Bearish trend in bonds to continue

advertisement

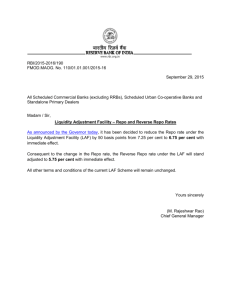

Bearish trend in bonds to continue Businessline. Chennai: May 2, 2005. pg. 1 http://proquest.umi.com/pqdweb?did=830987811&sid=5&Fmt=3&clientId=68814&RQT= 309&VName=PQD C. Shivkumar Abstract (Document Summary) The RBI on Thursday effected a 25 basis point hike in the reverse repo rate to 5 per cent. (The reverse repo is a mechanism whereby the RBI sells securities to eligible money market participants, including banks, and buys them back after a predetermined period. This mechanism is used to siphon off excess liquidity). The hike in the reverse repo rate was partly driven by inflationary concerns. Firstly, there was the cost-push element, as a result of oil price increases. The other cause was the rising domestic liquidity, on account of mounting foreign exchange inflows. Some banks attempted to cover losses in securities trading through parking in reverse repo auctions, traders said. At last week's reverse repo auction, the RBI was able to mop up close to Rs 28,000 crore. Real yields: Despite firm yields, real yields up to one year turned negative once again. Real yields, the difference between nominal yields and inflation, which had remained positive up to last week moved into negative territory by four basis points, as against the internationally accepted levels of a 1.5 per cent. Inflation as measured by the wholesale price index last week was 5.64 per cent. Traders said the government was likely face difficulties in placing the Rs 8,000 crore borrowings through reissue of the 7.55 per cent 2010 paper and the 7.50 per cent 2034 paper this week. Full Text (1026 words) (Copyright 2005. Financial Times Information Limited - Asia AfricaIntelligence Wire. All Material Subject to Copyright.) BOND yields went over the roof as traders were stunned by the Reserve Bank of India's move in the lean season Credit Policy. The RBI on Thursday effected a 25 basis point hike in the reverse repo rate to 5 per cent. (The reverse repo is a mechanism whereby the RBI sells securities to eligible money market participants, including banks, and buys them back after a predetermined period. This mechanism is used to siphon off excess liquidity). The hike in the reverse repo rate was partly driven by inflationary concerns. Firstly, there was the cost-push element, as a result of oil price increases. The other cause was the rising domestic liquidity, on account of mounting foreign exchange inflows. Most traders had expected the reverse repo rate to be retained, especially given the large government borrowings slated for the first half of this fiscal (April-September). Govt borrowings: The government was expected to raise at least Rs 83,000 crore during the first half. So far, the government has raised Rs 15,000 crore. With Rs 68,000 crore still in the pipeline, traders said that they had expected that any move to hike rates would be staved off to the second half of the year. That few traders expected the hike was evident from the low cut- off yields at the 91-day Treasury bill rate. The cut-off yield for the 91-day T-bill rate was 5.11 per cent. On a weighted average basis (evidently bids were made at even prices higher than the cutoff), yields were even lower at 5.08 per cent. Cut-off yields: The previous week, the cut-off yield on the 91- day T-bills was 5.15 per cent. Similarly, in the case of the 364- day T-bill, the yield was 5.60 per cent, slightly lower than the cut- off yield of the previous week's 5.64 per cent. The hike in the reverse repo rate, however, altered any expectations of yield softening. This was reflected by a sharp drop in the 10-year yield to maturity (YTM) to 7.29 per cent on a weighted average basis, up from previous week's 7.14 per cent. Windfall for banks: But, for most of the banks, the hike has come as a windfall. The earnings on reverse repo has improved by at least 20 basis points, implying better spreads over their weighted average cost of working funds. The weighted average cost of working funds for most banks, especially in the public sector, are about 4 per cent. Some banks attempted to cover losses in securities trading through parking in reverse repo auctions, traders said. At last week's reverse repo auction, the RBI was able to mop up close to Rs 28,000 crore. Bankers said that yields could go up further in the coming weeks. US Fed rate: This was because of the anticipated hike in the US Fed Funds rate (the rate at which US banking institutions lend/ borrow overnight funds). The Federal Open Market Committee is due to meet on Tuesday. Markets have already discounted a hike of 25 basis points. Traders said that any hike above this expectation would trigger a sharper rise in yields. This was particularly because such a hike was expected to trigger a sell-off in the equity markets by the foreign institutional investors (FIIs), which in turn was likely to tighten liquidity in the domestic money markets, they added. This apprehension, however, failed to reflect in the foreign exchange markets, where forward premia actually dropped below 2 per cent across all tenors. One month, which is by far the most volatile, fell to about 1.94 per cent. This was partly due to the fact that most of the FIIs have shifted to the spot market instead of taking forward cover. Oil cos stay away: Besides, none of the oil companies were in the foreign exchange markets during the week, anticipating correction in oil prices. Moreover, bankers said that there were substantial current account inflows to negate the impact of possible large FII/ hedge funds exit. Forex inflows for the latest week was over $ 1 billion. Bearish trend: However, traders foresaw a bearish market, evident from the thin trading volumes and wide spreads. Trading volumes were less than Rs 3,000 crore per day during the week. The spread between one year and 23 years was close to 180 basis points. Traders said that most of them were moving to the shorter dated securities. In fact, there was little demand for longer dated papers. Among the largest trading volumes recorded in a single paper was in the 11.50 per cent 2015 paper. At least, Rs 50 crore worth of this paper shifted hands on Friday. Bankers said this was partly because some banks pushed through the sale of this paper at 7.30 per cent, anticipating a further rise in yields in the coming weeks and therefore wanted to book profits. Moreover, life insurance companies, active in the markets after a gap of almost two weeks, were able to drive down prices and thereby push up yields to their advantage. Real yields: Despite firm yields, real yields up to one year turned negative once again. Real yields, the difference between nominal yields and inflation, which had remained positive up to last week moved into negative territory by four basis points, as against the internationally accepted levels of a 1.5 per cent. Inflation as measured by the wholesale price index last week was 5.64 per cent. Traders said the government was likely face difficulties in placing the Rs 8,000 crore borrowings through reissue of the 7.55 per cent 2010 paper and the 7.50 per cent 2034 paper this week. Rising C-D ratios: This anticipation also stemmed from the rising credit- deposit ratios. Banks, the largest investors in government securities, are facing huge credit growth. Credit-deposit ratios for most of them are close to 100 per cent. Moreover, most of them already have investment deposit ratios above 44 per cent. As a result, few were interested in picking up long-dated securities. Focus on deposits: Instead, the focus was on raising deposits. Many banks were now expected to push for raising more long-term deposits and some are preparing to hike deposit rates.