FOR ACTION Board of Trustees Charles Stewart Mott Community College

advertisement

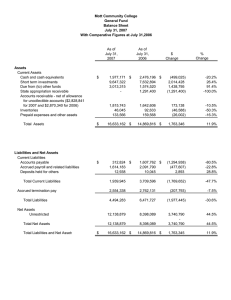

FOR ACTION Board of Trustees Charles Stewart Mott Community College Regular Meeting, February 23, 2015 Volume Treasurer’s Report for January 2015 This resolution is recommended. Be it Resolved, that The Charles Stewart Mott Community College Board of Trustees Accepts the financial report of the College for the month of January 2015 as presented by the Administration. Reviewed and Submitted By: _____________________________________ Larry Gawthrop, CFO Date: February 23, 2015 Board Policy Statement Reference: “3100 Budget Adoption: General: The Board recognizes that its annual budget represents the programmatic direction and vision of the College. It is also designed to meet both the legal requirements and needs of the College. 1. The Finance Committee shall receive and review budget reports on a monthly basis.” January’s Treasurer’s Report Larry Gawthrop, CPA Chief Financial Officer February 23, 2015 Summary of Expenditures: Month of January’s Spending: General Fund: All Other Funds: Total: $ $ $ 5,541,388 8,887,112 14,428,500 Comments on General Fund Financial Statements: Statement of Revenues, Expenditures and Changes in Net Assets In summary, total revenues for the seven months ended January 31, was approximately $50.7 million, representing 67.2% of the annual budget, compared to 68% in the prior year. The most significant changes are in the Tuition and fees State appropriations, and Property taxes which are discussed further below. Expenditures for the seven months ended were $40.8 million, which represents 54.1% of the annual budget, 1% higher than it was one year ago, due in large part to the combination of the UAAL payment to ORS offset by savings in Salaries and wages. Revenues Tuition and fees revenues are $30.6 million $240 thousand less than last year and 4.2% lower than the original budget at this time. This is attributable to the fall enrollment being less than originally budgeted. The amended budget is reflects the new estimate for the fiscal year. Property taxes collected are roughly $11.2 million. The amount budgeted is $17.3 million, the same as it was in the 2013-2014 fiscal year and is based on final taxable value figures provided by the Genesee County Equalization Department. State appropriations payments for FY 2014-15 are paid in eleven monthly installments starting with October. The total budgeted amount for the current fiscal year is $15.7 million or roughly $400 thousand (2.7%) more than last year excluding the UAAL stabilization pass-through. We received our January payment as expected. Expenditures Salaries and Wages are nearly $20.3 million, or 50.4% of the annual budget, 2.5% lower than it was one year ago, when we were at 52.9% of the budget. The decrease is attributable to the lower enrollment, continued holds on vacant positions and transfer of Mott temporary workers to a temporary agency on January 1. Fringe Benefits are at $10 million, or 57% of the budgeted amount compared to 50.6% of the budget one year ago. The increase in this line item is directly attributed to the UAAL stabilization payment received by the State if Michigan that is directly remitted to the Office of Retirement Services (ORS) for the unfunded portion of the retirement obligation. Other Expenditures A majority of the changes in the Other Expenses area for January is due in large part to timing differences of invoices from receipt and vouchering of invoices from last year as well as a change in the recognition of prepays from monthly to once a year. In addition, there continues to be an increase in the contracted services line item in the area of maintenance and ITS. Balance Sheet Total Assets are at approximately $22.9 million, down $1.7 million from last January. The largest differences are a $3.7 million increase in Cash and cash equivalents, a $5.5 million decrease in Due from other funds and a $151 thousand increase in Accounts receivable. The Accounts receivable increase is due to the reduction of the allowance for doubtful accounts due to better collection and student accounts receivable management. Due to/Due from Other Funds result from the College maintaining one checking account for all of its funds; deposits and disbursements. This necessitates the short-term “loaning” or “borrowing” between the funds throughout the year depending on which funds revenue or expenditures are being deposited or paid out. Each month the accounting department clears these “due to’s” and “due from’s” respectively assigning the activity to the proper fund. However, significant activity can occur after these transfers are completed, causing large variances when compared to the previous period. At roughly $6.7 million, Total Liabilities are down $234 thousand from the prior year. The most significant changes were an increase in Accounts payable and a decrease in Other accrued liabilities and Accrued termination pay. The Accounts payable was due to the timing of vendor payments and increase in the employer health insurance expenses and the other accrued liabilities were due to an overall reduction in the valuation we recorded for past property tax refund obligations and reduction in the actuarial valuation of the college liability for termination benefits paid upon leaving employment at MCC. Comments on spending from other funds: Of the roughly $8.9 million expended in the other funds, $204 thousand was expended out of the Maintenance and Replacement funds , $378 thousand out of the Bond funds, $16 thousand out of the Lapeer Capital Funds and the remaining $8.3 million out of the Agency, Scholarships, and Federal Grants, for grant activities and student scholarships. Mott Community College General Fund Statement of Revenues, Expenditures and Changes in Net Assets - Modified Accrual For the 7 Months Ended January 31, 2015 With Comparative Totals at January 31, 2014 FY 2014-2015 Budget YTD Actuals as of 1/31/15 Actual to Actual $ Change YTD Actuals as of 1/31/14 Actual to Actual % Change Revenues: Tuition and fees Property taxes State appropriations Ballenger trust Grants and other $ 38,177,492 $ 30,550,620 $ 17,338,093 11,245,639 15,736,817 6,781,882 1,815,763 1,103,344 2,362,191 1,045,293 30,790,808 12,104,556 6,134,241 1,030,029 978,553 75,430,356 50,726,778 Salaries and wages Fringe benefits Contracted services Materials and supplies Facilities rent Utilities and insurance Operations/communications Transfers out Equipment and Improvements 40,310,719 17,608,243 5,131,756 2,126,599 205,400 2,938,000 5,284,424 1,453,100 366,500 Total expenditures Total revenues $ (240,188) (858,917) 647,641 73,315 66,740 -0.78% -7.10% 10.56% 7.12% 6.82% 51,038,187 (311,409) -0.61% 20,326,716 10,032,361 2,925,750 1,153,958 118,728 1,808,093 3,124,261 1,165,878 162,715 21,154,638 9,410,694 2,452,186 1,038,391 111,473 1,734,160 3,446,304 473,253 123,640 827,922 (621,667) (473,564) (115,567) (7,255) (73,933) 322,043 (692,625) (39,075) 3.91% -6.61% -19.31% -11.13% -6.51% -4.26% 9.34% -146.35% -31.60% 75,424,741 40,818,460 39,944,739 (873,721) -2.19% 5,615 9,908,318 11,093,448 (1,185,130) -10.68% Expenditures: Net increase/(decrease) in net assets Mott Community College General Fund Balance Sheet - Modified Accrual January 31, 2015 With Comparative Totals at January 31, 2014 As of January 31 2015 Assets Current Assets Cash and cash equivalents Due from other funds Accounts receivable - net of allowance for uncollectible accounts ($4,212,625 for 2015 and $4,969,841 for 2014) Inventories Prepaid expenses and other assets Total Assets $ 18,378,125 $ (265,205) 4,516,164 48,024 233,021 As of January 31 2014 14,634,520 $ 5,281,268 4,365,196 44,069 298,271 $ Change 3,743,605 (5,546,473) 150,968 3,955 (65,250) $ 22,910,129 $ 24,623,324 $ (1,713,195) $ 2,481,395 $ 1,673,581 14,912 151,457 2,282,662 $ 1,641,693 15,576 540,536 198,733 31,888 (664) (389,079) 4,321,345 4,480,467 (159,122) Accrued termination pay 2,392,598 2,468,249 (75,651) Total Liabilities 6,713,943 6,948,716 (234,773) Net Assets Unrestricted 16,196,191 17,674,608 (1,478,417) Total Net Assets 16,196,191 17,674,608 (1,478,417) 22,910,134 $ 24,623,324 $ (1,713,190) Liabilities and Net Assets Current Liabilities Accounts payable Accrued payroll and related liabilities Deposits held for others Other accrued liabilities Total Current Liabilities Total Liabilities and Net Assets $