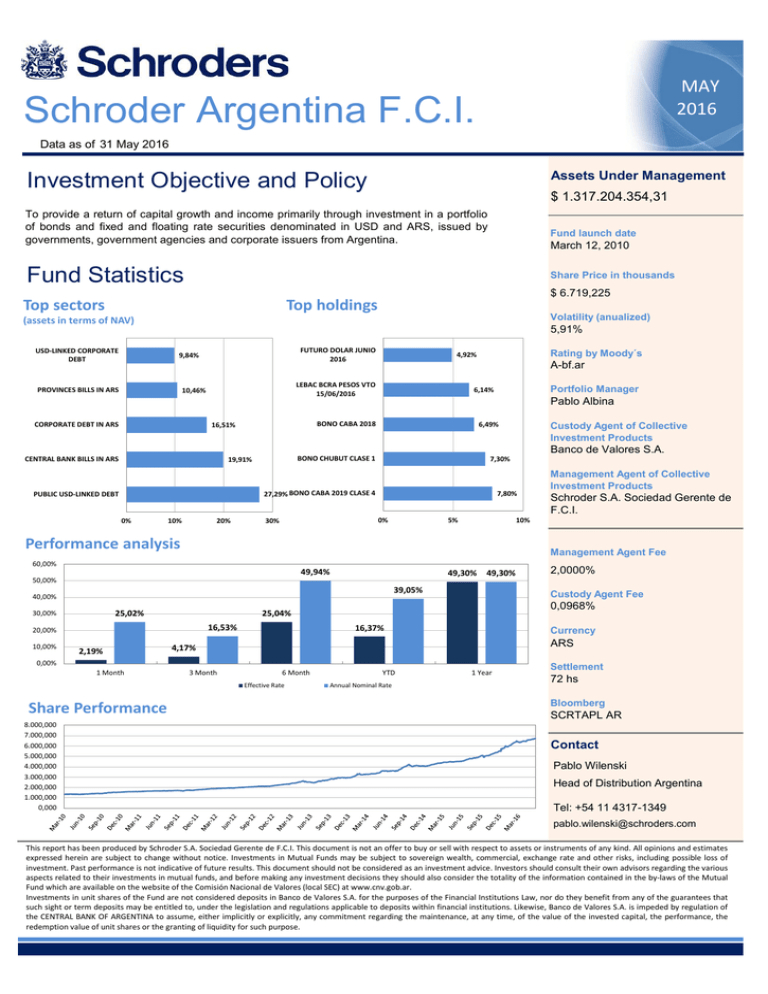

Schroder Argentina F.C.I. Investment Objective and Policy MAY 2016

advertisement

MAY 2016 Schroder Argentina F.C.I. Data as of 31 May 2016 Assets Under Management Investment Objective and Policy $ 1.317.204.354,31 To provide a return of capital growth and income primarily through investment in a portfolio of bonds and fixed and floating rate securities denominated in USD and ARS, issued by governments, government agencies and corporate issuers from Argentina. Fund launch date March 12, 2010 Fund Statistics Share Price in thousands Top sectors $ 6.719,225 Top holdings Volatility (anualized) (assets in terms of NAV) USD-LINKED CORPORATE DEBT 5,91% FUTURO DOLAR JUNIO 2016 9,84% PROVINCES BILLS IN ARS CORPORATE DEBT IN ARS A-bf.ar LEBAC BCRA PESOS VTO 15/06/2016 10,46% Portfolio Manager 6,14% Pablo Albina BONO CABA 2018 16,51% Rating by Moody´s 4,92% 6,49% Custody Agent of Collective Investment Products Banco de Valores S.A. CENTRAL BANK BILLS IN ARS BONO CHUBUT CLASE 1 19,91% 7,30% 27,29% BONO CABA 2019 CLASE 4 PUBLIC USD-LINKED DEBT 0% 10% 20% 7,80% 0% 30% 5% Management Agent Fee 60,00% 49,94% 50,00% 49,30% 49,30% 39,05% 40,00% 16,53% 2,19% 0,0968% 16,37% Currency ARS 4,17% 0,00% 1 Month 3 Month 6 Month Effective Rate Share Performance 8.000,000 7.000,000 6.000,000 5.000,000 4.000,000 3.000,000 2.000,000 1.000,000 0,000 2,0000% Custody Agent Fee 25,04% 25,02% 20,00% 10,00% Schroder S.A. Sociedad Gerente de F.C.I. 10% Performance analysis 30,00% Management Agent of Collective Investment Products YTD Annual Nominal Rate 1 Year Settlement 72 hs Bloomberg SCRTAPL AR Contact Pablo Wilenski Head of Distribution Argentina Tel: +54 11 4317-1349 pablo.wilenski@schroders.com This report has been produced by Schroder S.A. Sociedad Gerente de F.C.I. This document is not an offer to buy or sell with respect to assets or instruments of any kind. All opinions and estimates expressed herein are subject to change without notice. Investments in Mutual Funds may be subject to sovereign wealth, commercial, exchange rate and other risks, including possible loss of investment. Past performance is not indicative of future results. This document should not be considered as an investment advice. Investors should consult their own advisors regarding the various aspects related to their investments in mutual funds, and before making any investment decisions they should also consider the totality of the information contained in the by-laws of the Mutual Fund which are available on the website of the Comisión Nacional de Valores (local SEC) at www.cnv.gob.ar. Investments in unit shares of the Fund are not considered deposits in Banco de Valores S.A. for the purposes of the Financial Institutions Law, nor do they benefit from any of the guarantees that such sight or term deposits may be entitled to, under the legislation and regulations applicable to deposits within financial institutions. Likewise, Banco de Valores S.A. is impeded by regulation of the CENTRAL BANK OF ARGENTINA to assume, either implicitly or explicitly, any commitment regarding the maintenance, at any time, of the value of the invested capital, the performance, the redemption value of unit shares or the granting of liquidity for such purpose.