceeds at lower rates since issuers of callable bonds would redeem their bonds when interest rates are falling. It is also important to consider the credit quality of the issuer. While a bond with a lower credit rating may offer a higher yield, it also carries greater risk that the issuer would default on his obligations, i.e., he will not be able to repay the principal and pay interest. 3. Maximization of Income and Total Return An investor who wants to maximize his interest income can get higher yields on longerterm bonds. Since the time to maturity for these bonds is longer, they are more vulnerable to changes in interest rates. In the corporate market, borrowers with lower credit ratings pay higher income to compensate investors for the additional risk they carry. An investor who purchases highyield bonds may also want to diversify his investments among several issuers to minimize the possible impact of any single issuer's default. Many investors use callable securities to earn capital gains as well as income, as opposed to a buy-and-hold strategy focused on income and preservation of principal. Owners of callable securities have the view that yields will remain relatively stable so that the investors would be able to capture the yield spread over non- callable securities of similar duration. 4. Risk Management Another diversification strategy is laddering, or the purchase of securities of a range of maturities to reduce the portfolio's sensitivity to interest rate risk. If the portfolio were composed of only short-term securities, the portfolio is subject to low interest rate risk but may be giving up yield. Conversely, investing only in long-term securities may result in greater returns, but the prices of these securities will be more volatile, exposing the investor to losses should he sell before maturity. Building a laddered portfolio means buying an assortment of bonds with maturities distributed over time. For example, an investor may purchase bonds maturing in two, four, six, eight, and ten years. In two years, when the first bonds mature, the investor can reinvest his proceeds in a 10-year bond, maintaining the ladder. Suppose after two years interest rates had fallen, the proceeds from the two-year bonds would be reinvested at a lower rate, but the rest of the portfolio are earning the previous higher rates. If, on the other hand, interest rates rose, the outstanding portfolio would be earning below market rates, but this could be corrected by reinvesting the proceeds from the two-year bonds at the higher prevailing interest rates. Investors can also manage interest rate risk by using a barbell strategy, where investments only in short-term and long-term bonds are made (no intermediate terms). The long-term investments are expected to deliver high coupon rates, while having short-term assets gives the investor the flexibility of investing his principal elsewhere if the bond market suffers. References: http://www.investinginbonds.com http://www.fisbonds.com